Airport Passenger Security Market Research, 2033

The global Airport Passenger Security Market Size was valued at $16.4 billion in 2023, and is projected to reach $43.2 billion by 2033, growing at a CAGR of 10.3% from 2024 to 2033.

The airport passenger security market encompasses technologies, solutions, and services designed to enhance safety, detect threats, and streamline security screening processes at airports. It includes biometric authentication, advanced baggage scanning, body scanners, perimeter security, and AI-driven surveillance systems to ensure passenger safety and regulatory compliance.

Key Takeaways

- The airport passenger security market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious Airport Passenger Security Market Growth objectives.

The airport security market has experienced significant growth, driven by increasing passenger traffic, evolving security threats, and advancements in technology. The dynamic nature of this market is shaped by a combination of factors, including the need for enhanced safety measures, government regulations, technological innovations, and the strategic initiatives undertaken by key players in the industry. The ever-evolving nature of aviation security has led to the continuous upgrade of infrastructure and the adoption of advanced technologies to mitigate emerging threats while improving operational efficiency.

As global air traffic continues to grow, airport security is at the forefront of aviation management. This growth is accompanied by rising concerns over the safety of passengers and airport personnel, particularly due to an increase in terrorist activities and other criminal threats. To address these challenges, governments across the globe are investing in improving airport security infrastructure, ensuring that security measures are updated to counter evolving threats. For example, in the U.S., the Transportation Security Administration (TSA) has implemented various security upgrades, including the expansion of its PreCheck program in 2023 to enhance passenger screening efficiency without compromising safety. The TSA has also collaborated with the private sector, encouraging the development and deployment of cutting-edge security technologies such as advanced imaging systems and biometric recognition technologies. This collaboration has been vital in streamlining security checks and reducing passenger waiting times, which is a significant concern for travelers.

Technological advancements are one of the key drivers of the airport security market. The implementation of biometric screening, AI-driven threat detection, and automated systems is transforming the security landscape. For instance, in 2024, the International Air Transport Association (IATA) collaborated with key airport authorities to introduce "smart" airports that leverage facial recognition technology for passenger identification. This not only accelerates the security process but also reduces human error and improves accuracy. Airports such as Dubai International Airport (DXB) have already implemented biometric passport control systems that provide faster, more secure passenger flows. The success of these technologies has sparked a wave of adoption in other international airports, with many now experimenting with advanced surveillance systems and automated baggage handling to reduce operational bottlenecks and improve security effectiveness.

Furthermore, there is a strong push toward enhancing cybersecurity at airports. With the increasing reliance on digital systems for ticketing, baggage handling, and flight management, airports have become prime targets for cyber-attacks. In response, many airports are investing in robust cybersecurity measures. The UK Government introduced new policies in 2023 aimed at securing digital systems from cyber threats, as evidenced by their development of the National Cyber Security Strategy for Aviation. This strategy focuses on improving the resilience of aviation infrastructure, safeguarding against digital threats, and ensuring that security protocols are robust enough to withstand modern cyber-attacks.

Public-private partnerships are also playing an important role in shaping the market dynamics. Governments are increasingly working with private companies to enhance the quality of security systems at airports. One notable example is the collaboration between airports and security technology providers such as Smiths Detection and Rapiscan Systems, which have introduced innovative screening solutions. For example, in 2024, Smiths Detection announced the installation of its advanced CTX 9800 DSi scanners at multiple airports across Europe and the Middle East. This next-generation system uses 3D imaging and sophisticated algorithms to identify potential threats in carry-on baggage, providing faster and more accurate detection.

Another notable example of market dynamics is the shift towards enhanced cargo security. With air freight volumes growing, there is increasing emphasis on securing cargo shipments to prevent the trafficking of illegal goods or the transportation of explosives. In response to this, airports are incorporating high-tech screening solutions for cargo, using advanced scanners, X-ray machines, and detection technology to inspect cargo in real-time. The U.S. Customs and Border Protection (CBP) agency’s 2023 initiative to enhance cargo security at major U.S. airports is a case in point, where additional scanning technology and screening protocols have been put in place to ensure that cargo is thoroughly inspected before it is allowed to board international flights.

