Alternative Energy Market Research, 2031

The global alternative energy market was valued at $1.1 trillion in 2021, and is projected to reach $3.2 trillion by 2031, growing at a CAGR of 10.3% from 2022 to 2031.

Alternative energy includes energy which is generated from solar, nuclear and geothermal sources. It results in low or no emissions of greenhouse gases in the environment. Alternative energy derived directly or indirectly from the sun, or from heat generated deep within the earth and is used to produce electricity. Alternative energy is produced from the sources which are naturally based, and do not contribute to the greenhouse effect. Alternative energy should not be confused with renewable energy, even several renewable energy sources fall under alternative energy.

Globally, the adoption rate of alternative energy is increasing due to various factors such as surge in demand for electricity or power, depletion of fossil fuel resources, and surge in environmental pollution. Alternative energy can be produced in the form of electricity, industrial heat, and thermal energy which is used by various end users. Alternative energy helps to overcome the concerns which are related to pollution reduction, sustainability, and renewability of resources which will showcase positive impact on alternative energy market trends in near future.

The consumption rate of energy is accelerating in developing nations which is contributing toward the increase in alternative energy market share. Economic, social, and industrial progress all depend heavily on energy. Countries around the word are making themselves independent for the power sector which is boosting the alternative energy market size in furcate period. The major factor which plays an important role in the alternative energy market forecast is rise in demand for renewable energy sources for the generation of electricity in the upcoming years.

Higher authorities and government are involved in preparing of policies for the upliftment of utility sector and to increase the production capacity of alternative energy in plant which can easily fulfil the demand in the country. In coming years, the dependency on alternative energy will be more as alternative energy is a relatively clean form of energy.

The potential of alternative energy varies across regions. The potential is lower in coastal areas, due to increased cloud coverage, and is higher in the central regions. Accessibility is the primary objective of alternative energy production worldwide. The alternative energy industry has shown an exceptional recent year. Around the world, a lot of alternative energy sources have been installed.

As per the global alternative energy market analysis, increasing global warming and changing climatic conditions will lead to the faster adoption of alternative energy solutions in coming years. The installation of the solar system is increasing in North America comparing to the historical data. The awareness related to the clean energy is increasing in the developing nations which is boosting the demand for alternative energy during the forecast period.

The tracking of production and consumption of alternative energy is very important and can be done through the energy procurement systems. Commercial buildings are indulged in efficiently offsetting and diversifying their own electricity consumption. Through diversification, a society can increase the use of different energy sources like nuclear or solar energy and to offset a pressure on one energy source like coal and fossil. Diversification of energy can also cut back on the amount of fossil fuels used to generate electricity. Energy diversification involves incorporating new energy sources into the mix (portfolio) which is mix of alternative and non-renewable source of energy. To reduce reliance on a single energy source, it is described as increasing the share of alternative energy sources.

Several opportunities are coming in the way for different alternative energies. One of the most important recent advancements in nuclear energy is the shrinkage of reactors. 20% of the electricity in the US is generated by nuclear facilities. The newest development in nuclear power is the small modular reactor (SMR), which costs less and produces less energy than conventional reactors. Nowadays, nuclear reactors may produce 500 megawatts to 1 gigawatt of electricity. SMRs only generate about 300 MW. smaller reactors come with the advantage of more flexible than older designs. A single reactor might be useful for projects with lower energy needs, while SMR reactors are useful for projects with higher energy needs. Fresh wave of nuclear technologies might alter the situation and create the alternative energy opportunities. All current nuclear power generating models share a few important traits which make the source safer and more versatile than earlier versions.

Some of the factors which restrain the alternative energy growth such as, in alternative nuclear power plant include the operating costs like fuel, maintenance, and other costs (O&M). Estimates of fuel costs include the management of lost fuel and eventual waste disposal which is hampering the growth of alternative energy market. However, the process of purifying, processing, and converting uranium into fuel components raises the price of fuel by about 50%. Uranium has the benefit of being a highly concentrated source of energy and having quick and inexpensive transportation capabilities. However, the market for nuclear energy is facing a dilemma as a result of the rising uranium price breach.

The need for alternative energy has increased due to a boom in the global energy sector. A surge in the investigation of new renewable energy sources has grown over the past five years, aside from the pandemic period. Indian capital goods businesses are entering the green energy market as a result of a global expansion in the alternative energy sector. Manufacturers of alternative energy equipment are entering into agreements with companies, residential, and other sectors of the economy.

