Aluminum Wire Market Research, 2033

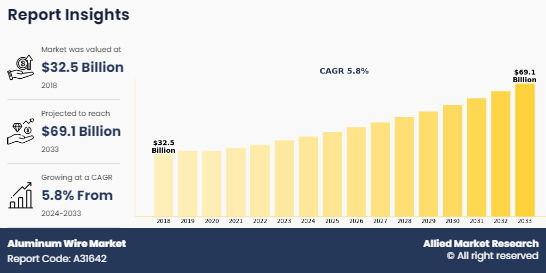

The global aluminum wire market was valued at $32.5 billion in 2018, and is projected to reach $69.1 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Introduction

Aluminum wire is a type of electrical conductor made primarily from aluminum metal, which is known for its lightweight and high conductivity properties. It is widely used in various applications such as electrical power transmission and distribution, residential wiring, and industrial installations. It is typically favored for overhead power lines due to its lower weight compared to copper, allowing for easier handling and installation. Aluminum wire, with its favorable properties such as lightweight, corrosion resistance, and excellent conductivity, has emerged as a preferred choice for various electrical applications. This trend is particularly evident in sectors such as renewable energy, where aluminum wire is extensively used in solar photovoltaic systems and wind energy installations. The transition to cleaner energy sources necessitates robust electrical connections that efficiently transmit power from generation sites to consumers. Moreover, industries and global economies shift towards electrification and digitalization increase the requirement for reliable electrical wiring. All these factors are expected to drive the growth of the aluminum wire market during the forecast period.

Key Takeaways

- More than 4,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and aluminum wire market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Aluminum wire market news and key industry trends are also included in the report.

- Production of aluminum wire, consumption of aluminum, breakdown of the cable market size by material, and gross profit margin by type are also covered in the report.

Market Dynamics

Aluminum wire, known for its excellent conductivity, lightweight properties, and lower cost compared to copper, has become a popular choice in various electrical applications, such as wiring for power grids, transformers, and electrical installations in residential, commercial, and industrial sectors. There is a greater need for cost-effective and efficient materials for power transmission and distribution as electrical infrastructure expands, particularly in developing regions. All these factors are expected to drive the demand for the aluminum wire during the forecast period. In addition, the global push for renewable energy sources such as solar and wind power drive the demand for aluminum wire. Renewable energy systems require extensive wiring to connect power generation sites to storage systems and grids. Aluminum wire is favored in these applications due to its resistance to corrosion, durability, and ability to handle high voltage loads.

Aluminum wire plays a pivotal role in ensuring efficient and cost-effective energy transmission as countries work to modernize their grids and integrate more renewable energy. Moreover, the rise in electric vehicles (EVs) and the accompanying need for charging infrastructure is another factor contributing to the increased use of aluminum wire. EV charging stations and electrical systems in vehicles rely heavily on efficient and lightweight materials. Aluminum wire meets these requirements that makes it an ideal choice for manufacturers looking to reduce vehicle weight and improve energy efficiency. Thus, the growing focus on sustainable energy solutions and the rapid electrification of transportation systems are expected to sustain the rise in demand for aluminum wire during the forecast period

However, the growth of the aluminum wire market faces significant challenges due to the increase in availability and preference for highconductivity alternatives, particularly copper. Copper's superior electrical conductivity, which is approximately 60% greater than that of aluminum, makes it the material of choice for many applications where efficiency is important. The demand for highly efficient and reliable electrical systems drives many manufacturers and contractors to prefer copper over aluminum in sectors such as residential wiring, telecommunications, and industrial applications. This shift in preference inhibits the growth of aluminum wire as users seek the best possible performance from their electrical systems. All these factors hamper the aluminum wire market growth.

Smart grids integrate digital communication technology with traditional electrical infrastructure to improve the monitoring, control, and management of electricity flow. Aluminum wire provides an effective solution due to its lightweight and flexibility, allowing for easier installation and maintenance as these systems require extensive wiring for sensors, communication devices, and data management. The surge in emphasis on enhancing grid reliability and resilience, especially in the face of climate change and increasing natural disasters, positions aluminum wire as a critical component in modern electrical transmission and distribution networks. All these factors are anticipated to offer new growth opportunities for the aluminum wire market during the forecast period.

