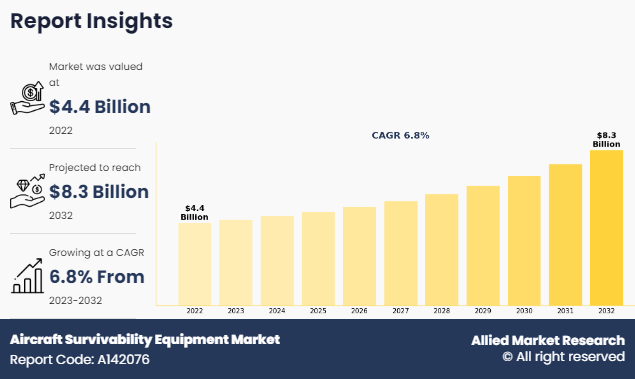

The global aircraft survivability equipment market was valued at $4.4 billion in 2022, and is projected to reach $8.3 billion by 2032, growing at a CAGR of 6.8% from 2023 to 2032.

A group of equipment and technologies installed on military aircraft with the intention of improving their capacity to survive in hazardous environments is referred to as "Aircraft Survivability Equipment" (ASE). These technologies are primarily intended to reduce the vulnerability of the aircraft to threats such enemy radar-guided missiles, infrared-guided missiles, anti-aircraft artillery, and other forms of attack.

For instance, in April 2022, BAE Systems expanded aircraft survivability equipment by receiving a $22 million award to supply the AN/AAR-57 Common Missile Warning System (CMWS) and associated equipment as part of a U.S. Foreign Military Sales contract. The deal, facilitated by the U.S. Army, is for the production and delivery of CMWS for a fleet of Apache helicopters.

The economic sector that includes the development, manufacturing, and marketing of technology, systems, and services intended to improve the survivability of military aircraft is known as the Aircraft Survivability Equipment (ASE) market. This market includes a broad spectrum of goods and services designed to defend pilots and their crews against different types of risks that arise in unfriendly settings.

Key Takeaways

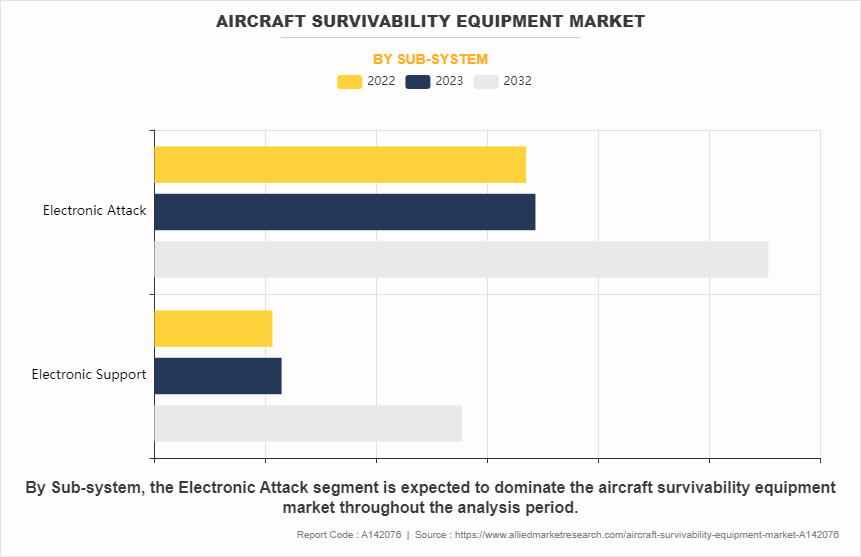

- On the basis of sub-system, the electronic attack segment held the largest share in the pitot tubes market in 2022.

