Aluminum Bare Wire Conductor Market Overview

The global aluminum bare wire conductor market size was valued at USD 11.3 billion in 2024, and is projected to reach USD 19.1 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034. Rising renewable energy projects, especially solar and wind, are boosting demand for lightweight, cost-effective aluminum conductors in long-distance power transmission. Government initiatives and grid expansion plans further accelerate market growth potential.

Key Market Trend & Insights

- Aluminum alloy wire segment projected to grow at CAGR of 6.2% during forecast period.

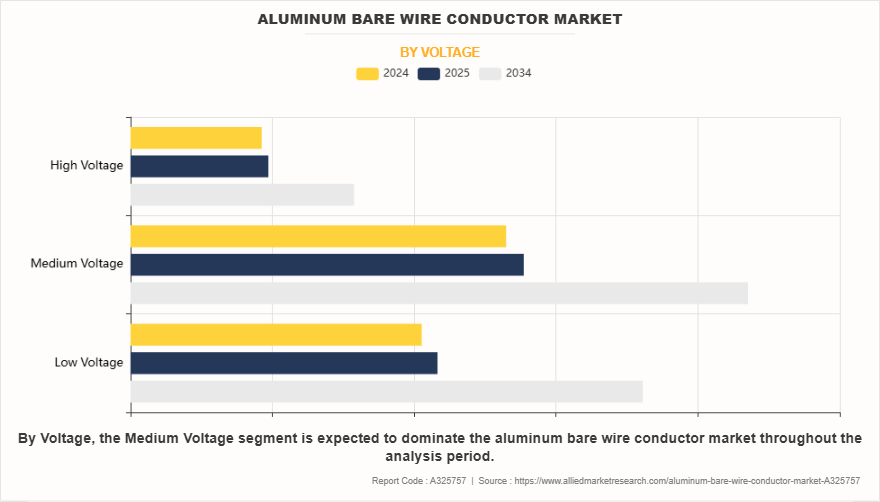

- Low voltage segment expected to grow at CAGR of 5.9% during forecast period.

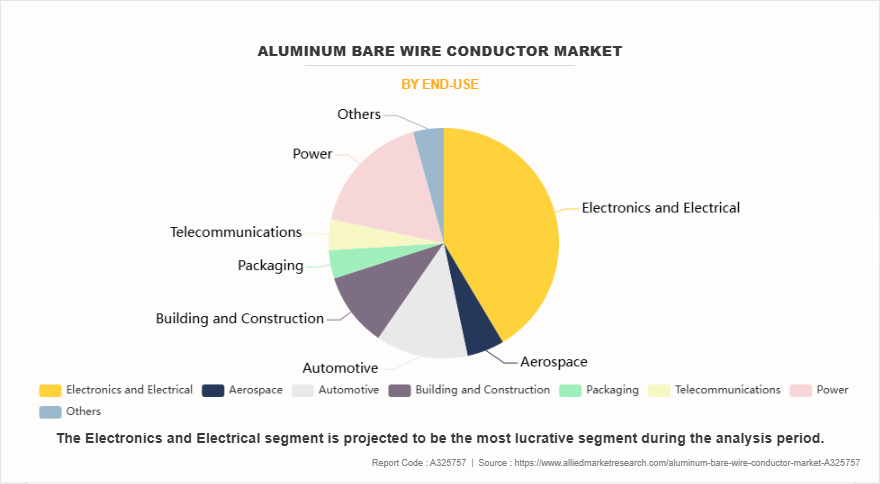

- Electronics and electrical segment dominated the market in 2024.

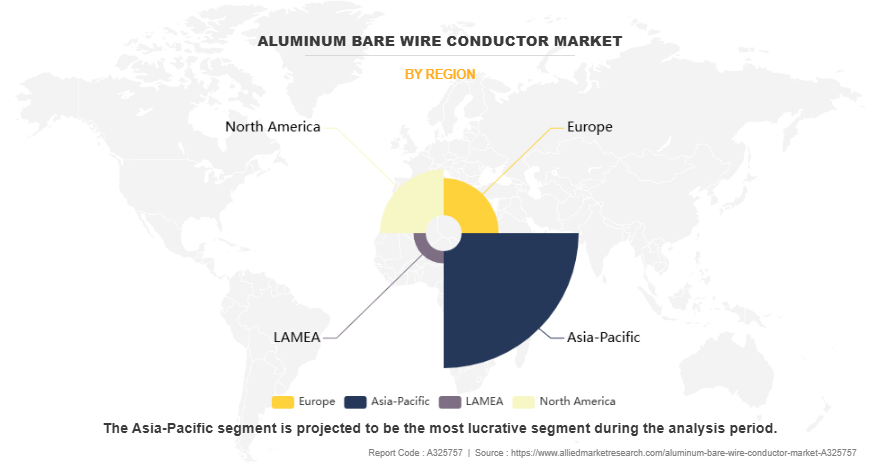

- Asia-Pacific accounted for over one-third of market share in 2024.

