The global airside services market was valued at $2.5 billion in 2021, and is projected to reach $4.9 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

Airside services encompass range of processes, which ensure that an aircraft runs smoothly and performs on time arrival and departure. The airside operations include aircraft handling, passenger handling and cargo handling. Range of powered and non-powered equipment airplane push-back & hook-up, forklifts & lifts, carts, vehicles, air-conditioning tugs, belt & container loaders, light-duty trucks, and other equipment that serve the purpose of powering, towing, and servicing are included in airside services. Further, such equipment enables passenger handling, baggage handling, aircraft mobility, repair, service, and maintenance functions.

The growth of airside services market is driven by factors such as increase in investment to support brown filed and green field airside services, rise in passenger traffic across the globe, and adoption of new technologies supporting automation and self-services. The COVID-19 is having a notable impact on airside services industry and has shifted the business dynamics within the forecast timeframe. Currently majority of the airports are focused toward reducing operational cost, increasing operational efficiency and reducing their carbon footprint. For instance, in June 2022, the Delhi International Airport Limited (DIAL) announced acquisition of 62 electric vehicles that is anticipated to optimize their airside operations. The electric vehicles are anticipated to be gradually induced within three to four months and reduce approximately 10,000 tons of greenhouse emissions per annum.

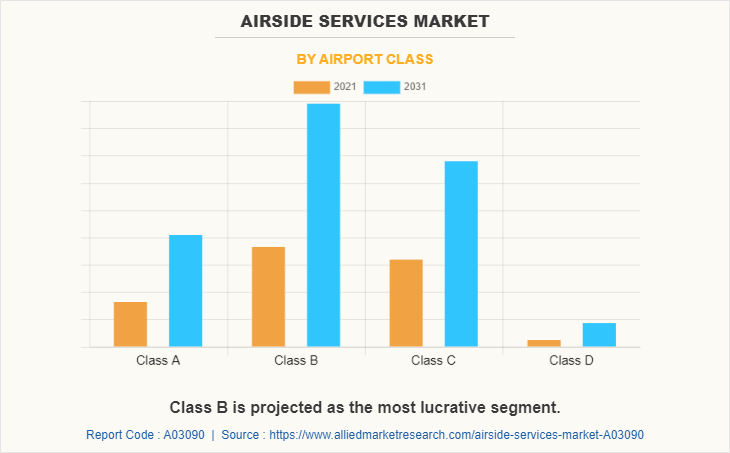

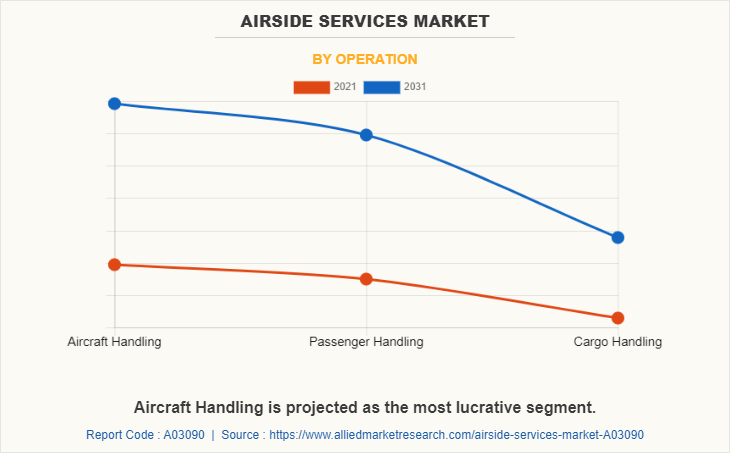

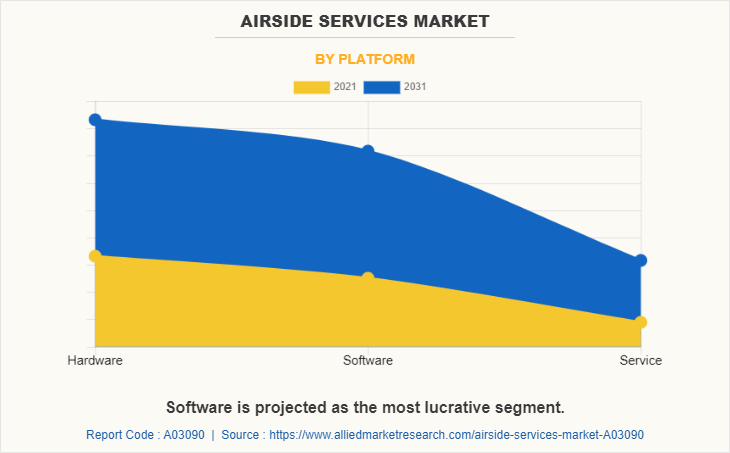

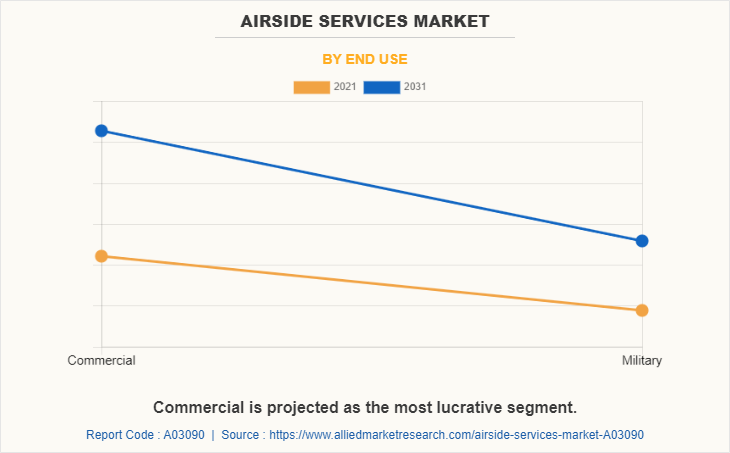

The airside services market is segmented on the basis of airport category, operation, service equipment, and end use. Depending upon airport category, the market is fragmented into Class A, Class B, Class C, and Class D airports. Depending on operation, the market is classified by aircraft handling, passenger handling, and cargo handling. The platform category is categorized into hardware, software and service. The end use segment includes commercial and military. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Companies have adopted product development and product launch as their key development strategies in the airside services industry. Moreover, collaborations and acquisitions are expected to enable leading players to enhance their product portfolios and expand into different regions. The key players operating in the airside services market are Cisco Systems, Inc., Honeywell International Inc., IBM, Indra, QinetiQ, Raytheon Technologies Corporation, Siemens, SITA, Teledyne Technologies Incorporated, Thales, Daifuku Co., Ltd., Damarel Systems International Ltd., Amadeus IT Group, Inform GmbH, Aena, Huawei Technologies Co., Ltd., and ES_Mobility.