The alternative energy market is segmented on the basis of type, end-use and region. The report further outlines the details about the revenue generated through the sale of alternative energy across North America, Europe, Asia-Pacific, and LAMEA. Major players operating in the alternative energy market include Enel Spa, LONGi, Constellation Energy Corporation, NextEra Energy Resources, LLC., Trina Solar, ACCIONA SA, Ontario Power Generation Inc., Northland Power Inc., ReNewPower, Adani Group, Capstone Infrastructure Corporation and Ormat.

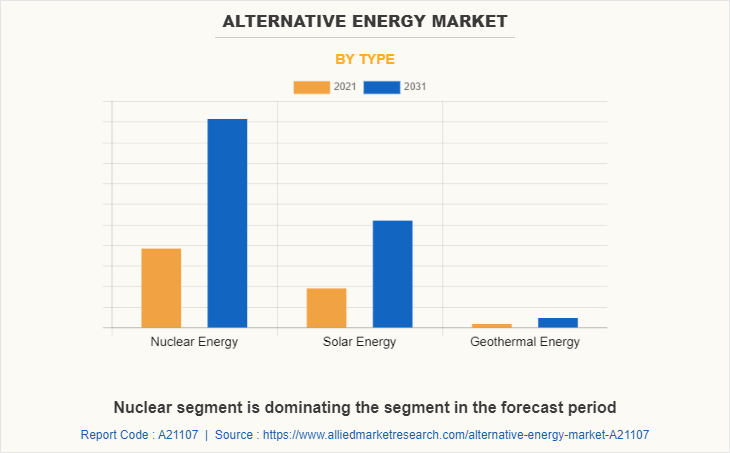

Based on type, the market is classified into solar energy, geothermal energy, and nuclear energy. The solar energy segment is further classified on the basis of technologies into passive solar gain, solar thermal, concentrated solar power and solar photovoltaics. The geothermal energy segment is further divided on the basis of system into enhanced geothermal systems (EGS) and advanced geothermal systems (AGS). The nuclear energy segment is further categorized on the basis of source into uranium and thorium and by reactor type in pressurized water reactor, pressurized heavy water reactor, boiling water reactor, high-temperature gas-cooled reactor, liquid-metal fast-breeder reactor and others. In 2021, the nuclear energy segment dominated the market as nuclear power plants can produce more energy in less time and is able to fulfil the increase in demand from different end-use. Another factor driving the demand for nuclear energy is its ability to produce safe, dependable, and low-emission electricity. However, more time and money both are involved in the development of nuclear power plant due to which its CAGR is growing at stable rate.

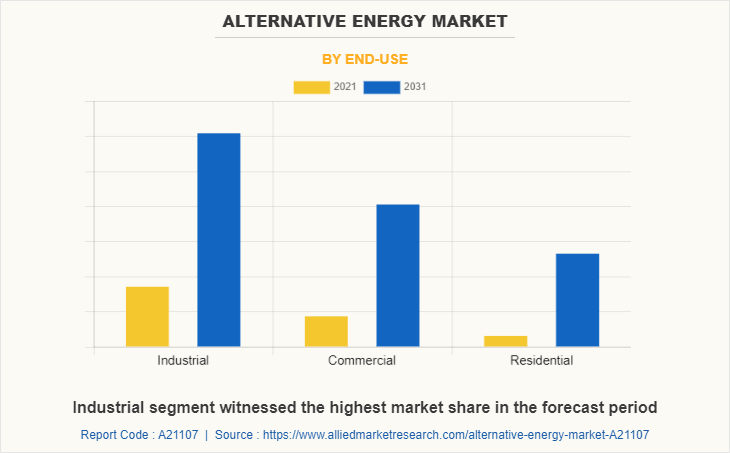

Based on end-use, the market is classified into residential, commercial and industrial. The industrial sector dominated the market in 2021 due to increased usage of alternative energy in manufacturing. The residential segment holds the highest CAGR during the forecast period, due to robust federal initiatives such as the solar investment tax credit, fast falling costs, and rise in demand for clean electricity in both the private and public sectors.

