Airport Sleeping Pods Market Research, 2034

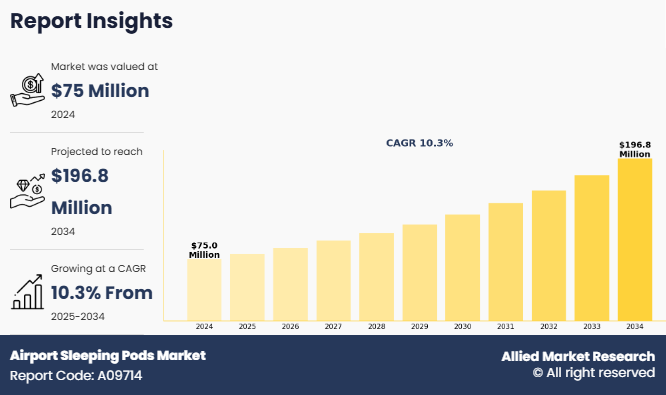

The global Airport Sleeping Pods Market Size was valued at $75 million in 2024, and is projected to reach $196.8 million by 2034, growing at a CAGR of 10.3% from 2025 to 2034.

The airport sleeping pods market refers to a specialized segment within airport infrastructure focused on providing travelers with compact, modular, and often technology-integrated rest spaces within airport terminals. These sleeping pods cater to the growing need for short-duration accommodation solutions during layovers, delayed flights, and overnight transits. As global air traffic rises, particularly on long-haul and connecting international routes, passenger expectations for in-terminal comfort have evolved significantly. These pods—ranging from minimal nap stations to fully equipped private suites—serve as a timely response to that demand, offering both convenience and privacy in crowded or high-transit terminals.

Key Takeaways

- The Airport Sleeping Pods Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global Airport Sleeping Pods Industryand to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

The demand for airport sleeping pods is being largely driven by the increasing number of international travelers and the subsequent pressure on global hub airports. According to the United Nations World Tourism Organization (UNWTO), over 975 million international tourist arrivals were recorded between January and September 2023, marking a 38% year-on-year increase from 2022. This sharp rise in global air traffic has put additional strain on major international airports such as Singapore Changi, Dubai International, and Hamad International in Doha—facilities that regularly serve transit passengers with layovers spanning 6 to 12 hours. To accommodate this influx and enhance passenger satisfaction, airport authorities are integrating sleeping pods into their terminal layouts, particularly within transit and sterile zones, offering convenient rest options that can be pre-booked or accessed on demand.

As a result of these dynamics, the transit passenger segment alone was valued at $29.3 million in 2024, signaling a significant concentration of pod usage within international hubs. Operators like YotelAir and GoSleep have expanded rapidly in these locations, deploying self-contained units fitted with USB charging, lighting controls, temperature regulation, and digital reservation systems. These features cater not only to comfort but also align with broader trends in smart travel experiences. Moreover, with IATA forecasting global passenger numbers to surpass 5.2 billion by 2025, airport operators are proactively investing in next-generation rest infrastructure to ensure terminal efficiency and passenger wellness.

However, while the Airport Sleeping Pods Market Outlook appears promising, several challenges remain—particularly related to cost. The installation and maintenance of advanced sleeping pods involve substantial investment, posing a barrier for small- to mid-sized airports. A single high-end sleeping pod equipped with smart features like ventilation, biometric access, soundproofing, and lighting can cost anywhere between $10,000 to $25,000. This is in addition to costs associated with installation, technical integration with airport IT systems, cleaning, repairs, and customer service staffing. While international airports with higher passenger volumes and longer dwell times are more likely to achieve a reasonable return on investment, domestic airports often find it difficult to justify such expenditure.

Furthermore, various regional U.S. airports that experimented with sleeping pod installations between 2021 and 2022 eventually discontinued the service due to limited usage and high maintenance costs. To address this, pod providers such as JetQuay and GoSleep are now exploring alternate business models including leasing, subscription-based deployment, or revenue-sharing agreements with airport authorities. These approaches aim to reduce the upfront capital burden and make sleeping pod adoption more feasible in budget-constrained environments.

