Ambulatory X-Ray Devices Market Research, 2031

The global ambulatory x-ray devices market was valued at $1.7 billion in 2021, and is projected to reach $2.4 billion by 2031, growing at a CAGR of 3.6% from 2022 to 2031. X-ray devices are the medical systems that are used for imaging of internal organs in humans and animals. X-ray devices generally consist of power source, an X-ray tube, an imaging platform, and several other optional components such as automatic exposure control, dose area product, collimator, workstation, electronic mechanic control systems and others. The devices emit electromagnetic radiations, having wavelength ranging from 10 picometres to 10 nanometers, which travel through the body and are absorbed in different amounts by different tissues, depending on the radiological density of the tissues they pass through. These images assist the healthcare provider and the radiologist to determine any abnormalities associated with internal organs. X-ray radiography helps in detection of bone fractures, certain tumors and other abnormal masses, pneumonia, various types of injuries, calcifications, foreign objects, or dental problems.

Historical overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The ambulatory X-ray devices market grew at a CAGR of around 3.6% from 2022 to 2031. Most of the growth during this period was derived from the Asia-Pacific owing to the improvement of health awareness, rise in disposable incomes, as well as well-established presence of domestic companies in the region.

Market dynamics

Major factors driving the growth of the ambulatory X-ray devices market are the increase in prevalence of chronic condition, increase in adoption of X-ray imaging for diagnosis of various diseases, increase in demand for portable X-ray devices and rise in technological advances in the field of X-ray imaging. There is an increase in demand for X-ray devices in the healthcare sector, due to the increase in X-ray imaging for diagnosis of chronic conditions in the population around the globe. Also, increase in prevalence of chronic conditions is also boosting the growth of the market. For instance, according to U.S. Department of Health & Human Services, by 2040, an estimated 78 million (26%) U.S. adults aged 18 years or older are projected to have doctor-diagnosed arthritis, which is one of the most common health issues in the U.S. There are many causes of arthritis, such as injury, inheritance, abnormal metabolism, and others and X-ray imaging is the most common way to diagnose arthritis. Arthritis can be easily detected on the image through X-ray, and the doctors often use this method to confirm it. Thus, increase in prevalence of arthritis and other orthopedic conditions increases the demand for X-ray imaging, which propels the growth of the ambulatory X-ray devices market.

In addition, increase in prevalence of other chronic conditions such as cancer, cardiovascular diseases, and dental conditions is anticipated to drive the growth of the market. Furthermore, the growth of the ambulatory X-ray devices market is expected to be driven by high potential in untapped, emerging markets, due to availability of improving healthcare infrastructure, increase in unmet healthcare needs, rise in prevalence of chronic diseases, and surge in demand for X-ray imaging devices. The healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the medical tourism industry in emerging countries.

Moreover, increase in demand for X-ray devices in developed countries as well as developing countries, such as China, Brazil, and India, fuel the growth of the market. Furthermore, rise in consumer awareness related to early detection of chronic conditions and awareness about technological advancements in the field of X-ray imaging is anticipated to boost the market growth.

Although various factors drive the growth of the ambulatory X-ray devices market, minor complications associated with the X-ray imaging is expected to provide hindrance to the growth of the market. Ingestion of a contrast material before X-ray may cause side effects such as hives, itching, nausea, lightheadedness and a metallic taste in mouth. Moreover, in some cases it might lead to severe reaction, such as anaphylactic shock, very low blood pressure, or cardiac arrest. Thus, these factors limit the growth of the ambulatory X-ray devices market. On the other hand, increase in investment by the key market players in developing regions and technological advances in X-ray devices is anticipated to provide ambulatory X-Ray devices market opportunity .

The COVID-19 outbreak had a positive impact on growth of the global ambulatory X-ray device market. COVID-19 pandemic was one of the biggest challenges for the healthcare system which is associated with respiratory disease and can affect and cause lasting damage to the lungs leading to symptoms such as difficulty in breathing and in some cases pneumonia and respiratory failure. As X-rays is used to detect conditions associated with lungs, this led to the rise in adoption of X-ray imaging for diagnosis of corona virus infection.

In addition, the pandemic has also imperiled the awareness drives regarding diagnosis and treatment of COVID-19, which also boosted the market. Furthermore, the government funding and drives regarding diagnosis and treatment of COVID-19, led to the increase in number of diagnoses of the corona virus infection. This boosts the ambulatory X-ray devices market growth.

