Aircraft Sensors Market Research, 2031

The global aircraft sensors market size was valued at $4 billion in 2021, and is projected to reach $9.7 billion by 2031, growing at a CAGR of 9.1% from 2022 to 2031. The sensors that are incorporated into the aircraft to serve the purpose of controlling, monitoring, and navigation are known as aircraft sensors.

The sensors in the aircraft are installed for flight instruments such as engine temperature gauges, tachometers, fuel and oil gauges, and others. Minor inconsistencies in the aircraft can lead to severe catastrophes. The sensors integrated into the aircraft detect such irregular discrepancies and notify the pilot. Such occurrences have initiated the demand for aircraft sensors in the aviation sector.

The sensors in the aircraft are installed for flight instruments such as engine temperature gauges, tachometers, fuel and oil gauges, and others. Minor inconsistencies in the aircraft can lead to severe catastrophes. The sensors integrated into the aircraft detect such irregular discrepancies and notify the pilot. Such occurrences have initiated the demand for aircraft sensors in the aviation sector.

Moreover, companies such as Raytheon Technologies, Thermocouple Technology, LLC along with other small or big players have been operating across the U.S. and are inclined toward the production & servicing of aircraft sensors which creates ample opportunities for the growth of the market across the country.

According to the General Aviation Manufacturers Association (GAMA) and International Trade Association (ITA), a total of 211,000 aircraft are based in the U.S. Presence of strong market players of the aviation industry as well as associated components and developed countries contribute largely toward the growth of the aircraft sensors market in the region.

Moreover, huge investments in R&D of various grades of aircraft drives the market growth. In addition, increase in concerns regarding air defense strengthening requires new aircraft equipped with advanced components to tackle incidents, which is expected to provide lucrative opportunities for growth of the aircraft sensors market across the region.

Moreover, China holds the most significant share in the global aviation industry attributed to the enhanced air travel and technological advancement in-flight solutions across the region. Moreover, the rapid changes in the preferences of the passengers to travel via air have contributed significantly to China’s aviation industry. Also, the growing demand for aircraft deliveries boosts the demand for aircraft sensors in the country.

In addition, the Japanese aerospace sector is one of the largest in the world with a strong international reputation, particularly in the field of research and development (R&D). Japanese companies have great potential in the research and development of dual-use (non-offensive but military) aerospace defense technology, such as drones and light attack aircraft for improved surveillance.

Also, Japan’s commercial aerospace business is dominated by big companies that supply the major airplane makers, majorly especially Boeing. Hence, surge in demand for technologically advanced aircraft to replace the ageing fleets and the high rate of adoption of wireless sensors for commercial & military purposes are expected to drive the growth of the aircraft sensors market in the country.

Due to automation, the number of sensors in an aircraft is increasing, which increases the accuracy of the intended aircraft functions. A modern aircraft is a complex technical object with many different sensors and measuring systems. Moreover, the rising adoption of sensors in unmanned aerial vehicles (UAVs) is foreseen to create several market opportunities in the coming years. For instance, in November 2020, General Atomics was awarded a $92.3 million contract by the U.S. army for the development of smart sensors with artificial intelligence (AI) for unmanned aircraft. Furthermore, the contract covered research, development, testing, and evaluation of the AI system for the smart sensor prototype for the unmanned aerial platform.

