Airport Kiosk Market Overview, 2032

The global airport kiosk market size was valued at $2.2 billion in 2022, and is projected to reach $5.1 billion by 2032, growing at a CAGR of 9.4% from 2023 to 2032. The airport kiosk market refers to the industry of supplying various types of interactive self-service kiosk hardware and software solutions to enable automation of passenger processing and airport operations such as check-in, bag drop, customs and immigration, payments, flight information, wayfinding, and others.

Report Key Highlighters:

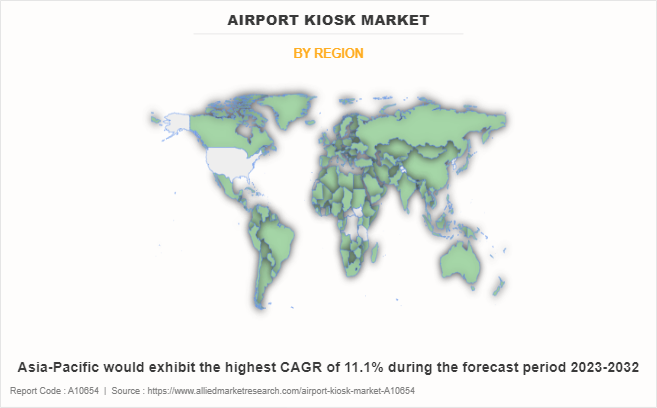

The airport kiosk market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the airport kiosk market.

The airport kiosk market share is moderately fragmented, with several players including Amadeus IT Group SA, Collins Aerospace, Embross, Thales Group, IER, Kiosk Information Systems Inc., Materna IPS GmbH, NCR Corporation, Olea Kiosks Inc., and SITA.

Factors such as increase in air passenger traffic globally, improvement in airport infrastructure in developing nations, and increased adoption of touchscreen, multimedia, and biometric kiosks to enhance passenger experience drive the growth of the airport kiosk market across the globe. In addition, high development and maintenance costs involved in airport kiosk hardware/software and security and privacy concerns related to data breaches act as a barrier for the growth of the airport kiosk market. However, the rise in utilization of artificial intelligence and data analytics tools and development of smart airport concepts globally provides an avenue for better kiosk adoption which are expected to create ample opportunities for the airport kiosk market growth during the forecast period.

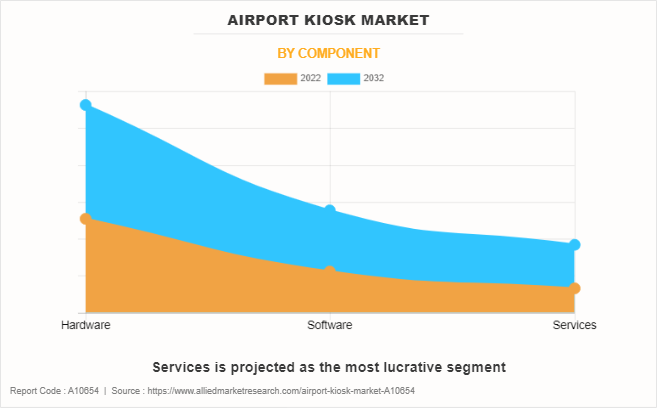

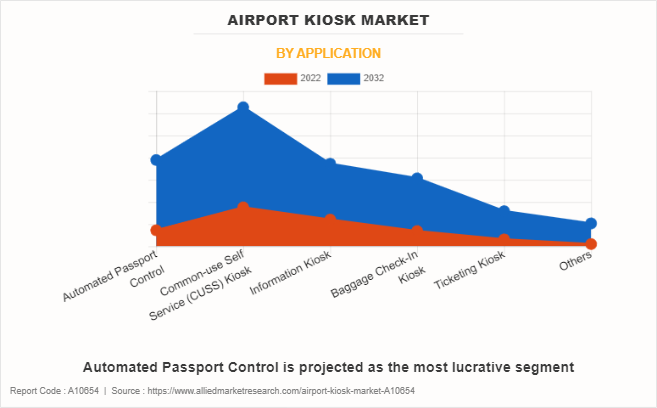

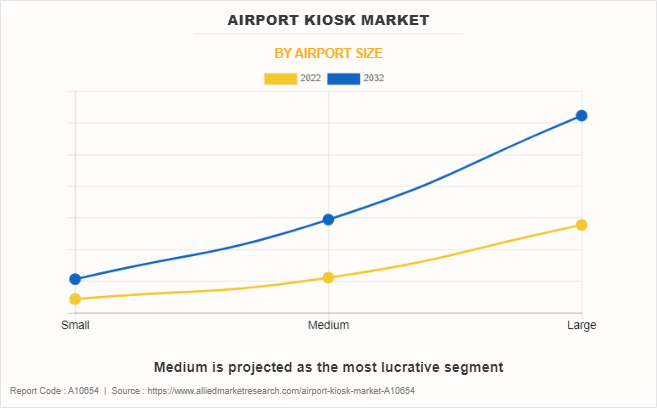

The airport kiosk market has been segmented on the basis of component, airport size, application, and region. By component, the airport kiosk market is segmented into hardware, software, and services. As per airport size, the airport kiosk market is divided into small, medium, and large. According to application, the airport kiosk market is segmented into check-in kiosk, automated passport control, common-use self-service (CUSS) kiosks, information, baggage check, ticketing kiosk, and others. Region-wise, the airport kiosk market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the global airport kiosk market include Amadeus IT Group SA, Collins Aerospace, Embross, Thales Group, IER, Kiosk Information Systems Inc., Materna IPS GmbH, NCR Corporation, Olea Kiosks Inc., and SITA.

