Aluminum Alloys Market Research, 2033

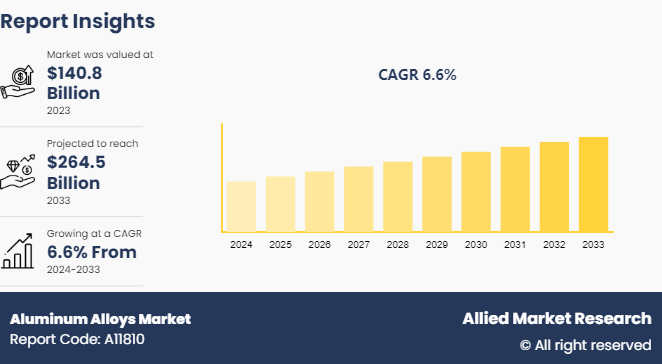

The global aluminum alloys market was valued at $140.8 billion in 2023, and is projected to reach $264.5 Billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Market Introduction and Definition

Aluminum alloy is a metallic material composed of aluminum and one or more other elements such as metals or metalloids. These alloys are designed to achieve desired characteristics such as strength, durability, corrosion resistance, conductivity, and formability that makes them suitable for a wide range of applications across various industries. Aluminum alloys are widely used in industries such as automotive, aerospace, construction, and electronics. In automotive applications, aluminum alloys are valued for their lightweight nature, contributing to improved fuel efficiency and reduced emissions. Furthermore, in aerospace, aluminum alloys offer high strength-to-weight ratios that make them suitable for structural components in aircraft and spacecraft.

Key Takeaways

- The aluminum alloys market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major aluminum alloys industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

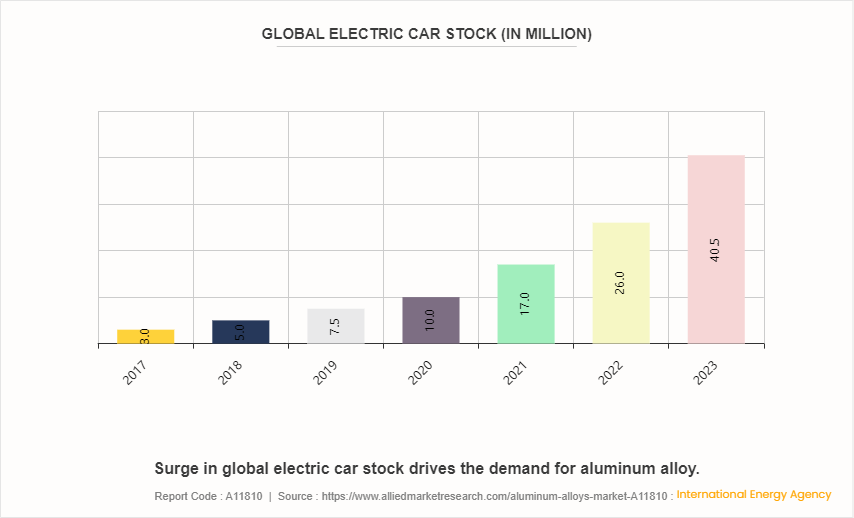

The rise of electric vehicles (EVs) drives the demand for aluminum alloys in the automotive industry. EV manufacturers seek to maximize the range and efficiency of their vehicles by reducing weight wherever possible. According to the International Energy Agency (IEA) , electric car sales neared 14 million in 2023, around 95% of which were in China, Europe and the U.S. Aluminum alloys are ideal for battery enclosures, motor housings, and structural parts due to their lightweight nature and ability to dissipate heat effectively. As the global market for EVs expands, so does the need for advanced aluminum alloy solutions tailored to the unique requirements of electric powertrains and battery systems. All these factors are expected to drive the demand for the aluminum alloys market during the forecast period.

However, the growth of aluminum alloys is significantly hampered by the energy-intensive nature of their manufacturing processes. In the production of aluminum alloys involves several stages such as the extraction of aluminum from bauxite ore, refining it into alumina, and then smelting it into pure aluminum before it is alloyed with other metals. Each of these steps consumes a substantial amount of energy, primarily electricity, that makes aluminum production one of the most energy-intensive industrial processes. All these factors hamper the growth of the aluminum alloys market.

