Aircraft Thrust Reverser Market Research, 2034

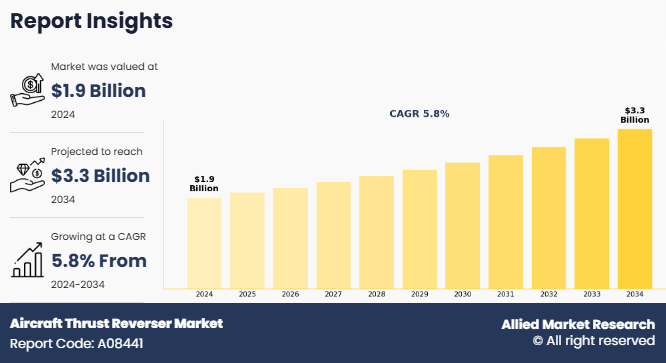

The global aircraft thrust reverser market size was valued at $1.9 billion in 2024, and is projected to reach $3.3 billion by 2034, growing at a CAGR of 5.8% from 2024 to 2034.

Report Key Highlighters:

- The aircraft thrust reverser market share covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2034.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the aircraft thrust reverser market.

- The aircraft thrust reverser market share is highly fragmented, into several players including Collins Aerospace, Safran S.A., FACC AG, The NORDAM Group LLC, General Electric Company, Rolls-Royce plc, Pratt & Whitney, Aernnova Aerospace, Barnes Aerospace, and Liebherr Aerospace. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

An aircraft thrust reverser is a critical aerodynamic device integrated into the exhaust section of a jet engine or nacelle system. It is designed to temporarily redirect the engine’s thrust forward rather than backward during landing. It typically consists of mechanical components such as cascade vanes, blocker doors, translating cowls, or clamshell doors, depending on the engine and airframe configuration. When deployed, these systems divert the high-velocity exhaust or bypass airflow to oppose the aircraft’s forward motion, significantly enhancing deceleration during landing and reducing brake wear. Aircraft thrust reversers are especially crucial for operations on short runways, wet or icy surfaces, or at airports with limited infrastructure

Factors such as increase in air travel, surge in orders for new aircraft from developing regions, and technological advancement in the electric & hybrid aircraft drives the growth of the market. However, factors such as stringent certification & regulatory requirements, and high development & manufacturing costs hinder the growth of the aircraft thrust reverser market to some extent. On the contrary, factors such as increase in sales of personal aircraft & regional jets and modernization of military aircraft offer lucrative market growth opportunities for aircraft thrust reverser industry.

The growth in air travel and fleet modernization program in developing countries has resulted in increased demand for new aircrafts. The demand for new aircrafts is particularly driven by economic growth, rise in middle-class population, and surge in focus on improving regional & international connectivity. Similarly, governments in developing countries are also focusing on construction of new airport and modernization of older airports, which are able to handle more flights.

For instance, on December 9, 2024, Air India announced its agreement with Airbus SE for orders of 10 A350. widebody and 90 A320 narrowbody aircraft. In addition, in 2023, Air India announced the order of 470 aircraft, out of which 250 were with Airbus SE. Air India has also announced that it has done an agreement with Airbus SE for services and component to support the maintenance requirements of its growing A350 fleet. Thus, the rise in demand for new aircrafts is projected to drive the growth of the aircraft thrust reverser market during the forecast period.

Moreover, the global aviation industry has witnessed strong growth over the past few decades owing to globalization, technological advancements, and increase in affordability of air travel. Surge in use of new aircraft for air travel is driving the demand for aircraft thrust reverser. According to a data published from the International Air Transport Association (IATA) in February 2023, there was a substantial of 55.5% increase in total air traffic globally, when compared to a data from 2022.

In addition, there is also rapid growth in air travel especially in developing countries, located in the Asia-Pacific region. For instance, in 2024, according to the data by Government of India’s, Press Information Bureau, the number of operational airports in India doubled from 74 in 2014 to 157 in 2024. Moreover, the country is aiming to increase it by 350-400 by the year 2047. The aviation sector in the country has shown substantial growth of 13% YoY. The demand for air travel is expected to continue to grow in the coming decade, thus driving the growth of the aircraft thrust reverser market.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On April 2024, Safran SA was granted U.S. Patent US11952963B2 for a new thrust reverser design that integrates an anti-buckling actuator system. This new mechanism improves structural performance under high load and enhances operational safety by preventing deformation during reverser deployment. The design focuses on increasing durability and reliability in extreme operating environments, supporting Safran’s push toward more advanced, efficient nacelle and reverser technologies.

