Aircraft Turboprop Propeller System Market Research, 2034

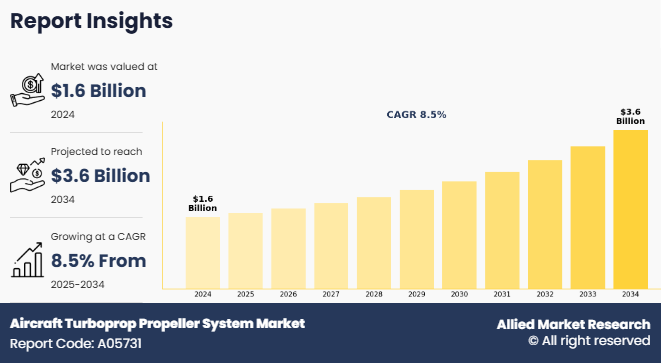

The global aircraft turboprop propeller system market size was valued at $1.6 billion in 2024, and is projected to reach $3.6 billion by 2034, growing at a CAGR of 8.5% from 2025 to 2034.

An aircraft turboprop propeller system is a propulsion mechanism that combines a gas turbine engine with a propeller to generate thrust for aircraft. Unlike jet engines, which rely solely on jet exhaust for propulsion, turboprop systems use the turbine to drive a reduction gearbox connected to a propeller, which provides the majority of the thrust. This system is especially efficient at lower flight speeds and altitudes, making it ideal for regional, cargo, and military aircraft.

Key Takeaways

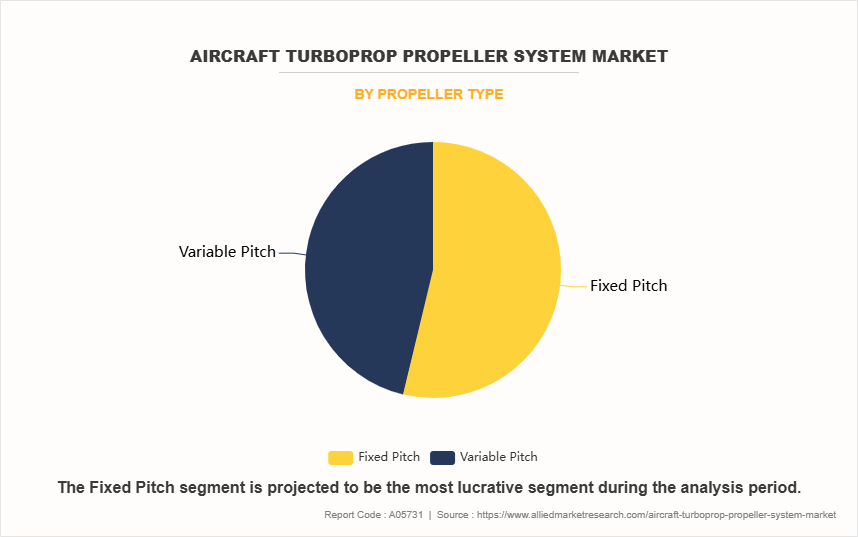

- Based on Propeller Type, the Fixed Wing Segment held the largest share in the aircraft turboprop propeller system market in 2024.

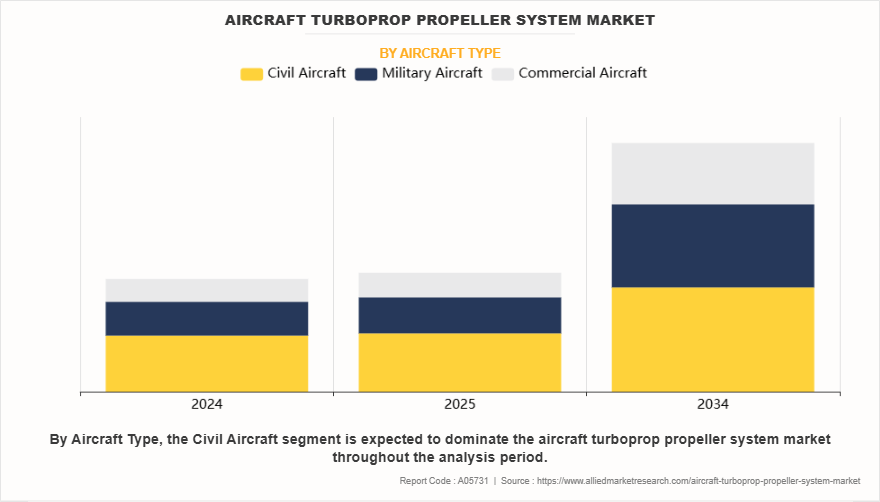

- By Aircraft Type, the Civil Aircraft segment was the major shareholder in 2024.

