Alpha Olefin Market Overview:

The global alpha olefin market was valued at $4.1 billion in 2021, and is projected to reach $8.2 billion by 2031, growing at a CAGR of 7.5% from 2022 to 2031. The alpha olefin market is significantly driven by rise in demand for polyolefins in packaging and automotive applications, owing to their lightweight, durable, and recyclable properties, which cater to sustainability goals and performance requirements. The growth in the detergent and surfactant industries further fuels the demand for alpha olefin, as alpha olefins serve as essential intermediates in producing biodegradable surfactants and detergents, aligning with rise in consumer preference for eco-friendly cleaning products.

Key Market Insights

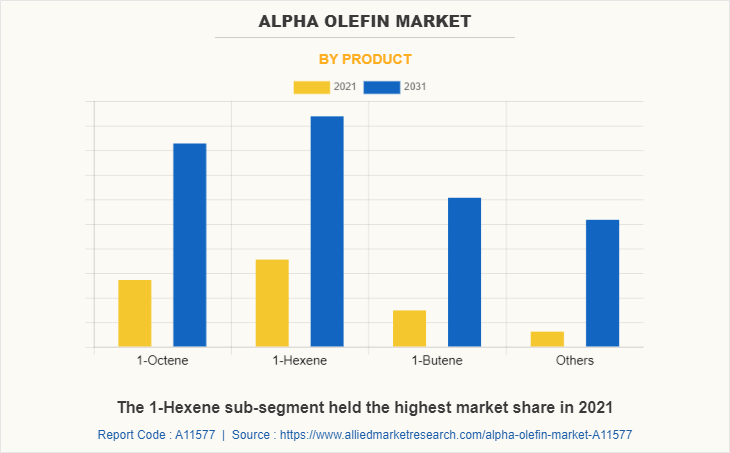

- By Product: The 1-Hexene sub-segment led the market.

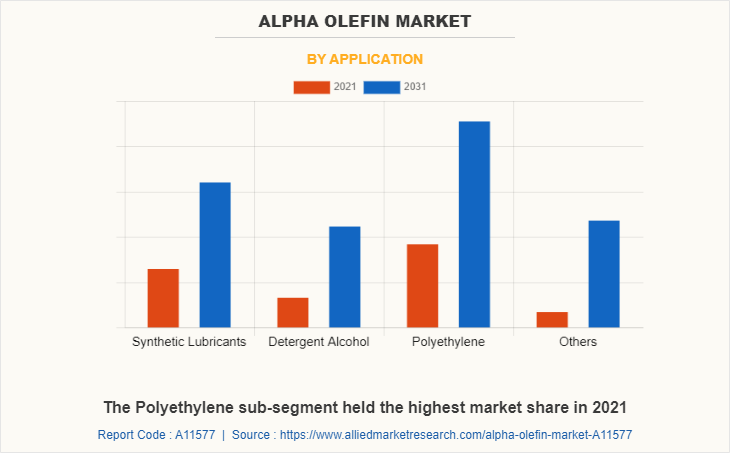

- By Application: Polyethylene held the largest global market share.

- By Region: North America dominated the global market.

Market Size & Forecast

- 2031 Projected Market Size: USD 8.2 Billion

- 2022 Market Size: USD 4.1 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 7.5%

How to Describe Alpha Olefin

Alpha olefins are a class of organic compounds characterized by the presence of a double bond between the first and second carbon atoms in their linear hydrocarbon chain. This specific positioning of the double bond gives alpha olefins unique reactivity, making them valuable intermediates in the production of a wide range of chemical products. Common applications include their use as co-monomers in polyethylene production, raw materials for synthetic lubricants, surfactants, and detergents, and precursors in manufacturing plasticizers and specialty chemicals.

Olefins are hydrocarbons with one or more double bonds between two adjacent carbon atoms, often known as alkenes. Olefins or alkenes with the chemical formula CnH2n are known as alpha olefins, which can be identified from other mono-olefins with a similar molecular formula by the regularity of the hydrocarbon chain and the positioning of the double bond at the main or alpha position. Alpha olefin are primarily used in the production of polyethylene, lubricants, detergents, plasticizers, oil field chemicals, and fine chemicals.

Market Dynamics

The increase in demand from the automobile industry is a major driver that is anticipated to expand the alpha olefin market size. Alpha olefin base synthetic lubricants are in high demand because of the constant rise in the number of automobiles around the world. Alpha olefin end products such as plasticizers, synthetic lubricants, and others are mostly used in the automotive industry. Natural atomic orbitals and their derivatives are widely used as plasticizers, surfactants, vehicle additives, synthetic lubricating oils, lubricating, paper scaling, and in a variety of specialized applications. Due to these applications, alpha olefins serve as the foundation for synthetic lubricants used in automotive and industrial applications. When compared to mineral base stocks, a number of parameters, including kinematic viscosity and viscosity index, pour point, volatility, thermal and oxidative stability, sensitivity to antioxidants, and flash and auto-ignition points, are superior to mineral-based synthetic lubricants.

The process used to manufacture alpha olefin is considered to be the main market constraint. The process requires extreme pressure and temperature for the manufacturing of olefins. Incorrect pressure and temperature changes may result in a product fault that makes it unusable and results in a considerable loss for the manufacturing company. These factors are projected to hamper the alpha olefin market growth in the forecast time.

