ATV Market 2022-2031:

The global all-terrain vehicle market was valued at $3.2 billion in 2021, and is projected to reach $5 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

An all-terrain vehicle (ATV) is a vehicle fitted with at least three low-pressure tires and handle bars. An all-terrain vehicle could have three, four or even six wheels. In addition, ATVs are of two types such as Type I ATVs and Type II ATVs. Type I ATVs are intended to be utilized by a single operator and no passenger. Type II ATVs are intended to be utilized by an operator and a passenger. ATVs are known for their manoeuvrability & off-road capabilities and are applicable in military, survey, forestry, agriculture, sports, and others. These are handled quite differently and require training. These are usually used in off-road environments, but few regions permit the use of these vehicles on public roads as well. These have gained popularity over the past few years as they allow access to remote areas and provide a convenient way to carry supplies and equipment.

The global all-terrain vehicle market is witnessing growth, due to increase in trend of adventure sports and recreational activities, rise in demand for ATV in military activities, and government rules to support driving ATVs on road. However, ban on ATV driving in wildlife area due to terrain damage, and high maintenance cost of ATVs are the factors hampering the growth of the market. Furthermore, production of safer ATVs is the factor expected to offer growth opportunities during the forecast period.

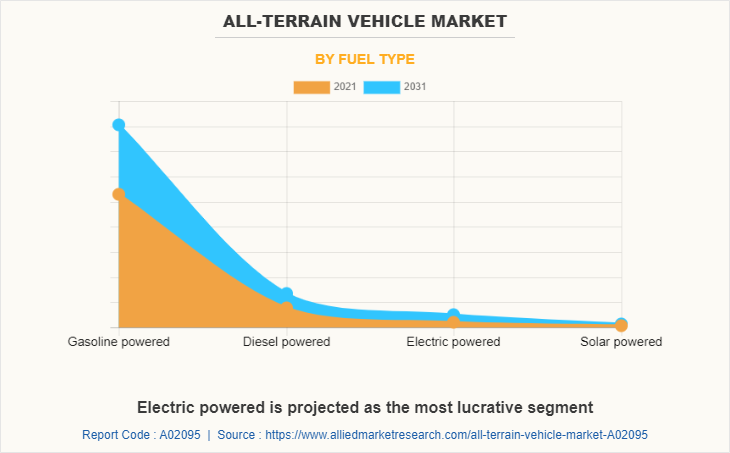

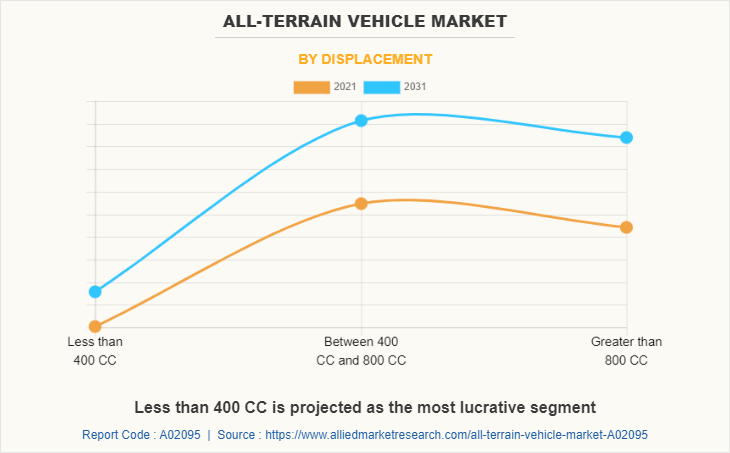

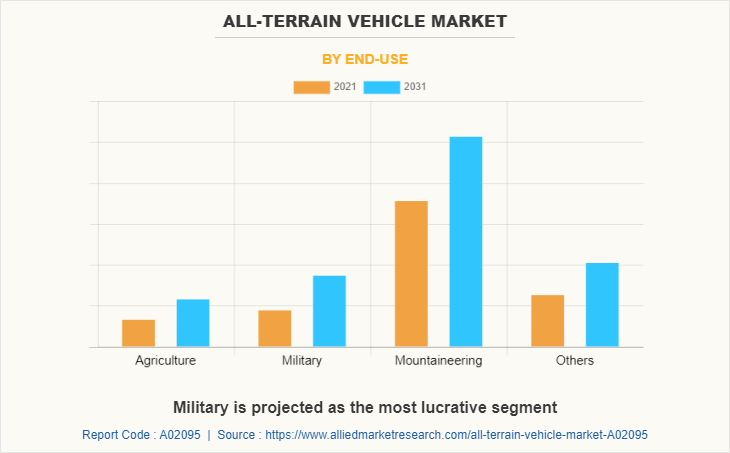

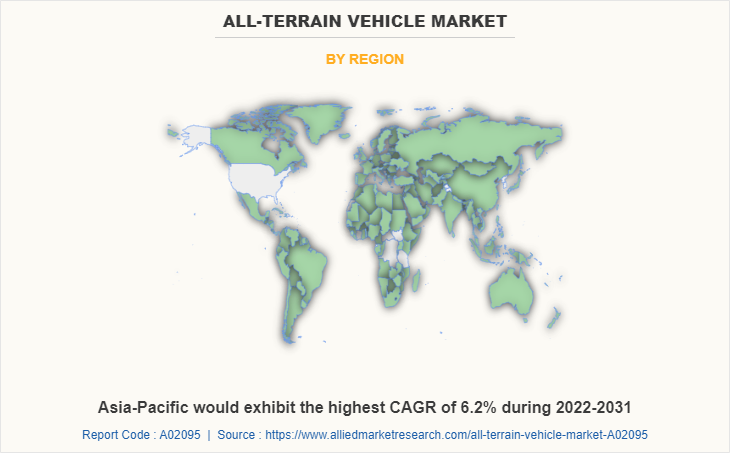

The all-terrain vehicle market is segmented on the basis of type, fuel type, displacement, end-use, and region. By type, it is segmented into utility all-terrain vehicle, sport all-terrain vehicle, and others. By fuel type, it is classified into gasoline powered, diesel powered, electric powered, and solar powered. By displacement, it is fragmented into less than 400 cc, 400 - 800 cc, and more than 800 cc. By end-use, it is categorized into agriculture, military, mountaineering, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the ATV market report comprises BRP Inc., CFMoto, Deere & Company, Hisun, Honda Motor Co., Ltd., Kawasaki Heavy Industries Ltd., Kubota Corporation, Kwang Yang Motor Co., Ltd., Polaris Industries Inc., Suzuki Motor Corporation, Textron Inc., and Yamaha Motor Co., Ltd.

Increase in trend of adventure sports and recreational activities