- Based on Sales Channel, the OEM segment dominated the market, in terms of share, in 2024.

- By Component, the Blade segment dominated the market in terms of share in 2024.

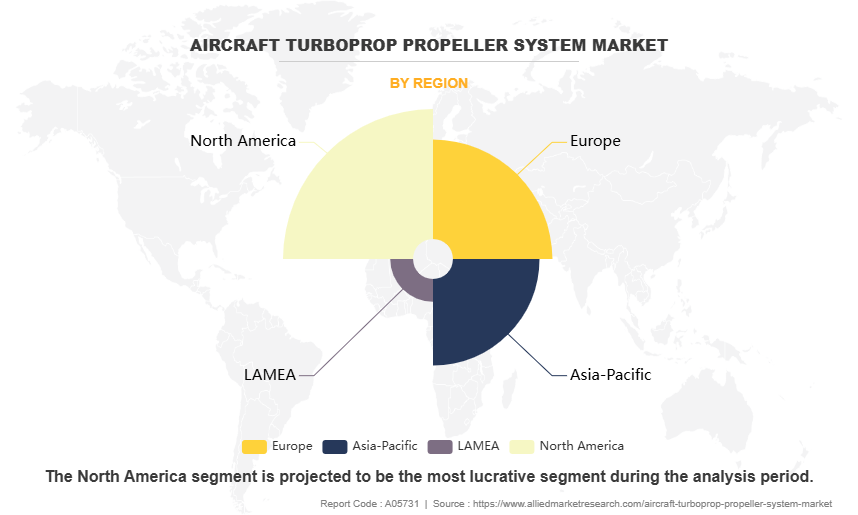

- Region-wise, the North America region held the largest market share in 2024.

The aircraft turboprop propeller system industry includes components such as the hub, blades, spinner, and control systems, which work together to convert engine power into aerodynamic thrust. Turboprop engines offer better fuel efficiency than pure jet engines for short to medium-haul routes and are known for their reliability and cost-effectiveness. Their ability to operate from shorter runways also enhances their utility in remote or underdeveloped areas. Overall, turboprop propeller systems strike a balance between performance, efficiency, and operational versatility.

For instance, in February 2025, Textron Aviation launched the first Cessna SkyCourier twin turboprop aircraft to a Canadian customer, marking a significant milestone for the aircraft's global expansion. The SkyCourier, known for its versatility, rugged design, and high payload capacity, is well-suited for Canada's vast and diverse geography, including remote and underserved regions. Moreover, In September 2022, Textron Aviation partnered with ZeroAvia to explore hydrogen propulsion for its Grand Caravan aircraft, aiming to support sustainable aviation by retrofitting a portion of the 2,400 delivered turboprop utility aircraft with ZeroAvia’s 600-kW ZA600 powertrain under a supplemental type certificate.

The increase in demand for regional air travel is driving the aircraft turboprop propeller system market growth. Turboprop aircraft are well-suited for short-haul routes due to their fuel efficiency and ability to operate from shorter runways. As airlines expand regional connectivity, especially in emerging markets, the need for reliable and cost-effective turboprop systems continues to rise. Furthermore, growth in military applications, and expansion of low-cost carriers have driven the demand for aircraft turboprop propeller system market trends . However, the complex maintenance requirements of gearbox and propeller systems are hampering the growth of the aircraft turboprop propeller system market share. These components demand regular inspection, specialized tools, and skilled technicians, which increases maintenance costs and aircraft downtime. This makes turboprop systems less attractive compared to simpler propulsion alternatives, particularly for operators seeking to minimize operational and servicing complexities. Moreover, volatility in raw material prices are major factors that hamper the growth of the aircraft turboprop propeller system market size. On the contrary, the expansion of regional aviation in emerging markets presents a lucrative opportunity for the aircraft turboprop propeller system market. Countries in Asia-Pacific, Africa, and Latin America are investing in regional air connectivity and airport infrastructure. Turboprop aircraft are ideal for these regions due to their cost-efficiency and short runway capabilities, driving demand for advanced and reliable propeller systems.