Segments Overview

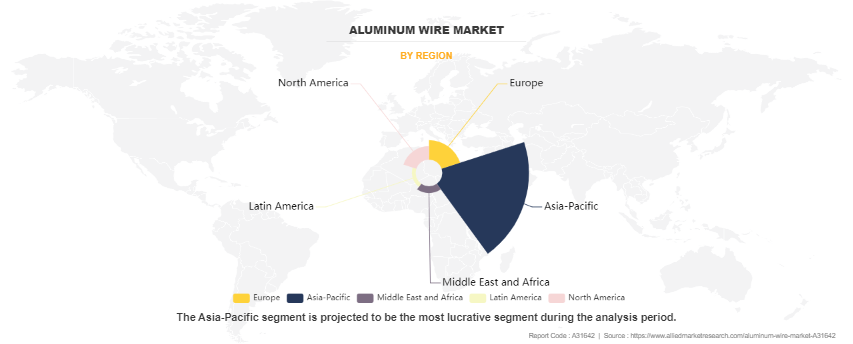

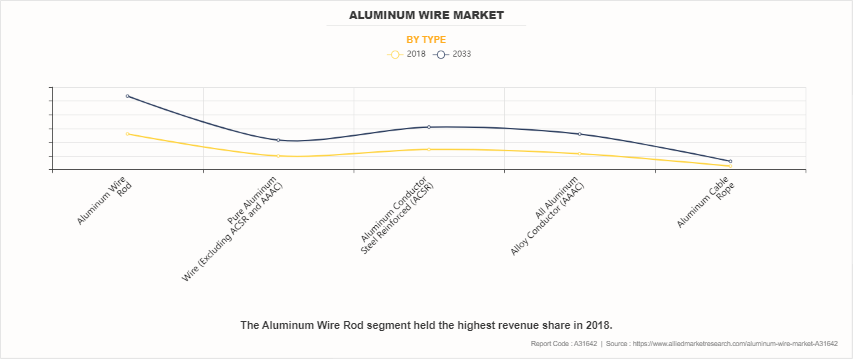

The aluminum wire market is segmented into type, and region. On the basis of type, the market is classified into aluminum wire rod, pure aluminum wire, aluminum conductor steel reinforced (ACSR), all aluminum alloy conductor (AAAC), and aluminum cable rope. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. On the basis of type, the market is classified into aluminum wire rod, pure aluminum wire, aluminum conductor steel reinforced (ACSR), all aluminum alloy conductor (AAAC), and aluminum cable rope. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

Aluminum wire is commonly used in solar photovoltaic (PV) systems and wind turbines due to its excellent electrical properties and resistance to corrosion. The demand for aluminum wire is expected to rise substantially as governments in the Asia-Pacific region implement supportive policies and incentives for renewable energy development. This is complemented by increasing investments in infrastructure and urbanization, leading to higher requirements for electrical wiring in construction and industrial applications. Moreover, increase in demand for lightweight materials in various industries, particularly in automotive and aerospace sectors drive the demand for the aluminum wire. Aluminum wire, known for its low weight and high conductivity, becomes a preferable alternative to traditional copper wire as manufacturers strive to improve fuel efficiency and reduce emissions. Moreover, advancements in technology and manufacturing processes are enhancing the performance characteristics of aluminum wire. Innovations such as improved alloy compositions and production techniques have led to wires with higher tensile strength and conductivity that makes them suitable for more demanding applications. This technological progress boosts the attractiveness of aluminum wire and encourages its adoption across various sectors, including telecommunications, where lightweight and efficient wiring solutions are essential for modern communication networks. All these factors are anticipated to offer new growth opportunities for the aluminum wire market in Asia-Pacific

Aluminum wire rods are used extensively in electrical transmission and distribution lines that offer a lighter alternative to copper with lower costs that makes them a favorable choice in the energy sector. There is an increase in the need for efficient, high-performance materials, such as aluminum wire rods, as nations upgrade their electrical grids to support growing populations and industries. Moreover, the increased focus on energy-efficient and eco-friendly materials has led manufacturers to choose aluminum over other materials, as it is highly recyclable and contributes to lower carbon footprints. The automobile industry also plays a significant role, as lightweight aluminum wire rods are increasingly utilized in electric vehicles (EVs) and automotive wiring systems to enhance fuel efficiency and meet stringent emission regulations. All these factors are anticipated to offer new growth opportunities for aluminum wire rod segment in the global aluminum wire market

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum wire market analysis from 2018 to 2033 to identify the prevailing aluminum wire market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum wire market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum wire market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Wire Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 69.1 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2018 - 2033 |

| Report Pages | 771 |

| By Type |

|

| By Region |

|

| Key Market Players | TT Cables, SouthWire, Heraeus Electronics, Totoku Electric Co. Ltd., Sumitomo Electric, Arfin India Limited, Novametal Group, MWS Wire Industries, Inc., Kobe Steel Ltd., TRIMET Aluminium SE |

Analyst Review

According to the opinions of various CXOs of leading companies, the aluminum wire market is expected to witness an increase in demand during the forecast period. Increase in demand for aluminum wire in electrical applications and expansion of infrastructure projects are expected to surge the demand for aluminum wires during the forecast period. Aluminum wire, known for its excellent conductivity and lightweight properties, is becoming a preferred choice in various electrical applications such as residential, commercial, and industrial settings. Its capability to transport substantial electrical loads over long distances with minimal energy loss makes it particularly suitable for power distribution networks, which are vital for meeting the growing energy demands of modern society.

Moreover, the ongoing expansion of infrastructure projects globally drives the demand for aluminum wires. Governments and private sectors are making significant investments in modernizing existing infrastructure and developing new projects, including transportation systems, telecommunications networks, and renewable energy installations. These initiatives require substantial amounts of wiring, and aluminum wire is increasingly recognized for its cost-effectiveness and performance advantages. The global shift towards sustainable energy sources, such as solar and wind increase the need for reliable electrical connections to integrate these technologies into the existing grid that amplifies the demand for aluminum wire

Aluminum wire rod is the leading type of Aluminum Wire Market.

Asia-Pacific is the largest regional market for Aluminum Wire.

Rapid urbanization, especially in developing countries, is increasing the demand for electricity, leading to investments in transmission and distribution networks. Aluminum wire’s cost advantages make it a preferred option for these large-scale infrastructure projects.

The aluminum wire market was valued at $32.5 billion in 2018, and is estimated to reach $69.1 billion by 2033, growing at a CAGR of 5.8% from 2024 to 2033.

Advancements in electrical transmission and distribution technologies create new opportunities for aluminum wire, particularly as energy systems evolve to meet growing demands for efficiency and sustainability.

Loading Table Of Content...

Loading Research Methodology...