Aluminum Fluoride Market Research, 2033

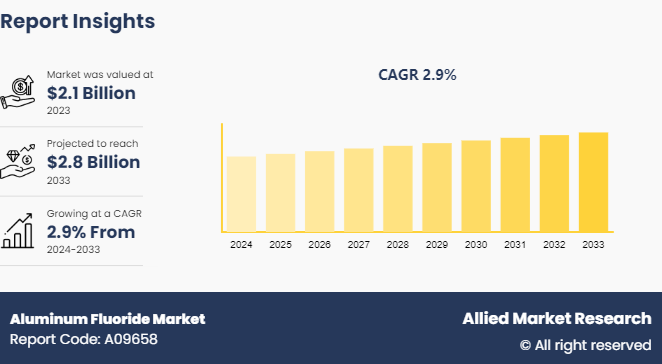

The global aluminum fluoride market was size valued at $2.1 billion in 2023, and is projected to reach $2.8 billion by 2033, growing at a CAGR of 2.9% from 2024 to 2033.

Market Introduction and Definition

Aluminum fluoride (AlF₃) is an inorganic compound that appears as a white or colorless crystalline solid. This substance is primarily known for its utility in various industrial applications, particularly in the production of aluminum. In the aluminum industry, aluminum fluoride plays a crucial role in the electrolytic reduction process of aluminum from alumina (Al₂O₃) . It is added to the electrolytic cell to lower the melting point of alumina, which enhances the efficiency of the electrolysis process. By reducing the operating temperature, aluminum fluoride helps to conserve energy and reduce costs that makes production of aluminum more economical and sustainable.

Moreover, aluminum fluoride is used in the manufacture of ceramics and glass. Its ability to act as a flux helps in lowering the melting points of raw materials, facilitating easier shaping and molding during the manufacturing process. Furthermore, aluminum fluoride is also utilized in the pharmaceutical industry and in the synthesis of various organic compounds, serving as a catalyst and reagent.

Key Takeaways

- The aluminum fluoride market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major aluminum fluoride industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Aluminum fluoride contributes to the production of aluminum alloys that are essential for creating lightweight, durable, and corrosion-resistant structures. The surge in urbanization, especially in emerging economies, has led to a boom in construction activities, ranging from residential housing to large-scale industrial complexes. This has escalated the need for aluminum, thereby boosting the demand for aluminum fluoride. In addition, surge in investments by governments and the private sector in renewable energy infrastructure such as solar and wind power installations drive the the demand for aluminum. Aluminum's favorable properties make it a preferred material in these technologies, thereby increasing the need for aluminum fluoride. All these factors are expected to drive the growth of the aluminum fluoride market during the forecast period.

However, the limited availability of fluorspar poses a significant challenge to the growth of the aluminum fluoride market. Fluorspar is a key raw material used in the production of aluminum fluoride, is facing supply constraints due to various factors such as geological scarcity, mining restrictions, and environmental regulations. These constraints lead to fluctuations in the supply chain, resulting in increased production costs and uncertainties for manufacturers of aluminum fluoride. Furthermore, the environmental concerns associated with fluorspar mining add another layer of complexity. All these factors hamper the growth of the aluminum fluoride market.

Innovations in smelting technology such as the development of more efficient electrolytic cells and the introduction of advanced anode and cathode materials, have significantly improved the efficiency and environmental performance of aluminum production. These technological improvements require enhanced and more precise use of aluminum fluoride to optimize the smelting process. As a result, the demand for high-purity and specialized grades of aluminum fluoride is on the rise and creates new opportunities for manufacturers to cater to these emerging needs. In addition, the push towards automation and digitalization in smelting operations is driving the need for more refined and consistent inputs, including aluminum fluoride. All these factors are anticipated to offer new growth opportunities for the global aluminum fluoride market during the forecast period.

Market Segmentation

The aluminum fluoride market is segmented into type, grade, application, and region. By type, the market is classified into anhydrous, dry, and wet. By grade, the market is bifurcated into industrial and optical. By application, the market is divided into aluminum production, glass manufacturing, ceramics production, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

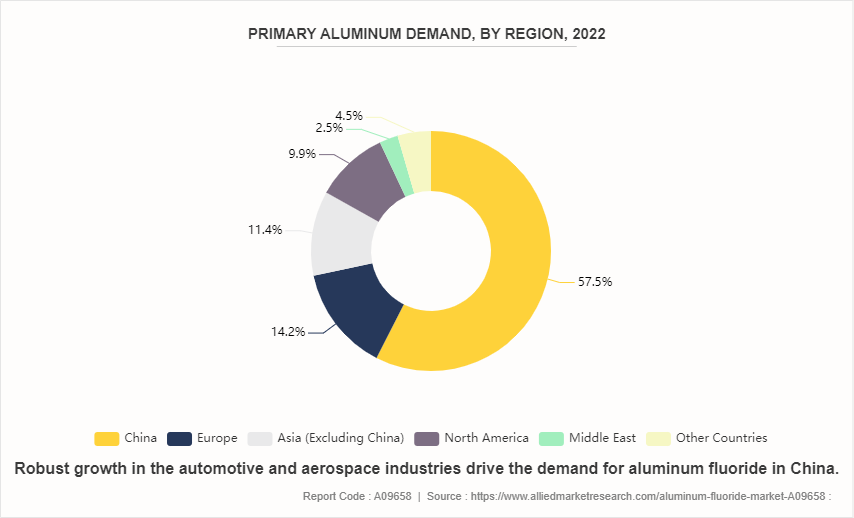

Asia-Pacific region is witnessing a robust growth in the automotive and aerospace industries. Countries such as Japan, South Korea, and China are leading manufacturers of automobiles and aircraft, sectors that require large amounts of aluminum due to its lightweight and strength properties. Aluminum fluoride is essential in the production of high-quality aluminum alloys used in these industries. The expansion of these industries not only boosts the demand for aluminum but also increases the need for aluminum fluoride to ensure efficient and cost-effective aluminum production. Moreover, the Asia-Pacific region is the largest aluminum producers in the world, with China being the most prominent player. The expansion of aluminum production capacities in the region directly influences the demand for aluminum fluoride. The competitive nature of the aluminum industry in Asia-Pacific, coupled with the continuous advancements in smelting technologies, necessitates a steady and reliable supply of aluminum fluoride to maintain production efficiency and quality.

