Airport Ground Handling Market Research, 2033

The global Airport Ground Handling Market Size was valued at $32.4 billion in 2023, and is projected to reach $83.8 billion by 2033, growing at a CAGR of 10.1% from 2024 to 2033.

Airport ground handling refers to the various services provided to aircraft on the ground, usually between flights. These services include tasks such as baggage handling, refueling, aircraft maintenance, catering, deicing, passenger boarding and disembarking, security services, cargo services, and others. Ground handling services are essential to ensure that aircraft operate safely and efficiently and are usually provided by specialized independent companies or airports. Ground handling procedures must comply with strict safety rules and procedures to ensure passenger and aircraft safety. These procedures include using dedicated equipment and personnel and coordinating activities between service providers, airlines, and airport authorities.

Key Takeaways

- The airport ground handling market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Airport ground handling also includes utilizing an integrated system to incorporate and manage all physical and documentation processes. It involves cargo handling with real-time updates on warehouse activities such as shipment status, arrival time, and other pertinent information. Moreover, it comprises delivering passenger handling and other individualized services according to customer requirements.

There is a rise in air travel for business and leisure with growth in economy. This has increased the demand for air travel and contributed to increase in air travel. Moreover, the rise in interconnectivity of the global economy has led to surge in international travel, which in turn contributes to the Airport Ground Handling Market Growth. For instance, in April 2023, the International Air Transport Association (IATA) announced that the Airport Ground Handling Market Demand for air travel continues to increase, based on traffic results from February 2023 onwards.

The total air traffic in February 2023 increased by 55.5% as compared to February 2022. Moreover, according to the International Civil Aviation Organization (ICAO), by 2035, passenger traffic and freight volume is expected to increase two times. In addition, low-cost airlines have witnessed exponential growth across the globe due to increased economic activity, ease of travel, growth of the travel and tourism sector, rapid urbanization, and preference for low-cost service along with non-stops and frequent service among the consumers.

Low cost carriers (LCCs) create demand for air travel by offering lower fares, thus attracting passengers with cheaper fares. This has led to growth in the airline industry and an increase in air traffic which is expected to drive the demand for airport ground handling services.

However, airport ground handling requires significant capital investment to acquire the necessary equipment and infrastructure such as aircraft towing tractors, baggage handling systems, and ground support equipment. The high capital cost of airport ground handling includes a large investment required to obtain the equipment, infrastructure, and staff required to provide airport ground handling services. This includes the cost of purchasing and maintaining ground support equipment such as aircraft towing tractors, baggage handling systems, and cargo loaders. It also comprises the cost of constructing and maintaining facilities such as cargo terminals, passenger lounges, and baggage handling areas. In addition, the cost also increases to invest in training and hiring personnel to operate and maintain the equipment and facilities. Therefore, the overall high capital cost of ground handling is expected to hinder the growth of the market.

Technological advancements transform the airport ground handling industry, by improving efficiency, safety, and the overall passenger experience. There is a rise in the design of automated ground handling systems to improve efficiency. For instance, in December 2022, Sarcos Robotics and Changi Airport Group revealed the demonstration of a jointly developed outdoor-based autonomous baggage loading system prototype. The prototype is designed to automate the loading and unloading of loose passenger bags from small aircraft. Moreover, artificial intelligence is increasingly being utilized in airport operations to optimize ground handling operations, cut down on delays, and enhance the passenger experience.

For instance, in March 2023, Royal Schiphol Group, operator of Amsterdam Airport Schiphol company collaborated with security technology provider Pangiam to design technology powered by artificial intelligence (AI) and algorithms for baggage screening. The technology is developed for image analysis of hand baggage and the detection of banned items and other security threats. In addition, in April 2023, MSG Aviation, a private aviation company announced the construction of the largest robot in the world driven by artificial intelligence at Oslo Airport (OSL) in Norway. The designed robot is expected to be used for carrying out de-icing and service procedures of ground handling. Therefore, such technological advancements to enhance airport operations are expected to provide significant opportunities for the growth of the market.

