Aluminum Wire Rod Market Research, 2034

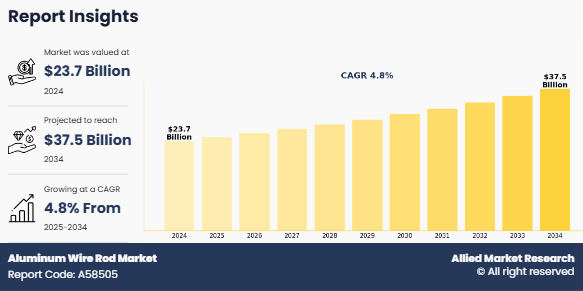

The global aluminum wire rod market size was valued at $23.7 billion in 2024, and is projected to reach $37.5 billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.

Key Takeaways:

- Quantitative information mentioned in the global aluminum wire rod industry includes the market numbers in terms of value ($billion) and volume (kilotons) concerning different segments, annual growth rate, CAGR (2025-34), and growth analysis.

- The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the country, and value chain analysis.

- A few companies, including Hindalco Industries Ltd., Norsk Hydro ASA, Sumitomo Electric Industries, Bahra Electric, MIDAL CABLES COMPANY B.S.C., Arfin India Limited, Nalco India Limited, Sakar Industries Limited, Vedanta Limited, and Palriwal Industries Pvt. Ltd. hold a large proportion of the Global aluminum wire rods market.

- This report makes it easier for existing market players and new entrants to the global aluminum wire rod market share to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Introduction

Aluminum wire rod is a semi-finished product made from aluminum and its alloys, typically produced through continuous casting and rolling processes. It serves as a critical input for manufacturing electrical conductors, cables, and wires used in power transmission and distribution. Its excellent conductivity, lightweight nature, corrosion resistance, and recyclability make it a preferred material in the electrical, automotive, and construction industries. Increasing urbanization, electrification, and renewable energy projects globally are driving demand for aluminum wire rods. Additionally, the shift toward lightweighting in vehicles and rising investments in smart grid infrastructure further support market growth for aluminum wire rods.

Market Dynamics

The aluminum wire rod market growth is driven by the rapid expansion of the power transmission and distribution (T&D) infrastructure, growing demand for lightweight and high-conductivity materials in the automotive sector, and the global push for electrification. As nations invest heavily in upgrading aging power grids and expanding renewable energy connections, there is a surging requirement for overhead conductors such as All-Aluminum Conductor (AAC), All-Aluminum Alloy Conductor (AAAC), and Aluminum Conductor Steel-Reinforced (ACSR), which are produced using aluminum wire rods. Emerging economies, especially in Asia and Africa, are witnessing substantial grid expansions to meet rising electricity consumption, making aluminum wire rods a critical component. Additionally, in the automotive sector, especially with the growth of electric vehicles (EVs), manufacturers are increasingly replacing traditional copper wiring with aluminum to reduce vehicle weight and improve energy efficiency, further boosting demand. The use of aluminum in vehicle electrical systems, battery cables, and charging infrastructure is becoming more prevalent due to its cost-effectiveness and favorable strength-to-weight ratio.

Moreover, aluminum wire rods are used extensively in building wiring, appliance manufacturing, and welding applications, and with the global trend of urbanization and industrial development, these downstream sectors are seeing significant growth. The continuous casting and rolling (CCR) method also enhances production efficiency, allowing for better surface finish and uniform properties, which supports large-scale industrial demand. Governments and regulatory bodies promoting energy-efficient and sustainable materials are also indirectly driving the aluminum wire rod market by encouraging the substitution of copper with aluminum in multiple end-use applications. For instance, aluminum’s abundance and recyclability make it a more environmentally sustainable option, aligning with global carbon neutrality goals.

However, the market faces several restraints that could hinder its growth trajectory. One of the major challenges is the volatility in aluminum prices, which are subject to global supply-demand dynamics, geopolitical factors, and energy costs associated with smelting. This price instability affects procurement planning and can reduce profitability for manufacturers and cable producers. Additionally, in applications where higher conductivity and resistance to oxidation are crucial, such as in marine or aerospace environments, aluminum wire rods face stiff competition from copper-based products. Technical limitations such as lower tensile strength compared to copper, susceptibility to corrosion in certain environments, and challenges related to long-distance transmission efficiency also restrain wider adoption in some regions.

Despite these challenges, the market presents several promising opportunities. One significant opportunity lies in the shift toward renewable energy and smart grids, where aluminum conductors are essential for establishing cost-effective and efficient T&D networks. Government-funded infrastructure projects and rural electrification programs in countries like India, Indonesia, Brazil, and several African nations are creating new avenues for market expansion. Furthermore, the increased focus on electric mobility and charging infrastructure development globally opens up a lucrative growth path for aluminum wire rods in the automotive and EV charging sectors. The transition toward 5G, smart cities, and high-speed rail projects also contributes to demand for high-quality wiring and cabling solutions, thus providing a favorable outlook for the aluminum wire rod market over the next decade.

