Airplane Carbon Brake Disc Market Research, 2033

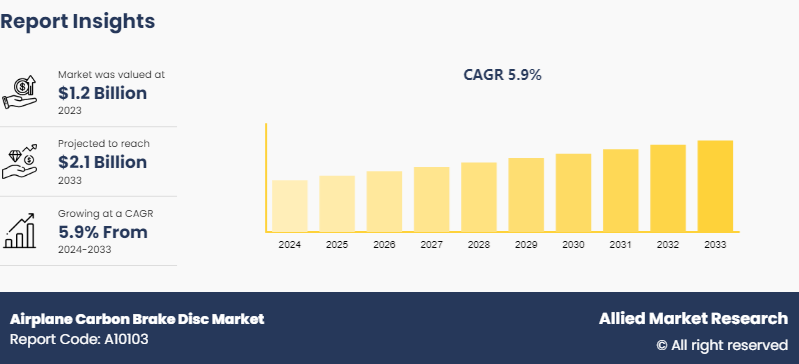

The global Airplane Carbon Brake Disc Market Size was valued at $1.2 billion in 2023, and is projected to reach $2.1 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Market Introduction and Definition

Airplane carbon brake discs are essential components of aircraft braking systems, replacing traditional steel brakes due to their superior performance and durability. These discs are manufactured using advanced carbon composite materials, offering benefits such as lightweight construction, high thermal conductivity, and resistance to wear and corrosion.

The Airplane Carbon Brake Disc Industry for airplane carbon brake discs exists to meet the stringent requirements of modern aviation, including enhanced safety, reduced maintenance costs, and improved operational efficiency. With the exponential Airplane Carbon Brake Disc Market Growthin air travel and the increasing demand for fuel-efficient aircraft, there is a continual need for braking systems that can withstand the rigorous demands of frequent takeoffs and landings while minimizing weight and maximizing performance. As such, the airplane carbon brake disc market plays a pivotal role in ensuring the safety and efficiency of air transportation worldwide.

Key Takeaways

The Airplane Carbon Brake Disc Market Size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Airplane Carbon Brake Disc industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global Airplane Carbon Brake Disc Market Share and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In April 2024, Safran Landing Systems launched a new generation of lightweight carbon brake discs, improving aircraft fuel efficiency and reducing CO2 emissions.

In February 2024, Honeywell Aerospace acquired a majority stake in a leading carbon brake disc manufacturer to enhance its product portfolio and technological capabilities.

In March 2024, Meggitt PLC expanded its manufacturing facility in Singapore to increase production capacity for advanced carbon brake discs, meeting the rising demand in the Asia-Pacific region.

In January 2024, Collins Aerospace entered into a strategic partnership with a European aerospace firm to co-develop next-generation carbon brake technology.

In May 2024, Dunlop Aircraft Tyers introduced an innovative recycling process for carbon brake discs, aiming to reduce waste and enhance sustainability in the aviation industry.

In December 2023, Lufthansa Technik announced the opening of a new maintenance and repair facility in Dubai, specializing in carbon brake disc services to support Middle Eastern airlines.

Key Market Dynamics

The airplane carbon brake disc market is experiencing notable growth driven by several key dynamics. One significant driver is the increasing demand for lightweight and durable materials in the aviation industry. Carbon brake discs are favored over traditional steel brakes due to their superior performance, including better heat dissipation and a significant reduction in aircraft weight, which contributes to fuel efficiency and overall cost savings. According to industry reports, the adoption of carbon brake discs can reduce an aircraft's weight by approximately 300 kg, resulting in fuel savings of about $200, 000 per aircraft annually. Additionally, the growth in global air traffic and the corresponding increase in commercial aircraft deliveries are propelling the demand for these advanced braking systems. Boeing, for instance, has forecasted that the global fleet of commercial aircraft will double by 2040, requiring over 43, 000 new airplanes.