Segmental Overview

The ambulatory X-ray devices market is segmented into type, application, end user and region. By type, the market is categorized into standalone and mobile. By application, the market is segmented into orthopedic, cancer, cardiovascular and other applications (dental, respiratory). By end user, the market is classified into hospitals, ambulatory surgical centers and others (clinics, urgent care centers). Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

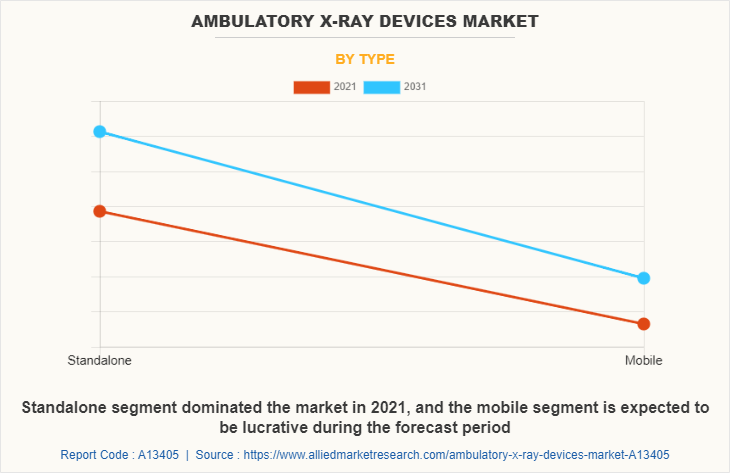

By type

The standalone segment dominated the ambulatory X-Ray devices market size in 2021, owing to the increase in prevalence of chronic conditions and subsequent increase in X-ray imaging for diagnosis of diseases. The mobile segment is expected to grow at the fastest rate during the forecast period, owing to increase in adoption of mobile X-ray devices in the hospitals and other diagnostic centers. The adoption of these mobile devices is attributed to the advantages offered by these mobile devices such as greater mobility and portability, better speed, safer operation, cost effectiveness, no special installation process, flexibility of operation and improved patient care quality.

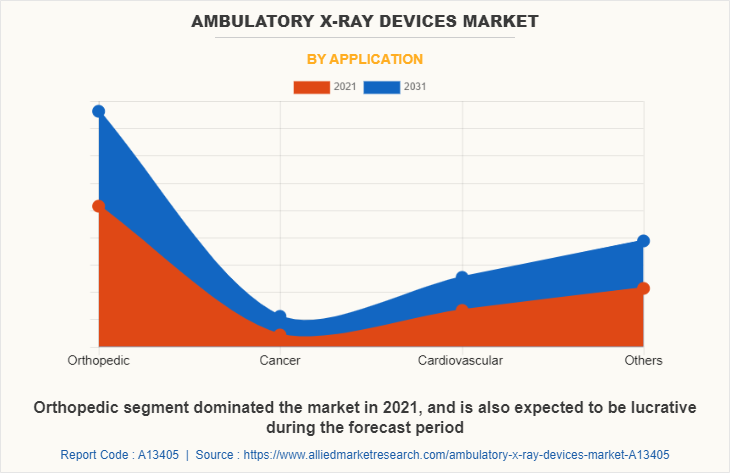

By application

The orthopedics segment dominated the ambulatory X-Ray devices market size in 2021, and is anticipated to grow at the fastest rate during the forecast period due to the increase in prevalence of orthopedic conditions and technological advances in X-ray devices for diagnosis of orthopedic conditions.

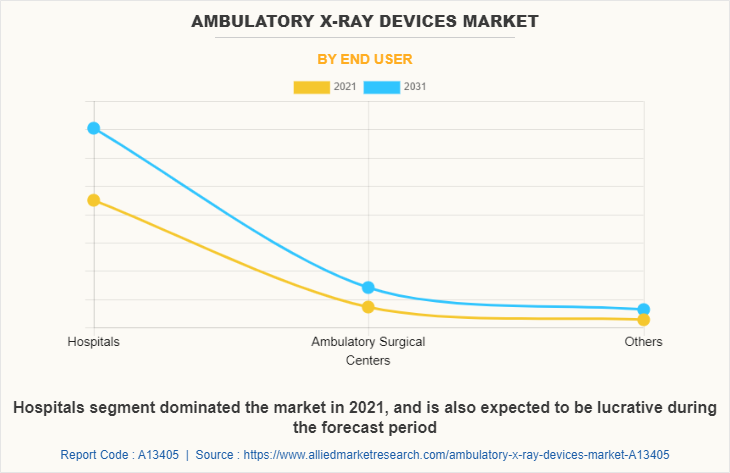

By end user

The hospitals segment held the largest ambulatory X-Ray devices market share in 2021, and is expected to grow at the fastest rate during the forecast period owing to the increase in number of outpatient care department in hospitals which also offers X-ray imaging services.