Segment Review

The aircraft turboprop propeller system market segmentation on the basis of propeller type, aircraft type, component type, sales channel and region. On the basis of propeller type, the market is divided into fixed pitch, and variable pitch. By aircraft type, it is segmented into civil aircraft, military aircraft, and commercial aircraft. On the basis of component, it is categorized into blade, spinner, Hub, and others. By sales channel, the market bifurcated into OEM, and aftermarket. Region wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Propeller Type

On the basis of propeller type, the fixed segment attained the highest market share in 2024 in the aircraft turboprop propeller system market. This dominance is due to its superior performance, efficiency, and adaptability across varying flight conditions. Variable pitch systems allow pilots to adjust blade angles for optimal thrust, improving fuel efficiency and takeoff capabilities, especially on short runways. They are widely used in commercial, military, and regional aircraft where flexibility and performance are crucial. Although fixed pitch propellers are simpler and cost-effective, their limitations in efficiency and control under diverse conditions have led to a stronger preference for variable pitch systems in modern aircraft turboprop propeller system industry.

By Aircraft Type

On the basis of aircraft type, the civil aircraft segment acquired the highest aircraft turboprop propeller system market share in 2024. This is primarily due to the increasing demand for regional connectivity, short-haul flights, and cost-effective air travel in developing and developed regions. Turboprop-powered civil aircraft offer better fuel efficiency and lower operating costs, making them ideal for regional routes. The expansion of regional airlines and government initiatives to enhance air connectivity in remote areas have further driven demand. The rising adoption of advanced turboprop engines for improved performance and reduced emissions also supports this growth.

By Region

Region wise, North America emerged as the leading region in the aircraft turboprop propeller system market in 2024, securing the highest market share due to its strong presence of key aircraft manufacturers, advanced aerospace infrastructure, and high defense spending. The region hosts major players involved in the production and maintenance of turboprop systems, supporting both military and civil aviation needs. The U.S. military’s continued use of turboprop aircraft for transport, surveillance, and training significantly boosts demand. Regional air travel and cargo services in remote and rural areas further contribute to the adoption of turboprop aircraft, reinforcing North America's dominant market position.

However, Asia-Pacific is projected to grow at the fastest rate in the aircraft turboprop propeller system market during the forecast period, driven by rising demand for regional air connectivity, increasing defense budgets, and rapid expansion of aviation infrastructure. Countries such as China, India, and Indonesia are investing in regional airports and short-haul aircraft to improve accessibility across remote regions. Government initiatives such as India’s UDAN scheme support the adoption of turboprop aircraft for affordable air travel. Growing military modernization programs and rising procurement of surveillance and transport aircraft further fuel the demand for advanced turboprop propeller systems across the Asia-Pacific region.

The report focuses on growth prospects, restraints, and trends of the aircraft turboprop propeller system market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the aircraft turboprop propeller system market.

Competitive Analysis

The report analyses the profiles of key players operating in the aircraft turboprop propeller system market such as Textron Aviation, Pratt & Whitney, General Electric, Rolls-Royce Holdings plc, Safran, Collins Aerospace, Daher, Honeywell International Inc., Pilatus Aircraft Ltd., and PBS AEROSPACE. These players have adopted various strategies to increase their market penetration and strengthen their position in the aircraft turboprop propeller system market.

Increase in Demand for Regional Air Travel

The increase in demand for regional air travel is significantly boosting the growth of the aircraft turboprop propeller system market. As air connectivity expands to smaller cities and remote areas, especially in emerging economies, there is a growing need for cost-effective and fuel-efficient aircraft suitable for short-haul operations. For instance, in June 2025, ATR partnered with Pratt & Whitney Canada to develop advanced propulsion technologies aimed at shaping the future of low-emission regional turboprop aircraft. This partnership seeks to enhance the industry-leading performance of ATR aircraft powered by Pratt & Whitney Canada's PW127XT engines while also exploring innovative technologies for next-generation aircraft, including ATR’s 'EVO' concept. Moreover, turboprop aircraft, powered by advanced propeller systems, are well-suited for these routes due to their ability to operate on shorter runways and their lower operating costs compared to jet engines. Airlines are increasingly deploying turboprop aircraft for regional routes to meet the rising passenger demand while maintaining profitability. In addition, government initiatives supporting regional air connectivity, such as India’s UDAN scheme and the U.S. Essential Air Service program, further encourage the use of turboprop aircraft. This surge in regional air traffic is creating a strong market demand for efficient and reliable turboprop propeller systems, making them a critical component in modern regional aviation strategies. Therefore, an increase in demand for regional air travel is drivng the demand for the aircraft turboprop propeller system market growth

