Airport Baggage Handling System Market Research, 2032

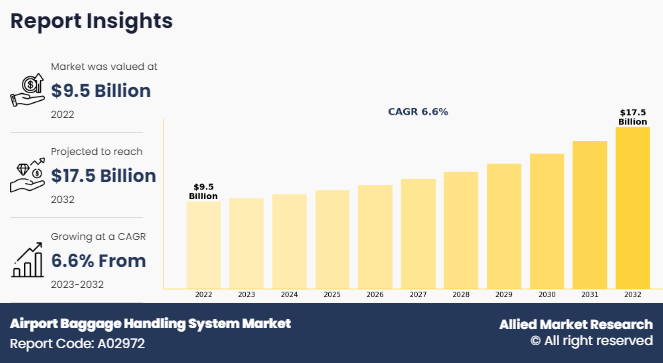

The global airport baggage handling system market size was valued at $9.5 billion in 2022, and is projected to reach $17.5 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.The baggage handling system (BHS) at airports is a process of transporting passenger’s baggage from check in counter from the departing airport to the cargo plane thereafter collecting it at the arrival airport or destination. The BHS is made up of numerous different processes and checks. Some of the major tasks carried out by this system is baggage sortation, baggage counting, weight checking, balance loading, screening baggage for security purposes and transportation of baggage with the help of conveyors and destination coded vehicles (DCV) by reading information present on the bag.

Furthermore, an airport's baggage handling system is a complex network of devices and procedures intended to move travelers' bags through the facility quickly and easily. Ensuring that every bag is accurately routed from check-in, through security screening, if necessary, to the appropriate aircraft, and finally to baggage reclaim at the destination is the main objective of a airport baggage handling system.

Key Takeaways

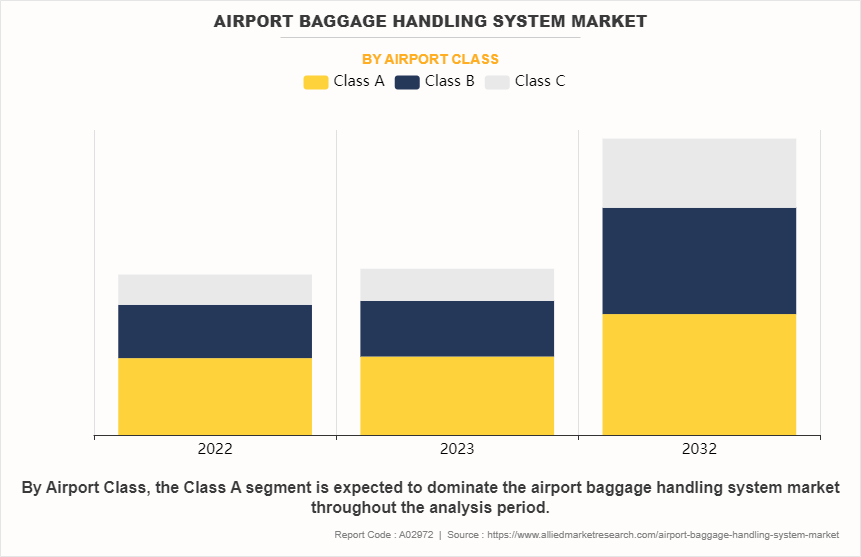

- On the basis of airport class, the class A segment held the largest share in the airport baggage handling system market in 2022.

- By service, the assisted service segment held the largest share in the market in 2022.

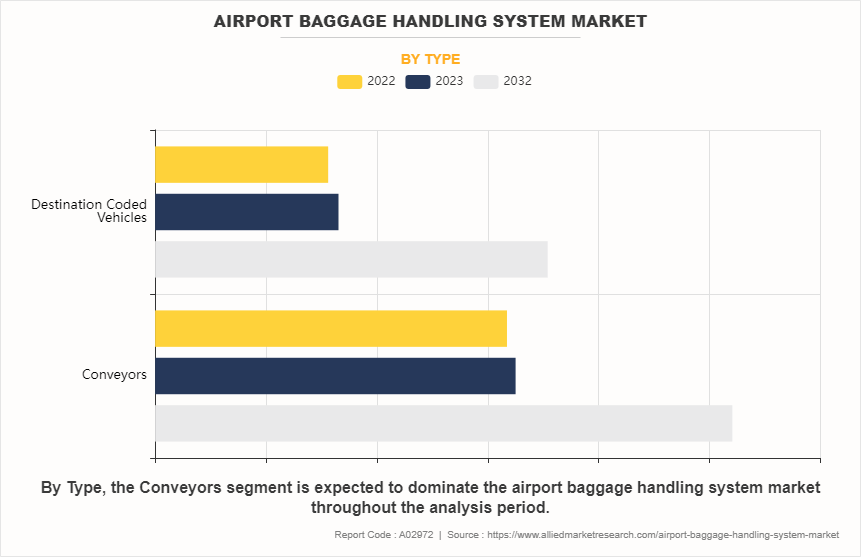

- On the basis of type, the conveyors segment held the largest market share in 2022.

