The global aluminum alloy wheel market size was valued at $16.4 billion in 2022, and is projected to reach $31.9 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

Report Key Highlights:

- The report covers a detailed analysis on the aluminum alloy wheels used in automotive industry.

- The aluminum alloy wheels market has been analyzed from the year 2022 till the year 2032.

- Latest developments have been mentioned in the research study.

- Top companies operating in the industry has been profiled in the research study.

- The research study includes different segments & regions across which the market has been analyzed

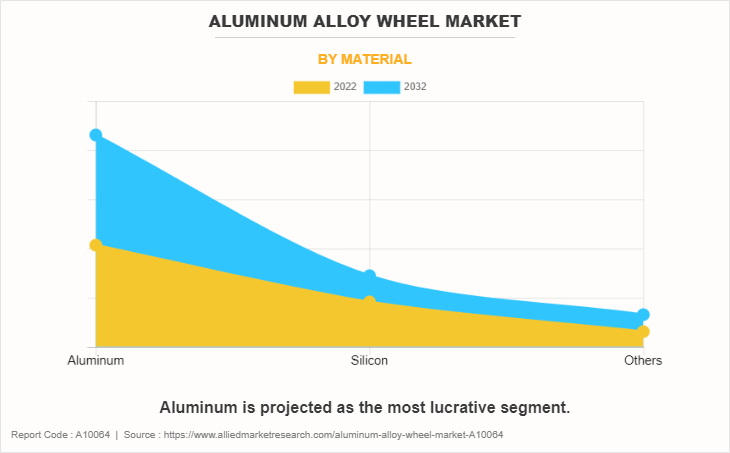

Aluminum alloy wheels used in automobiles are specially designed vehicle rims, which are made of a combination of aluminum and other minerals such as copper, nickel, zinc, and others. Aluminum used in the casting of aluminum alloy wheels holds around 85%-90% of the portion whereas the remaining portion is held by other materials, which makes aluminum alloy wheel stronger. Increase in demand for fuel efficient vehicles along with increase in demand for light weight & durable components to be installed in vehicles has created numerous opportunities for the wheel manufacturers to develop aluminum casted wheels for vehicles. In addition, key manufacturers operating in the industry are inclined towards the production of superior quality aluminum alloy wheels to be used in vehicles as aluminum wheels increase the performance of the vehicle, which is a factor supplementing the growth of the market across the globe.

The aluminum alloy wheel market is governed by factors such as increase in demand for superior quality alloy wheels for vehicles and increase in production of vehicles, which drive the market towards a positive growth. However, factors such as high cost of aluminum alloy wheels and availability of steel based wheel rims are expected to hamper the growth of the market during the forecast period. However, factors such as rise in adoption of carbon fiber in automotive industry and increase in investment on wheel design for better aerodynamics create opportunities for the growth of the market across different regions.