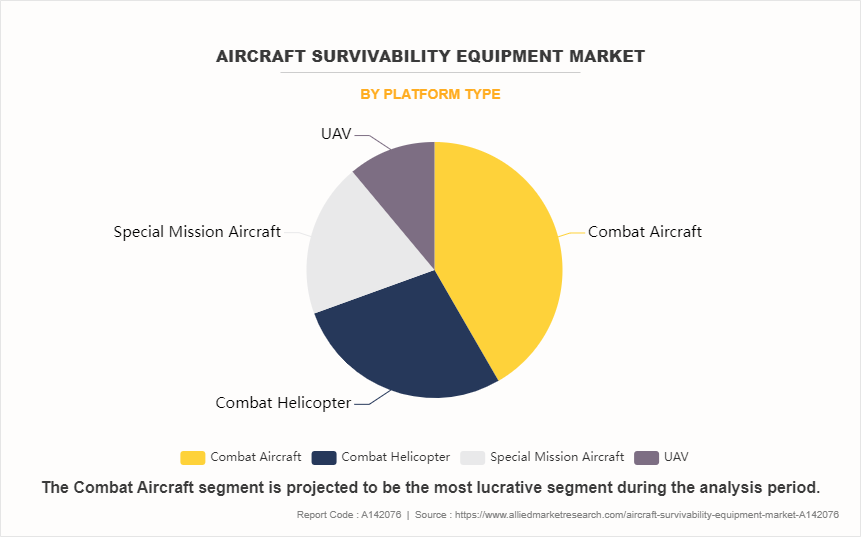

- By platform type, the combat aircraft segment held the largest share in the market in 2022.

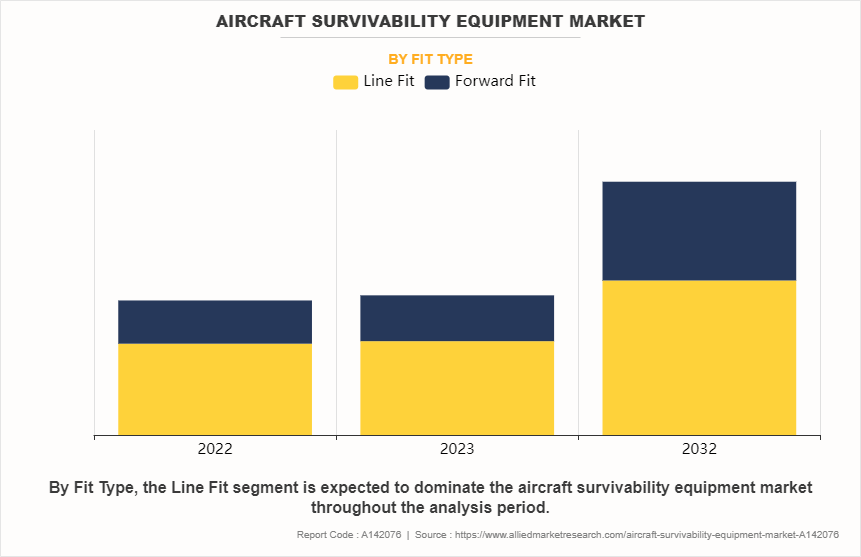

- On the basis of fit type, the line fit segment held the largest market share in 2022.

- On the basis of region, North America held the largest market share in 2022.

Aircraft survivability equipment include radar warning receivers (RWR), missile warning systems (MWS), laser warning systems (LWS), and other sensors designed to detect threats such as radar-guided missiles, infrared-guided missiles, and laser targeting systems.

Furthermore, major market players have undertaken various strategies to increase the competition and offer enhanced services to their customers. For instance, in February 2024, BAE Systems expanded aircraft survivability equipment by being awarded a $114 million Foreign Military Sale by the U.S. Army for AN/AAR-57 Common Missile Warning Systems (CMWS) to be installed on allies’ existing fleets and recently acquired aircraft, including AH-64 Apaches, CH-47 Chinooks, and UH-60 Black Hawks. The combat-proven system is installed on more than 40 different aircraft types around the world, which have accumulated more than 4 million combat hours.

Furthermore, in February 2023, BAE System collaborated with Leonardo to develop an interoperable aircraft survivability suite consisting of BAE Systems’ AN/AAR-57 Common Missile Warning System (CMWS) and Leonardo’s Miysis Directed Infrared Countermeasure (DIRCM) System. The combined capability will significantly enhance aircraft survivability against advanced threats.

Factors such as increase in military operations in contested environments, emphasis on force protection, and replacement of legacy system with advanced combat system drive the growth of the aircraft survivability equipment industry across the globe. However, cost rise in electronic warfare techniques and cost constraints act as barriers for the growth of the aircraft survivability equipment market trend. Furthermore, rise in number of aircraft to strengthen the military create ample opportunities for the growth of the aircraft survivability equipment market during the forecast period.