- Rising demand for modern electrical infrastructure fueling aluminum conductor adoption.

Market Size & Forecast

- 2034 Projected Market Size: USD 19.1 billion

- 2024 Market Size: USD 11.3 billion

- Compound Annual Growth Rate (CAGR) (2025-2034): 5.5%

Introduction

Aluminum bare wire conductors are electrical conductors made from aluminum without any insulation or coating. These wires are manufactured from high-purity aluminum or aluminum alloys and are designed to conduct electricity efficiently while being lightweight, corrosion-resistant, and relatively cost-effective compared to copper conductors. As the name suggests, “bare” refers to the absence of any insulating material or sheath on the conductor, making them suitable for overhead power transmission and distribution systems where insulation is not required due to environmental exposure.

Aluminum bare wires come in various forms, including solid and stranded conductors, and can be used independently or combined with steel cores for added tensile strength having lightweight electrical conductors properties. One of the most well-known types of aluminum conductors is the aluminum conductor steel reinforced (ACSR), which combines the light weight and conductivity of aluminum with the strength of a steel core for energy-efficient conductor solutions. This unique structure makes ACSR ideal for long-span overhead transmission lines. In addition to ACSR, other variants include all-aluminum conductor (AAC) and all-aluminum alloy conductor (AAAC), each with specific use cases depending on mechanical strength, corrosion resistance, and conductivity requirements.

The fundamental appeal of aluminum as a conductor material lies in its excellent conductivity-to-weight ratio in power transmission infrastructure. Though it has about 61% of the conductivity of copper, aluminum is only about one-third the weight, making it advantageous in applications where weight is a concern. Aluminum’s natural resistance to corrosion also adds to its suitability for use in harsh outdoor environments, especially in coastal or industrial regions. Additionally, aluminum is more cost-effective than copper, making it a preferred material for utility-scale applications where cost and weight are critical factors.

Key Takeaways

- The aluminum bare wire conductor market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global aluminum bare wire conductor market share and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the aluminum bare wire conductor market are Prysmian Group, LS Cable & System, Southwire Company, LLC, Nexans S.A., Apar Industries Ltd., MIDAL CABLES COMPANY B.S.C., NKT A/S, Henan Chalco, Classic Wire Products (P) Ltd, and Swarnagiri Wire Insulations Pvt. Ltd. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Growing demand for electrical infrastructure is expected to drive the growth of the aluminum bare wire conductor market. The growing demand for efficient and modern electrical infrastructure is significantly driving the aluminum conductor market. Rapid urbanization and population growth are pushing both developed and emerging economies to upgrade and expand their power grids for reliable and sustainable electricity distribution. Aluminum conductors are increasingly preferred due to their lightweight nature, which reduces transportation and installation costs for long-distance transmission lines. The Ministry of Power in India announced a major initiative in September 2024, allocating ₹9.15 lakh crore (approx. $109.5 billion) to enhance the national power grid. The plan targets a projected peak demand of 458 GW by 2032, aiming to expand the transmission network from 4.85 lakh ckm to 6.48 lakh ckm and increase transformation capacity from 1,251 GVA to 2,342 GVA for electrical material innovations. It also includes the development of 50 GW of Inter-State Transmission System (ISTS) capacity to evacuate 280 GW of renewable energy by 2030, of which 42 GW has already been completed.

However, the lower conductivity of aluminum compared to copper is expected to hamper the growth of aluminum bare wire conductor market. The lower conductivity of aluminum compared to copper is one of the most significant technical limitations when evaluating materials for electrical conductors. Conductivity directly affects how efficiently electricity can be transmitted through a material. Aluminum, despite being widely used in overhead transmission lines, has only about 60% of the electrical conductivity of copper. This means that for the same cross-sectional area, an aluminum conductor will carry significantly less current than a copper one. To compensate for this, aluminum conductors must be manufactured with a larger cross-sectional area to match the current-carrying capacity of copper. This adjustment increases the size and, in some cases, the weight of the conductor, potentially impacting the design of support structures such as transmission towers. Additionally, larger aluminum wires can be more challenging to install in confined spaces, such as in residential or industrial wiring systems, making copper a preferred choice in those scenarios.