Adoption of Total Airport Management (TAM)

The success of individual stakeholders is anticipated to determine the direction of airport management in the future. All agents, from landside to terminal & airside, are anticipated to be placed into a unified platform, enabling real-time analysis to assist decision-making. By connecting processes and systems across the airport, total airport management (TAM) promotes data-driven decision making, comprehensive KPI management, and the integration of operations. TAM includes performance-based airside services that permit the development, adoption, and upkeep of the Airport Operational Plan (AOP) on the basis of performance. This ensures fairness and the resolution of potential conflicts of interest between stakeholders and makes sure that everyone is putting forth their best effort in the direction of a common objective.

Rise in air-traffic, surpassing pre-COVID levels

The rise in aviation traffic is attributed to a variety of factors. The primary reason is population and economic expansion, which is being fueled by the burgeoning middle class. By 2035, the global economy is projected to increase by 3% annually, while aviation traffic is projected to grow by an average of 6% annually. The second development element is introducing low-cost airlines with competitive rates on well-travelled routes. They play a significant role in the intensification of air traffic in Europe; at present, they account for more than 40% of Europe's and 25% of traffic globally. By encouraging international airlines to lower ticket rates, these businesses significantly influence airline prices.

Threat of cybersecurity and data breach

The entire safe operation of the airport environment and passenger safety depend on airport security. Despite having multi-layered security systems for passport checks and luggage scans, many airports are becoming targets of cyber-attacks. Such assaults have occurred in the travel business, most especially in the airline industry. According to IATA, hacks cost the world economy $460 billion annually. In the next three years, cybersecurity is anticipated to account for over $33 billion in IT spending anticipated for airlines and airports.

In order to combat such threats, airports across the world have invested heavily on cyber security solutions. In July 2021, Manchester Airport Group (MAG) selected independent cyber security services provider Bridewell as its security partner to boost security event awareness by 1500%. Through the creation of an internal security operations center that is more contemporary and responsive, the cooperation has enabled the airport to revolutionize its visibility and defense against cyber-attacks. Real-time activity monitoring on devices and servers has increased thanks to the alliance from the previous 5,000 to 80,000 events per second.