The airport ground handling market is segmented on the basis of service, airport, provider, and region. By service, it is categorized into passenger handling, ramp handling, cargo handling, and others. By airport, it is classified into domestic, and international. By provider, it is divided into independent, and airlines and airports. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Service

Based on service, the Passenger Handling segment had the dominating airport ground handling market share in the year 2023 and is likely to remain dominant during the Airport Ground Handling Market Forecast period. This is primarily due to the growing air passenger traffic worldwide, driven by increased disposable income, rising tourism, and the expansion of low-cost carriers (LCCs). Passenger handling services, including check-in, security screening, boarding assistance, baggage handling, and special assistance services, are essential for smooth airport operations. Additionally, the shift toward digitalization and automation, such as biometric check-ins, self-service kiosks, and AI-powered passenger management systems, is enhancing efficiency and reducing wait times, further strengthening this segment's market presence. With airports continuously investing in improving passenger experience and operational efficiency, the demand for advanced passenger handling services remains high. Moreover, post-pandemic recovery in international travel and increased airline competition have further propelled the need for seamless and efficient passenger handling solutions.

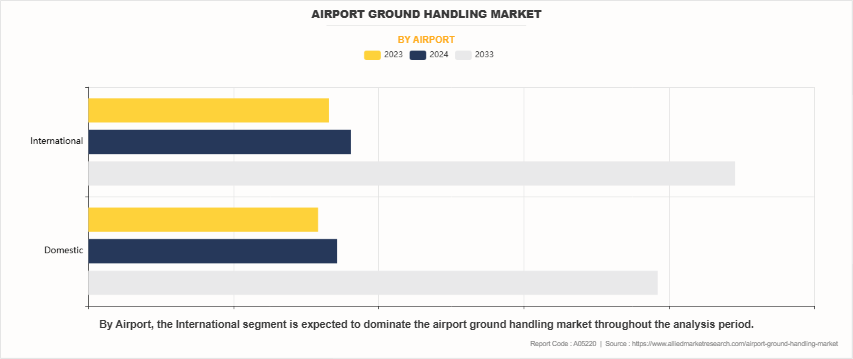

By Airport

Based on airport, the international segment dominated the global Airport Ground Handling industryin the year 2023 and is likely to remain dominant during the forecast period. The rapid increase in global air travel, expansion of cross-border tourism, and growing international trade are major factors contributing to this segments growth. International airports handle significantly higher passenger volumes compared to domestic airports, necessitating advanced ground handling services to manage security checks, customs clearance, baggage transfers, and aircraft turnaround processes efficiently. Additionally, major hub airports, such as London Heathrow, Dubai International, and Singapore Changi, serve as critical connection points for global travelers, further reinforcing the demand for sophisticated ground handling services. The rise in long-haul flights, expansion of international airline alliances, and increased investments in modernizing international airport infrastructure have also supported the dominance of this segment. With global travel demand continuously rising, international airports will remain key revenue generators for ground handling service providers.