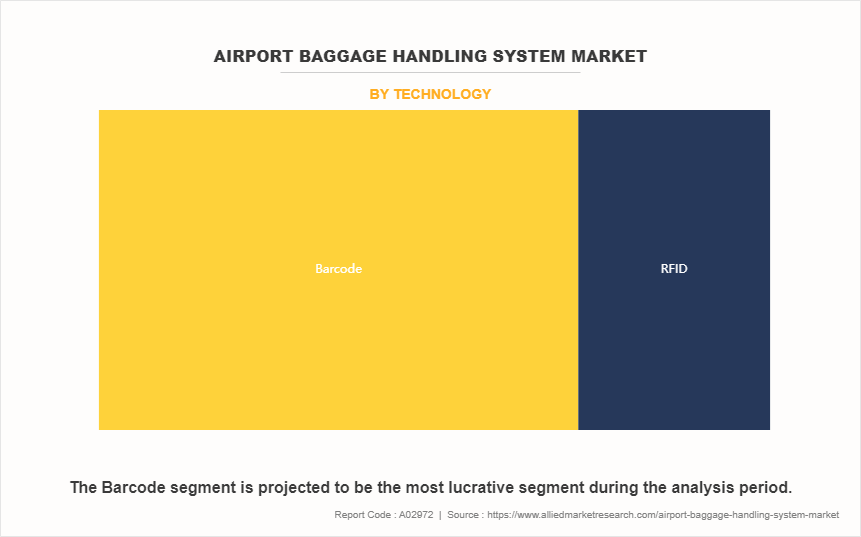

- On the basis of technology, the barcode segment held the largest market share in 2022.

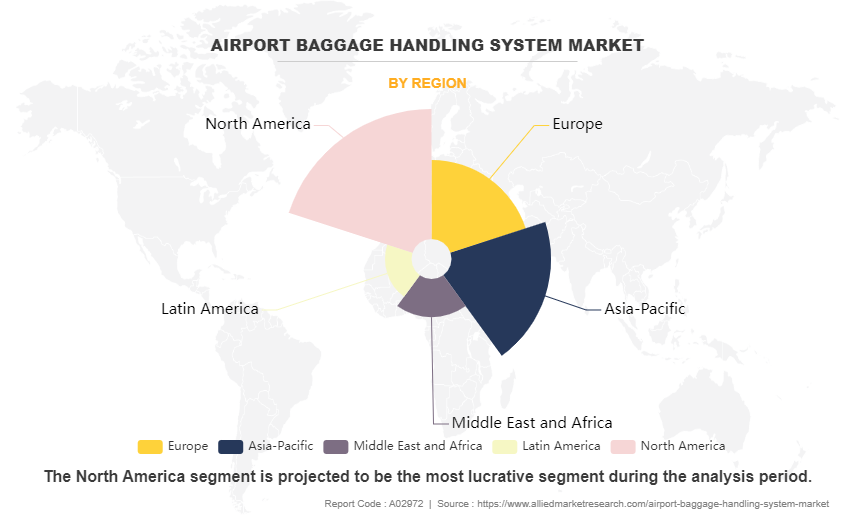

- On the basis of region, North America held the largest market share in 2022.

Advanced communication technologies are utilized by defense and aerospace telemetry systems to guarantee secure and dependable data transfer over extended distances and in difficult conditions. Since the data being communicated frequently contains sensitive and classified information, these systems are subject to strict security requirements. Telemetry solutions are become more complex as technology advances, providing increased data rates, better accuracy, and stronger encryption to satisfy the aerospace and defense industries' rising needs.

For instance, in January 2023, Siemens Logistics was responsible for the provision and implementation of a state-of-the-art baggage handling system (BHS) at Austin-Bergstrom international airport in the U.S. This project represents a significant upgrade to the airport's infrastructure, aimed at enhancing operational efficiency and meeting the evolving needs of modern air travel.