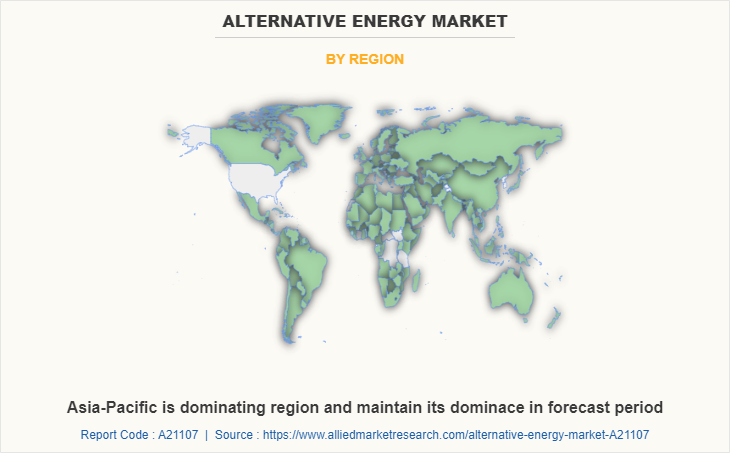

By region, the market is studied across North America, Europe, Asia-Pacific and LAMEA. In 2021, Asia-Pacific dominated the market owing to increased production of alternative energy production equipment in the region. China and India are the two biggest players in the Asia-Pacific market. However, Japan’s recent alternative energy policy has made the country an interesting prospect regarding alternative energy projects.

The Russian Federation is among the ten most energy-rich countries in the world. It has large reserves of energy minerals and a significant potential for renewable energy sources. The invasion of Russia has further worsened an already precarious scenario for the energy markets, notably in Europe. To minimize the possibility of an interruption in Russian alternative energy company must collaborate with governments.

Longer term, the sector needs to increase its adaptability and relevance in a rapidly evolving energy environment. The scenario brought about by the conflict between Russia and Ukraine influences the alternative energy market as well. Many projects that were previously underway in the nations are now on hold, and new projects are being delayed, which has slowed the market's expansion in recent years.

The booming world economy has caused exponential population growth with high energy demand which is becoming very difficult to satisfy. Oil and other commonly utilized energy sources are depleting, endangering nations and their people. It is nearly hard to significantly reduce energy demand, and the severe environmental issues associated with electricity production force companies to investigate alternative energy methods of generating energy. Several companies are investing the doing the business expansion.

Key Strategies:

- In October 2022, The ACCIONA firm plans to treble its installed capacit to more than 2,600 MW, primarily due to solar PV projects. The company has planned to invest $1.3 billion and will add up to 1,600 employees while construction is at its busiest. Future revenue growth for the business is facilitated by this advancement.

- In March 2022, LONGi has agreed to increase the Green Energy Plans' capacity by adding 20 GW Mono-Si Wafer, 30 GW Mono-Si Cell, and 5 GW Module. LONGi Green Energy has disclosed plans to spend RMB 19.5 billion on additional Chinese capacity expansion. This new development aids the business in growing its clientele.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alternative energy market analysis from 2021 to 2031 to identify the prevailing alternative energy market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alternative energy market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alternative energy market trends, key players, market segments, application areas, and market growth strategies.

Alternative Energy Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3153.4 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 354 |

| By Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Ontario Power Generation Inc., Acciona SA, Enel Spa, Constellation Energy Corporation, Ormat Technologies Inc., Northland Power Inc., adani group, ReNewPower, Trina solar, NextEra Energy Resources, LLC, capstone infrastructure corporation, LONGi |

Analyst Review

The CXOs of major corporations claim that the spread of COVID-19 caused a considerable and quick reduction in global economic activity. This therefore has an impact on the demand for oil as well as for other goods and services like alternative energy and solutions. Pandemic had a detrimental effect on the market. Other pandemic consequences include decreased client spending, negative net income and revenue, operations interruptions

The demand for digital products and services has decreased during this moment of severe economic disruption and low oil prices, which is anticipated to last for some time. Manufacturers of solar energy equipment are anticipated to enhance their manufacturing capacity and mergers to broaden their customer base and global presence. Other sources, such as hydro and wind energy also play an important role although these sources come under renewable sources only. Government support and increase in research and development in the solar energy solution is projected to help drive growth of the global alternative energy market in near future.

Increase in preference toward environment-friendly energy solutions

Asia-Pacific region is the largest regional market for Alternative Energy

Industry segment is the leading end use of Alternative Energy Market

Enel Spa, LONGi, Constellation Energy Corporation, NextEra Energy Resources, LLC., Trina Solar and ACCIONA SA.

The market size of alternative energy market is around $3.2 trillion by 2031

Loading Table Of Content...