- The push for renewable energy sources such as solar power has led to increased investment in industries such as solar panels. Aluminum fluoride is used in the production of primary aluminum, which is a key component in solar panels, indicating potential growth in this segment.

- According to the Invest India, India stands 4th globally in renewable energy installed capacity (including Large Hydro) , 4th in wind power capacity, and 5th in solar power capacity. The country set an enhanced target at COP26 of 500 GW of non-fossil fuel-based energy by 2030. As of 2024, renewable energy sources including large hydropower, have a combined installed capacity of 191.67 GW.

- The rapid industrialization and urbanization in countries such as China and India have been driving the demand for various industrial chemicals, including aluminum fluoride. As industries expand, the need for aluminum fluoride as a crucial input in aluminum production also rises.

Competitive Landscape

The major players operating in the aluminum fluoride market include Do-Fluoride Chemicals Co., Ltd., Fluorsid. Industries Chimiques du Fluor, Tanfac Industries Ltd., Alufluoride Limited, Mexichem Fluor S.A de C.V., Gulf Fluor, AB LIFOSA, Alufluor, and Henan Weilai Aluminum (Group) Co., Ltd.

World Production of Primary Aluminum in 2022

China dominates the global aluminum production at 58.30%, it significantly influences the regional demand for raw materials such as aluminum fluoride. This led to higher demand concentrations in regions supplying aluminum fluoride to China's aluminum smelting industry. Countries with substantial aluminum production, such as India, and Russia, are likely to have a higher demand for aluminum fluoride to support their smelting operations. Consequently, the aluminum fluoride market experience fluctuations based on the production trends in these key countries. Moreover, countries such as Canada, the UAE, and Bahrain, which produce significant amounts of aluminum but relatively smaller quantities of aluminum fluoride and rely on imports to meet their aluminum fluoride requirements.

Production of Primary Aluminum, By Country

Sr. No. | Country | Production (Thousand Tons) | % |

1 | China | 40,000 | 58.30% |

2 | India | 4,000 | 5.80% |

3 | Russia | 3,700 | 5.40% |

4 | Canada | 3,000 | 4.40% |

5 | UAE | 2,700 | 3.90% |

6 | Bahrain | 1,600 | 2.30% |

7 | Australia | 1,500 | 2.20% |

8 | Norway | 1,400 | 2.00% |

9 | U.S. | 860 | 1.30% |

10 | Iceland | 750 | 1.10% |

11 | Other countries | 9,100 | 13.30% |

Industry Trends

- Technological advancements in the production processes of aluminum fluoride could lead to improved efficiency, reduced costs, and lower environmental impact. R&D efforts focus on developing innovative production methods or improving existing ones.

- The primary application of aluminum fluoride is in the aluminum production process, where it acts as a flux. As the demand for aluminum continues to grow in various industries such as automotive, aerospace, and construction, the demand for aluminum fluoride is also expected to rise.

- Surge in adoption of lightweight materials is a dominant trend across industries such as automotive, aerospace, and transportation. Aluminum is favored for its high strength-to-weight ratio that makes it essential for reducing vehicle weight, improving fuel efficiency, and enhancing performance. Demand for lightweight materials such as aluminum alloy is expected to rise during the forecast period as regulations on emissions and fuel economy become stricter.

- According to the Internation Energy Agency (IEA) , electric car sales in 2023 was 3.5 million higher than in 2022, a 35% year-on-year increase. This is more than six times higher than in 2018. In 2023, there were over 250, 000 new registrations per week, which is more than the annual total in 2013.

Key Sources Referred

- International Trade Administration

- Asian Development Bank

- Invest India

- U.S. Department of Energy

- Internation Energy Agency (IEA)

- The Aluminum Association

- International Aluminum Institute

- European Aluminum

- Aluminum Association of India

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum fluoride market analysis from 2024 to 2033 to identify the prevailing aluminum fluoride market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum fluoride market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum fluoride market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Fluoride Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.8 Billion |

| Growth Rate | CAGR of 2.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 440 |

| By Grade |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Henan Weilai Aluminum (Group) Co., Ltd, Do-Fluoride Chemicals Co.,Ltd., Industries Chimiques du Fluor, AB LIFOSA, Alufluoride Limited, Tanfac Industries Ltd., Fluorsid, Mexichem Fluor S.A de C.V., Gulf Fluor, Alufluor |

The global aluminum fluoride market was valued at $2.1 billion in 2023, and is projected to reach $2.8 billion by 2033, growing at a CAGR of 2.9% from 2024 to 2033.

Asia-Pacific is the largest regional market for Aluminum Fluoride.

Aluminum production is the leading application of Aluminum Fluoride Market.

Technological advancements in aluminum smelting is the upcoming trends of Aluminum Fluoride Market in the globe.

The major players operating in the aluminum fluoride market include Do-Fluoride Chemicals Co., Ltd., Fluorsid. Industries Chimiques du Fluor, Tanfac Industries Ltd., Alufluoride Limited, Mexichem Fluor S.A de C.V., Gulf Fluor, AB LIFOSA, Alufluor, and Henan Weilai Aluminum (Group) Co., Ltd.

Loading Table Of Content...