Segment Review

The aircraft survivability equipment market is segmented on the basis of sub-system, platform type, fit type, and region. By sub-system, it is divided into electronic support, and electronic attack. As per platform type, the market is classified into combat aircraft, combat helicopter, special mission aircraft, and UAV. By fit type, it is categorized into line fit and forward fit. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and Latin America & Middle East.

By Fit Type

On the basis of fit type, the line fit segment attained the highest market share in 2022 in the aircraft survivability equipment market. This is attributed to the fact that original equipment manufacturers (OEMs) play a significant role in promoting line fit ASE solutions by incorporating them into their aircraft offerings and marketing them as integral components of the overall platform. The influence and reputation of OEMs contribute to the widespread adoption of line fit ASE solutions by military customers.

Meanwhile, the forward fit segment is projected to be the fastest-growing segment during the forecast period. This is explained by the fact that forward-fit ASE systems are made to easily interface with aircraft platforms of the future that include cutting-edge avionics, sensors, and weaponry.

By Sub-system

On the basis of sub-system, electronic attack segment attained the highest market share in 2022 in the aircraft survivability equipment market. This is attributed to the fact that electronic attack systems enable aircraft to actively disrupt or degrade enemy electronic systems, including radars, communication links, and command-and-control networks. This offensive capability provides a critical advantage in denying the enemy the ability to detect, track, and engage friendly aircraft.

Meanwhile, the electronic support segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that electronic support systems play a crucial role in detecting and identifying threats by monitoring and analyzing electromagnetic signals emitted by radars, communication systems, and other electronic sources. This early warning capability is essential for aircraft survivability, as it allows crews to react promptly to incoming threats.

By Platform Type

On the basis of platform type, the combat aircraft segment attained the highest market share in 2022 in the aircraft survivability equipment market. This is explained by the fact that combat aircraft frequently lead military operations and carry out missions in dangerous situations where survival is crucial. Consequently, there is a high need for ASE to improve combat aircraft survivability and effectiveness in dangerous environments.

Meanwhile, the UAV segment is projected to be the fastest-growing segment during the forecast period. This is explained by the fact that unmanned aerial vehicles (UAVs) can be built and set up for a variety of tasks, such as target acquisition, surveillance, offensive operations, and reconnaissance. Because of their adaptability, they can be fitted with a variety of ASE systems that are suited to certain mission needs, improving their capacity to survive in harsh situations.

By Region

On the basis of region, the North America attained the highest market share in 2022 in the aircraft survivability equipment market. This is attributed tyo tyhe fact that North America, particularly the U.S, possesses one of the world's largest and most technologically advanced military forces. The creation and application of state-of-the-art ASE technologies are facilitated by the region's substantial defense budget and investment in R&D.

Meanwhile, the Asia-Pacific is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that Asia-Pacific region is home to a growing number of defense companies and research institutions that are developing cutting-edge ASE technologies. The quick development and uptake of ASE systems in the area has been facilitated by this local ingenuity as well as alliances with multinational defense companies.

Competitive Analysis

Some major companies operating in the market are Aselsan A.S., BAE System PLC, Israel Aerospace Industries Ltd., L3Harris Technologies Inc, Leonardo S.p.A., Northrop Grumman Corporation, Orbital ATK, Inc., Raytheon Technologies Corporation Saab AB and Thales Group.

Increase in Military Operations in Contested Environments

When operating in contested environments, military aircraft are susceptible to a range of threats, including infrared seekers, surface-to-air missiles, cyberattacks, radar-guided systems, and anti-aircraft artillery. Strong survivability measures are required due to the serious risks these threats bring to aircraft. Critical missions including close air support, reconnaissance, and strategic strikes are also frequently part of military operations in disputed settings. The failure of an aircraft or its deterioration as a result of enemy action might compromise military goals and missions. Through improved mission effectiveness and aircraft survivability, ASE helps reduce these risks.

In order to target military aircraft, adversaries are constantly creating and utilizing cutting-edge weaponry and strategies. Because of this, ASE systems that can neutralize changing threats and give friendly aircraft operating in contested skies a survivability edge are always needed. In addition, military aircraft frequently transport personnel, gear, and secret cargo; their disappearance could lead to deaths, damage to gear, or compromising of intelligence. The market for aircraft survivability systems is expanding as a result of a rise in military operations in contested areas. ASE plays a critical role in enhancing aircraft survivability against enemy threats, protecting onboard troops and assets.