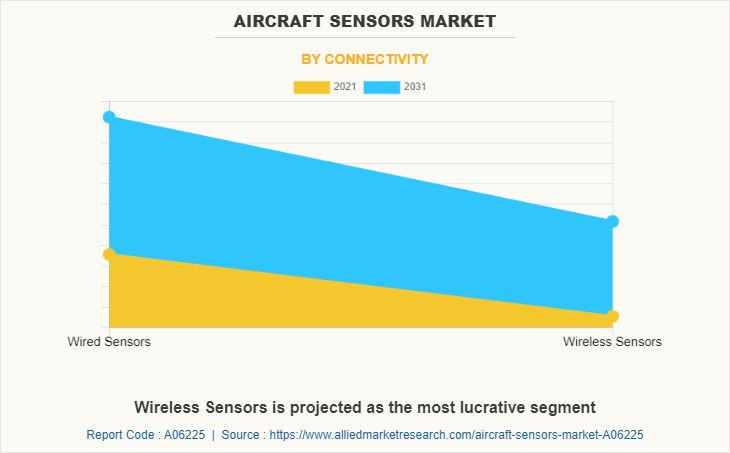

The factors such as rise in demand for expansion of aircraft fleet across the globe, increased usage of sensors for data sensing and measurement, and increasing demand for UAVs supplement the growth of the aircraft sensors industry. However, privacy and security concerns and regulations by safety agencies in the aviation industry are the factors expected to hamper the growth of the market. In addition, technological advancements in the aviation industry and adoption of wireless sensors create market opportunities for the key players operating in the aircraft sensors market.