For instance, in July 2021, the worldwide air transport IT supplier, announced the takeover of Safety Line S.A.S., a Paris-based start-up focusing on digital solutions of aviation safety and efficiency. This takeover will expand SITA's Digital Day during Operation offering, assisting airlines in driving greater economies and fuel savings on the aircraft whilst taking instant and long-term efforts to minimize their carbon impact.

Anticipated rise in air travel is a significant driver of the growth of the market. The number of people using airports around the world has significantly increased as a result of the general rise in air travel. The increase in passenger traffic places strain on baggage handling systems to handle more bags more quickly and effectively. Furthermore, technological advancements have driven the demand for the market. However, high upfront and maintenance costs of baggage handling system (BHS) have hampered the growth of the market. Airports have limited funding, and funding for baggage handling infrastructure may not always be available due to competing priorities for capital spending. Financial resources are frequently contested by other important sectors including security improvements, terminal modifications, and runway development.

Moreover, high consequences of system failure are major factors that hamper the growth of the market. On the contrary, utilization of robotization at the airports is a lucrative opportunity for the growth of the market. Automating repetitive processes such as baggage sorting, loading, and unloading can be done by robotic devices, which will result in fewer delays and faster processing times. Therefore, due to this increased effectiveness, airports can manage higher passenger volumes more skillfully and with more productivity overall.

Segment Review

The market is segmented on the basis of airport class, service, type, technology, and region. By airport class, it includes Class A, Class B, and Class C. By service, the market is bifurcated into self-service and assisted service. By type, the market is classified into conveyors, destination coded, and vehicles. By technology, it is categorized into barcode and RFID. By region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

By Airport Class

On the basis of airport class, the class A segment attained the highest market share in 2022 in the market. This is attributed Class A systems being ideal for busy airports with high passenger flow since they are designed to handle big volumes of baggage effectively. These technologies ensure smooth operations even during periods of high travel demand, processing and sorting hundreds of bags each hour. Meanwhile, class B is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that class B systems offer a balance between capacity and cost, making them attractive to medium-sized airports looking for efficient baggage handling solutions without the high investment associated with class A systems. The affordability of class B systems appeals to airports operating within constrained budgets.

By Service

On the basis of service, the assisted service segment attained the highest market share in 2022 in the market. This attributed to assisted service solutions offering a balance between automation and manual labor, making them more cost-effective compared to fully automated systems (Class A) that require significant upfront investment. This affordability appeals to airports with budget constraints seeking efficient baggage handling solutions. Meanwhile, the self-service segment is projected to be the fastest-growing segment during the forecast period as self-service baggage handling options give travelers more convenience and control over their belongings, making their trip more customized and effective. The option for travelers to self-check in and tag their own bags minimizes wait times and lessens reliance on airport employees.

By Type

On the basis of type, the conveyors segment attained the highest market share in 2022 in the market. This was due to conveyor systems being scalable and adaptable to different airport configurations, layouts, and operating needs. They can handle a variety of baggage kinds, such as checked baggage, carry-ons, and unique things such as fragile or enormous baggage. However, the destination coded vehicles segment is projected to be the fastest-growing segment during the forecast period as the advanced sensors and communication technologies installed in destination coded vehicles allow for real-time tracking and monitoring of baggage movements. The entire baggage handling procedure is visible to and controlled by airport operators.

By Technology

On the basis of technology, the barcode segment attained the highest market share in 2022 in the airport baggage handling system market forecast. This was due to baggage processing at airport checkpoints, such as check-in, security screening, sorting, and loading, is made effective and quick by barcode technology. Data entry by hand is minimized and processing times are shortened when barcode labels are scanned.

However, the RFID segment is projected to be the fastest-growing segment during the forecast period as the RFID enables automated and real-time tracking of baggage throughout its journey within the airport. RFID tags embedded in baggage contain unique identification codes that can be read by RFID readers at various checkpoints, reducing the need for manual scanning and improving operational efficiency.

By Region

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the market. This is attributed to the fact that airports in North America are equipped with modern infrastructure and facilities, including advanced baggage handling systems. Many airports have undergone significant renovations and expansions to accommodate growing passenger volumes and meet industry standards for efficiency and passenger experience.

However, Asia-Pacific is projected to be the fastest-growing region for the market during the forecast period. This growth is attributed to the fact the Asia-Pacific region's airports are expanding and modernizing extensively to handle an increase in travelers and boost productivity. This covers expenditures on automated systems to expedite luggage processing and cutting-edge baggage handling technologies.

The report focuses on growth prospects, restraints, and trends of the airport baggage handling system market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the airport baggage handling system industry.