U.S. and Canada are major early adopters of integrating advanced technologies in airports to handle increasing air passenger traffic efficiently. Moreover, U.S. airlines experienced a significant increase in passenger numbers, carrying an additional 194 million passengers compared to the previous year, marking a 30% year-to-year growth in 2022.

U.S. is at the forefront where prominent airports like Dallas Fort Worth, Los Angeles International, and John F. Kennedy have heavily adopted automated self-service kiosk infrastructure over the past decade to optimize passenger handling. Canada and Mexico are also witnessing investments in touchscreen kiosks for bag checks, immigration, etc.

In addition, U.S. based airports have adopted advanced kiosk from manufactures of airport kioskto provide better experience to air passengers. For instance, in December 2023, Harry Reid International Airport in Las Vegas announced plans to introduce self-screening security kiosks, enabling passengers, particularly those in the Trusted Traveler Program, to complete the screening process with minimal to no assistance from transportation security officers. These self-service screening kiosks are designed to improve productivity and expedite travelers' security procedures at airports. Therefore, increased air passenger traffic in the U.S., coupled with innovative developments in North America, is anticipated to drive airport kiosk market demand in the region during the forecast period.

Increase in air passenger traffic globally

According to the International Civil Aviation Organization’s (ICAO) yearly worldwide statistics, in 2022, there was a substantial rise in the volume of air travelers, estimated at 47% higher than in 2021. This increase is attributed to the swift recovery of numerous international flight routes. Moreover, in 2022, the number of passenger aircraft in operation reflects the broader recovery in air traffic, with current projections indicating that it has reached 75% of pre-pandemic levels.

The statistics suggest a rise in air passenger traffic over the years internationally. This rise is expected to result in a tremendous surge in demand for new airplanes globally, which would require the application of smart technologies at airports to properly manage resources and people at the airports throughout the globe.

Airport kiosks enable passengers to perform check-in, obtain boarding passes, and access essential information independently. This self-service approach significantly enhances the efficiency of airport operations, reducing congestion and wait times. During peak travel seasons or busy times, airports equipped with self-service kiosks can better accommodate the increased number of passengers, ensuring that check-in and information processes remain efficient and seamless.

Therefore, the increase in air passenger traffic globally is a driving force behind the airport kiosk market growth, as airports seek innovative solutions to manage higher volumes efficiently and enhance the overall passenger experience in an increasingly busy aviation landscape.

Improvement in airport infrastructure in developing nations

There has been a major expansion of airport infrastructure within developing countries across Asia-Pacific, Middle East, and Africa over the past decade. As these nations invest to upgrade existing airports or construct new modern terminal buildings, they are increasingly adopting self-service airport technologies like check-in and bag drop kiosks as part of automation initiatives.

Moreover, installing airport kiosk solutions helps these airports handle growing passenger volumes more efficiently while minimizing congestion, queues, and wait times at manual counters. For instance, markets like China, India, Thailand, Indonesia, and Malaysia have seen significant growth in air passenger traffic and are prominent adopters of self-service processes via kiosks.

For instance, in 2022, China made significant growth in airport construction. The Civil Aviation Administration of China reported the completion of 6 new freight airports and 29 new general-purpose airports on the Chinese mainland throughout 2022. This brought the total number of freight airports to 254 and general-purpose airports to 399 by the end of 2022. These developments further support the adoption of airport kiosks. The infrastructure upgrades also allow installation of more sophisticated kiosk hardware with larger screens, faster processors, and intuitive software. Thus, the airport infrastructure improvement momentum within emerging markets acts as a driver for self service airport kiosk market spurring greater demand and adoption of airport kiosk products.

High development and maintenance costs involved in airport kiosk hardware/software

While airport kiosks provide automation benefits, a key challenge deterring even faster deployments is the significant upfront development costs as well as ongoing maintenance expenses involved. Integrating the kiosk hardware such as machines, peripherals, large touch displays require sizeable customized application development especially interfacing with complex airport IT environments and backends.

Regular software updates, adding new features, ensuring systems availability/reliability amid high passenger usage also translates into considerable manpower and infrastructure costs for airports. Additionally, the constant need for hardware refreshments every few years to avoid systems becoming obsolete requires further capex investment outlays. For many airports, especially smaller regional ones with budget constraints, these investment requirements pose adoption barriers.