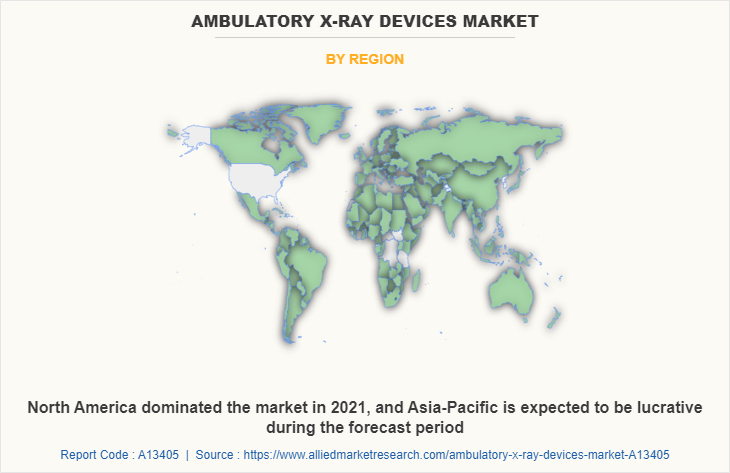

By region

The ambulatory X-ray devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major ambulatory X-Ray devices market share in 2021, and is expected to maintain its dominance during the forecast period.

Presence of several major players offering X-ray devices in North America region, such as GE Healthcare, Koninklijke Philips NV, Fujifilm Holdings Corporation, Siemens Healthineers and advancement in manufacturing technology of X-ray devices in the region drives the growth of the market. In addition, increase in gеrіаtrÑ–Ñ Ñ€Ð¾Ñ€ulаtіоn, along with increase in orthopedic, dental and cancer conditions is driving the market of ambulatory X-ray devices. Furthermore, presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of X-ray devices for diagnosis of various conditions are driving the market growth. Furthermore, product launch, mergers, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market.

Asia-Pacific expected to grow at the highest rate during the ambulatory X-Ray devices market forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the increasing purchasing power of populated countries, such as China and India. Furthermore, the Asia-Pacific region exhibits the largest medicine and medical devices supply and the largest pharmaceuticals industry with availability of raw material in abundance, which can be easily accessed by manufacturers of X-ray devices. This, in turn, drives the growth of the market. Asia-Pacific offers profitable opportunities for key players operating in the ambulatory X-ray devices market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rising disposable incomes, as well as well-established presence of domestic companies in the region.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the ambulatory X-ray devices, such as Amrad Medical Equipments, Canon Inc., Carestream Health Inc., FUJIFILM Corporation, General Electric Company, Koninklijke Philips N.V., Oehm und Rehbein GmbH, Siemens AG, Shimadzu Corporation, Source-Ray, Inc are provided in this report. There are some important players in the market such as Toshiba Corporation, Hitachi Medical Corporation and others. Major players have adopted product launch, product approval, partnership, acquisition and others as key developmental strategies to improve the product portfolio of the ambulatory X-ray devices market.

Some examples of product launches in the market

In June 2021, Oehm und Rehbein GmbH announced the launch of Amadeo R motorized, expanding its product range for the inpatient sector in human medicine. The digital X-ray system with auto-tracking function is suitable for all X-ray exposures in sitting, lying and standing positions.

In July 2022, Shimadzu Corporation announced the launch of the new MobileDaRt Evolution MX8 Version v type, a digital mobile X-ray system outside Japan.

In November 2020, Canon Inc. announced the launch of OMNERA 500A Digital Radiography System, which offers heightened productivity for fast-paced imaging departments thereby offering optimal productivity and patient care.

