Airline Technology Integration Market Statistics, 2031

The global airline technology integration market size was valued at $21 billion in 2021, and is projected to reach $89.1 billion by 2031, growing at a CAGR of 15.9% from 2022 to 2031.

The airline technology integration market is being driven by key factors such as increased demand from the airline industry. The airline sector includes a wide spectrum of firms, involving airlines, airports, and service providers. Digital transformation is at the heart of every decision being made by these businesses.

One of the most essential strategies that airline technology integration experts around the world are using is the integration of technologies to improve airline technology integration activities.

The huge expansion of the airline sector in recent years can be ascribed to the rise in travel, e-commerce, and logistical transportation on airplanes. The digital interactions between airlines and passengers are becoming more personalized, optimized, which can be attributed to artificial intelligence. The airline business is using AI to tailor its services to the needs of its customers based on social sentiment of the passengers. Governments have spent billions on supporting the airline industry, and as long as there are problems, they will probably have to pay considerably more. Because of the nature of fixed and variable costs, the cost of airline operations is particularly difficult. Whether it's aircraft, maintenance, renting airport space, or IT systems, the fixed costs are fairly significant. This raises concerns because government funding will result in an increase in airline debt (generating more debt than equity).

The significant technical advancements in the airline IT systems industry have resulted in lower operating and investment costs. Furthermore, smart airport IT professionals are looking for innovative methods to increase operational efficiency and the passenger experience, which is projected to drive airline technology integration market growth during the forecast period.

Additionally, the advanced IT systems used at airline are expected to improve travel experiences. Airline technology integration industry are now modernizing their security systems with highly advanced and automated technology that can assist travelers wait lesser time. The rising need for eco-friendly and security technologies is expected to drive demand for green and smart Airline technology integration in the coming years. In collaboration with key companies, governments in several countries are planning and creating smart airline technology integration industry.

The key players profiled in this report include Airbus, Boeing, Collins Aerospace, General Electric, Honeywell International Inc., IBM, L3Harris Technologies, Inc., Lufthansa Technik, Oracle, and SAP SE.