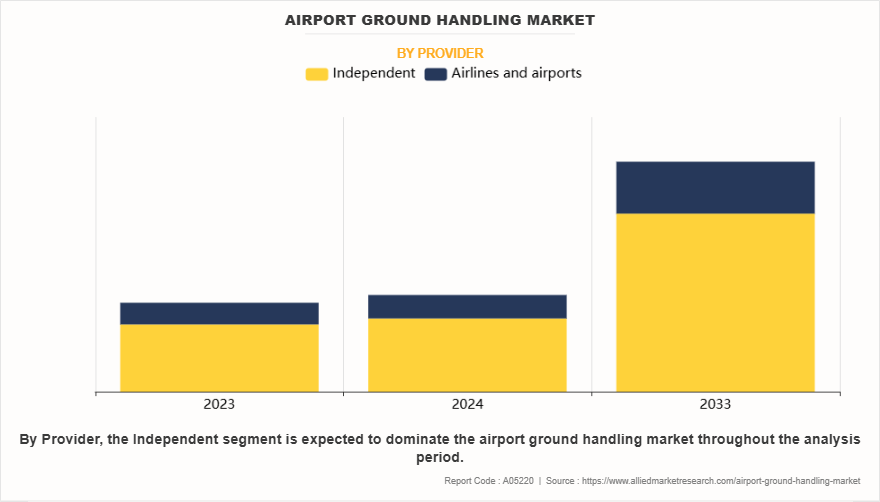

By Provider

Based on provider, the independent segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. Independent ground handling companies offer specialized, cost-effective, and high-quality services, making them the preferred choice for many airlines and airports. Unlike airline-owned or airport-operated services, independent providers bring flexibility, innovation, and efficiency to ground operations, enabling airlines to focus on their core business. Companies such as Swissport, Menzies Aviation, and Dnata have expanded their global presence by offering comprehensive ground handling solutions, including baggage handling, fueling, cargo operations, and ramp services. The increasing trend of outsourcing ground handling services to third-party providers allows airlines to optimize costs, improve operational efficiency, and enhance service quality. As airports continue to face high passenger traffic and demand for seamless operations, independent providers are expected to play a crucial role in meeting these evolving industry needs.

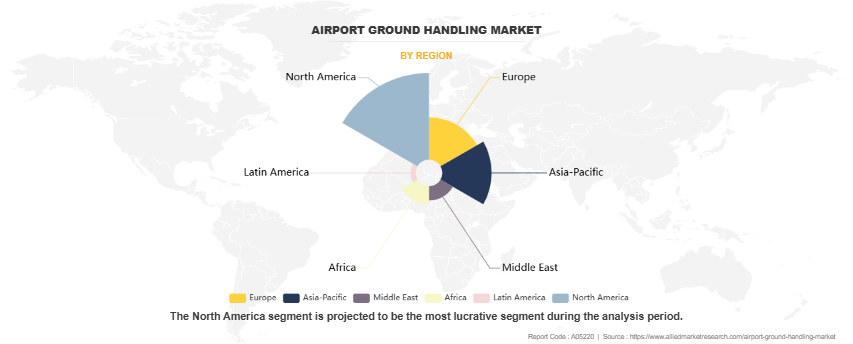

By Region

Based on region, North America region dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. The strong position of North America region is driven by the presence of major international airports, high air passenger traffic, and significant investments in airport infrastructure development. The United States and Canada have some of the busiest airports globally, including Hartsfield-Jackson Atlanta International, Los Angeles International (LAX), and Toronto Pearson International, which require advanced ground handling solutions to manage high passenger and cargo volumes efficiently. Additionally, the rapid adoption of automation and AI-driven technologies in airport operations is enhancing service efficiency, reducing operational costs, and improving passenger experience. North Americas strong presence of leading ground handling companies and its proactive approach toward sustainability initiatives, such as the adoption of electric ground support equipment (eGSE), further contribute to the regions market leadership. As air travel demand continues to rise, North America is expected to remain the dominant player in the global airport ground handling market.

Competition Analysis

- The leading companies profiled in the report include Fraport AG, Qatar Airways, SATS Ltd, Aviapartner, Swissport International AG, The Emirates Group, Flughafen München GmbH , Menzies Aviation Limited, Celebi Aviation, and AOT Ground Aviation Services Co., Ltd.

- May 2024, Menzies Aviation Limited acquired Flystar Flight Support and incorporated it into a new VIP brand for ground support services called Pearl Executive Aviation. Flystar, a Montenegrin firm, provided private jet ground services across the Balkans, including Serbia, Montenegro, Kosovo, and Croatia.

- March 2023, Menzies Aviation Limited received a contract from Wipro Limited, a technology services and consulting company to transform its air cargo management services.

- February 2023, Menzies Aviation Limited secured a contract from Aeroports de Montreal, an international airport in Canada. Under this contract, Menzies Aviation is expected to provide its full allocation of services until the contract ends in December 2030. These services are set to include ramp, passenger, and cabin cleaning services.

- July 2022, Aviapartner & Colossal Africa announced joint venture to establish Colossal Aviapartner for ground handling services across Africa. This strategy helps to redefine aviation service excellence in Africa, supported by significant investment in ground service equipment (GSE) for efficient client servicing. This service catered to airlines like South African Airways, Emirates, Etihad Airways, and British Airways.

- July 2022, Aviapartner announced a merger with Argos Private Handling (Argos), a Fixed Base Operator (FBO) and ground services provider in Italy. With the merger, Aviapartner and Argos became the largest General Aviation handling network in Italy, with 18 handling stations including 15 FBOs.