Despite cost-related constraints, the Airport Sleeping Pods Industry holds considerable untapped potential, especially in Tier-II international airports and high-traffic domestic terminals. Many developing and emerging countries are investing heavily in modernizing airport infrastructure, creating new opportunities for pod integration. In India, for example, the upcoming Navi Mumbai and Noida (Jewar) international airports are expected to handle more than 12 million passengers annually during their initial operational phases. These greenfield airports are being designed with a focus on passenger experience and are expected to include sleeping pods in their core terminal planning. Similarly, domestic terminals like Bengaluru’s Terminal 2 or Chicago Midway Airport are witnessing increased congestion and wait times, prompting interest in compact rest solutions.

Operators such as SnoozeCube and GoSleep are actively targeting secondary airports, where full-fledged hotels are unavailable or underutilized. Pods provide a space-saving alternative that can be installed in unused gate areas, concourses, or even near security checkpoints. Additionally, the ongoing growth of domestic travel—particularly in countries like China, Brazil, and India—adds to the viability of sleeping pods. According to domestic civil aviation authorities in these regions, domestic passenger volumes rose by more than 20% year-over-year in 2023, indicating a rising population of travelers who could benefit from rest facilities during short delays or layovers.

In addition, airport operators are increasingly seeking ways to boost non-aeronautical revenues amid volatile airline performance. Sleeping pods, with their flexible booking options and minimal spatial footprint, offer a scalable way to diversify income while improving overall passenger experience. The shift toward wellness-oriented travel infrastructure also makes these pods an attractive feature that complements other airport amenities like lounges, wellness zones, and digital concierges. The availability of pods enhances the airport's branding, potentially influencing traveler satisfaction scores and airport rankings.

The Global Airport Sleeping Pods Market is segmented based on product type, stay hour, airport type, and region. By product type, the market is categorized into single occupancy and shared occupancy pods. Based on stay hour, the market is divided into less than 2 hours and more than 2 hours. By airport type, the market is segmented into international and domestic airports. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

By ProductType

Based on product type, the shared occupancy segment had the dominating Airport Sleeping Pods Market Share in the year 2024, and is likely to remain dominant during the forecast period. This dominance can be attributed to the cost-effectiveness and space efficiency of shared occupancy pods, making them attractive to budget-conscious travelers and airports alike. They allow facilities to accommodate more passengers in limited space, while still offering essential comfort features such as privacy partitions, reclining seats, and noise reduction. The increasing adoption of shared occupancy models at major hubs to cater to high passenger traffic further strengthens this segment’s leading position.

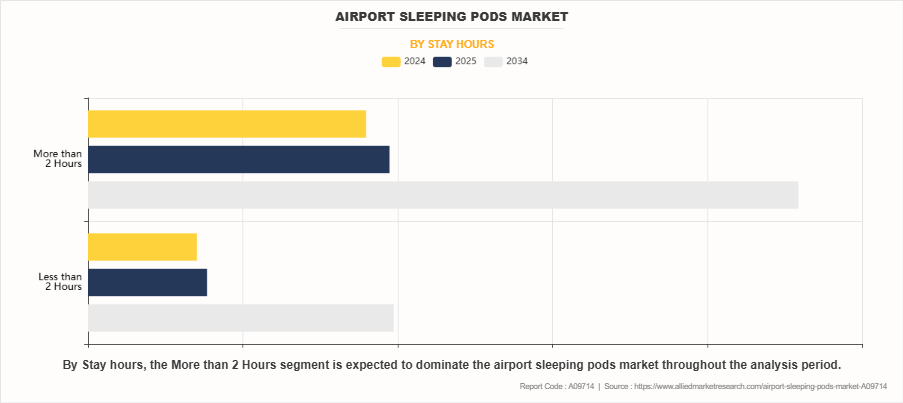

By Stay Hours

Based on stay hours, the more than 2 hours segment dominated the global market in the year 2024, and is likely to remain dominant during the forecast period. This segment leads due to its appeal among long-haul travelers, passengers with extended layovers, and transit flyers seeking substantial rest before connecting flights. Longer stay durations offer better value for money and access to enhanced amenities, including sleeping beds, charging stations, luggage storage, and sometimes showers. With rising global connectivity, multi-stop flights, and increasing intercontinental travel, Airport Sleeping Pods Market Demand for longer-duration air pod stays continues to grow, ensuring sustained dominance of this category.