Market Segmentation

The aluminum bare wire conductor market is segmented into type, voltage, end-use, and region. On the basis of type, the market is divided into all aluminum alloy conductor (AAAC), aluminum alloy wire, aluminum conductor steel reinforced (ACSR). As per voltage, the aluminum bare wire conductor market is categorized into low voltage, medium voltage, and high voltage. On the basis of end-use, the aluminum bare wire conductor market is divided into electronics and electrical, aerospace, automotive, building and construction, packaging, telecommunications, power, and others. Region-wise, the market is divided into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the aluminum conductor steel reinforced (ACSR) segment dominated the market, accounting for more than half of the market share in 2024. The bare aluminum wires used in ACSR conductors are typically hard[1]drawn to enhance mechanical strength without significantly compromising electrical properties. These aluminum wires are usually made from 1350-H19 grade aluminum, known for its high conductivity and corrosion resistance. Surrounding the steel core, the aluminum strands ensure efficient current flow, while the steel core adds tensile strength, enabling the conductor to withstand mechanical stresses such as wind, ice loading, and long-span tension.

On the basis of voltage, the medium voltage dominated the aluminum bare wire conductor market in 2024. Aluminum bare wire conductors are widely used in medium voltage (MV) applications due to their favorable balance of cost, weight, and conductivity. In MV applications, aluminum bare wire conductors are commonly used in configurations such as All-Aluminum Conductor (AAC), All-Aluminum Alloy Conductor (AAAC), and Aluminum Conductor Steel-Reinforced (ACSR). Each type is selected based on the specific requirements of the system, including mechanical strength, conductivity, and environmental conditions. ACSR, for instance, combines the high conductivity of aluminum with the tensile strength of a steel core, making it particularly suitable for long-span installations in overhead lines.

On the basis of end-use, the electronics and electrical segment dominated the market in 2024. In the electronics industry, aluminum bare wire conductors are used for grounding purposes and in some internal wiring systems where high current carrying capacity is not a primary requirement. Although its electrical conductivity is lower than copper, aluminum's performance can be enhanced by using larger diameter wires or alloying it with small amounts of other metals. Moreover, aluminum wire is favored in situations where weight and cost are more important than the highest conductivity, such as in aerospace or automotive electrical systems.

Region-wise, Asia-Pacific dominated the aluminum bare wire conductor market in 2024. The usage of aluminum bare wire conductors in the Asia-Pacific region is integral to the growth of the electrical and telecommunications industries. Aluminum, known for its lightweight, conductivity, and cost-effectiveness, is extensively used in power transmission and distribution networks. In countries like China and India, the demand for aluminum conductors has been steadily increasing due to the rapid urbanization, infrastructure development, and the expansion of the power grid to rural areas. In Southeast Asia, countries like Indonesia, Malaysia, and the Philippines also make extensive use of aluminum bare wire conductors, particularly in the construction of electrical grids and for the electrification of remote areas. The region’s focus on renewable energy sources like solar and wind also contributes to the increased demand for aluminum conductors, as they are often used in renewable energy projects due to their durability and conductivity properties.

Which are the Top Aluminum Bare Wire Conductor companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the aluminum bare wire conductor industry.

- Prysmian Group

- LS Cable & System

- Southwire Company, LLC

- Nexans S.A.

- Apar Industries Ltd.

- MIDAL CABLES COMPANY B.S.C.

- NKT A/S

- Henan Chalco

- Classic Wire Products (P) Ltd

- Swarnagiri Wire Insulations Pvt. Ltd.

What are the Recent Developments in the Aluminum bare wire conductor the Market

- In Feburary 2024, Alcoa partnered with Nexans to supply low-carbon aluminum produced using ELYSIS™ technology, which eliminates greenhouse gas emissions during production. This collaboration aims to reduce the carbon footprint in cable manufacturing.

- Hydro and NKT announced a partnership in March 2024 to integrate low-carbon aluminum wire into power cable solutions, focusing on research and development to enhance aluminum wire applications and support renewable energy transitions

- In December 2024, the Indian government's Revamped Distribution Sector Scheme (RDSS) has allocated substantial funds to modernize power distribution infrastructure, indirectly boosting the demand for aluminum conductors. As of August 2024, projects worth $31.57 billion (₹2,620 billion) have been sanctioned under the scheme.

- In March 2024, the Central Electricity Authority (CEA) issued advisories to implement Bureau of Indian Standards (BIS) for aluminum ingots, wire rods, and wires used in manufacturing conductors and cables, ensuring compliance with standards like IS 5484 and IS 2067.