- On December 2023, Collins Aerospace announced its collaboration with Embraer to supply nacelle system, which crucially includes the thrust reverser, for Embraer's next-generation E190-E2 and E195-E2 regional jets. This agreement underscores Collins Aerospace's continued leadership and expertise as a key partner for new aircraft programs. The company also plans to integrated, efficient, and reliable thrust reversal capabilities for the latest regional airliners in coming years.

- On November 2023, Safran Nacelles signed a long-term service agreement with EgyptAir, according to the agreement the company will offer thrust reverser system to airline’sfleet of Airbus A330ceo aircraft under the Safran’s NacelleLife program. The agreement will also include comprehensive MRO services, spare parts support, and engineering expertise for thrust reversers. The development of thrust reverser will be carried out at the AMES (Airbus Middle East Services) facility in Dubai to reduced aircraft downtime.

Segmental Analysis

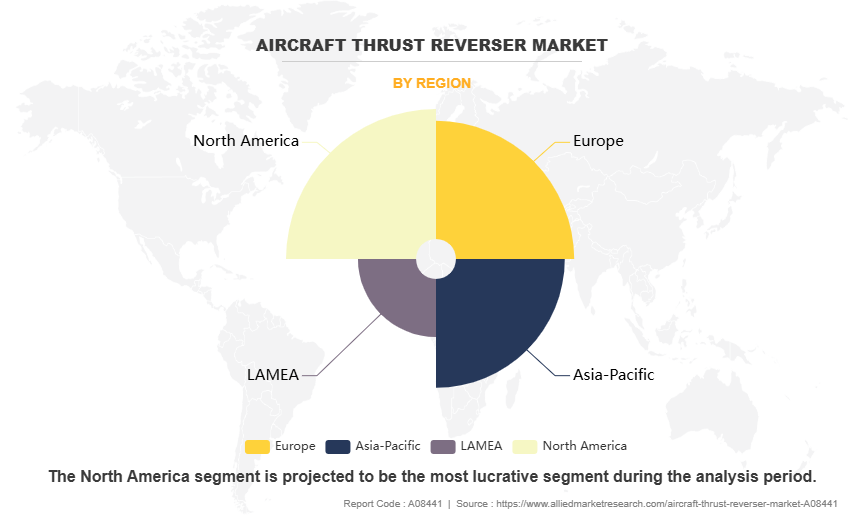

The aircraft thrust reverser market forecast is segmented into mechanism, deployment location, end user, and region. On the basis of mechanism, the market is segregated into hydraulic and electrical. By deployment location, the global market is divided into engine-mounted and fuselage-mounted. By end user, the market is classified into commercial and military. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