Lightweight automotive design is creating substantial opportunities for the aluminum alloys market, driven by the automotive industry's need to enhance fuel efficiency, reduce emissions, and meet stringent regulatory standards. According to the report of the Aluminum Institute of America, for every 1kg of aluminum used in a car, a weight reduction effect of 2.2kg is obtained, and the exhaust emission is reduced by 20kg during the use period. As vehicles become lighter, they consume less fuel and produce fewer greenhouse gases that makes aluminum alloys an ideal material choice due to their high strength-to-weight ratio. This advantage allows automotive manufacturers to significantly reduce the weight of various vehicle components without compromising safety or performance. All these factors are anticipated to offer new growth opportunities for the global aluminum alloys market during the forecast period.

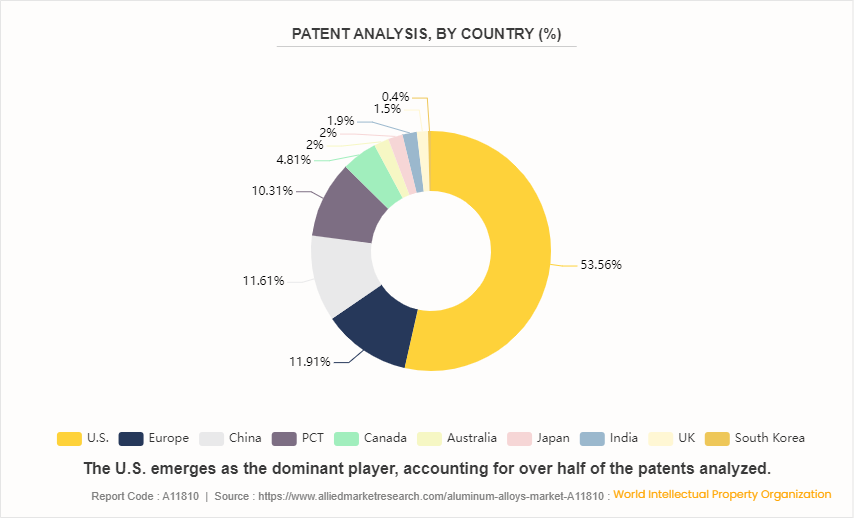

Patent Analysis of Global Aluminum Alloys Market

The U.S. emerges as the dominant player in aluminum alloy innovation, accounting for over half of the patents analyzed. This reflects the significant investment in research and development within the U.S., driven by a strong industrial base, advanced manufacturing capabilities, and a culture of innovation. Patents originating from the U.S. include a wide range of applications, from automotive and aerospace to consumer goods and construction, showcasing the diverse utilization of aluminum alloys across various industries. The recently filed patent is related to the composition for brazing aluminum or aluminum alloy, method of joining aluminum alloys, aluminum alloy powder for sliding members, and extrusion method for high-brittleness aluminum alloy.

Market Segmentation

The aluminum alloys market is segmented into alloy type, process, end-use industry, and region. By alloy type, the market is bifurcated into wrought and cast. By Series, the market is divided into 1000 series, 2000 series, 3000 series, 4000 series, 5000 series, 6000 series, 7000 series, 8000 series. By process, the market is classified into rolling, extrusion, forging, casting, and others. By end-use industry, the market is categorized into automotive, building and construction, transportation, aerospace and defense, electrical and electronics, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the aluminum alloys market include Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, RusAL, Hindalco Industries Ltd., Constellium, AMG ALUMINUM, Kaiser Aluminum, Arconic, and Vedanta Aluminium & Power.

In March 2024, NALCO launched a new product AL-59 in the form of aluminum alloy ingot. AL59 is primarily used in producing conductors for electrical transmission and distribution. AL59 alloy conductors are used in power transmission and distribution lines for a wide voltage range and due to their high corrosion resistance, that makes them suitable particularly for deployment in transmission & distribution at coastal regions.

In February 2024, Elementum 3D launched high-strength aluminum alloy A5083-RAM5. It exhibits consistent tensile properties in horizontal and vertical orientations, as well as, in as-printed and stress-relieved states.

Regional Market Outlook

The surge in the construction sector in Asia-Pacific is fueling demand for aluminum alloys in building and infrastructure projects. Rapid urbanization, population growth, and rise in disposable incomes are driving investment in residential, commercial, and public infrastructure across the region. Aluminum alloys are favored in construction applications for their corrosion resistance, durability, and design flexibility. In addition, the push towards sustainable building practices is driving the adoption of lightweight and recyclable materials such as aluminum alloys that drive their demand in the construction sector. Furthermore, aluminum alloys are valued in the electronics industry for their excellent thermal conductivity, electrical conductivity, and light weight that makes them ideal for heat sinks, casings, and other components. As the demand for high-performance and energy-efficient electronic devices continues to rise, so does the demand for aluminum alloys as a preferred material choice among manufacturers in the region.