In recent days, tourists are highly attracted to the trails of ATV along with related activities for recreational purposes. Many tourism councils are introducing ATV related activities by building tracks for these vehicles to attract and retain visitors. In addition, increase in the expenditure on off-trailing activities and outdoor sports activities has been observed, which is contributing in the growth of the market. For instance, in 2020, as per the Bureau of Economic Analysis (BEA), the outdoor recreation economy accounted for 1.8% of GDP, which is $374.3 billion of current-dollar gross domestic product (GDP) of the U.S. At the state level, outdoor recreation value-added as a share of state GDP ranged from 4.3% in Montana to 1.2% in New York. Moreover, several countries are organizing yearly championships, which are gaining popularity at a remarkable rate as anyone capable of driving ATV can participate in the race. Therefore, increase in trend of such adventure sports attracts the tourists and propels the growth of the all-terrain vehicle market.

Rise in demand for ATV in military activities

There is an increase in demand for ATV for military activities such as transportation of troops, driving on difficult terrain, and others. In addition, ATVs are expected to witness substantial growth in the military segment, owing to superior mobility provided for tactical missions. Moreover, factors, such as high maneuverability, flexibility, and superior navigational aids to provide instant directions for vehicle operators, further foster the ATV market growth. For instance, in October 2020, Kia Motors Corporation, revealed its plan of developing a new generation military ATVs. The vehicle will be equipped with automatic transmission systems, satellite navigation, rear parking assistant, anti-spin regulator, and around view monitor.

In addition, in May 2020, the U.S. Special Operations Command (USSOCOM) awarded $109 million seven year contract to Polaris Government and Defense for the Polaris MRZR Alpha, a new Lightweight Tactical All-Terrain Vehicle (LTATV). Therefore, rise in demand for ATVs from military troop drives the growth of the all-terrain vehicle market.

Government rules to support driving ATVs on road

Earlier, driving ATV on roadways was not allowed for safety purpose. However, in recent days, new bills and ordinance are being passed by government authorities to allow driving ATVs on road. For instance, in 2021, in U.S., Washington State Legislature passed two bills regarding ATV use on public roads. The first bill SHB 1322 modifies the reciprocity provision which enables a person who has properly registered an ATV in another state, to use the vehicle in Washington without first registering it in Washington. The second bill EHB 1251, amends RCW 46.09.455 and expands the locations where a person may potentially operate an ATV, as long as it is approved by the local entity. In addition, in October 2020, the Wisconsin Dells Common Council approved an ordinance opening all city streets to ATV access. Therefore, government support to allow ATV on roadways is anticipated to boost the growth of the all-terrain vehicle market.