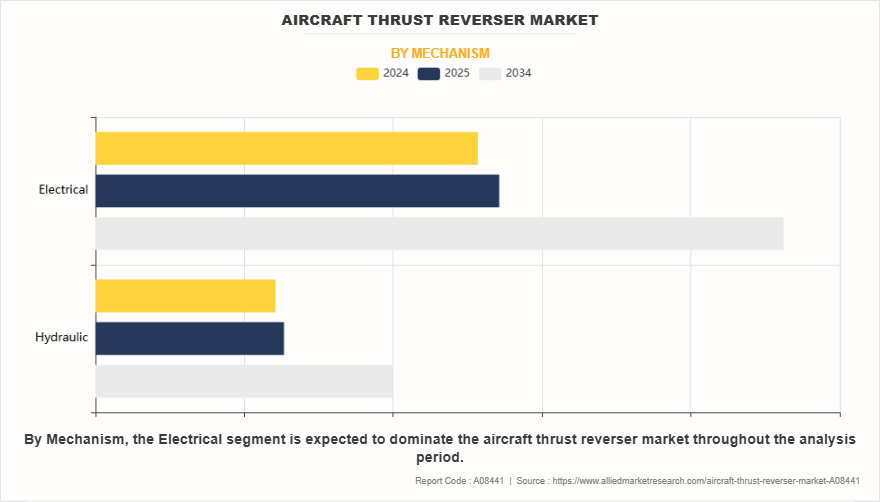

By Mechanism

By mechanism, the aircraft thrust reverser market segmentation is categorized into hydraulic and electrical. The electrical segment dominated the aircraft thrust reverser market in 2024. Owing to, electrical thrust reversers use electric actuators and motors instead of hydraulic power to activate the reverser mechanism. These systems are increasingly being adopted in modern and next-generation aircraft due to their lower weight, simplified design, and reduced maintenance requirements. They are particularly suitable for regional jets, business jets, and emerging electric or hybrid aircraft platforms.

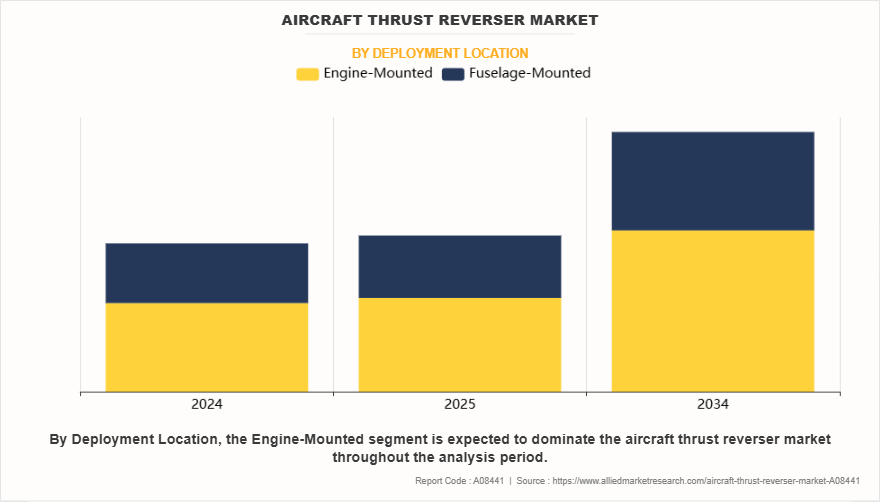

By Deployment Location

By deployment location, the aircraft thrust reverser market size is categorized into engine-mounted and fuselage mounted. The engine-mounted segment dominated the aircraft thrust reverser market. Owing to, engine-mounted thrust reversers are directly integrated into the aircraft engine nacelle. Engine Mounted are the most common type of thrust reverser configuration, especially in commercial airlines where engines are mounted on the wings. Engine-mounted reverser system is built around the engine’s exhaust section and includes components such as blocker doors or translating sleeves which redirect the engine’s thrust forward to slow the aircraft during landing.

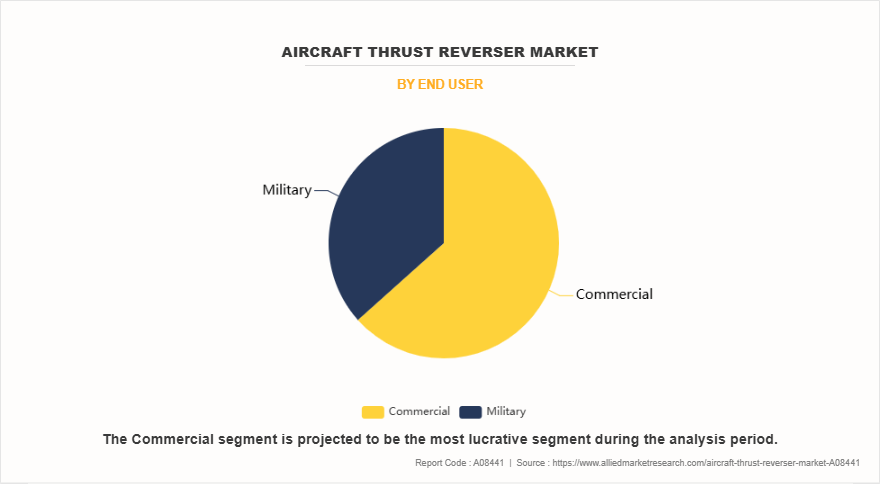

By End User

By end user, the aircraft thrust reverser market growth is categorized into commercial and military. The commercial segment dominated the aircraft thrust reverser market in 2024. Owing to, commercial aircraft are designed and primarily used for transporting passengers and cargo. They are operated by airlines and are part of the civil aviation sector. These airplanes vary in size, ranging from small regional jets to large international airliners such as the Boeing 777 or Airbus A380. Commercial airplanes are equipped with features that enhance passenger comfort, safety, and efficiency, and they follow strict aviation regulations set by civil aviation authorities such as the FAA or ICAO.