In August 2020, Canon Inc. announced the launch of SOLTUS 500, a mobile digital X-ray system to enhance workflow and productivity of imaging.

In November 2021, Carestream Health announced the launch of CARESTREAM DRX-Revolution Nano Mobile X-ray System, which effectively and noninvasively examines and aids in the treatment of pediatric patients.

In August 2020, Carestream Health announced the launch of DRX-Compass X-ray System for mid-tier hospitals and medical imaging centers worldwide which offers a flexible and scalable approach to digital imaging increasing workflow efficiency and reducing costs.

In March 2021, FUJIFILM Corporation announced the launch of PORTABLE X-RAY UNIT FDR Xair XD2000 that can be used in case of limited space and resources, providing quick and easy access to diagnostic imaging.

Acquisitions in the market

In July 2022, Canon Inc. announced the acquisition of NXC Imaging, a medical imaging equipment distributor and service provider headquartered in Minneapolis, Minnesota.

In March 2022, Canon Inc. announced the acquisition of Danish medical equipment manufacturer Nordisk Rontgen Teknik A/S to strengthen its global X-ray business with advanced technology for the development and manufacture of diagnostic X-ray systems.

Product Approval

In September 2019, GE Healthcare announced the Food and Drug Administration's 510(k) approval of Critical Care Suite, which is an industry-first collection of artificial intelligence (AI) algorithms included in a mobile X-ray device.

Partnership

In May 2019, Philips announced a partnership with Rutherford Diagnostics to utilize innovative technology to increase access to diagnostic services with five new community sites across England.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ambulatory x-ray devices market analysis from 2021 to 2031 to identify the prevailing ambulatory x-ray devices industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ambulatory x-ray devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ambulatory x-ray devices industry trends, key players, market segments, application areas, and market growth strategies.

Ambulatory X-Ray Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.4 billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 254 |

| By Type |

|

| By Application |

|

| By End user |

|

| By Region |

|

| Key Market Players | Canon Inc., Oehm und Rehbein GmbH, Carestream Health, Inc, General Electric Company, FUJIFILM Corporation, Koninklijke Philips N.V., Siemens AG, Source-Ray, Inc., Shimadzu Corporation, Amrad Medical Equipments |

Analyst Review

This section provides various opinions of top-level CXOs in the global ambulatory X-ray devices market. According to the insights of CXOs, the increase in demand for advanced diagnostic procedures such as X-ray imaging for chronic disorders is expected to offer profitable opportunities for the expansion of the market. Also, increase in adoption of X-ray imaging by healthcare providers is attributed to the technological advances in the diagnostic field and various strategies adopted by the key market players.

CXOs further added that increase in prevalence of orthopedic condition, cancer and cardiovascular conditions in the population of developed as well as developing regions has largely contributed in the market revenue in 2021, and is expected to maintain this trend throughout the forecast period. Also, increase in awareness around the globe regarding X-ray imaging diagnostic technique and its advantages, increases its demand in the healthcare sector and thus, significantly contributes towards the revenue generation.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to increase in awareness among the people regarding management of chronic conditions and rise in government initiatives promoting awareness drives for early detection of chronic conditions, lead to the growth of the market. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for manufacturing of X-ray imaging instruments and devices and upsurge in healthcare expenditure in the emerging economies such as India and China.

The increase in prevalence of various chronic diseases is the major upcoming trend of the ambulatory X-ray devices market. Arthritis in joints, heart problems (such as congestive heart failure), blood vessel blockages, digestive problems, cancer conditions are few of the conditions, which are on the raise day by day.

Orthopedics is the leading application of Ambulatory X-Ray Devices Market.

North America is the largest regional market for Ambulatory X-Ray Devices.

The ambulatory X-ray devices market valued for $1,699.16 million in 2021 and is estimated to reach $2,413.29 million by 2031, exhibiting a CAGR of 3.6% from 2022 to 2031.

Major Key players that operate in the ambulatory X-ray devices market are Amrad Medical Equipments, Canon Inc., Carestream Health Inc., FUJIFILM Corporation, General Electric Company, Koninklijke Philips N.V., Oehm und Rehbein GmbH, Siemens AG, Shimadzu Corporation, and Source-Ray, Inc.

2021 is the base year of Ambulatory X-Ray Devices Market.

2022 to 2031 is the forecast year of Ambulatory X-Ray Devices Market.

Loading Table Of Content...