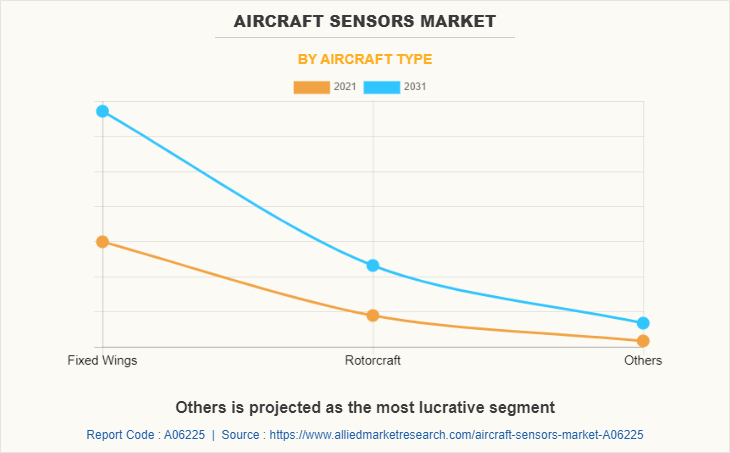

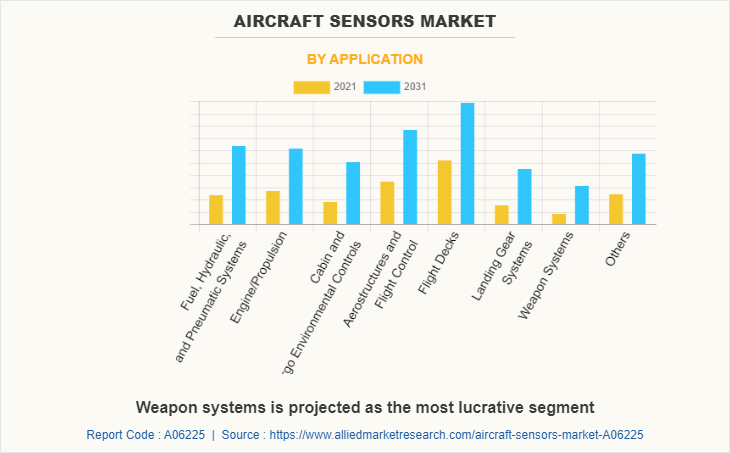

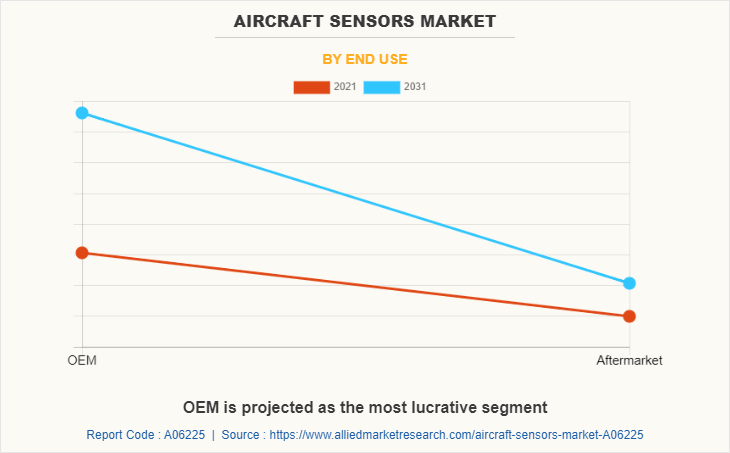

The aircraft sensors market is segmented into aircraft type, application, connectivity, end use, and region. By aircraft type, the market is divided into fixed wings, rotorcraft, and others. By application, it is fragmented into fuel, hydraulic, and pneumatic systems, engine/propulsion, cabin & cargo environmental controls, aerostructures & flight control, flight decks, landing gear systems, weapon systems, and others. By connectivity, it is categorized into wired sensors and wireless sensors. By end use, it is further classified into OEM and aftermarket. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the aircraft sensors market are Ametek, Inc., Auxitrol Weston, BAE Systems, Curtiss-Wright, Eaton, General Atomics, General Electric, Honeywell International Inc., Meggitt PLC, Raytheon Technologies Corporation, Safran, Schneider Electric, Smith Systems Incorporated, TE Connectivity, Thales Group, Thermocouple Technology, LLC, and Woodward, Inc.

Rise in Demand for Expansion of Aircraft Fleet Across the Globe

The increase in the financial condition of the middle classes in developing countries is the reason for the rise in air passenger traffic. According to the International Civil Aviation Organization (ICAO), by 2035, passenger traffic and freight volume should double. Factors such as growth in disposable income of the middle-class population and the emergence of low-cost airlines have led to an increase in the number of airline passengers. Major countries such as Canada, U.S., Brazil, Indonesia, the Philippines, China, Saudi Arabia, and India witnessed a rise in the number of air passengers.

For instance, according to the Bureau of transportation, in October 2021, U.S. Airlines’ passengers increased by 119% from October 2020. According to International Air Transport Association (IATA), passenger numbers could double to 8.2 billion in 2037 at a 3.5% compound annual growth rate (CAGR). As stated by Oliver Wyman, there were 27,492 aircraft across the globe, and it is anticipated to rise by 11,600 aircraft in the next ten years. Therefore, an increase in aviation passenger traffic & rise in demand for expansion of aircraft fleet indirectly is expected to boost the demand for the market during the forecast period.

Increased Usage of Sensors for Data Sensing and Measurement

Feedback on a variety of flight situations as well as the conditions of different flight instruments and systems is necessary for safe and efficient flight control. These conditions are continuously monitored by various sensors that send data to the flight computer for processing before the pilot sees it. Moreover, lubricating oil, liquid coolant, and the amount of liquid moving through the fuel transfer and bleed systems are all detected by flow sensors. In hydraulic systems, such as those used for braking, moving control surfaces, and raising and lowering landing gear, pressure sensors monitor the pressure.

Position sensors, such as rotary variable differential transformers (RVDT) and linear variable differential transformers (LVDT), detect the displacement of different aircraft parts, such as the state of deployment of thrust reversers. Temperature sensors are essential to keep track of the temperature in environmental cooling systems as well as the conditions of hydraulic oils, fuels, and refrigerants. Missile indication and deterrence systems play a crucial role in combat-driven operations, with sensor systems capable of acting in radar-denied zones. Thus, owing to the increased usage of sensors for data sensing and measurement is expected to drive the aircraft sensors market growth.

Privacy and Security Concerns

Digitalization and system integration are the logical next steps for the airline industry. The airline industry will evolve into a fully connected, open ecosystem that is more exposed to the outside world than ever before, replacing closed systems that only communicate with each other. Aircraft OEMs and integrators can harness the power of the Internet of Things to proactively identify maintenance issues, order faulty parts to be replaced, and notify in-flight ground maintenance personnel, ensuring that everything can be repaired without delaying the flight of the aircraft. Thousands of sensors embedded in each aircraft can transmit real-time data to ground personnel.

For instance, the F-35's Autonomous Logistics Information System (ALIS) uses sensors embedded in the aircraft to detect the performance of the aircraft, compare its parameters to standardized parameters, and uses advanced analytics to predict maintenance needs and communicate with maintenance personnel. The F-35's ALIS serves as an information infrastructure, transmitting data about the aircraft to relevant users through a globally distributed network of technicians. However, this leaves the system vulnerable to cybersecurity attacks from sources anywhere in the world.

