The global alternative fuel and hybrid vehicle market was valued at $352.0 billion in 2020, and is projected to reach $7,976.0 billion by 2030, growing at a CAGR of 34.5% from 2021 to 2030.

Alternative fuel vehicle is a vehicle designed to operate on compressed natural gas, electricity, biofuel, bio-diesel, fuel cell, liquid nitrogen, and dimethyl ether. Different types of natural gas vehicles include, dedicated vehicles, bi-fuel vehicles, and dual fuel vehicles. Plug-in hybrid electric vehicles are considered as alternative fuel vehicle, as the primary input fuel is electricity. Moreover, alternative fuel vehicles create less or no CO2 emissions and also aid in reducing the pollution.

The global decrease in oil reserves, growth in prices of fossil fuels, increase in adoption of clean mobility solutions, stringent government norms for emission control, and growth in supportive government policies to promote adoption of alternative fuel vehicles are factors that drive the growth of the market. However, low fuel economy and performance associated with alternative fuel vehicles and lack of infrastructure to support alternative fuel vehicles are factors expected to hamper the growth of the market. Furthermore, development of charging infrastructure, electrification of public fleet, and technological advancements are expected to offer growth opportunities during the forecasted period.

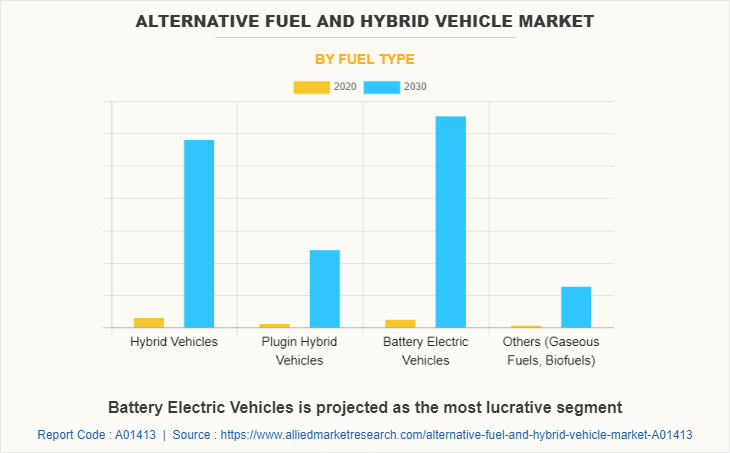

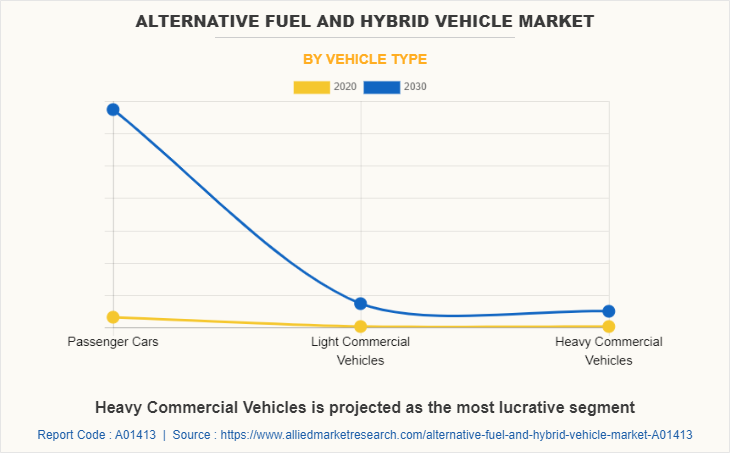

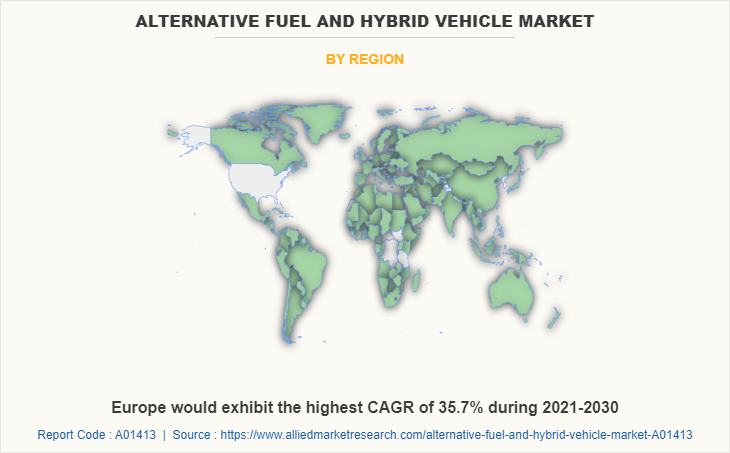

The alternative fuel and hybrid vehicle market is segmented on the basis of fuel type, vehicle type, vehicle class, and region. By fuel type, the market is fragmented into hybrid vehicles, plugin hybrid vehicles, battery electric vehicles, and others. On the basis of vehicle type, it is fragmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. Based on vehicle class, the market is divided into economical vehicles, mid-priced vehicles, and luxury vehicles. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the alternative fuel and hybrid vehicle industry report include, BMW Group, BYD Company Ltd., Ford Motor Company, Honda Motor Co., Ltd., Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., Tesla, Inc., Toyota Motor Corporation, and Volkswagen AG.

Growth in Prices of Fossil Fuels

Several countries across the globe face rise in the price of fossil fuels. For instance, in 2021, Europe registered increase in gas prices owing to several factors, such as reduced gas supply from Russia, low storage levels, extreme weather conditions, and carbon pricing. This increase in price of fossil fuels results in adoption of vehicles running on alternate fuel as a future mobility solution. Moreover, fossil fuel-based vehicles emit harmful gases and contribute to increased level of pollution. However, vehicles based on alternative fuel do not emit CO2 emissions or harmful gases, which make alternative fuel vehicle an efficient mobility solution with low operating cost. Hence, growth in prices of fossil fuel is expected to contribute in increase in adoption of alternative fuel and hybrid vehicle during the forecast period.