Competitive Analysis

The report analysis the profiles of key players operating in the airport baggage handling system market such as Beumer Group, Daifuku Co. Ltd., Fives Group, G&S Airport Conveyor, Glidepath group, Grenzebach Group, Logplan LLC, Pteris Global Limited, Siemens AG, and Vanderlande Industries B.V. These players have adopted various strategies to increase their market penetration and strengthen their position in the market.

Market Dynamics

Anticipated Growth in Air Travel

The number of people using airports throughout the world has significantly increased as a result of the general rise in air travel. The increase in passenger traffic puts pressure on baggage handling systems to handle more bags more quickly and efficiently. Furthermore, airports and airlines are looking for ways to streamline baggage handling procedures in order to cut down on mishandled baggage occurrences, eliminate delays, and improve overall operational effectiveness. Sophisticated baggage handling systems including robotics, automation, and smart technology can increase accuracy and optimize workflows. Moreover, sophisticated baggage screening and tracking capabilities are required by strict security rules. In order to guarantee adherence to security procedures and preserve effective baggage flow, modern baggage handling systems use cutting-edge screening technology.

For instance, in October 2022, Daifuku, a global leader in material handling and automation solutions, has made a significant investment of $26 million to establish a state-of-the-art manufacturing facility spanning 225,000 square feet in Boyne City, Michigan. This world-class facility, operated by Daifuku's subsidiary Jervis B. Webb Company, consolidates the operations of three previous plants located in Boyne City, Harbor Springs, and Pellston into a single, unified location. Situated on a sprawling 22-acre site at 300 M-75 South, this manufacturing hub specializes in producing airport baggage handling products and automated guided vehicles (AGVs). Therefore, anticipated growth in air travel drive the demand for airport baggage handling system market.

Renewal of Airports

Airport passenger volumes have increased as a result of the rise in air travel worldwide. There is a growing demand for effective baggage handling systems that can handle higher luggage volumes in airports due to increased foot traffic. Therefore, technological advancements in sensors and communication are driving the demand for airport baggage handling system market. Furthermore, airports are focused on providing a seamless and enjoyable experience for travellers. Modern baggage handling systems contribute to shorter wait times, reduced risk of mishandled luggage, and overall smoother travel processes, enhancing passenger satisfaction.

Moreover, airports are investing in cutting-edge baggage screening devices that are integrated into baggage handling systems in response to increased security concerns in the aviation sector. This guarantees adherence to strict security guidelines and rules. In addition, automation and robotics are frequently used into baggage handling procedures as part of airport modernization projects. Automated systems enhance overall airport operations by minimizing human error, cutting expenses, and increasing efficiency. For instance, August 2021, Stansted Airport in the UK recently completed a USD $74.5 million upgrade to its baggage handling system, which included installing 2.4km of conveyor belts and track, along with 180 automated car. Therefore, renewal of airport is driving the demand of the airport baggage handling system market.

Technological Advancements

The way that robotics and automation are integrated has completely changed how baggage handling is done. Automated systems reduce human error and manual work by streamlining the transfer of baggage from check-in to airplane loading. Examples of these systems include robotic arms and conveyor belts with sorting capabilities. Furthermore, Real-time baggage tracking is made possible by technologies such as Radio Frequency Identification (RFID). By affixing RFID tags to baggage, airports and airlines are able to track its whereabouts, which lowers the possibility of maltreatment and increases baggage reconciliation efficiency.

Moreover, technological advancements in baggage screening, including as explosive detection systems (EDS) and computed tomography (CT) scanners, improve security while speeding up the screening procedure. By offering more comprehensive photographs of the contents of the bag, these technologies enhance danger identification and lessen the need for physical checks. Therefore, technological advancements is increasing the demand for the airport baggage handling system market share.

High upfront and maintenance cost of Baggage Handling System (BHS)

Baggage handling systems are complex infrastructures that involve extensive conveyor networks, sorting equipment, screening technologies, and automation components. Designing, installing, and maintaining these systems require substantial capital investment due to their scale and sophistication. Furthermore, customized baggage handling system solutions are required because every airport has different needs and space limitations. Upfront expenses may increase when integrating BHS with current infrastructure and addressing certain operational requirements.

Moreover, the cost of updating or changing out old baggage handling systems is increased by the inclusion of cutting-edge technologies like automated sorting, RFID tagging, and CT scanning systems. Adopting state-of-the-art technology frequently necessitates large software and equipment investments.

In addition, the design and execution of baggage handling systems become more complex and expensive in order to comply with the strict safety and security rules enforced by aviation authorities. Investing in specialist equipment and continuing maintenance to guarantee operational compliance are necessary to meet regulatory criteria. Therefore, high upfront and maintenance cost of baggage handling system is hampering the airport baggage handling system market growth.