- January 2025, SATS Ltd. received cargo and ground handling contracts by Air India across multiple major airports in Asia, Europe, the Middle East, and North America. The contracts included locations like Chicago, Washington Dulles, London Heathrow, Birmingham, Frankfurt, Milan, and Hong Kong. SATS' CEO, Bob Chi, expressed pride in Air India's trust, citing their global network and service excellence.

- January 2024, SATS Ltd. received a contract by Hainan Airlines for cargo handling services in Saudi Arabia. Hainan Airlines operated three Airbus passenger flights weekly to Riyadh and Jeddah. The contract involved warehouse handling for over 2,400 tons of annual airfreight, including special cargo.

- September 2022, SATS Ltd. announced an agreement to acquire Worldwide Flight Services, an air cargo handling company. from an affiliate of Cerberus Capital Management (Cerberus). The transaction is valued at an enterprise value of $2.15 billion.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airport ground handling market analysis from 2023 to 2033 to identify the prevailing airport ground handling market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airport ground handling market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airport ground handling market trends, key players, market segments, application areas, and market growth strategies.

Airport Ground Handling Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 83.8 billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Service |

|

| By Airport |

|

| By Provider |

|

| By Region |

|

| Key Market Players | SATS Ltd., The Emirates Group, Qatar Airways, Aviapartner, Flughafen München GmbH, Swissport International AG, Fraport AG, Çelebi Aviation, AOT Ground Aviation Services Co., Ltd., Menzies Aviation Limited |

Analyst Review

According to the perspectives of CXOs of the leading companies, the global airport ground handling market is expected to witness growth owing to the globalization of air travel, and an increase in air traffic. Moreover, there has been an increase in collaborations, acquisitions, and mergers among various airport ground handling providers. For instance, in April 2023, SATS Ltd acquired Worldwide Flight Services (WFS), a provider of air freight logistics services worldwide for about $1.3 billion. Craig Smyth, WFS CEO, stated in a press release that companies can build relationships and enter new markets by combining operations and strengths with the help of mergers and acquisitions.

In addition, the airport ground handling market has been experiencing significant growth in the key global markets such as India. The rise in the number of stakeholders is expected to introduce new technologies, more efficient processes, and lower prices to increase competition and market growth. For instance, Yogendra Tomer, president of Aroon Aviation Services said that the key factors determining the growth of ground handling in India are expected to be the entry of new domestic and foreign stakeholders in the airport ground handling services market.

Despite strong growth drivers, the market faces several challenges that could impact its expansion. High capital investments required for upgrading infrastructure and adopting cutting-edge technologies pose financial constraints for smaller airports and independent service providers. Regulatory complexities, including stringent safety standards, labor laws, and environmental regulations, further add to operational challenges. Moreover, labor shortages, especially skilled ground handling personnel, remain a critical issue, leading to potential service disruptions during peak travel periods. Geopolitical factors, fluctuating fuel prices, and economic uncertainties also create risks for market stability, affecting investment decisions and strategic planning for key stakeholders.

However, growth opportunities in emerging markets, particularly in Asia-Pacific, the Middle East, and Africa, offer significant potential for market players. These regions are experiencing rapid urbanization, increasing disposable incomes, and major airport infrastructure investments, fueling demand for efficient ground handling services. The growing emphasis on sustainability, including the transition to green ground handling solutions, presents a lucrative opportunity for innovation and differentiation. As airlines continue to expand their fleets and global connectivity increases, the demand for efficient, cost-effective, and sustainable ground handling operations will remain a key priority for the aviation industry.

The global airport ground handling market was valued at $32,393.1 million in 2023, and is projected to reach $83,766.4 million by 2033, registering a CAGR of 10.1% from 2024 to 2033.

From 2024-2033 would be forecast period in the market report.

2023 is base year calculated in the Airport Ground Handling Market report. The leading companies adopt strategies such as product launch, partnership, acquisition, expansion, and collaboration to strengthen their market position.

Fraport AG, Qatar Airways, SATS Ltd, Aviapartner, Swissport International AG, The Emirates Group, Flughafen München GmbH are the top companies hold the market share in Airport Ground Handling Market.

Passenger Handling segment is the most influencing segment growing in the Airport Ground Handling Market report

Loading Table Of Content...

Loading Research Methodology...