Segment Overview

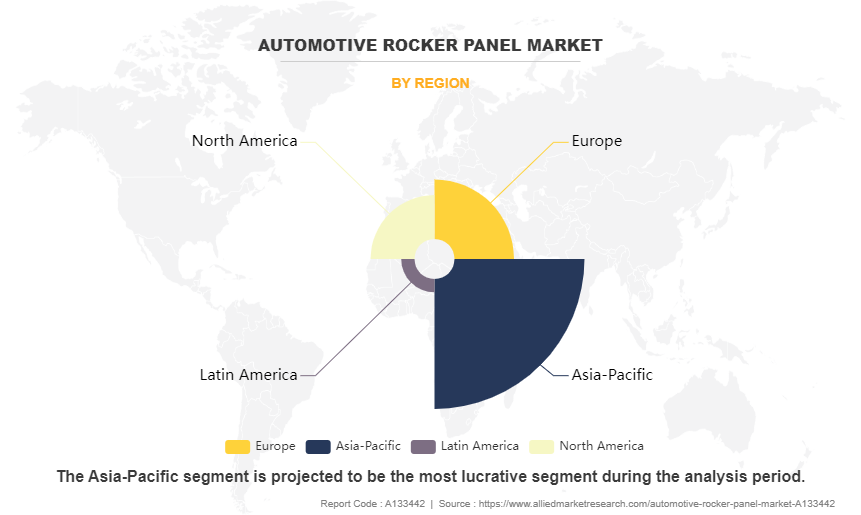

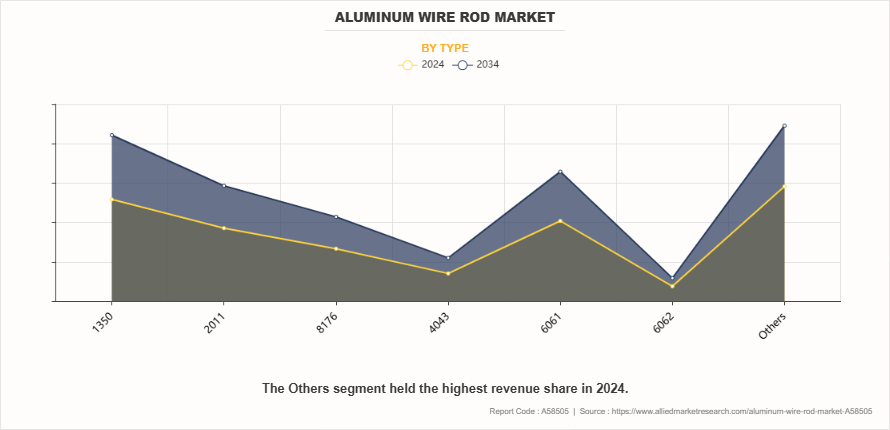

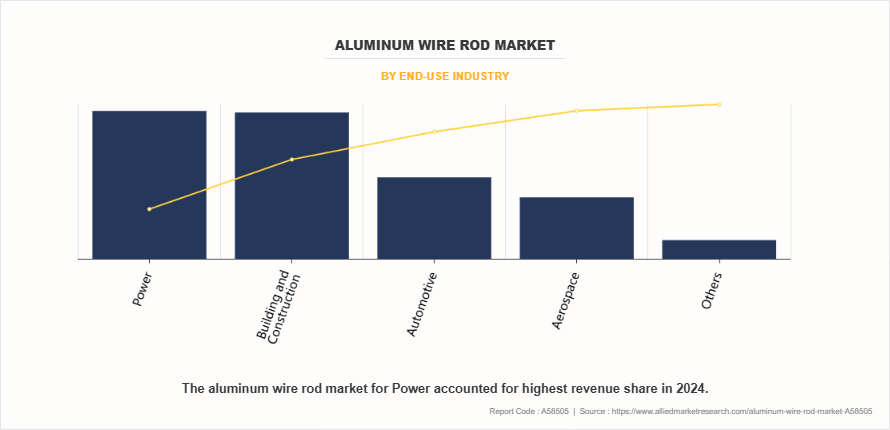

The aluminum wire rod market is segmented on the basis of type and end-use industry. On the basis of type, the market is categorized into 1350, 2011, 8176, 4043, 6061, 6062, and others. On the basis of end-use industry, the market is categorized into aerospace, automotive, building and construction, power, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The Asia-Pacific segment is projected to be the most lucrative segment during the analysis period. The Asia-Pacific aluminum wire rod market is witnessing strong growth, fueled by rapid urbanization, industrial development, and increasing investments in infrastructure and renewable energy across the region. Countries like China and India are at the forefront, driven by initiatives to modernize power transmission networks, expand rural electrification, and support the integration of renewable energy sources such as solar and wind. The electrical sector continues to be the dominant application area, with aluminum wire rods widely used in manufacturing conductors for power distribution and transmission lines. Additionally, the rising adoption of electric vehicles and the push for lightweight, energy-efficient automotive components are accelerating demand from the automotive industry. Government policies promoting clean energy, smart grids, and green mobility further support market expansion. However, the sector faces headwinds from raw material price fluctuations and competition with copper in certain high-performance applications. Despite these challenges, the Asia-Pacific region remains a key growth engine for the global aluminum wire rod market, with sustained momentum expected due to ongoing industrial and energy sector transformation.

The Others segment held the highest revenue share in 2024. The others segment includes aluminum‐¯wire rods such as 6061, 6063, 7075, 2024, 5052, 5083, 1100, and others. 6061 aluminum wire rod is a popular aluminum alloy with excellent strength and good corrosion resistance. It is often used in applications where moderate strength and workability are required, such as aerospace and automotive components. 6063 aluminum wire rod is known for its extrudability, making it suitable for applications such as architectural and structural extrusions, as well as automotive trim components.

7075 is a high-strength aluminum alloy often used in aerospace and military applications due to its exceptional strength-to-weight ratio. It is commonly found in aircraft structural components. 2024 is another high-strength aluminum alloy used in aerospace and structural applications. It is valued for its fatigue resistance and is often found in aircraft components. 5052 aluminum wire rod offers good corrosion resistance and is used in applications such as marine and automotive parts. In addition, 5083 aluminum wire rod is known for its excellent corrosion resistance and is commonly used in marine and underwater applications.