Emphasis on Force Protection

The protection of military people aboard aircraft is one of the main objectives of aviation survivability equipment (ASE). In contemporary combat, airplanes play a vital role as both transportation and reconnaissance assets in addition to being platforms for delivering weaponry. Aerial surveillance and emergency (ASE) systems, like radar warning receivers, missile warning systems, and countermeasure dispensing systems, are engineered to identify and neutralize threats to aircraft, protecting the lives of those within. Furthermore, by improving military aircraft's operational efficacy, aircraft survivability technology supports force protection. Military forces can operate in hostile settings with more confidence when aircraft are equipped with ASE systems because they can successfully detect and counter threats. This makes it possible to carry out missions more successfully and persistently, which eventually strengthens force.

Due to their inherent vulnerability, airplanes are susceptible to various threats such as electronic warfare, surface-to-air missiles, and anti-aircraft artillery. ASE systems assist in reducing these vulnerabilities by delivering early notice of impending threats and putting in place defenses to stop or avoid them. ASE directly supports force protection initiatives by lowering the possibility of aircraft losses or damage. Therefore, the market trend for aircraft survivability equipment is growing as a result of the emphasis on force protection.

Replacement of Legacy System with Advanced Combat System

Many legacy aircraft survivability equipment (ASE) systems may not be equipped to counter modern threats effectively. As adversaries develop more sophisticated weapons and tactics, older ASE systems may become outdated and less effective. The replacement of legacy systems with advanced ASE technologies is essential to maintain a high level of survivability for military aircraft in modern combat environments. Furthermore, advanced combat systems often include integrated platforms that incorporate multiple sensors, countermeasures, and defensive systems. When it comes to threat detection, identification, and neutralization, these platforms are superior than isolated ASE systems. The necessity to incorporate these cutting-edge systems into military aircraft to increase survivability and mission effectiveness is what is driving the demand for ASE.

Advanced air defense systems, electronic warfare, and cyberattacks are only a few of the many threats that exist in modern battle scenarios. These sophisticated threats might be too strong for legacy ASE systems to handle. To increase aircraft survivability against changing and complex threats, improved ASE technologies are becoming more and more necessary. This has raised the need for aircraft survivability equipment market forecast as modern combat systems are replacing outdated ones.

Rise in Electronic Warfare Techniques

The efficacy of conventional ASE countermeasures like flares, chaff, and radar warning systems may be compromised by advanced electronic warfare tactics. To trick or overload ASE systems, adversaries may use advanced jamming tactics or electronic warfare methods, decreasing the effectiveness of ASE systems in defending aircraft. Additionally, electronic warfare tactics designed to lessen the electromagnetic signature of an aircraft or interfere with radar detection might complicate ASE systems' ability to identify and monitor approaching threats. The amount of time that ASE systems have to react to threats can be decreased by using electronic countermeasures and stealth technology to make aircraft less likely to be detected by radar warning receivers. Technology for electronic warfare is advancing quickly, and opponents are always creating new tools and strategies to undermine ASE systems. For ASE manufacturers, this presents a dilemma.

The field of electronic warfare is advancing quickly, and opponents are always creating new tools and methods to undermine ASE systems. This presents a problem for military strategists and ASE makers, who have to constantly innovate and modify their systems to stay up with new threats. Therefore, the expansion of the aircraft survivability equipment market overview is being impeded by the rise in electronic warfare techniques.

Cost Constraints

Advanced ASE technology development, testing, and research can be costly. It takes a large investment in research, engineering, and prototyping to design systems that adhere to strict military criteria and can detect, identify, and counter a wide range of threats. The ability of ASE manufacturers to pursue ambitious development initiatives or to innovate quickly in response to changing threats may be hampered by financial restrictions. Furthermore, the cost of procuring ASE systems for military aircraft fleets can be substantial, particularly for large or technologically sophisticated platforms. Military budgets are often constrained, and ASE procurement may compete with other defense priorities for funding. Limited budgets may result in reduced procurement quantities or delayed acquisition of ASE systems, impacting the growth potential of the market.