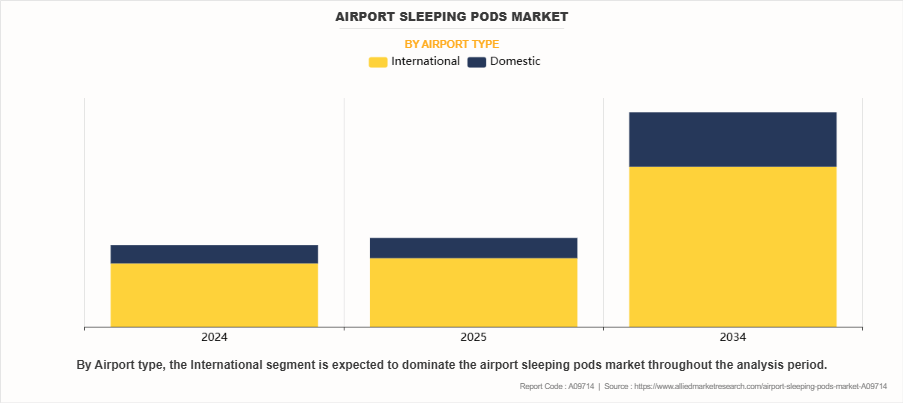

By Airport Type

Based on airport type, the international segment dominated the global market in the year 2024, and is likely to remain dominant during the forecast period. International airports attract higher passenger volumes, longer average layovers, and more long-haul flights compared to domestic airports, directly increasing the need for in-terminal sleeping facilities. These hubs serve as transit points for global travelers who often require extended rest options during connections. Investments by major airports in Asia-Pacific, the Middle East, and Europe to expand sleeping pod infrastructure further enhance service quality and passenger convenience, reinforcing the international segment’s market leadership.

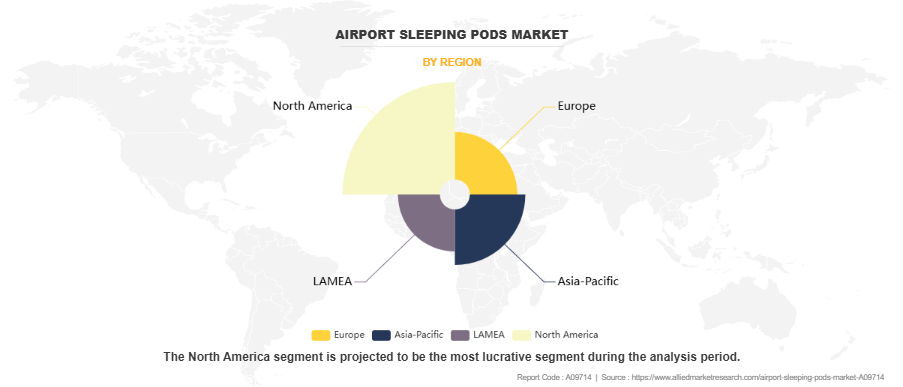

By Region

Based on region, the North America region dominated the global market in the year 2024, and is likely to remain dominant during the Airport Sleeping Pods Market Forecast period. North America and Europe are established markets with ongoing pod deployments across major hub airports like JFK, Heathrow, and Frankfurt. Asia-Pacific leads in Airport Sleeping Pods Market Growth, fueled by rising passenger volumes, infrastructure expansion, and adoption of smart airport technologies in countries like China, India, and Singapore. The LAMEA region is experiencing gradual uptake, with high-end adoption in the Middle East (Dubai, Doha, Abu Dhabi) and emerging interest in Latin America and Africa, where modernization efforts are opening the door for scalable, pod-based infrastructure.