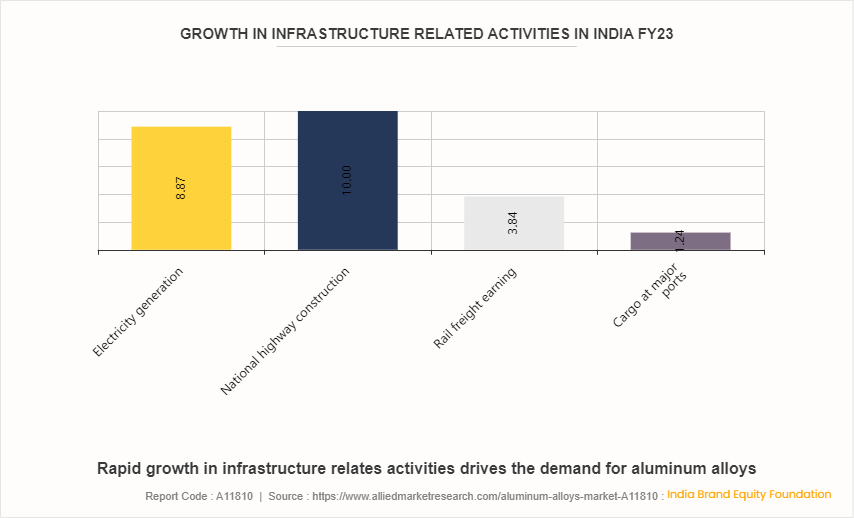

The construction industry in India is expected to reach $1.4 trillion by 2025. An estimated 600 million people are likely to be living in urban centers by 2030.

China’s 14th five-year plan emphasizes new infrastructure projects in transportation, energy, water systems, and new urbanization. According to the International Trade Administration, overall investment in new infrastructure during the 14th five-year plan period (2021-2025) is expected to reach $4.2 trillion.

According to the India Brand Equity Foundation, the automobile sector in India received a cumulative equity FDI inflow of about $35.65 billion between April 2000 to December 2023. This increase in investment drives the demand for aluminum alloy in the automotive industry.

Industry Trends

The aerospace and defense industry generated $952 billion in combined sales in 2022, a 6.7% increase from the prior year. In addition, the A&D industry generated $418 billion in economic value, which represented 1.65% of total nominal GDP in the U.S.

Surge in adoption of lightweight materials is a dominant trend across industries such as automotive, aerospace, and transportation. Aluminum alloys are favored for their high strength-to-weight ratio that makes them essential for reducing vehicle weight, improving fuel efficiency, and enhancing performance. Demand for lightweight materials such as aluminum alloy is expected to rise during the forecast period as regulations on emissions and fuel economy become stricter.

According to the Internation Energy Agency (IEA) , electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. This is more than six times higher than in 2018. In 2023, there were over 250, 000 new registrations per week, which is more than the annual total in 2013.

Key Sources Referred

World Intellectual Property Organization

International Trade Administration

Internation Energy Agency (IEA)

Invest India

Aerospace Industries Association (AIA)

The Aluminum Association

International Aluminum Institute

European Aluminum

Aluminum Association of India

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum alloys market analysis from 2024 to 2033 to identify the prevailing aluminum alloys market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the aluminum alloys market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global aluminum alloys market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Alloys Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 264.5 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 440 |

| By Alloy Type |

|

| By Series |

|

| By Process |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Rio Tinto, Constellium, AMG ALUMINUM, RusAL, Vedanta Aluminium & Power, Kaiser Aluminum, Norsk Hydro ASA, Alcoa Corporation, Arconic, Hindalco Industries Ltd. |

Aluminum alloys market was valued at $140.8 billion in 2023, and is estimated to reach $264.5 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Automotive is the leading application of aluminum alloys market.

Lightweight automotive design is the upcoming trends of aluminum alloys market in the globe.

Asia-Pacific is the largest regional market for aluminum alloys.

The major players operating in the aluminum alloys market include Alcoa Corporation, Rio Tinto, Norsk Hydro ASA, RusAL, Hindalco Industries Ltd., Constellium, AMG ALUMINUM, Kaiser Aluminum, Arconic, and Vedanta Aluminium & Power.

Loading Table Of Content...