Integration of artificial intelligence (AI) and machine learning (ML) technologies

AI employs robust algorithms to analyze massive volumes of data and spot patterns. These are used in airports to estimate processing times by looking at things like productivity, wait for length, and the number of open security lanes. Some significant operations that can be automated through the integration of AI include analyzing demanded flight routes, consumer trends, expected marginal seat revenue, ancillary price optimization, airspace safety, aircraft maintenance, feedback analysis, crew management, consumer front-end automation, fuel efficiency and optimization, inflight sales & food supply, fraud detection and in-airport self-service among others. could rise to 8.2 billion in 2037 at 3.5% compound annual growth rate (CAGR).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the airside services market analysis from 2021 to 2031 to identify the prevailing airside services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the airside services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global airside services market trends, key players, market segments, application areas, and market growth strategies.

Airside Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.9 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 338 |

| By Airport Class |

|

| By Operation |

|

| By Platform |

|

| By End Use |

|

| By Region |

|

| Key Market Players | INFORM GMBH, Daifuku Co. Ltd, Siemens, HUAWEI TECHNOLOGIES CO., LTD., Teledyne Technologies Incorporated, Indra, IBM, Honeywell International Inc., Aena, QinetiQ, Raytheon Technologies Corporation, Damarel System International Ltd., SITA, Amadeus IT Group SA, Cisco Systems, Inc., Thales |

Analyst Review

The airside services market is expected to undergo a major shift in the coming years. Adoption of total airport management (TAM), change in consumer dynamics, privatization of airports, arrival of electric vertical takeoff & landing vehicles (eVTOL), and air taxi are anticipated to support business potential within the airside services market during the forecast period. Aggressive initiatives by federal organizations such as FAA and Euro control to standardize protocol to support global growth. As of June 2022, FAA 45,000 flights were handled by FAA per day, with 520 airport traffic control towers, 147 terminal radar approach control facilities, and more than 14,000 air traffic controllers.

Consumer centric approach is expected to enhance their travel experience, which is anticipated to remain primary goal of new age airports. These goals are anticipated to be achieved by integration of cutting-edge technologies such as predictive analysis for disruption management & flight operations, personalized consumer attention, touch less onboarding system, and bagless airports. Several major airports from developed and developing nations such as the U.S., China, Canada, the UK, Germany, and India among others have already started investing in these technologies. The full-scale implementation and establishment of a cohesive network is expected be established by 2025.

Industry leaders within the airside services market are anticipated to be investing heavily in research and development to achieve carbon neutrality. Inclination of regional agencies such as IATA to achieve zero carbon emission by 2050 is enforcing business players to introduce eco-friendly solutions. In line with such initiatives, companies are developing airside and landside products that can reduce overall carbon emission of an airport by optimizing operations or reducing aircraft turnaround time. For instance, in May 2022, Honeywell announced to display NAVITAS in Dubai Airport show 2022. Once implemented, NAVITAS is capable of reducing aircraft turnaround time, optimize airside operations and decrease maintenance downtime by 25%. The company is anticipated to demonstrate FORGE, an enterprise performance management solution to support landside operation, ensuring double digit energy saving through predictive and reactive maintenance schedule.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. Asia-Pacific is expected to witness the highest growth rate during the forecast period, owing to increasing efforts of the Indian and Chinese governments to develop indigenous airside services’ infrastructure.

The key players operating in the airside services market are Cisco Systems, Inc., Honeywell International Inc., IBM, Indra, QinetiQ, Raytheon Technologies Corporation, Siemens, SITA, Teledyne Technologies Incorporated, Thales, Daifuku Co., Ltd., Damarel Systems International Ltd., Amadeus IT Group, Inform GmbH, Aena, Huawei Technologies Co., Ltd., and ES_Mobility.

The global airside services market was valued at $2,540.8 million in 2021, and is projected to reach $4,926.3 million by 2031, registering a CAGR of 7.2% from 2022 to 2031.

Asia-Pacific is the largest regional market for airside services

Factors such as increase in investment to support brown filed and green field airside services, rise in passenger traffic across the globe, and adoption of new technologies supporting automation and self-services.

Aircraft handling, passenger handling, and cargo handling are among the primary applications of airside services market.

Loading Table Of Content...