The global aircraft window frame market was valued at $136.3 million in 2021, and is projected to reach $250.5 million by 2031, growing at a CAGR of 6.3% from 2022 to 2031.

Window frames are the structural members that hold the windows in place. Aircraft window frames are most commonly used in windshields and passenger cabin windows in order to provide rigidity to the windows. It consists of one inner flange and one vertical flange, which is manufactured from a fiber-reinforced synthetic resin, in which a semifinished part comprising fiber material is inserted into a molding tool under pressure and temperature. Subsequently, the component made in this manner is hardened in the molding tool. Generally, metal window frames are highly preferred in most aircraft frames. It offers superior sturdiness and rigidity to the windows for operating in diversified altitudes and climatic conditions.

Currently, several industry players are continuously investing in R&D for developing advanced manufacturing technologies for window frames. For instance, in August 2021, PPG Industries, Inc. expanded its development and production capabilities by investing $15 million in its manufacturing facility in Sylmar, California. The facility was upgraded with state-of-the-art processing equipment and new information technology infrastructure for enhanced digital manufacturing capabilities across windows for the aviation industry.

The factors such as surge in the number of aircraft deliveries, increased use of lightweight materials in manufacturing aircraft window frames, and a surge in the replacement of old aircraft supplement the growth of the aircraft window frame market. However, fluctuating prices of raw materials and congestion and delay in air traffic are the factors expected to hamper the growth of the market. In addition, government support & initiatives for promoting domestic aircraft and adopting low-cost carriers (LCC) in emerging economies create market opportunities for the key players operating in the aircraft window frame industry.