Power segment accounted for highest revenue share in 2024. Aluminum wire rods are widely utilized in the power sector, mainly for producing conductors used in overhead transmission and distribution lines. Demand of aluminum wire rod is driven by key attributes such as lightweight, high corrosion resistance, and superior electrical conductivity. These properties make aluminum wire rods well suited for long-distance power transmission, offering both efficiency and durability in various environmental conditions.

Competitive Analysis

Key players in the aluminum wire rod industry include Hindalco Industries Ltd., Norsk Hydro ASA, Sumitomo Electric Industries, Bahra Electric, MIDAL CABLES COMPANY B.S.C., Arfin India Limited, Nalco India Limited, Sakar Industries Limited, Vedanta Limited, and Palriwal Industries Pvt. Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aluminum wire rod market analysis from 2024 to 2034 to identify the prevailing aluminum wire rod market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aluminum wire rod market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aluminum wire rod market trends, key players, market segments, application areas, and market growth strategies.

Aluminum Wire Rod Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 37.5 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Type |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | MIDAL CABLES COMPANY B.S.C., Bahra Electric, Nalco India Limited, Palriwal Industries Pvt. Ltd., Arfin India Limited, Sumitomo Electric Industries, Vedanta Limited, Norsk Hydro ASA, Hindalco Industries Ltd., Sakar Industries Limited |

Analyst Review

According to the opinions of various CXOs of leading companies, the aluminum wire rod market is expected to witness an increase in demand during the forecast period. The key driver of the aluminum wire rod market is the increasing emphasis on renewable energy integration, particularly solar and wind power, which requires extensive use of aluminum conductors for transmission infrastructure. As countries transition toward cleaner energy sources, there is a growing need for cost-effective and lightweight transmission solutions that can span long distances—from remote solar farms or offshore wind installations to consumption centers. Aluminum wire rods, due to their lower weight and cost compared to copper, are the preferred material for manufacturing these conductors. Additionally, the rise in smart grid development, which demands high-performance cabling for monitoring and control systems, is also driving demand. The proliferation of data centers, electrified railways, and modern infrastructure requiring efficient electrical distribution networks further fuels the growth of the aluminum wire rod market.

The key driver of the aluminum wire rod market is the growing preference for aluminum in green building technologies and energy-efficient electrical systems.

A few companies, including Evonik Industries AG, Hexcel Corporation, Teijin Limited, DuPont, Mitsubishi Chemical Advanced Materials Inc, Solvay, SGL Carbon, Toray Industries, Inc., Copps Industries Inc, and Sumitomo Bakelite Co., Ltd. hold a large proportion of the Global aluminum wire rods market.

The aluminum wire rod market was valued at $23.7 billion in 2024, and is estimated to reach $37.5 billion by 2034, growing at a CAGR of 4.8% from 2025 to 2034.

Power is the leading application of Aluminum Wire Rod Market.

Asia-Pacific is the largest regional market for Aluminum Wire Rod.

Loading Table Of Content...

Loading Research Methodology...