By Region

Region wise, the aircraft thrust reverser industry is analyzed into North America, Europe, Asia-Pacific, and LAMEA. The North America region dominated the aircraft thrust reverser market in 2024. Owing to increase in military spending in the U.S., Canada, and Mexico. In addition, rise in geopolitical tension has lead to increased investment in modernizing military aircrafts. Moreover, the U.S. and Canda have pledged their allegiance to NATO, and also works for United Nations peace keeping mission and arctic security, which has resulted in increased need for modern aircrafts, thus driving the market demand. Likewise, the region has presence of numerous aircraft manufacturing companies such as Boeing, Lockheed Martin, and Textron Aviation which further contribute to the growth of the market. In addition, increase in focus on the development of next-generation aircraft technologies and innovations in fuel efficiency standards has spurred advancements in thrust reverser design and materials, further stimulating the aircraft thrust reverser market demand.

Technological Advancement in the Electric and Hybrid Aircraft

The global aviation industry is undergoing a technological advancement in the electric and hybrid aircraft industry, driven by the need for more sustainable and fuel-efficient aviation solutions. Technological advancements in electric propulsion systems are significantly influencing aircraft design, including the integration of advanced thrust reverser systems to ensure safe and efficient deceleration. As aircraft become quieter and more energy-efficient, the role of thrust reversers is becoming even more critical in maintaining landing performance and meeting stringent safety standards. According to a report by the International Civil Aviation Organization (ICAO) in November 2023, over 200 electric and hybrid aircraft programs were under development globally. In addition, governments and private companies are heavily investing in electric aviation infrastructure. For instance, in 2023, the European Union invested around $4.2 billion through its Clean Aviation program in sustainable aviation projects, including electric propulsion systems. Such developments are expected to drive the demand for compatible, lightweight, and efficient aircraft thrust reversers specifically for use in next-generation aircraft.

Increase In Sales of Personal Aircraft and Regional Jets

Advancements in aviation technology, change in consumer preferences, and surge in demand for convenience dr the sales of personal aircraft. The growing technological advancement of light jets, turboprops, and single-engine aircrafts are further driving the sales of personal aircrafts. Moreover, increase in number of billionaires and high net worth individual is further growing the market. According to a report published by Air Charter Association, the sales of pre-owned private jet grew significantly in 2022, especially in Asia-Pacific and the Middle East region. The company also stated that pre-owned business jets has grew significantly in the last two years due to affordability of pre-owned jets. According to the report, the sales of private aircrafts is expected to continue in 2025 owing to strong economic growth in developing countries. Thus, the growing inclination toward sales of personal aircraft offers lucrative market growth opportunity for aircraft thrust reverser market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft thrust reverser market analysis from 2024 to 2034 to identify the prevailing aircraft thrust reverser market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft thrust reverser market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Thrust Reverser Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.3 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 280 |

| By Mechanism |

|

| By Deployment Location |

|

| By End User |

|

| By Region |

|

| Key Market Players | THE NORDAM GROUP LLC, Barnes Aerospace, Rolls-Royce plc., Aernnova Aerospace, Liebherr Aerospace, General Electric Company, Pratt & Whitney, Safran S.A., FACC AG, Collins Aerospace |

Integration of lightweight materials in the manufacturing are the upcoming trends in the aircraft thrust reverser industry.

The commercial aviation segment is the leading application of the aircraft thrust reverser market.

North America is the largest regional market for aircraft thrust reverser.

The aircraft thrust reverser market was valued at $1,890.0 million in 2024 and is estimated to reach $3,311.1 million by 2034, exhibiting a CAGR of 5.8% from 2024 to 2034.

Collins Aerospace, Safran S.A., FACC AG, The NORDAM Group LLC, General Electric Company, Rolls-Royce plc, Pratt & Whitney are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...