Trump’s Tarriff Impact on Aluminum Bare Wire conductor Industry

The tariffs have led to increased costs for aluminum ingots, a primary raw material for bare wire conductors. Cable manufacturers, reliant on these ingots, face higher production costs, which are often passed on to consumers. Additionally, the tariffs have disrupted supply chains, forcing manufacturers to seek alternative suppliers or adjust sourcing strategies, leading to longer lead times and increased uncertainty in production planning.

Canada, supplying over 70% of U.S. aluminum wire imports, experienced a slight decline of 0.3% in aluminum wire exports to the U.S. from January to October 2024 compared to the same period in 2023. While this decrease appears minimal, the broader context reveals a 5.3% drop in total U.S. aluminum imports of metals and alloys during the same timeframe, indicating a tightening supply.

The tariffs have contributed to a 25% increase in the U.S. aluminum premium over the global benchmark, reaching 35 cents per pound. This surge in prices exacerbates challenges for industries dependent on aluminum, including the bare wire conductor sector. Moreover, the U.S. faces difficulties in ramping up domestic aluminum production due to limited smelting capacity and high energy costs, further straining the market.

The increased production costs and supply chain uncertainties have broader economic implications. Alcoa's CEO warned that the tariffs could jeopardize approximately 100,000 U.S. jobs, highlighting the potential for significant employment impacts across the aluminum industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum bare wire conductor market analysis from 2024 to 2034 to identify the prevailing aluminum bare wire conductor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum bare wire conductor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global aluminum bare wire conductor market growth forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum bare wire conductor market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Bare Wire Conductor Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 19.1 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 486 |

| By Type |

|

| By Voltage |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | NKT (NKT A/S), Southwire Company, LLC, Nexans S.A., LS Cable & System Co., Ltd., Classic Wire Products (P) Ltd, Prysmian Group, Henan Chalco, MIDAL CABLES COMPANY B.S.C., Swarnagiri Wire Insulations Pvt. Ltd., Apar Industries Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, growing electricity demand & infrastructure development is expected to drive the growth of the aluminum bare wire conductor market. The growing demand for electricity, driven by rapid urbanization and rural development, is a major factor fueling the increased use of aluminum bare wire conductors in power transmission and distribution systems. As cities expand and new urban centers emerge, the need for reliable and efficient electrical infrastructure becomes critical. At the same time, governments and utility providers in many emerging economies are launching large-scale rural electrification programs to extend power access to previously underserved or completely off-grid areas. This dual push—urban growth on one hand, and rural connectivity on the other has led to a surge in investments in transmission and distribution (T&D) infrastructure. Aluminum conductors, with their cost-effectiveness and lightweight properties, offer an ideal solution for such widespread deployment. Compared to copper, aluminum is significantly cheaper and easier to transport and install, especially over long distances, which is particularly advantageous in large-scale rural electrification projects where budget constraints and logistical challenges are common.

One of the significant challenges associated with aluminum bare wire conductors is their susceptibility to corrosion, particularly in coastal and industrial environments where moisture, salt, and pollutants are prevalent. Unlike copper, which naturally forms a protective patina that resists further degradation, aluminum tends to form an oxide layer that can be brittle and less effective in preventing ongoing corrosion under certain conditions. In humid or salty air, this oxide layer can break down or become porous, allowing corrosion to penetrate deeper into the material over time. To mitigate these risks, manufacturers often apply surface treatments or coatings, such as anodizing or greasing, to protect the aluminum from environmental exposure. Alternatively, composite conductors like ACSR (Aluminum Conductor Steel Reinforced) or advanced aluminum alloys are used in place of pure aluminum in especially harsh environments. These solutions improve mechanical strength and corrosion resistance but may increase costs. Therefore, careful material selection and environmental assessment are essential when deploying aluminum conductors in regions with high corrosion potential, ensuring both system reliability and longevity.

The global aluminum bare wire conductor market was valued at $11.3 billion in 2024, and is projected to reach $19.1 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034.

The major prominent players operating in the aluminum bare wire conductor market include Prysmian Group, LS Cable & System, Southwire Company, LLC, Nexans S.A., Apar Industries Ltd., MIDAL CABLES COMPANY B.S.C., NKT A/S, Henan Chalco, Classic Wire Products (P) Ltd, and Swarnagiri Wire Insulations Pvt. Ltd.

Asia-Pacific is the largest regional market for aluminum bare wire conductor.

Electronics and Electrical is the leading end-use of aluminum bare wire conductor market.

Increase in demand for overhead power lines are the upcoming trends of aluminum bare wire conductor market.

Loading Table Of Content...

Loading Research Methodology...