The consumption of alpha-olefins is increasing across the globe due to the increase in usage of alpha olefins in various industries. The major businesses are ready to make huge investments in the study and creation of alpha olefins. The market for alpha olefins is anticipated to expand in the upcoming years due to its numerous applications in areas such as consumer goods, packaging, industrial processes, and others. Alpha olefins can be used as the drilling fluids for drilling equipment owing to the increase in the extraction of oil and gas.

The industry players are investing on the R&D of smart and unique strategies to sustain their growth in the market. These strategies include product launches, mergers & acquisitions, collaborations, partnerships, and refurbishing of existing technology. On February 25, 2022, Axens and Univation Technologies entered into an agreement to increase capital and operational efficiency for the production of on-purpose linear alpha olefins, including butene-1 and hexene-1, for use in producing polyethylene resins using the UNIPOL PE process.

Alpha Olefin Market Segmented Review:

The alpha olefin market is segmented on the basis of product, application, and region. By product, the market is divided into 1-Octene, 1-Hexene, 1-Butene, and others. By application, the market is classified into synthetic lubricants, detergent alcohol, polyethylene, and others. By region, the alpha olefin market outlook is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product, the 1-Hexene sub-segment dominated the market in 2021. 1-Hexene is a higher olefin, or alkene, with the formula C6H12. Since 1-hexene is an alpha-olefin, its double bond is in the alpha position, giving the alpha olefins greater reactivity and hence advantageous chemical characteristics. 1-Hexene is a commercially important linear alpha olefin. The principal application of 1-hexene is as a comonomer in the manufacturing of polyethene. Another important application of 1-hexene is the manufacturing of linear aldehyde by hydroformylation for the subsequent generation of the short-chain fatty acid heptanoic acid. These are predicted to be the major factors affecting the alpha olefin market share during the forecast period.

By application, the polyethylene sub-segment dominated the global alpha olefin market share in 2021. One of the most widely used polymers in the world is polyethylene, usually referred to as polythene or polyethene. Synthetic polymers are largely used in packaging; polyethylene is commonly used in plastic bottles, films, bags, and containers. Every year, more than 100 million tons of polyethene are produced for commercial and industrial purposes.

By region, North America dominated the global market in 2021 and is projected to remain the fastest growing region during the forecast period. The region offers significant market potential for alpha olefins due to its extensive and diverse industrial base. The existence of several manufacturing enterprises, as well as an increase in developments in petrochemical and gas and oil infrastructure, are projected to drive the expansion of the regional market. North America is considered as a potential investment hub for the manufacturing of alpha olefins by both local and international firms due to its abundant natural resource reserves. For instance, in December 2021, Chevron Phillips Chemical announced a final investment decision for a new C3 splitter facility to help expand its propylene business. The unit will be housed within the company's Cedar Bayou factory in Baytown, Texas. Starting in 2023, it is planned to have an annual capacity of 1 billion pounds.

Which are the Leading Companies in Alpha Olefin

The alpha olefin market key players profiled in the report include Qatar Chemical Company Ltd (Q-chem)., Chevron Phillips Chemical Company LLC, Mitsubishi Chemical Corp, Exxon Mobil Corporation, INEOS Oligomers, Petrochemicals Sdn. Bhd, Royal Dutch Shell, Evonik Industries, and JAM Petrochemicals Company.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alpha olefin market analysis from 2021 to 2031 to identify the prevailing alpha olefin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alpha olefin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alpha olefin market trends, key players, market segments, application areas, and market growth strategies.

Alpha Olefin Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 8.2 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Evonik Industries AG, SABIC, Chevron Phillips Chemical Company LLC, Qatar Chemical Company Ltd, Idemitsu Kosan Co., Ltd, INEOS, LANXESS, Exxon Mobil Corporation |

Analyst Review

An increase in demand for polyethylene is the key factor that is projected to drive the growth of the global alpha olefins market during the forecast period. In addition, increase in demand for alpha olefins in the automotive sector for various uses such as surfactants, lubricants, and oil chemicals is expected to drive the growth of the market during the forecast period. However, high initial investments and environmental concerns associated with alpha olefins are the key factors expected to hamper the market growth. The rapid increase in the extraction of crude oil and natural gas, rise in demand for synthetic lubricants for automobiles, and increase in investments in R&D of synthetic polymers are all factors expected to contribute to the alpha olefins market growth in the upcoming years.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by 2031, followed by Asia-Pacific, Europe, and LAMEA. Rapid industrialization and urbanization are the key factors responsible for the leading position of North America and Asia-Pacific in the global alpha olefins market.

The alpha olefin market is being driven by an increase in demand from end-use industries including plastic and automotive. For instance, polyethylene is manufactured using alpha olefin. Therefore, the increase in usage of polyethylene in the plastic industry is likely to drive the market for alpha olefin.

The increase in usage of polyethylene and rising demand for alpha olefin in the automotive sector are estimated to be the most important driving factors in the alpha olefin market.

The major growth strategies adopted by the alpha olefin market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global alpha olefin market in the future.

The polyethylene sub-segment of the application acquired the maximum share of the global alpha olefin market in 2021.

Qatar Chemical Company Ltd (Q-chem)., Chevron Phillips Chemical Company LLC, Mitsubishi Chemical Corp, Exxon Mobil Corporation, INEOS Oligomers, Petrochemicals Sdn. Bhd, Royal Dutch Shell, Evonik Industries, and JAM Petrochemicals Company are the major players in the alpha olefin market.

Loading Table Of Content...