High consequences of system failure

The high consequences of system failure represent a significant challenge that hampers the growth of the airport baggage handling system market. Baggage handling systems are critical components of airport operations, and any failure or disruption can have serious implications for airport efficiency, passenger experience, and airline operations. Furthermore, significant operational interruptions, including as missed connections, longer flight turnaround times, and delays in luggage processing, might result from a baggage handling system malfunction. The inefficiencies caused by these disruptions may lead to lower airport productivity and higher operating expenses for airlines.

Moreover, system malfunctions can have a direct negative effect on the tourist experience, causing annoyance, irritation, and discontent. System malfunctions that cause baggage to be lost or delayed can damage an airport's reputation and reduce patronage. In addition, if baggage is not appropriately inspected or routed in accordance with security regulations, baggage handling system malfunctions may provide threats to safety and security. Airport security and regulatory compliance may be jeopardized as a result. Therefore, high consequence of system failure is hampering the growth of the airport baggage handling system industry.

Utilization of Robotization in the Airports

Robots can automate various tasks involved in baggage handling, including sorting, loading, and unloading luggage. This automation streamlines operations, reduces manual labor, and increases the speed and accuracy of baggage processing. Furthermore, robotization minimizes human error and variability in baggage handling processes, leading to more consistent and reliable performance. This reliability translates into improved on-time performance for flights and enhanced customer satisfaction. Moreover, robots can navigate efficiently in constrained airport spaces, maximizing the utilization of available areas for baggage handling operations. This is particularly beneficial in busy terminals where space is limited. In addition, Robotized systems are scalable and adaptable to changing operational needs and passenger volumes. They can handle fluctuations in baggage traffic more effectively than traditional manual systems. In addition, robots equipped with RFID or other tracking technologies can provide real-time visibility into the location and status of luggage, enabling better management of baggage flows and reducing the risk of lost or mishandled bags. Therefore, utilization of robotization is lucrative opportunity for airport baggage handling system market opportunity.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Airport Baggage Handeling System market analysis from 2022 to 2032 to identify the prevailing airport baggage handelings system market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airport baggage handling system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airport baggage handling system market trends, key players, market segments, application areas, and market growth strategies.

Airport Baggage Handling System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.5 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 485 |

| By Airport Class |

|

| By Service |

|

| By Type |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Daifuku Co. Ltd., LOGPLAN, LLC, Fives Group, pteris global limited, G&S Airport Conveyor, BEUMER Group, Grenzebach Group, Glidepath Group LLC, vanderlande industries b.v., Siemens AG |

Analyst Review

The airport baggage handling system market is growing at a steady growth rate. Improved accuracy, efficiency, and speed of operations are expected to drive the market growth during the forecast period. The RFID technology segment is expected to grow at the fastest CAGR during the forecast period.

Anticipated growth in air travel, modernization of airports, and technological advancements drive the growth of the market. However, increased upfront and maintenance cost of the baggage handling system (BHS) and high consequences of system failure impede the growth. In the near future, utilization of robotization in the airport’s baggage handling process is expected to create lucrative opportunities for the key players operating in this market.

North America is expected to account for the highest revenue in the global market throughout the forecast period (2018–2025). However, LAMEA is expected to exhibit growth at a high rate, predicting lucrative opportunities for the global airport baggage handling system market. The market participants continue to introduce the technologically advanced products to remain competitive in the market. Agreement and expansion are the prominent strategies adopted by the market players.

The key market players analyzed in this report include Siemens AG, Beumer Group, G&S Airport Conveyor, Vanderlande Industries B.V., Daifuku Co. Ltd., Pteris Global Limited, Fives Group, Grenzebach Group, Logplan LLC, and Glidepath group.

Upcoming trends in the Airport Baggage Handling System Market include increased automation and integration of artificial intelligence for enhanced efficiency and passenger experience.

The leading application of Airport Baggage Handling System Market is to efficiently and accurately transport passengers' luggage from check-in counters to aircraft and vice versa, ensuring smooth operations and passenger satisfaction.

North America is the largest regional market for Airport Baggage Handling System

USD $17491.5 million is the estimated industry size of Airport Baggage Handling System

Beumer Group, Daifuku Co. Ltd., Fives Group, G&S Airport Conveyor, Glidepath group, Grenzebach Group, Logplan LLC, Pteris Global Limited, Siemens AG, and Vanderlande Industries B.V.

Loading Table Of Content...

Loading Research Methodology...