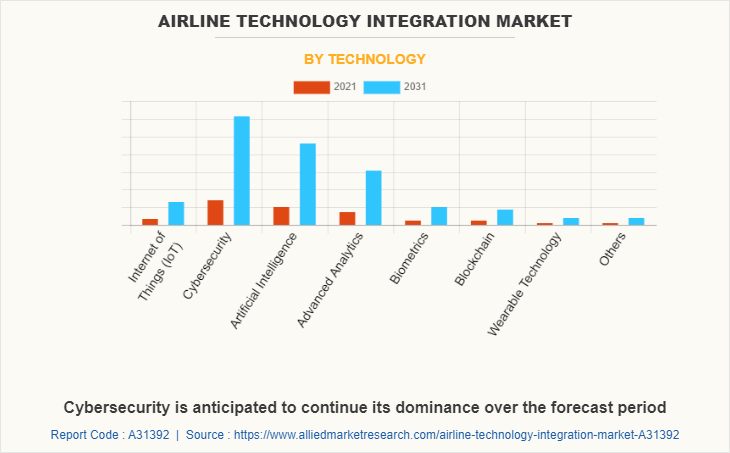

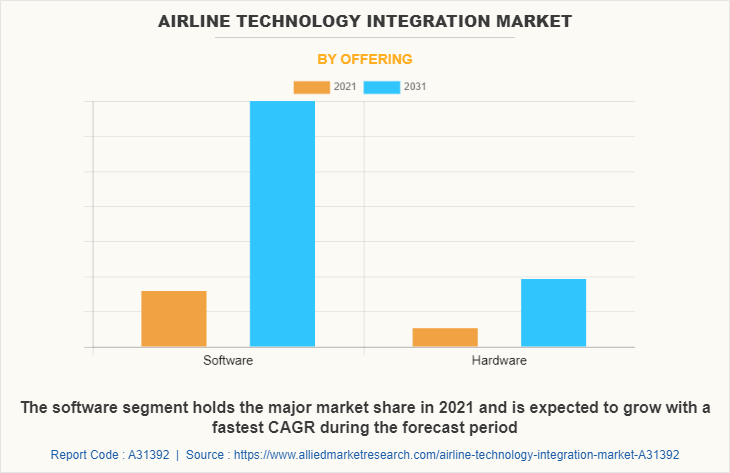

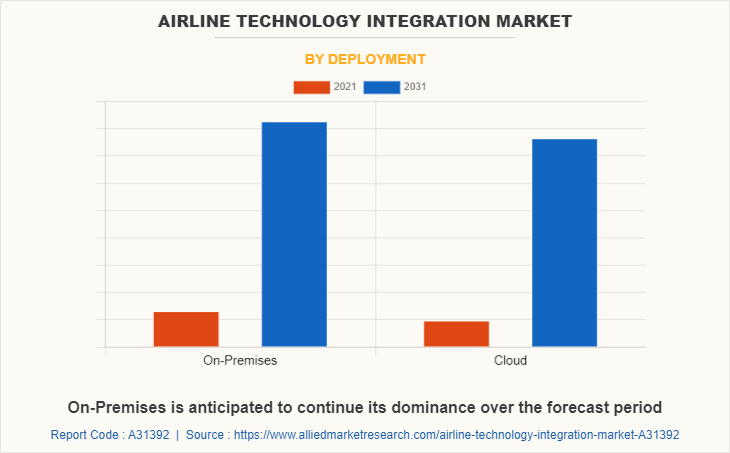

The airline technology integration market is segmented on the basis of technology, offering, deployment, and region. By technology, the market is divided into Internet of Things (IOT), cybersecurity, artificial intelligence, advanced analytics, biometrics, blockchain, wearable technology, and others. By offering, the market is classified into software and hardware. By offering, the market is divided into on-premises and cloud. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The airline technology integration market is segmented into Technology, Offering and Deployment.

By technology, the cybersecurity sub-segment dominated the market in 2021. The airline technology integration sector is growing increasingly dependent on information technology and is increasingly susceptible to malicious cyber-attacks. The global aviation cybersecurity segment is expected to expand significantly, owing mostly to the increasing instances of cyber-attacks and cybercrime in the airline sector.

By offering, the software sub-segment dominated the global airline technology integration market share in 2021. Software includes application software, solutions, systems, and information technology services to airlines. For specific activities, including maintenance or airport operations, several airport software vendors provide off-the-shelf solutions. However, the majority of them offer integrated systems made up of modules for various operations. Such applications of airline technology integration in the aviation sector are bound to create a scope of growth for the sub-segment during the forecast period.

By deployment, the on-premise sub-segment dominated the global airline technology integration market share in 2021. Airlines analytics solutions and services help to improve performance by lowering costs and downtime through the use of predictive and prescriptive analytics. These solutions are generally installed on-premises because end users choose internal software infrastructure and services to provide high levels of data security. As a result, several major airports use on-site aviation analytics rather than cloud-based ones. The higher cost of on-premises aviation analytics systems prevents small airports and airline companies from implementing them.

By region, North American dominated the global market in 2021 and is projected to be the fastest growing region during the forecast period. The presence of well-established air transport infrastructure in the region, as well as increased investments in the adoption of cutting-edge digital and novel technologies, has contributed to the growth of the North America AI in airline technology integration market forecast period. The region's high demand for air travel and growing number of air travelers are projected to attract considerable investments in the use of AI technology at airports and aircrafts. Business globalization has resulted in an increase in international flight travel in the United States and Canada. North America was among the first to use AI-based technology in the aviation business.

Impact of COVID-19

- The emergence of the COVID-19 pandemic has had a significant impact on practically all industries throughout the world. Furthermore, due to lockdown enforcements and travel limitations, it was shown that COVID-19 had a negative impact on airline technology operations, primarily affecting their revenue streams. Travel restrictions and border closures harmed airports and the aviation component of the travel industry.

- Furthermore, airline information technology must have measures to control virus transmission. Many steps are being made to control virus transmission at airline, including paperless ticketing, automatic doors, restroom motion sensors, and doorless restroom entries.