The sustainability of airport security infrastructure is also gaining momentum. Many airport operators are looking at environmentally friendly solutions that can help reduce the carbon footprint of security systems. For instance, in 2023, several airports in Scandinavia began implementing eco-friendly security equipment, including energy-efficient scanners and systems designed to reduce overall energy consumption. This aligns with the broader global trend of integrating sustainability into aviation infrastructure, which is becoming increasingly important for airports to remain competitive and align with international environmental standards.

The airport security market is segmented into airport type, security solution, component, and region. By airport type, the market is bifurcated into international and domestic. By security solution, it is classified into biometric screening, X-ray and millimeter wave scanners, Explosive Detection Systems (EDS), perimeter security systems, video surveillance and analytics, access control systems, and Cybersecurity solutions. By component, it is divided into hardware, software, and services. Region wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa.

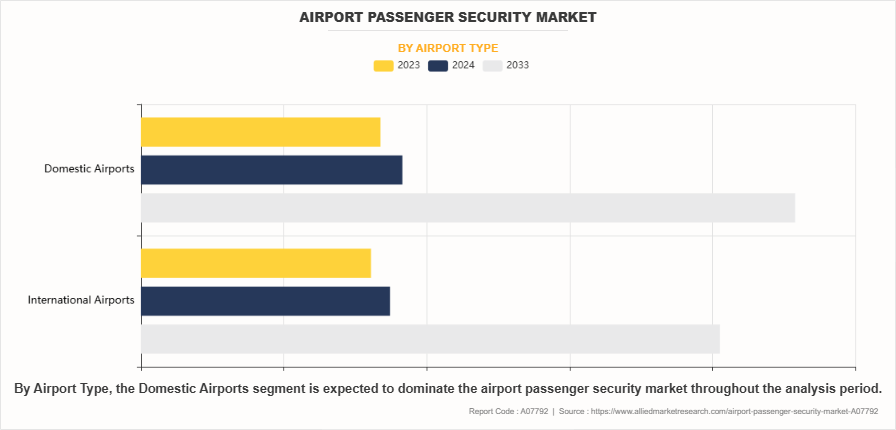

By Airport Type

Based on airport type, the domestic airport segment dominated the global market in the year 2023 and is likely to remain dominant during the Airport Passenger Security Market Forecast period. This is attributed to the significant rise in domestic air travel, especially in densely populated countries with expansive domestic airline networks such as the U.S., China, and India. Domestic airports handle a higher volume of passengers daily, necessitating robust security measures to manage threats efficiently and maintain passenger safety. Additionally, the rapid growth of low-cost carriers and the post-pandemic rebound in domestic tourism have led to increased investments in security infrastructure at domestic terminals. Governments and airport authorities are prioritizing upgrades in screening technologies, surveillance systems, and access control to meet regulatory requirements and enhance operational efficiency.

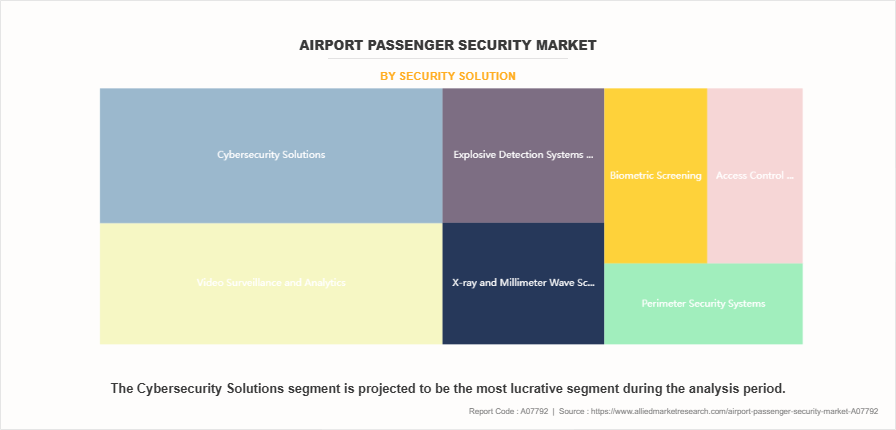

By Security Solution

Based on security solutions, the Cybersecurity Solutions segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the increasing reliance on digital infrastructure across airport operations, making cybersecurity a critical priority. With rising threats of cyberattacks targeting airport networks, passenger data, and automated systems, airport authorities are investing heavily in advanced cybersecurity solutions. The integration of cloud computing, IoT devices, and biometric technologies has expanded the digital attack surface, thereby driving the demand for robust firewalls, threat detection, encryption, and incident response systems. Moreover, regulatory frameworks mandating data protection and the need to ensure uninterrupted airport operations are encouraging stakeholders to prioritize cybersecurity as a key element of airport passenger security.