However, the market faces restraints such as the high initial cost of carbon brake discs compared to their steel counterparts. The production process for carbon composites is complex and expensive, which translates to higher costs for airlines and aircraft manufacturers. Moreover, the COVID-19 pandemic has impacted the aviation industry severely, leading to a temporary decline in aircraft production and, consequently, a reduced demand for airplane components, including carbon brake discs. This has caused short-term market disruptions and financial challenges for key players.

Despite these challenges, significant opportunities exist within the market, particularly with advancements in technology and materials science. The development of next-generation carbon composites that offer enhanced performance and longer lifespan is a key area of focus. For example, new carbon-carbon composite technologies are being researched to improve thermal conductivity and resistance to oxidation, which could extend the life of brake discs and reduce maintenance costs for airlines. Additionally, the increasing emphasis on sustainability and the reduction of carbon footprints in aviation is likely to drive further innovations and investments in this sector. The shift towards greener aviation solutions aligns with global environmental goals and can foster market growth through eco-friendly product developments.

Market Segmentation

The Airplane Carbon Brake Disc market is segmented into aircraft type, brake type, end user, and region. On the basis of aircraft type, the market is divided into Commercial Aircraft, Military Aircraft, Business Jets, Regional Aircraft. As per end-user, the market is segregated into OEM & Aftermarket. On the basis of brake type, the market is categorized into Carbon-Carbon (C/C) Brakes, Carbon-Silicon Carbide (C/SiC) Brakes, and Carbon-Ceramic Brakes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The airplane carbon brake disc market is experiencing significant growth, particularly in the Asia-Pacific region, which is emerging as a dominant force due to several key factors. The increasing demand for air travel in countries such as China, India, Japan, and South Korea is driving the need for more aircraft, subsequently boosting the demand for high-performance carbon brake discs. China and India, in particular, are witnessing rapid growth in their aviation sectors, with both countries investing heavily in expanding their fleets to meet domestic and international travel demands. China's civil aviation sector is growing at an unprecedented rate, supported by government initiatives aimed at improving aviation infrastructure and expanding the country's network of airports.

Similarly, India's aviation market is set to become the third largest globally, with increasing passenger traffic and government policies supporting the aviation industry's growth. Japan and South Korea also play significant roles due to their advanced technological capabilities and strong focus on manufacturing and innovation in aerospace components.

Furthermore, the region's burgeoning middle class and rising disposable incomes are fueling air travel demand, necessitating the expansion of airline fleets and modernization of existing aircraft, which directly influences the carbon brake disc market. The technological advancements and cost-efficiency of carbon brake discs, compared to traditional steel brakes, are making them a preferred choice among airlines looking to improve performance and reduce maintenance costs.

Moreover, Asia-Pacific's proactive approach towards adopting greener technologies and reducing carbon footprints aligns well with the benefits offered by carbon brake discs, which are lighter and contribute to fuel efficiency. Overall, the region's dynamic growth in the aviation sector, combined with favorable economic conditions and technological advancements, positions the Asia-Pacific as a pivotal market for airplane carbon brake discs in the coming years.

Competitive Landscape

The major players operating in the airplane carbon brake discs market include Safran, Honeywell International Inc., Meggitt PLC, UTC Aerospace Systems, Collins Aerospace, Dunlop Aircraft Tyres Limited, Lufthansa Technik, TP Aerospace, Seginus Inc., and Aircraft Wheel & Brake.

Other players in the airplane carbon brake discs market include Parker Hannifin Corporation, Crane Aerospace & Electronics, Air France Industries KLM Engineering & Maintenance, HAECO Group, GKN Aerospace, Ameco Beijing, Aviation Component Solutions, Aero Brake & Spares, MRO Holdings Inc., Kellstrom Aerospace, AAR Corp., Aviall, Inc., Ontic, AJW Group, and Moog Inc. and so on.

Industry Trends

March 2024, Honeywell Aerospace announced the launch of a new generation of carbon brake discs for commercial airplanes, featuring improved durability and reduced weight. This product launch aims to enhance fuel efficiency and reduce maintenance costs for airlines, contributing positively to the aerospace industry in the USA.