Technology Advancements in Aviation Industry

Currently, the Internet of Things and sensor networks are developing rapidly and attracting attention. The use of wireless sensor networks is widespread in many industries. It serves as a key infrastructure for IoT development and is a key component of the IoT sensor layer. It is used in the aviation sector to facilitate a variety of services, from the safety of the aircraft itself to enhancing the passenger travel experience. Different parts of the aircraft are equipped with different types of sensors that can measure speed, angle, altitude, and attitude and communicate with each other. With an IoT system in place, this data is made available to the pilots or ground authorities, increasing operational efficiency, flight safety, and passenger comfort. IoT systems monitor the on-ground and in-flight conditions of arriving planes as well as the state of each of their individual parts.

The concerned engineers can receive this informational data well in advance, allowing them to determine which maintenance task needs to be completed on which aircraft first. This helps in reducing the runway time of the aircraft and ensures proper maintenance. Thus, the technological advancements in the aviation sector is expected to create lucrative opportunities for aircraft sensors market expansion.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global aircraft sensors market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall aircraft sensors market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Aircraft Sensors Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.7 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 334 |

| By Aircraft Type |

|

| By Application |

|

| By Connectivity |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Safran Electronic & Defense, Ametek, Inc., The Raytheon Company, UTC Aerospace Systems, Eaton Corporation, Schneider Electric SE, Thales Group, Esterline Technologies Corporation, BAE Systems, Curtiss-Wright Corporation, General Electric Company, Zodiac Aerospace, Honeywell International Inc., TE Connectivity Ltd., Meggitt PLC, General Atomics Corporation, Woddward Inc. |

Analyst Review

This section provides the opinions of various top-level CXOs in the global aircraft sensors market. The growing demand for technologically advanced aircraft to replace the old fleets and the high rate of adoption of wireless sensors for commercial & military purposes are expected to drive the aircraft sensors market over the predicted years. Also, the inflation in defense funding and the emergence of new technology such as IoT, AI, & big data analytics expects a boost to the market. Furthermore, the increasing demand for UAVs for civil & commercial applications to improve operations is anticipated to propel the aircraft sensor market. According to the recent report released in January 2022 by Federal Aviation Administration, 329,114 commercial drones (Unmanned Aircraft Systems) were registered.

Also, factors such as the growth in disposable income of the middle-class population and the emergence of low-cost airlines have led to an increase in the number of airline passengers. Major countries such as Canada, U.S., Brazil, Indonesia, the Philippines, China, Saudi Arabia, and India witnessed a rise in the number of air passengers. For instance, according to the Bureau of transportation, in October 2021, U.S. Airlines’ passengers increased by 119% from October 2020. According to International Air Transport Association (IATA), passenger numbers could double to 8.2 billion in 2037 at a 3.5% compound annual growth rate (CAGR). Therefore, an increase in aviation passenger traffic & rise in demand for expansion of aircraft fleet indirectly is expected to boost the demand for the aircraft sensors market during the forecast period.

The market growth is supplemented by factors such as rise in demand for expansion of aircraft fleet across the globe, increased usage of sensors for data sensing and measurement, and increasing demand for UAVs supplement the growth of the aircraft sensors market. However, privacy and security concerns and regulations by safety agencies of aviation industry are the factors expected to hamper the growth of the aircraft sensors market. In addition, technological advancements in aviation industry and adoption of wireless sensors create market opportunities for the key players operating in the aircraft sensors market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to lead during the forecast period due to the growth in air passenger traffic and the rising disposable income in this region.

The global aircraft sensors market size was valued at $4 billion in 2021, and is projected to reach $9.7 billion by 2031, growing at a CAGR of 9.1% from 2022 to 2031.

The global aircraft sensors market is growing at a CAGR of 9.1% from 2022 to 2031.

Asia-Pacific region accounted largest share for aircraft sensors market.

The leading players operating in the aircraft sensors market are Ametek, Inc., Auxitrol Weston, BAE Systems, Curtiss-Wright, Eaton, General Atomics, General Electric, Honeywell International Inc., Meggitt PLC, Raytheon Technologies Corporation, Safran, Schneider Electric, Smith Systems Incorporated, TE Connectivity, Thales Group, Thermocouple Technology, LLC, and Woodward, Inc.

The aircraft sensors market has witnessed significant growth in recent years, owing to the growth in the investments in the aerospace industry and the increasing integration of the internet of things (IoT) in airplanes to gain real-time statistics, which is raising the utilization & need for sensors to generate more accurate data.

Loading Table Of Content...