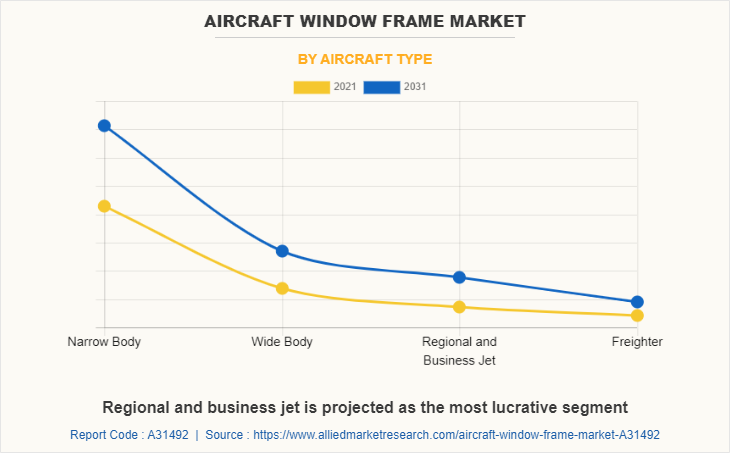

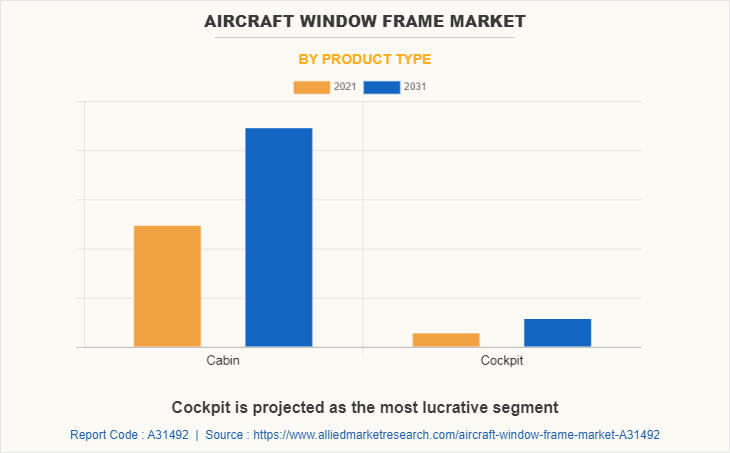

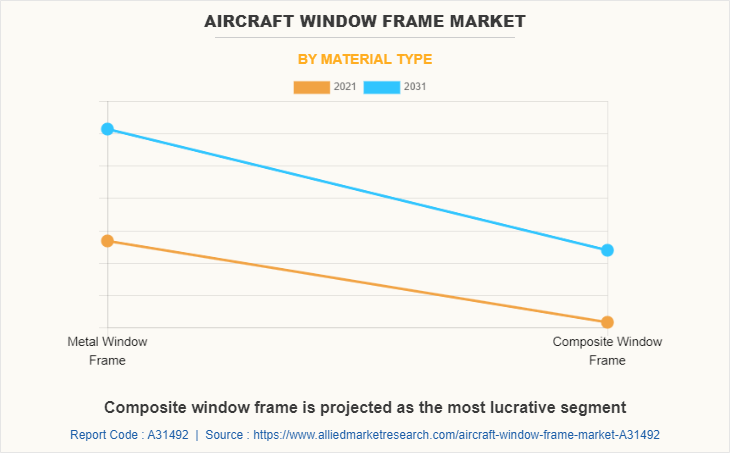

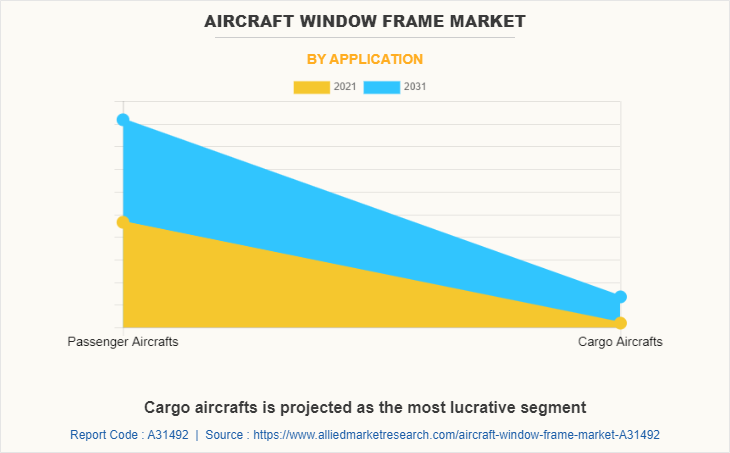

The aircraft window frame market is segmented into aircraft type, product type, material type, application, and region. By aircraft type, the market is divided into narrow body, wide body, regional & business jet, and freighter. By product type, it is fragmented into cabin and cockpit. By material type, it is categorized into the metal window frame and composite window frame. By application, it is further classified into passenger aircrafts and cargo aircrafts. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the aircraft window frame market are ACE Advanced Composite Engineering GmbH, Aerospace Plastic Components, Bayern Innovativ, Control Logistics Inc., Gentex Corporation, GKN Aerospace Services Limited, Lee Aerospace, LP Aero Plastics Inc., Perkins Aircraft Windows, Plexiweiss GmbH, PPG Industries, Inc., Saint-Gobain S.A., SIFCO Industries Inc., Skyart, Tech-Tool Plastics, The Nordam Group LLC and Llamas Plastics, Inc.

Surge in the number of aircraft deliveries

According to the International Civil Aviation Organization (ICAO), by 2035, passenger traffic and freight volume should double. Factors such as the growing disposable income of the middle-class population and the emergence of low-cost airlines are led to an increase in the number of airline passengers. Thus, the increase in passengers tends to increase the number of commercial aircraft deliveries. With the increase in the number of commercial aircraft deliveries, demand for avionics systems & services is also on an increase at a significant rate. Major countries such as Canada, U.S., Brazil, Indonesia, Philippines, China, Saudi Arabia, and India witness a rise in the number of air passengers and aircraft deliveries. For instance, according to the Bureau of transportation, in October 2021, U.S. Airlines’ passengers increased by 119% from October 2020. According to International Air Transport Association (IATA), passenger numbers could double to 8.2 billion in 2037 at a 3.5% compound annual growth rate (CAGR). Thus, increasing aircraft production during the forecast period owing to the rise in air traffic is expected to drive the aircraft window frame market’s growth.

Increased use of light-weight materials in manufacturing aircraft window frames

Rising preference for the usage of lightweight materials for lowering the total weight of the aircraft, along with advancements in production technologies, have been instrumental in making aircraft window frames a critical component of modern-age airplanes. For instance, manufacturers use “Lexan polycarbonate”, a lightweight window frame material that is relatively strong and has decent optical properties. Also, major commercial aircraft OEMs, Boeing and Airbus, have worked with material suppliers and parts fabricators and developed composite window frames for their next-generation aircraft, B787 and A350XWB. Composite window frames offer superior damage tolerance and have almost 50% lower weight compared to traditional aluminum frames. Therefore, the advancements in production technologies & increased use of lightweight materials in manufacturing aircraft window frames is expected to drive the market’s growth.

Fluctuating prices of raw materials

The aircraft window frame material normally consists of both light and heavy components mainly because the aircraft has to fly and, therefore, cannot be made out of super-heavy metals. The weight of the body, in particular, has to be kept to a minimum. Most aircraft also have frames made out of lightweight aluminum or composite materials that often include carbon-reinforced plastic or CREP. Also, the composite materials include high cost, and immediate repair is needed in case of damage. It is also important to avoid fire when using composite materials because the resin used weakens and causes the release of toxic fumes. Moreover, the consequences of the COVID-19 pandemic have affected the supply chain, which negatively impacted the delivery of raw materials, parts, and components such as aluminum and acrylic plastics, thereby hampering the aircraft window frame market growth.