- January 2024, Safran Landing Systems completed the acquisition of a leading carbon brake disc manufacturer, expanding its product portfolio and strengthening its market position in Europe. This strategic move is expected to boost Safran's production capabilities and support the growth of the aerospace sector in France.

- November 2023, AVIC Composite Corporation announced the expansion of its carbon brake disc manufacturing facility in Xi'an, China. This expansion is part of China's initiative to advance its aerospace industry by increasing the local production of high-tech components, reducing reliance on imports, and fostering innovation.

- July 2023, Meggitt PLC secured a long-term contract with a major European airline to supply carbon brake discs for its fleet. This contract underscores Meggitt's strong market presence and commitment to supporting the aviation industry's sustainability goals by providing high-performance, eco-friendly braking solutions.

- October 2023, Tokyo Carbon Co., Ltd. launched a new R&D center dedicated to developing next-generation carbon brake disc technologies. This initiative aims to position Japan as a leader in aerospace innovation and contribute to the global competitiveness of its aviation sector.

Key Sources Referred

Honeywell Aerospace

Meggitt Aircraft Braking Systems

Safran Landing Systems

Collins Aerospace

UTC Aerospace Systems

Aviation Partners Inc.

Boeing

Airbus

Lufthansa Technik AG

Heico Corporation

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airplane carbon brake disc market analysis from 2024 to 2033 to identify the prevailing Airplane Carbon Brake Disc Market Opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the airplane carbon brake disc market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global airplane carbon brake disc market trends, key players, market segments, application areas, and market growth strategies and Airplane Carbon Brake Disc Market Forecast.

Airplane Carbon Brake Disc Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Aircraft Type |

|

| By Break Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Aircraft Wheel & Brake, Safran, Honeywell International Inc, UTC Aerospace Systems, Dunlop Aircraft Tyres Limited, Meggitt PLC, Lufthansa Technik, Seginus Inc, TP Aerospace, Collins Aerospace |

Analyst Review

The airplane carbon brake disc market is experiencing notable advancements driven by increasing demand for lightweight and durable components in the aviation industry. Carbon brake discs are preferred over traditional steel brakes due to their superior performance, reduced weight, and enhanced fuel efficiency. The market's growth is primarily fueled by the rise in global air travel, which has escalated the need for more aircraft, thereby boosting the demand for reliable and efficient braking systems. Additionally, the emphasis on reducing carbon emissions and improving overall aircraft efficiency has led manufacturers to adopt carbon brake discs extensively.

Technological innovations play a crucial role in shaping the market, with companies investing in research and development to enhance the performance and longevity of carbon brake discs. The adoption of advanced materials and manufacturing techniques has resulted in the production of brake discs that offer better heat dissipation, increased lifespan, and reduced maintenance costs. Furthermore, the market is witnessing a trend towards the development of eco-friendly braking solutions, aligning with the aviation industry's commitment to sustainability.

Regionally, North America and Europe dominate the market due to the presence of major aircraft manufacturers and a high rate of technological adoption. Asia-Pacific is emerging as a significant market player, driven by the rapid expansion of the aviation sector in countries like China and India. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at expanding product portfolios and strengthening market presence.

The global airplane carbon brake disc market was valued at $1.2 billion in 2023, and is projected to reach $2.1 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

The Airplane carbon brake disc Market is product type, and region. 2024-2033 would be the forecast period in the market report.

The Commercial Aircraft segment held the largest market share in 2023 and is expected to grow at the fastest rate during the forecast period. The global Airplane carbon brake disc Market was valued at $1.2 billion in 2023.

The Airplane carbon brake disc Market is analyzed across North America, Europe, Asia-Pacific, LAMEA. 2023 is the base year calculated in the Airplane carbon brake disc Market report.

The top companies that hold the market share are Safran, Honeywell International Inc., Meggitt PLC, UTC Aerospace Systems, Collins Aerospace, Dunlop Aircraft Tyres Limited, Lufthansa Technik.

Loading Table Of Content...