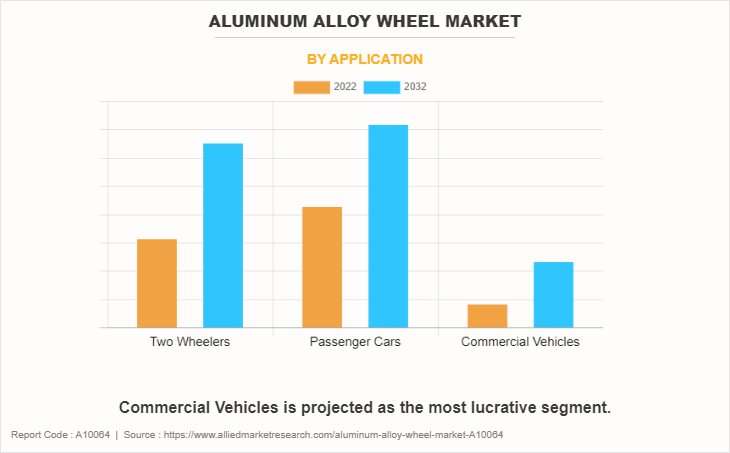

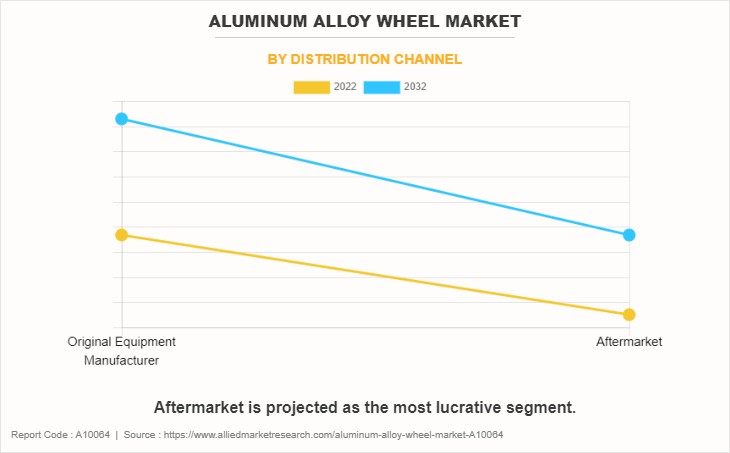

The global aluminum alloy wheel industry is segmented into vehicle type, material, distribution channel, and region. By vehicle type, the market is segmented into two wheelers, passenger cars, and commercial vehicles. By material, the market is segmented into aluminum alloy, silicon alloy, and others. By distribution channel, the market is segmented into original equipment manufacturers (OEMs) and aftermarket. By region, the global market has been studied across North America, Europe, Asia-Pacific and LAMEA.

The key players profiled in the aluminum alloy wheel market research study include Uno Minda, Maxion Wheels, Wheels India Limited, Enkei International, Inc., Mobis India Limited, Status Wheels, Howmet Aerospace, Image Wheels International Ltd., Wheel Pros., and Foshan Nanhai Zhongnan Aluminium Wheel Co., Ltd.

Increased demand for superior quality alloy wheels for vehicles

Increase in demand for lightweight materials to be used across the automotive industry and increase in demand for fuel efficiency across vehicles have tremendously increased the demand for light weight components to be installed in vehicles. Thus, aluminum alloys are distinguished for their lighter weight as compared to other wheel components such as steel and at the same time has proved to be highly efficient in increasing the efficiency of the vehicle.

In addition, aluminum alloy wheel’s ability to withstand corrosion and rust as compared to their steel counterparts has enabled it to be a preference for vehicles amongst OEMs. Hence, apart from being lightweight, it also provides longer life, benefiting customers monetarily. Moreover, customers' approach while buying cars is shifting toward luxury due to increase in their buying power and urbanization. In addition, majority of OEMs operating across the globe are using aluminum alloy wheels in their models, which is supplied from the companies such as Minda Kosei Aluminum Wheel Pvt. Ltd., Steel Strips Wheels Ltd., Enkei Wheels, Maxion Wheels, and others. This increased domestic production followed by the availability of numerous players is expected to propel the growth of the aluminum alloy wheel market share during the forecast period.

Increased production of vehicles

The competition in the manufacturing sector has increased rapidly in the past decade, which has forced automakers to adopt new technologies to be installed in their vehicles. This has enabled vehicle component manufacturers to develop light weight and efficient products to be used in automobiles, which has created a wider scope for the growth of the market in different countries. With the upgradation of technology, the vehicle production across globe has increased by around 6% in 2022 as compared to 2021, followed by a stagnant growth in the production of automotive components across different countries.

In addition, as of 2020, alloy wheel sales for trucks were up at least 32%, which has also proved to be a factor supplementing the growth of the market across countries. Moreover, with rise in sales of vehicles, the sale of associated components such as aluminum alloy wheels has also increased subsequently. Increase in sales and production of all types of vehicles in developing and developed countries due to the growing mobility and investment in the transportation sector is expected to boost the aluminum alloy wheel market forecast in the near future.