Government support & initiatives for promoting domestic aircraft

Government agencies around the world are focusing on promoting domestic aircraft production to ensure economic development along with the expansion of the overall aviation industry. Additionally, several government agencies around the world offer tax incentives and benefits for aircraft manufacturers to improve their manufacturing facilities and increase aircraft production. For instance, in January 2019, the Government of India announced the development of a concept focused on encouraging and facilitating domestic manufacturing of aircraft and components by providing financial assistance to industry players. Also, industry players are continuously investing in R&D to develop advanced manufacturing technologies for window frames. For instance, Nordam, along with Hexcel Corp., are offering composite aircraft window frames that are manufactured using the innovative HexMC technology. This plays a major role in improving the frame corrosion resistance, durability and lowers maintenance significantly. Owing to all such factors is expected to create a lucrative opportunity for the aircraft window frame market.

Key Benefits For Stakeholders

- This study presents an analytical depiction of the global aircraft window frame market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall aircraft window frame market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global aircraft window frame market with detailed impact analysis.

- The current aircraft window frame market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Aircraft Window Frame Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 250.5 million |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 258 |

| By Aircraft Type |

|

| By Product Type |

|

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mitsubishi Heavy Industries, Perkins Aircraft Windows, Gentex Corporation, GKN AerospaceLMI Aerospace, LMI Aerospace, Nordam Group, Boeing, ACE Advanced Composite Engineering GmbH, PPG Industries Inc, SIFCO Industries, Bombardier Inc, Otto Fuchs KG, Saint-Gobain S.A., BBG GmbH & Co. KG, SkyArt, Embraer, ATR |

Analyst Review

This section provides the opinions of various top-level CXOs in the global aircraft window frame market. The growing demand for composite materials used in the manufacturing of aircraft window frames in order to improve corrosion resistance, lower aircraft weight, and enhance durability are key factors driving the aircraft window frame market growth. Moreover, rising demand for customized aircraft with improved fuel efficiency and growing emphasis on reduced carbon emissions are further boosting the sales of aircraft window frames which is likely to continue throughout the forecast period.

Furthermore, government agencies around the world are focusing on promoting domestic aircraft production to ensure economic development along with the expansion of the overall aviation industry. Additionally, several government agencies around the world offer tax incentives and benefits for aircraft manufacturers to improve their manufacturing facilities and increase aircraft production. For instance, in January 2019, the Government of India announced the development of a concept focused on encouraging and facilitating domestic manufacturing of aircraft and components by providing financial assistance to industry players. Further, the expansion in network capacities and long-haul low-cost carriers in many of the emerging economies is highly opportunistic for the market. This has increased the number of aircraft deliveries and is anticipated to boost the aircraft window frame market.

The market growth is supplemented by factors such as surge in the number of aircraft deliveries, increased use of lightweight materials in manufacturing aircraft window frames, and a surge in the replacement of old aircraft supplement the growth of the aircraft window frame market. However, fluctuating prices of raw materials and congestion and delay in air traffic are the factors expected to hamper the growth of the aircraft window frame market. In addition, government support & initiatives for promoting domestic aircraft and adopting low-cost carriers (LCC) in emerging economies create market opportunities for the key players operating in the aircraft window frame market.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, Europe is expected to lead during the forecast period due to the rising production of aircraft and advancements in manufacturing technologies, along with the usage of lightweight materials for lowering the overall aircraft weight.

The global aircraft window frame market was valued at $136.3 million in 2021, and is projected to reach $250.5 million by 2031, registering a CAGR of 6.3% from 2022 to 2031

The leading players operating in the aircraft window frame market are ACE Advanced Composite Engineering GmbH, Aerospace Plastic Components, Bayern Innovativ, Control Logistics Inc., Gentex Corporation, GKN Aerospace Services Limited, Lee Aerospace, LP Aero Plastics Inc., Perkins Aircraft Windows, Plexiweiss GmbH, PPG Industries, Inc., Saint-Gobain S.A., SIFCO Industries Inc., Skyart, Tech-Tool Plastics, The Nordam Group LLC and Llamas Plastics, Inc.

Asia-Pacific is the largest regional market for aircraft window frame

Increased use in passenger aircraft is the leading application of aircraft window frame market

Introduction of Composite Window Frame are the upcoming trends of aircraft window frame market in the world

Loading Table Of Content...