Increase in Adoption of Clean Mobility Solutions

Increase in the adoption of clean mobility solutions is observed globally due to climatic changes. Continuous usage of fossil fuels in automobiles is a major factor resulting in climate change. Vehicles that run on alternative fuels, such as natural gas, electricity, biofuel, bio-diesel, fuel cell, liquid nitrogen, and dimethyl ether result in lesser carbon emissions. Increasing environmental concerns among consumers, introduction of stringent emission regulations, and launch of advanced vehicles supporting alternative fuels are expected to increase the adoption of alternative fuel and hybrid vehicle market during the forecast period.

Growth in Supportive Government Policies to Promote Adoption of Alternative Fuel Vehicles

Several countries are taking numerous initiatives to achieve net zero emissions target. Different governments across the globe promote adoption of alternative fuel vehicles, such as electric vehicles and plug-in hybrid vehicles. Several governments are providing various benefits to buyers on adoption of electric vehicle in their region. For instance, in 2022, the Government of India has increased subsidy on purchase of electric vehicle to promote adoption of electric vehicle under Faster Adoption and Manufacturing of Hybrid & Electric Vehicle (FAME) scheme. This growth in supportive government policies to promote adoption of alternative fuel vehicles is anticipated to drive the growth of alternative fuel and hybrid vehicle industry.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alternative fuel and hybrid vehicle market analysis from 2020 to 2030 to identify the prevailing alternative fuel and hybrid vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alternative fuel and hybrid vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alternative fuel and hybrid vehicle market trends, key players, market segments, application areas, and market growth strategies.

Alternative Fuel and Hybrid Vehicle Market Report Highlights

| Aspects | Details |

| By Fuel Type |

|

| By Vehicle Type |

|

| By Vehicle Class |

|

| By Region |

|

| Key Market Players | BMW Group, Volkswagen AG, Tesla, Inc., Mitsubishi Motors Corporation, Honda Motor Co., Ltd, Nissan Motor Co., Ltd, Ford Motor Company, Mercedes-Benz Group AG, Toyota Motor Corporation, BYD Company Ltd |

Analyst Review

Growth of the alternative fuel and hybrid vehicle market is driven by increase in adoption of clean mobility solutions and development of charging infrastructure. In addition, numerous governments provide various benefits for adoption of clean mobility solutions, which strengthens the growth of the market across the globe.

Increase in focus on electrification of public fleet due to fuel & maintenance cost savings is expected to aid in reduction of pollution level. In addition, several supportive government schemes and incentives encourage adoption of electric vehicles in commercial fleets.

Increase in demand for alternative fuel and hybrid vehicle from emerging economies, such as Asia-Pacific coupled with supportive government policies for adoption of alternative fuel and hybrid vehicles is expected to supplement the market growth. Several developments have been carried out by key players operating in the alternative fuel and hybrid vehicle market. In September 2021, Ford Motor Company announced that it is going to establish new mega campus in Tennessee and twin battery plants in Kentucky to power new lineup of advanced electric vehicle. Moreover, in March 2021, Mitsubishi Motors Corporation introduced Eclipse Cross Plug-In Hybrid Vehicle Model in New Zealand and Australia.

The global alternative fuels and hybrid vehicles market is expected to reach $7,976.0 billion in 2030 from $352 billion in 2020.

Alternative fuel vehicle is a vehicle designed to operate on compressed natural gas, electricity, biofuel, bio-diesel, fuel cell, liquid nitrogen, and dimethyl ether. Alternative fuel vehicles create less or no CO2 emissions and also aid in reducing the pollution.

The sample/company profiles for global alternative fuels and hybrid vehicles market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

The drivers for alternative fuel and hybrid vehicles include global decrease in oil reserves, growth in prices of fossil fuels, increase in adoption of clean mobility solutions, stringent government norms for emission control, and growth in supportive government policies to promote adoption of alternative fuel vehicles.

The different types of alternative fuel and hybrid vehicles include hybrid vehicles, plugin hybrid vehicles, battery electric vehicles, and others (gaseous fuels and biofuels).

The company profiles of the top market players of alternative fuel and hybrid vehicles industry can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the alternative fuel and hybrid vehicles industry.

The opportunities in the alternative fuel and hybrid vehicles industry include development of charging infrastructure, electrification of public fleet, and technological advancements.

In September 2021, Ford Motor Company announced establishment of new mega campus in Tennessee and twin battery plants in Kentucky to power new lineup of advanced electric vehicle. In March 2021, Mitsubishi Motors Corporation introduces Eclipse Cross Plug-In Hybrid Vehicle Model in New Zealand and Australia. In April 2020, BYD Company Ltd. & Hino has signed an agreement to jointly establish a new company for commercial Battery Electric Vehicles development.

The upcoming trends in the alternative fuel and hybrid vehicles market include integration of advanced features in alternative fuel and hybrid vehicles to improve performance and comfort, development of charging infrastructure to promote growth of alternative fuel vehicles, and increase in focus on electrification of public fleet.

Some leading companies manufacturing alternative fuel and hybrid vehicles include, BMW Group, BYD Company Ltd., Ford Motor Company, Honda Motor Co., Ltd., Mercedes-Benz Group AG, Mitsubishi Motors Corporation, Nissan Motor Co., Ltd., Tesla, Inc., Toyota Motor Corporation, and Volkswagen AG.

Loading Table Of Content...