Growth in Military Applications

Growth in military applications is significantly driving the demand for the aircraft turboprop propeller system market. Turboprop aircraft are widely used by defense forces across the world for missions such as troop and cargo transport, maritime patrol, border surveillance, and pilot training. These aircraft offer excellent fuel efficiency, short takeoff and landing capabilities, and reliable performance in harsh environments, making them ideal for military operations. For instance, in August 2024, The Philippine Air Force has acquired two ATR 72 aircraft, which are being converted in Israel for maritime patrol missions, with delivery expected by mid-2025. These turboprop-powered aircraft are being equipped with advanced surveillance and communication systems to enhance maritime domain awareness and support coastal defense operations. The use of turboprop propeller systems in these aircraft provides the fuel efficiency, endurance, and low-speed maneuverability essential for extended patrol missions.

Moreover, the increase in focus on modernizing defense fleets, particularly in developing countries, is leading to the procurement of advanced turboprop aircraft fitted with high-performance propeller systems. In addition, the rising demand for unmanned aerial vehicles (UAVs) in military surveillance and reconnaissance roles is further contributing to market growth. Governments are also investing in indigenous defense manufacturing, which boosts the development and integration of advanced turboprop systems. As a result, the expanding scope of military applications is reinforcing the demand for durable and efficient turboprop propeller technologies.

Expansion of low-cost carriers (LCCs)

The expansion of low-cost carriers (LCCs) is significantly driving the demand for the aircraft turboprop propeller system market. LCCs are rapidly increasing their presence in regional and short-haul routes, especially in emerging economies where connectivity to tier-2 and tier-3 cities is crucial. Turboprop aircraft, known for their fuel efficiency and ability to operate on shorter runways, are ideally suited for these operations. Their lower operating and maintenance costs align perfectly with the cost-sensitive business models of LCCs. As a result, many budget airlines are incorporating turboprop aircraft into their fleets to improve route coverage while maintaining profitability. For instance, in June 2025, ATR partnered with Pratt & Whitney Canada (P&WC) to advance propulsion technology for regional turboprop aircraft, aiming to support the future of low-emission aviation. Building on the proven performance of the PW127XT engine, this partnership seeks to develop more efficient and sustainable solutions aligned with ATR’s next-generation ‘EVO’ aircraft concept. For low-cost carriers, which prioritize fuel efficiency and lower operating costs on short-haul routes, these advancements are particularly beneficial.

In addition, government support for regional air connectivity, particularly in countries like India and Southeast Asian nations, is encouraging LCCs to expand services to underserved regions. This growing network of short-haul operations by low-cost carriers is creating robust demand for reliable and efficient turboprop propeller systems, reinforcing their importance in the evolving aviation landscape.

Complex Maintenance of Gearbox and Propeller Systems

Complex maintenance of gearbox and propeller systems is acting as a significant restraint on the growth of the aircraft turboprop propeller system market. These components require frequent inspection, specialized tools, and highly skilled technicians to ensure safe and efficient operation. The intricate design of reduction gearboxes and variable-pitch propellers leads to increased maintenance time and higher operational costs compared to simpler propulsion systems. For operators, especially in remote or emerging markets, the limited availability of MRO (maintenance, repair, and overhaul) facilities further compounds the challenge. Unscheduled maintenance caused by gearbox wear, oil leaks, or propeller imbalance can disrupt operations and affect profitability. These factors reduce the overall appeal of turboprop aircraft, especially when compared to newer regional jets that offer lower maintenance complexity. As cost efficiency and operational uptime are key priorities for both commercial and military users, the burdensome upkeep of propeller systems continues to hinder wider adoption and long-term investment in turboprop platforms.

Volatility in Raw Material Prices

Volatility in raw material prices is hampering the aircraft turboprop propeller system market demand due to increase in production costs and disrupting supply chains. Key materials used in propeller systems—such as aluminum alloys, titanium, and advanced composites—are subject to frequent price fluctuations due to global supply-demand imbalances, geopolitical tensions, and trade restrictions. These unpredictable cost shifts pose challenges for manufacturers in maintaining stable pricing and profit margins. For aircraft operators, rising component costs translate into higher procurement and maintenance expenses, which can deter investment in new turboprop platforms. In addition, uncertainty in raw material availability can delay production schedules and limit the scalability of manufacturing operations. Small and regional aircraft manufacturers, in particular, are more vulnerable to these fluctuations, affecting their ability to meet growing demand efficiently. As price instability continues to pressure the aerospace industry, it remains a significant barrier to the sustained growth of the turboprop propeller system market.