Ban on ATV driving in wildlife area due to terrain damage

Driving ATV in wildlife area has many negative effects on the terrain such as noise disturbance, damage to vegetation, increased runoff, soil erosion, and degradation of water quality. In several countries, driving ATV in wildlife areas is banned due to terrain damage to protect wildlife habitat and others. In addition, when ATVs leave trails, plants and young saplings are damaged, reducing coverage for the forest floor. As soil is eroded, roots are often exposed and damaged, thereby harming nearby trees. Some regulations are incorporated to support wildlife recovery management strategies and to control unmanaged ATV use in the area. Therefore, ATVs are banned in wildlife area as they affect the wildlife habitat and grassland health, which is anticipated to hamper the growth of the all-terrain vehicle market.

High maintenance cost of ATVs

ATVs are durable, but are prone to part breakage, part failure, overheating, and others. Both used and new vehicle show wear & tear over time, but aging ATVs have completely different maintenance needs than that of new vehicles. Maintenance of new vehicle for a year is covered under one year warranty by manufacturer, but replacement of broken part is not covered in this warranty. These vehicles are majorly used in uneven terrain, mountains, uphill, and others due to which parts of the vehicle are prone to damage. Regular maintenance of these vehicles for optimum performance is recommended due to the damage caused to ATVs by driving on rough terrain. However, this maintenance is very expensive. Therefore, high maintenance cost of ATVs is anticipated to hinder the growth of the all-terrain vehicle market.

The all-terrain vehicle market is segmented into Type, Fuel Type, Displacement and End-use.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the all-terrain vehicle market analysis from 2021 to 2031 to identify the prevailing all-terrain vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the all-terrain vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global all-terrain vehicle market trends, key players, market segments, application areas, and market growth strategies.

All-terrain Vehicle Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Fuel Type |

|

| By Displacement |

|

| By End-use |

|

| By Region |

|

| Key Market Players | KUBOTA Corporation, Polaris Industries, Inc., Kawasaki Heavy Industries Ltd., Textron Inc., Suzuki Motor Corporation, BRP Inc., Yamaha Motor Co., Ltd., Kwang Yang Motor Co., Ltd., Honda Motor Co., Ltd., CFMOTO, Hisun Motors Corp., Deere & Company |

Analyst Review

The global all-terrain vehicle market is expected to witness significant growth due to increase in trend of adventure sports and recreational activities, rise in demand for ATV in military activities, and government rules to support driving ATVs on road.

ATVs are used for exploring nature camping and others, but these vehicles are also very risky and dangerous. There is an increase in the rate of accidents related to ATVs, owing to the rise in the number of such vehicles in the market. For instance, the highest number of deaths due to ATV accidents occurred in the U.S., a country with the highest number of ATVs. Nearly all the accidents related to these vehicles are caused due to the driver’s failure to act in a safe and reasonable manner.

Moreover, the market players are introducing more safe and secure ATVs with advanced features such as GPS. For instance, automotive company, Yamaha Motor Corp., USA, announced its proven off-road recreational, utility, and sport ATVs with class-leading safety, capability, comfort, and equipped with GPS tablet. Therefore, the production of ATVs with added safety measures to avoid injuries and death hold an opportunity for the key players operating in the all-terrain vehicle market.

In order to gain a fair share of the market, major players adopted different strategies, for instance, partnership, product launch, and business expansion. Among these, business expansion is the leading strategy used by prominent players such as Honda Motor Co., Ltd., Kawasaki Heavy Industries Ltd., KUBOTA Corporation, Kwang Yang Motor Co., Ltd., Polaris Industries, Inc. Aforementioned companies launched cutting-edge all-terrain vehicle products seeking to grab a fair share of the market.

The global all-terrain vehicle market was valued at $3.2 billion in 2021 and is projected to reach $5.0 billion in 2031, registering a CAGR of 4.8%.

The leading companies include BRP Inc., CFMoto, Deere & Company, Hisun, Honda Motor Co., Ltd., Kawasaki Heavy Industries Ltd., Kubota Corporation, Kwang Yang Motor Co., Ltd., Polaris Industries Inc., Suzuki Motor Corporation, Textron Inc., and Yamaha Motor Co., Ltd.

The largest regional market is North America.

The leading application is mountaineering.

The upcoming trends in the market include greater adoption of electric-powered vehicles and increasing adoption in mountaineering applications.

Loading Table Of Content...