Key players profiled in the airport sleeping pods market include GoSleep, Napcabs GmbH, YOTEL, MetroNaps, JetQuay Pte Ltd., Sleep ’n Fly, ZZleepandGo, 9h nine hours, Minute Suites, LLC, and Aviserv Airport Services India Private Limited.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airport sleeping pods market analysis from 2024 to 2034 to identify the prevailing airport sleeping pods market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airport sleeping pods market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airport sleeping pods market trends, key players, market segments, application areas, and market growth strategies.

Airport Sleeping Pods Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 196.8 million |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 298 |

| By Product Type |

|

| By Stay hours |

|

| By Airport type |

|

| By Region |

|

| Key Market Players | YOTEL, ZZZleepandGo, 9h nine hours, Napcabs GmbH, Minute Suites, LLC, Sleep ’n Fly, MetroNaps, AVISERV AIRPORT SERVICES INDIA PRIVATE LIMITED, GoSleep, JetQuay Pte Ltd. |

Analyst Review

The airport sleeping pods market has swiftly evolved from a niche comfort service into a core element of modern airport infrastructure, driven by rising passenger expectations, international layovers, and the global push toward smart terminal experiences. As a CXO or strategic analyst observing this segment, it’s clear that the convergence of personalized travel, digital integration, and spatial efficiency is redefining how airports approach passenger rest and wellness.

One of the standout transformations in recent years is the growing Airport Sleeping Pods Market Demandfor on-demand, private, and tech-enabled rest spaces. With travelers becoming increasingly time-sensitive and comfort-conscious, especially post-pandemic, sleeping pods offer an elegant solution to enhance satisfaction without large capital expenditure. International hubs like Changi, Doha, and Munich have pioneered this trend—embedding single-occupancy pods with circadian lighting, air filtration, and biometric access. These features not only improve passenger wellbeing but also demonstrate the pod's value as a touchpoint for smart airport personalization.

Another dimension lies in the revenue diversification opportunity. For airport authorities under pressure to boost non-aeronautical revenues, sleeping pods present an attractive ROI model. The units require minimal real estate, offer scalable installation, and can be dynamically priced based on peak hours, layovers, or passenger volumes. Operators such as YotelAir, GoSleep, Napcabs, and Minute Suites have already proven the viability of such partnerships, offering hourly or overnight rates with integrated booking through airport apps or airline loyalty platforms. This integration creates a seamless user experience that aligns well with the evolving “phygital” (physical + digital) airport environment.

Region wise, while Asia-Pacific and the Middle East dominate current adoption—largely due to long-haul transit flows and aggressive airport modernization—emerging opportunities exist in Tier-II international airports, domestic terminals, and smart regional hubs. In LAMEA, sleeping pods are becoming relevant across both high-end and cost-sensitive traveler profiles, reflecting the segment’s ability to adapt across income tiers and infrastructure maturity levels.

Going forward, the sleeping pods market is poised to intersect with wider airport trends such as green building design, AI-powered passenger flow management, and health-based zoning. From a CXO standpoint, early investments in modular pod infrastructure represent a strategic move toward holistic passenger engagement and operational efficiency. As the global airport experience moves beyond just travel facilitation toward total passenger well-being, sleeping pods are not just a luxury—they are becoming a baseline expectation.

The global airport sleeping pods market was valued at $74,945.5 thousand in 2024, and is projected to reach $196,803.2 thousand by 2034, registering a CAGR of 10.3% from 2025 to 2034.

From 2024-2034 would be forecast period in the market report.

$74.9 million is the market value of Airport sleeping pods market in 2025.

2024 is base year calculated in the Airport sleeping pods market report.

GoSleep, Napcabs GmbH, YOTEL, MetroNaps, JetQuay Pte Ltd., Sleep ’n Fly, ZZleepandGo are the top companies hold the market share in Airport sleeping pods market.

Loading Table Of Content...

Loading Research Methodology...