Alternative Finance Market Research, 2032

The global alternative finance market was valued at $173.9 billion in 2022, and is projected to reach $920.9 billion by 2032, growing at a CAGR of 18.5% from 2023 to 2032.

Financing that is accessible outside the conventional big banks is referred to as alternative finance. It provides founders with a wider range of options and greater flexibility when selecting financial services solutions. Alternative finance specifically refers to a class of financing solutions, such as debt and venture capital that fill in holes in traditional financial markets. Online lenders, peer-to-peer consumer & commercial lending, reward-based crowdfunding, equity crowdfunding, revenue-based financing, invoice trading third party payment platforms, and online lenders are some examples of alternative financing operations through "online marketplaces.".

The alternative finance market is a dynamic and rapidly evolving industry that is changing the way individuals and businesses access funding and invest their money. In addition, the alternative finance market has gained popularity with new players entering the market all the time. This has led to increased competition and innovation in the industry. Moreover, there is a rise in focus on sustainability in the alternative finance market, with investors and borrowers increasingly looking for opportunities to invest in and borrow from companies that have a positive impact on the environment and society. These factors are boosting the growth of alternative finance market.

However, Lack of awareness and understanding and lack of standardization of alternative finance and are limiting the industry expansion. On the contrary, opportunity to access unexplored markets and the availability of industry professionals are expected to create lucrative opportunities for the market in upcoming years. Moreover, alternative finance providers often offer loans and other financial products at lower rates than traditional lenders. This can help to reduce borrowing costs for individuals and businesses.

The report focuses on growth prospects, restraints, and trends of the alternative finance market. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the alternative finance market outlook.

The alternative finance market is segmented into Type and End User.

Segment Review

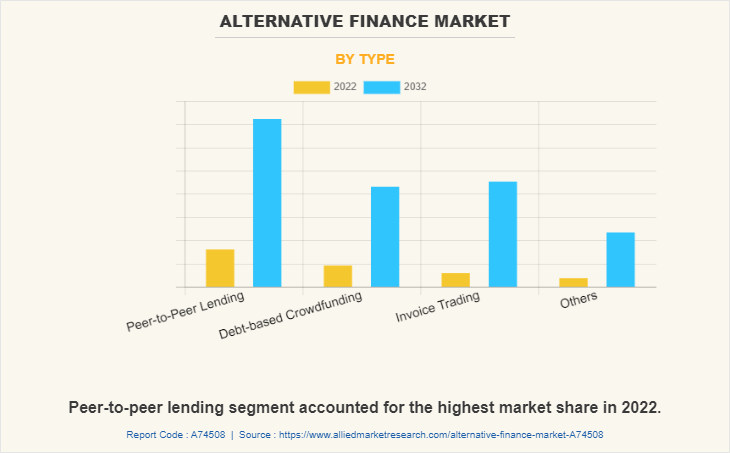

The alternative finance market is segmented into type, end user, and region. By type, the market is divided into peer-to-peer lending, debt-based crowdfunding, invoice trading, and others. Depending on end user, it is bifurcated into businesses and individuals. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the peer-to-peer lending segment acquired a major alternative finance market size in 2021. The growth of this segment is attributed to the fact that institutional investors such as hedge funds, pension funds, and banks are becoming more involved in P2P lending, attracted by the high returns and diversification benefits. In addition, with growing popularity of P2P lending platforms, governments are paying closer attention to the lending industry and introducing regulations to protect investors and borrowers.

By region, the North America dominated the alternative finance market share in 2021. This is attributed to increasing demand for alternative financing, technological innovation, regulatory support, changing consumer behaviours toward finance, and strong entrepreneurial culture. Further, regulatory bodies in North America have generally been supportive of alternative finance platforms, which has encouraged the growth of the industry.

The key players operating in the global alternative finance market include LendingCrowd, Funding Circle Limited, LendingTree, LLC, Prosper Funding LLC, Fundly, Invoice Interchange Private Limited, Mintos, Indiegogo, Inc., LendingClub Bank, and SoFi. These players have adopted various business strategies to increase their market penetration and strengthen their position in the alternative finance industry.

Country Specific Statistics & Information

Rise in partnerships to develop the financing practices and adoption of the advance technologies are some of the trends that have helped to augment the alternative finance market growth. For instance, in December 2019, U.S.-based fintech company Drip Capital has signed a memorandum of understanding with the Buying Agents Association (BAA), a non-profit organization representing buying houses and liaison offices from all sectors including accessories, apparel, carpets, handicrafts, jewelry, leather, processed foods, textiles, furnishings and other labor-intensive sectors. The partnership would provide small- and medium-sized exporters access to fintech products, which are regarded as one of the major disruptors in international commerce.

Furthermore, introduction of new and innovative products in the market by key players is expected to boost the growth of alternative finance market during the forecast period. For instance, in January 2023, ReferLoan, one of the leading financial technology startups, launched the innovative ‘Refer and Earn’ model in fintech industry. ReferLoan's primary area of expertise is the financial sector, which includes nearly every financial product such as loans, credit cards, insurance, and investments on behalf of financial institutions. A platform that combines digital and physical forms has been developed by ReferLoan.

COVID-19 pandemic had a moderate impact on the alternative finance industry, owing to increased adoption of online & digitalized platforms for the customer service operations globally. Further, the pandemic had led to increased demand for alternative finance as traditional lenders have become more cautious about lending due to economic uncertainty. This has led to an increase in demand for products such as peer-to-peer lending and crowdfunding.