High cost of aluminum alloy wheels

Alloy wheels made of aluminum are costly as compared to steel wheels due to high manufacturing cost of alloy wheels as compared to the steel. This is due to high cost incurred in molding an aluminum alloy wheel as compared to a steel wheels. In addition, steel wheels are easy to repair as compared to aluminum wheels due to the fact that aluminum wheels require recasting upon being damaged. Moreover, steel based wheels finds their major application in low segment vehicles due to the low refurbishment cost incurred in repairing the wheel. Moreover, aluminum is the most abundant metal in the Earth's crust and is expensive predominantly due to the amount of electricity required in the extraction process. Thus, such factors hamper the aluminum alloy wheel market demand during the forecast period.

Rise in adoption of carbon fiber in automotive industry

Weight of an automobile is a major challenge in the automotive industry. Aluminum is a substitute of steel, but OEM are now adopting carbon fiber-reinforced plastics (CFRP) technologies for automotive equipment manufacturing, since these materials offer further weight reduction with higher specific stiffness. In addition, numerous automotive manufacturers, such as BMW and Mercedes, are planning or have already started to scale-up their production of fuel-efficient cars through weight reduction by using carbon fibers.

For instance, in September, 2023, Maxion Wheels developed latest light vehicle wheel innovation technology, Maxion BIONIC. It is developed by teams in Brazil, Mexico, the U.S., and Germany. Maxion BIONIC answers the growing demand from OEMs for affordable, stylish, and sustainable wheel solutions especially for light vehicle programs where wheel load is increasing. Similarly, in March, 2023, Uno Minda approved the acquired stake in Kosei Minda Aluminium Company (KMA) and 49.90% stake in Kosei Minda Mould (KMM) from joint venture partner Kosei, Japan. Such developments create growth opportunities for the growth of aluminum alloy wheel industry.

Key Developments in Aluminum Alloy Wheel Industry

- In September 2023, Uno Minda collaborated with Kosei Aluminium Co. Ltd., for premium range of alloy wheels in the Indian aftermarket. These alloy wheels are available in different sizes and designs, as well as compatibility with radial and regular tube tyres. It is also capable of improving acceleration & road handling, resulting in safer riding while improving fuel efficiency.

- In September 2023, Maxion Wheels developed latest light vehicle wheel innovation technology, Maxion BIONIC. It is developed by teams in Brazil, Mexico, the U.S., and Germany. Maxion BIONIC answers the growing demand from OEMs for affordable, stylish, and sustainable wheel solutions especially for light vehicle programs where wheel load is increasing.

- In January 2023, Wheels India Limited launched flow form technology equipped in cast alloy wheel, and it considered as one of the most advanced manufacturing technologies in the wheel industry. The new technology involves the application of pressure to the inner barrel of the wheel while spinning and after casting.

- In September 2022, Maxion Wheels partnered with Inci Holding to start new truck steel wheels plant in Turkey by investing $150 million. These two companies plan to build a plant to offer forged aluminium Commercial Vehicle (CV) wheels beginning in 2024.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum alloy wheel market analysis from 2022 to 2032 to identify the prevailing aluminum alloy wheel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum alloy wheel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum alloy wheel market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Alloy Wheel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.9 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 200 |

| By Application |

|

| By Distribution Channel |

|

| By Material |

|

| By Region |

|

| Key Market Players | Howmet Aerospace, Wheels India Limited, Enkei International, Inc., Status Wheels, Wheel Pros, MOBIS INDIA LIMITED, Uno Minda, Maxion Wheels, Foshan Nanhai Zhongnan Aluminium Wheel Co.,Ltd., Image Wheels International Ltd. |

Aluminum alloy wheels are the upcoming trends of Aluminum Alloy Wheel Market in the world

Passenger Cars is the leading application of Aluminum Alloy Wheel Market

Asia-Pacific is the largest regional market for Aluminum Alloy Wheel

The global aluminum alloy wheel market was valued at $16,364.3 million in 2022, and is projected to reach $31,929.6 million by 2032, registering a CAGR of 7.2% from 2023 to 2032

The key players profiled in the research study include Uno Minda, Maxion Wheels, Wheels India Limited, Enkei International, Inc., Mobis India Limited, Status Wheels, Howmet Aerospace, Image Wheels International Ltd., Wheel Pros., and Foshan Nanhai Zhongnan Aluminium Wheel Co., Ltd.

Loading Table Of Content...

Loading Research Methodology...