In addition, to acquisition costs, ASE systems entail ongoing expenses related to maintenance, upgrades, and sustainment throughout their operational life cycle. Cost constraints may affect the availability of funding for maintenance and support activities, potentially leading to reduced system reliability, increased downtime, or deferred upgrades. These factors can impact the overall effectiveness and attractiveness of ASE solutions to military customers. Therefore, cost constraints hamper the growth of the aircraft survivability equipment market growth.

Rise in Number of Aircraft to Strengthen the Military

As military forces expand their aircraft fleets to bolster their capabilities, there is a corresponding increase in the demand for ASE systems to protect these assets. Each additional aircraft represents a potential market for ASE manufacturers, driving growth opportunities in terms of both system sales and aftermarket support. Furthermore, the introduction of new aircraft models or the upgrade of existing platforms often involves the integration of advanced ASE technologies to enhance survivability and mission effectiveness. The expansion of aircraft fleets provides an opportunity for ASE manufacturers to supply cutting-edge solutions tailored to the specific requirements of modern military aircraft.

The rise in the number of aircraft strengthens military capabilities across various domains, including air superiority, close air support, reconnaissance, and aerial refueling. This diversity of applications creates opportunities for ASE manufacturers to develop specialized solutions tailored to different mission profiles and operational environments, expanding the range of products and services offered to military customers. Therefore, rise in number of aircraft to strengthen the military offers ample opportunities for aircraft survivability equipment market size.

Impact of Russia-Ukraine War on Aircraft Survivability Equipment

As a result of the conflict between Russia and Ukraine, Ukraine is probably going to need more aircraft survivability equipment (ASE) as it tries to make its military aircraft more resilient to possible threats from Russian forces. Ukraine can give priority to ASE system purchases in order to better safeguard its aircraft when they are flying in disputed airspace. Furthermore, the conflict in Russia and Ukraine may have resulted in export restrictions or embargoes on defense-related technologies imposed by Western countries on Russia. This could impact the availability of certain ASE components or technologies that are subject to export controls, potentially disrupting supply chains and affecting the production of ASE systems by Russian defense contractors.

The war has brought attention to the threat presented by unmanned aircraft systems (UAS), sometimes known as drones, which are employed by both sides for targeting, reconnaissance, and monitoring. Because of this, there can be a rise in the need for ASE systems with counter-UAS features, including directed energy weapons, electronic jammers, or laser dazzlers, to safeguard military aircraft from UAS threats. In addition, there's a chance that the war between Russia and Ukraine has sparked additional defense technology cooperation and transfer between Ukraine and Western nations—especially those that are members of NATO. The creation and acquisition of ASE systems are just two examples of cooperative development initiatives or technology-sharing contracts that might result from this, with the ultimate goal of strengthening the military power of Ukraine.

Key Benefits for Stakeholders

• This study presents the analytical depiction of the global aircraft survivability equipment market analysis along with the current trends and future estimations to depict imminent investment pockets.

• The overall aircraft survivability equipment market opportunity is determined by understanding profitable trends to gain a stronger foothold.

• The report presents information related to the key drivers, restraints, and opportunities of the global aircraft survivability equipment market with a detailed impact analysis.

• The current aircraft survivability equipment market share is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

• Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Aircraft Survivability Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.3 billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 283 |

| By Fit Type |

|

| By Sub-system |

|

| By Platform Type |

|

| By Region |

|

| Key Market Players | BAE System PLC, Northrop Grumman Corporation., L3Harris Technologies, Inc., Chemring Group PLC, Raytheon Technologies Corporation, Leonardo S.p.A., Thales Group, Saab AB, Aselsan A.S., Israel Aerospace Industries Ltd |

Integration of Artificial Intelligence (AI) and Machine Learning (ML) for enhanced threat detection and response.

Electronic Attack is the leading application of Aircraft Survivability Equipment Market

Asia-Pacific is the largest regional market for Aircraft Survivability Equipment

USD 8304.14 million is the estimated industry size of Aircraft Survivability Equipment

Aselsan A.S., BAE System PLC, Israel Aerospace Industries Ltd., L3Harris Technologies Inc, Leonardo S.p.A., Northrop Grumman Corporation, Orbital ATK, Inc., Raytheon Technologies Corporation Saab AB and Thales Group.

Loading Table Of Content...

Loading Research Methodology...