Furthermore, the pandemic had created significant economic uncertainty, which has made it more difficult for alternative finance providers to assess credit risk and price their products accurately. While the pandemic has created challenges for alternative finance providers, it has also created opportunities for those that are able to adapt to the changing market conditions. Moreover, governments around the world introduced a range of measures to support businesses and individuals during the pandemic, including changes to regulations governing the alternative finance market. This, in turn, became one of the major growth factors for the alternative finance industry during the global health crisis.

Top Impacting Factors

Advancement in Technology

Alternative finance is a term that encompasses a wide range of non-traditional financial services, including crowdfunding, peer-to-peer lending, and digital currencies. These types of financial services have emerged in recent years due to several driving factors that have created a demand for alternatives to traditional financial institutions. One of the main driving factors of the alternative finance market includes the advancements in technology that have led to the creation of new platforms and tools that make it easier for people to connect with one another and exchange goods and services. Furthermore, alternative finance services are built on these technologies, making it easier for people to access funding, investment opportunities, and other financial services.

For instance, crowdfunding platforms such as Kickstarter and Indiegogo have enabled entrepreneurs and creatives to access funding from a large number of people, bypassing the need to go through traditional financial institutions. Similarly, peer-to-peer lending platforms such as LendingClub and Prosper use technology to match borrowers with investors, creating a more efficient and cost-effective lending process. Therefore, these are the major growth factors for the alternative finance market.

Lack of Access to Traditional Finance

Many people and businesses are underserved by traditional financial institutions, which can be slow to approve loans or may require collateral that many people do not have. Alternative finance services provide an opportunity for these people and businesses to access funding that they might not have been able to access otherwise. For instance, microfinance institutions provide small loans to entrepreneurs in developing countries who do not have access to traditional banking services. These loans can help these entrepreneurs start or grow their businesses, creating jobs and economic growth. Therefore, these are the major growth factors of the alternative finance market.

Change in Consumer Preferences and Regulatory Environment

Consumers are increasingly looking for financial services that are more transparent, convenient, and tailored to their needs. Alternative finance services are often able to provide these benefits, making them an attractive option for many consumers. For instance, digital currencies such as Bitcoin and Ethereum offer fast and secure transactions, without the need for intermediaries such as banks. This can be especially attractive to people who want to make international transactions or who are concerned about privacy and security.

In addition, the regulatory environment for financial services has evolved in recent years, creating both opportunities and challenges for alternative finance services. In some cases, regulations have created barriers to entry for new alternative finance services. In other cases, regulations have provided a framework for alternative finance services to operate within, creating more trust and stability in the market. For instance, the JOBS Act in the U.S. created a regulatory framework for equity crowdfunding, enabling startups and small businesses to raise funds from a larger pool of investors. Similarly, the European Union's Payment Services Directive (PSD2) has created a regulatory framework for digital payment services, making it easier for consumers to make transactions online. Therefore, these are the major growth factors driving the growth of the alternative finance market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alternative finance market analysis from 2022 to 2032 to identify the prevailing alternative finance market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alternative finance market size segmentation assists to determine the prevailing alternative finance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alternative finance market trends, key players, market segments, application areas, and market growth strategies.

Alternative Finance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 920.9 billion |

| Growth Rate | CAGR of 18.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Fundly, LendingClub Bank, Social Finance, Inc., Funding Circle Limited, Mintos, Indiegogo, Inc., LendingCrowd, LendingTree, LLC, Prosper Funding LLC, Invoice Interchange Private Limited |

Analyst Review

Alternative finance is a dynamic and rapidly evolving industry that has changed the way individuals and businesses access funding and invest their money. Furthermore, the alternative finance market presents several opportunities for investors, borrowers, and providers of financial services. The market has grown rapidly and is likely to continue to expand as more individuals and businesses become aware of the benefits of alternative finance.

The COVID-19 outbreak had a significant impact on the alternative finance market and accelerated the usage & adoption of alternative finance owing to rise in need for financing tools globally. Moreover, governments around the world introduced a range of measures to support businesses and individuals during the pandemic, including changes to regulations governing the alternative finance market. For example, some countries relaxed regulations around crowdfunding and peer-to-peer lending to make it easier for businesses to access funding. This promoted the demand for alternative finance, thereby accelerating revenue growth.

The key players in the alternative finance market are LendingCrowd, Funding Circle Limited, LendingTree, LLC, Prosper Funding LLC, Fundly, Invoice Interchange Private Limited, Mintos, Indiegogo, Inc., LendingClub Bank, and SoFi. Major players that operate in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for alternative finance across the globe, major players are collaborating to provide differentiated and innovative products.

The alternative finance is estimated to grow at a CAGR of 18.5% from 2023 to 2032.

The alternative finance is projected to reach $920.84 billion by 2032.

Advancement in technology, lack of access to traditional finance and change in consumer preferences and regulatory environment majorly contribute toward the growth of the market.

The key players profiled in the report include reinsurance market analysis includes top companies operating in the market such as LendingCrowd, Funding Circle Limited, LendingTree, LLC, Prosper Funding LLC, Fundly, Invoice Interchange Private Limited, Mintos, Indiegogo, Inc., LendingClub Bank, and SoFi.

The key growth strategies of alternative finance players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...