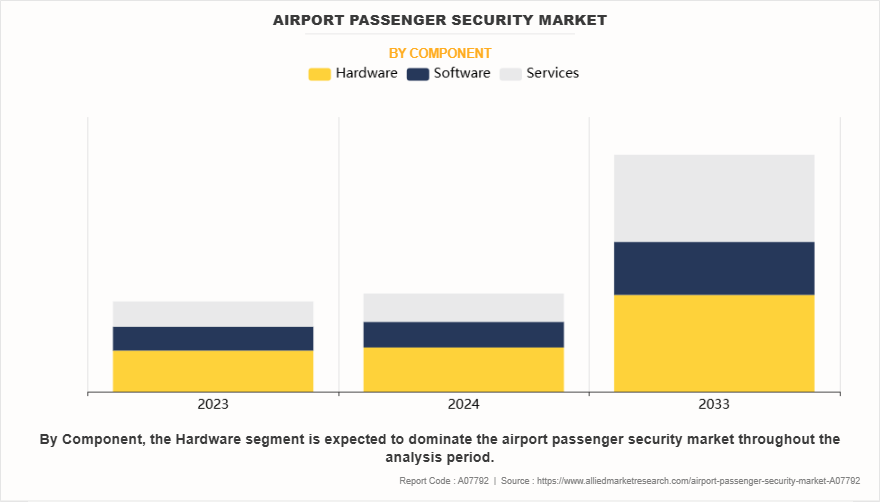

By Component

Based on components, the hardware segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the essential role of physical security infrastructure in airport environments, where hardware systems such as X-ray scanners, metal detectors, biometric access controls, and surveillance cameras form the backbone of passenger screening and threat detection. Despite advancements in software, these hardware components are irreplaceable for real-time, on-ground security operations. Continuous technological improvements in imaging, automation, and AI-powered screening devices are further enhancing hardware efficiency. Additionally, rising airport modernization projects and expansions, particularly in developing countries, are accelerating the procurement and deployment of advanced hardware systems to comply with international aviation security standards.

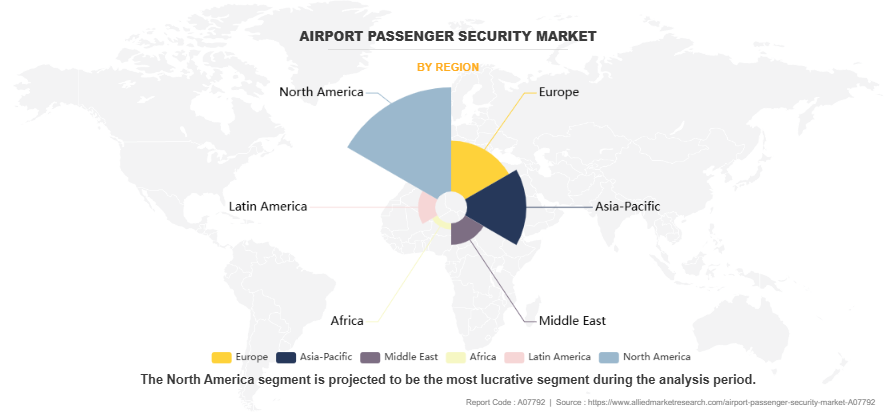

By Region

Based on region, the North America region dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. This is attributed to the presence of major international airports, high air traffic volumes, and a strong focus on national security in the North America region. The U.S. Transportation Security Administration (TSA) and Canadian Air Transport Security Authority (CATSA) enforce stringent security protocols, prompting airports to adopt cutting-edge technologies and solutions. North America leads in the deployment of biometric screening, advanced imaging systems, and AI-powered surveillance tools. Moreover, substantial government funding and collaboration with private security tech providers contribute to the region’s continued dominance. The region also serves as a hub for security innovation, driving early adoption of emerging technologies.