- Additionally, there are strong indications that the present decrease in demand for IT technology and digital solutions is a cultural phenomenon. COVID-19's influence on technology may be extremely favorable in the medium-to-long term, as everyone is forced to accept new technologies and discover their benefits. Further investments in digital infrastructure are expected.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airline technology integration market analysis from 2021 to 2031 to identify the prevailing airline technology integration market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airline technology integration market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airline technology integration market trends, key players, market segments, application areas, and market growth strategies.

Airline Technology Integration Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 89.1 billion |

| Growth Rate | CAGR of 15.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Technology |

|

| By Offering |

|

| By Deployment |

|

| By Region |

|

| Key Market Players | Palo Alto Networks, Inc., Microsoft Corporation, Amazon Web Services, Inc., Amadeus IT Group SA, Sabre, Raytheon Technologies Corporation, Thales Group, Honeywell International Inc., SITA, Accenture plc |

Analyst Review

Airline technology integration refers to the use of the latest technologies such as internet of things (IoT), artificial intelligence (AI), big data, cloud computing, and others to collect and analyze massive amount of data generated by airline industry. Airline technology integration market is gaining huge popularity owing to the use of interconnected technologies in the airline industry and rise in the passenger traffic globally. According to the International Air Transport Association (IATA), by 2035 the global passenger traffic is anticipated to reach 7.2 billion. To stay ahead in market, the airline companies are adopting various technologies to offer safe and travel experience to the travelers. For instance, the latest technological advancements in the airline sector with the launch of Airport 2.0, the commercial aviation sector has seen a rapid boost. Some of the latest technology being incorporated in the airline include internet of things (IoT) that brings new digital transformation in the aviation sector. With the help of sensor-equipped devices, the airline sector is able to gather sufficient amount of data regarding the customer behavior and the travel patterns. These factors are anticipated to boost the airline technology integration market size in the recent years. However, integration of these technologies can incur additional operational expenses for airline companies, which is anticipated to restrain the market growth in the coming years.

Additionally, the use of digital twins, AI, machine learning, virtual reality, and other technologies offer an immersive experience to travelers which is anticipated to generate excellent opportunities in the market. For instance, the use of digital twin technology is currently being tested at the U.S. East Coast Airport which will boost decision-making by providing a holistic view of airport operations. Also, the use of AI and machine learning help in analyzing millions of crucial data points regarding aircraft positions to drive smarter operational decisions.

Among the analyzed region, North America accounted for the highest market share in 2021, followed by Asia-Pacific, Europe, and LAMEA. The growth of North America airline technology integration industry is majorly attributed to the presence of extensive air transportation network in this region. For instance, the commercial aviation sector drives the 5% of the U.S. GDP which is equivalent to $1.25 trillion in 2022.

The worldwide airline technology integration market will be dominated by artificial intelligence. The expanding demand for big data analytics and the growing requirement for data collection are driving up demand for machine learning technologies in the global airline technology integration. Because of the expanded capabilities of machine learning technology to conduct difficult and impossible calculations, the machine learning has dominated the worldwide AI in airline technology integration market.

The major growth strategies adopted by the airline technology integration market players are product development and mergers & acquisitions.

The software sub-segment of the offering acquired the maximum share of the global airline technology integration market in 2021.

The airline industry leaders are the major customers in the global airline technology integration market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global airline technology integration market from 2021 to 2031 to determine the prevailing opportunities.

The use of airline technology integration as a technology, in AI and cybersecurity is estimated to drive the adoption of airline technology integration.

Increase in application of airline technology integration in the innovation of new technology and in the aviation sector facilities is anticipated to boost the airline technology integration market in the upcoming years.

North America will provide more business opportunities for the global airline technology integration market in the future.

Airbus, Boeing, Collins Aerospace, General Electric, Honeywell International Inc., IBM, L3Harris Technologies, Inc., Lufthansa Technik, Oracle, and SAP SE are the major players in the airline technology integration market.

Loading Table Of Content...