Security and privacy concerns related to data breaches

There are underlying worries about data privacy and system security, even though biometric-enabled airport kiosks offer extremely convenient identification and verification for processing passengers. Passengers often worry about confidential data like fingerprints and facial imagery collected on these devices being stored securely without risks of external hacking. There are also apprehensions about usage of collected biometric data for surveillance or tracking without consent.

Data breaches exposing traveler data at airports highlight how cyber risks persist around kiosk systems handling sensitive information, causing more passengers to avoid using self-service biometrics options altogether due to personal privacy reservations. Overcoming these security and data protection fears through stringent cybersecurity standards has emerged as an area requiring more industry focus.

The rise in utilization of artificial intelligence and data analytics tools

Airports collect a vast amount of data from passengers, flights, and operations. Big data analysis tools are like super-powered computers that can make sense of all this data. They help airports understand passenger behavior, optimize resource allocation, and plan. For instance, an airport may use this data to figure out the busiest times for check-in, making sure there are enough staff on hand to handle the crowds.

Moreover, modern airports are adopting AI to make their operations more efficient and passenger friendly. AI may act like a smart assistant for the airport, helping with tasks such as predicting flight delays, automating check-in and security procedures, and even providing customer service through chatbots. This makes the airport experience smoother and more convenient for travelers. Airports operators have adopted AI by collaborating with AI companies.

For instance, in July 2022, Delta introduced a new airport screen that utilizes AI and facial recognition technology to display personalized flight information to multiple travelers simultaneously. Known as the parallel reality screen, this futuristic display may cater to the individual preferences of up to 100 people at once. After going through security, passengers on Delta can access this information at the parallel reality display kiosk located close to the Delta sky club. Passengers can use facial recognition or scan their boarding pass to get personalized information. Therefore, airports use big data analysis to improve passenger experiences and resource management, while AI enhances operational efficiency and traveler convenience. These collaborations drive the growth of the airport kiosk market.

The airport kiosk market is segmented into Component, Application and Airport Size.

Recent Developments in the Airport kiosk Industry

In January 2023, NCR VOYIX Corporation signed an agreement with Position Imaging Inc. to provide multilanguage service and support foundation to handle installations, customer service, and technical support for its iPickup Point platform globally.

In May 2023, Amadeus IT Group SA signed an agreement with Noida International Airport (NIA) to provide smart and modern capabilities including biometric-based Digi Yatra integration at every passenger touch point for smooth passenger experiences.

In July 2023, Olea Kiosks Inc. launched Hypermodular kiosk technology. It is designed to allow for complex kiosk configurations to be piloted and in-service faster than a custom-designed product.

In March 2023, Materna IPS GmbH received contract from Düsseldorf Airport (DUS), Germany to implement several self-service check-in and bag drop systems across the airport. It helps to allow passengers to check-in on site and print their bag tags, prior to dropping off baggage at one of the self-bags drop systems.

In May 2023, Embross signed contracts with multiple Greenland Airports such as Nuuk International, IIulissat Airport, and Qaqortoq Airport. Under this contract Embross will provide biometric and airport management solutions along with improvement and optimization of internal processes. As a part of the contract, it will install its cloud based CUPPS platform to reduce time and effort.

In April 2023, IER, a part of Bollore Group, received contract from Groupe ADP to supply 75 self-service check-in kiosks, including check-in printers, boarding gates, and biometric solutions such as Skylane, SkyCheck, and SkyDrop. This contract will help to increase demand for air transportation.

In November 2023, Collins Aerospace entered into a contract with NEOM Bay Airport, Saudi Arabia, to provide its suite of connected airport system products, including operational database, resource management, messaging, baggage, and self-bag drop systems.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airport kiosk market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The airport kiosk market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the airport kiosk market players.

The report includes the analysis of the regional as well as global airport kiosk industry trends, key players, market segments, application areas, and market growth strategies.

Airport Kiosk Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.1 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Component |

|

| By Application |

|

| By Airport Size |

|

| By Region |

|

| Key Market Players | Collins Aerospace, SITA, KIOSK Information Systems, Inc, NCR VOYIX Corporation, Embross, IER, Materna IPS GmbH, Olea Kiosks Inc., Amadeus IT Group SA, Thales Group |

The Airport Kiosk Market was valued at $2,150.00 million in 2022 and is estimated to reach $5,106.60 million by 2032, exhibiting a CAGR of 9.4% from 2023 to 2032.

Upcoming trends of Airport Kiosk Market are the rise in utilization of artificial intelligence and data analytics tools and development of smart airport concepts globally.

Largest regional market for Airport Kiosk is North America

Leading application of Airport Kiosk Market is common-use self service (CUSS) kiosk .

Amadeus IT Group SA, Collins Aerospace, Embross, Thales Group, IER, Kiosk Information Systems Inc., Materna IPS GmbH, NCR Corporation, Olea Kiosks Inc., and SITA.

Loading Table Of Content...

Loading Research Methodology...