Competition Analysis

The key players included in the Airport Passenger Security Market Analysis are Analogic Corporation, OSI Systems INC., Garrett Metal Detectors, C.E.I.A. S.P.A., Smiths Group PLC, Honeywell International INC., Bosch Limited, Siemens AG, IDEMIA, and ICTS International N.V.

Key Benefits For Stakeholders

- This Airport Passenger Security Market Report provides a quantitative analysis of the Airport Passenger Security Industrysegments, current trends, estimations, and dynamics of the airport passenger security market analysis from 2023 to 2033 to identify the prevailing airport passenger security market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airport passenger security market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airport passenger security market trends, key players, market segments, application areas, and market growth strategies.

Airport Passenger Security Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 43.2 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Security Solution |

|

| By Component |

|

| By Airport Type |

|

| By Region |

|

| Key Market Players | IDEMIA, Garrett Metal Detectors, OSI Systems Inc., Smiths Group plc, ICTS International N.V., Siemens AG, Analogic Corporation, Honeywell International Inc., C.E.I.A. S.p.A., Bosch Limited |

Analyst Review

The deep space robotics industry is experiencing significant advancements driven by the escalating need for satellite maintenance and servicing. Satellites, operating in the harsh environment of space, are subjected to extreme temperatures, high radiation, and the vacuum of space, leading to frequent breakdowns and necessitating regular maintenance. This has spurred the development of robotic systems capable of performing complex tasks such as repairs, refueling, and extending the operational lifespan of satellites.

Global space agencies and private companies are increasingly investing in space robotics to enhance the sustainability and resilience of space operations. For instance, NASA identified several robotics sectors as vital components of its space technology roadmap for 2035, focusing on developing autonomous systems for satellite servicing and debris removal. Similarly, the European Space Agency (ESA) is collaborating with space robotics companies through initiatives such as the PERASPERA program, which aims to advance technologies for in-orbit servicing and assembly.

The integration of emerging technologies such as Artificial Intelligence (AI) and Deep Learning (DL) is revolutionizing the capabilities of space robots. AI-powered robots are developed to operate with minimal human intervention, enabling them to execute complex tasks over extended periods. These robots autonomously navigate, make real-time decisions, and adapt to unpredictable conditions in space, thereby enhancing the efficiency and safety of space missions.

Recent developments have led to the rapid progress in this field. In January 2025, the Indian Space Research Organisation (ISRO) achieved a significant milestone by successfully docking two satellites, demonstrating the feasibility of robotic servicing in space. This accomplishment highlights India's growing capabilities in space technology and its commitment to advancing space exploration.

Furthermore, the U.S. Naval Research Laboratory has developed a spaceflight-qualified robotics suite capable of servicing satellites in orbit. This technology is expected to play a crucial role in future satellite maintenance missions, offering solutions for on-orbit repairs and extending the operational life of satellites.

The convergence of AI, robotics, and space exploration is paving the way for more sustainable and efficient space operations. As these technologies continue to evolve, they are able to transform space exploration, making it more autonomous and resilient. The ongoing research and development in this domain are crucial for addressing the challenges of maintaining and servicing satellites, ensuring the longevity and functionality of space assets.

The global airport passenger security market was valued at $16,433.1 million in 2023, and is projected to reach $43,152.7 million by 2033, registering a CAGR of 10.3% from 2024 to 2033.

From 2024-2033 would be forecast period in the market report.

$16.4 billion is the market value of airport passenger security market in 2023.

2023 is base year calculated in the airport passenger security market report.

ANALOGIC CORPORATION, OSI SYSTEMS INC., GARRETT METAL DETECTORS, C.E.I.A. S.P.A., SMITHS GROUP PLC, SIEMENS AG, IDEMIA, ICTS INTERNATIONAL N.V. are the top companies hold the market share in airport passenger security market.

Loading Table Of Content...

Loading Research Methodology...