Expansion in Emerging Regional Aviation Markets

The expansion of emerging regional aviation markets presents a lucrative opportunity for the turboprop propeller system market. Countries across Asia-Pacific, Latin America, and Africa are investing heavily in regional connectivity and airport infrastructure to improve access to remote and underserved areas. Turboprop aircraft, with their ability to operate on shorter runways and lower operating costs, are ideally suited for these regional routes. Government initiatives like India’s UDAN scheme and Brazil’s regional aviation development plans are encouraging airlines to deploy turboprop fleets for short-haul services. As passenger demand rises in tier-2 and tier-3 cities, the need for reliable, fuel-efficient propulsion systems grows. For instance, in May 2023, Honeywell has partnered with PT Dirgantara Indonesia (PTDI) to supply TPE331 turboprop engines for the NC212i aircraft, which are being exported to the Philippine Air Force. This partnership supports Honeywell’s objective of expanding its global defense footprint while providing reliable and efficient propulsion solutions that enhance the performance and operational readiness of regional military aircraft fleets. In addition, increased focus on intra-regional travel and tourism is creating sustained demand for smaller, cost-effective aircraft. This surge in regional aviation activity is expected to drive the adoption of advanced turboprop propeller systems, creating growth opportunities for manufacturers, suppliers, and maintenance service providers in these fast-developing markets.

Development of Hybrid-Electric Turboprop Technologies

The development of hybrid-electric turboprop technologies presents a lucrative opportunity for the turboprop propeller system market. With the aviation industry under increasing pressure to reduce emissions and improve fuel efficiency, hybrid-electric propulsion is emerging as a promising solution—particularly for regional and short-haul aircraft. Turboprop platforms are well-suited for hybrid integration due to their lower speed and power requirements, making them ideal candidates for early adoption. Furthermore, manufacturers and research institutions are actively investing in next-generation propulsion systems that combine traditional engines with electric motors to enhance efficiency and reduce environmental impact. This shift opens new avenues for innovation in propeller design, energy management systems, and lightweight materials. For instance, in March 2025, GE Aerospace invested in hybrid-electric propulsion technologies at the 2025 Verticon Conference, including advanced demonstrator engines that integrate gas turbines with electric power systems—aimed at accelerating the development of scalable, low-emission solutions across both commercial and military aviation. Moreover, as regulatory bodies push for greener aviation technologies, demand for hybrid-ready turboprop systems is expected to rise. The transition to hybrid-electric aircraft not only aligns with sustainability goals but also enhances the market potential for advanced and adaptive turboprop propeller systems in the years ahead.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aircraft turboprop propeller system market analysis from 2024 to 2034 to identify the prevailing aircraft turboprop propeller system market forecast.

- Market research is offered along with information related to key drivers, restraints, and aircraft turboprop propeller system market opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aircraft turboprop propeller system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aircraft turboprop propeller system market trends, key players, market segments, application areas, and market growth strategies.

Aircraft Turboprop Propeller System Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 3.6 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 340 |

| By Propeller Type |

|

| By Aircraft Type |

|

| By Sales Channel |

|

| By Component |

|

| By Region |

|

| Key Market Players | PBS AEROSPACE, Pilatus Aircraft Ltd., Safran, Rolls-Royce Holdings plc, Textron Aviation, Honeywell International Inc., Pratt & Whitney, Daher, Collins Aerospace, General Electric |

Upcoming trends in the global aircraft turboprop propeller system market include the adoption of lightweight composite materials, increased integration of smart propeller technologies, rising demand for fuel-efficient regional aircraft, and growing use of turboprops in military surveillance and cargo operations.

The leading application of the global Aircraft Turboprop Propeller System Market is commercial aviation, where turboprop propeller systems account for about 50% of total market revenue—driven by their fuel efficiency, reliability, and suitability for short-haul regional flights

North America is the largest regional market for Aircraft Turboprop Propeller System.

$1642,4 million is the estimated industry size of aircraft turboprop propeller system.

Textron Aviation, Pratt & Whitney, General Electric, Rolls-Royce Holdings plc, Safran, Collins Aerospace, Daher, Honeywell International Inc., Pilatus Aircraft Ltd., and PBS AEROSPACE.

Loading Table Of Content...

Loading Research Methodology...