Amorphous Core Power Transformers Market Research, 2033

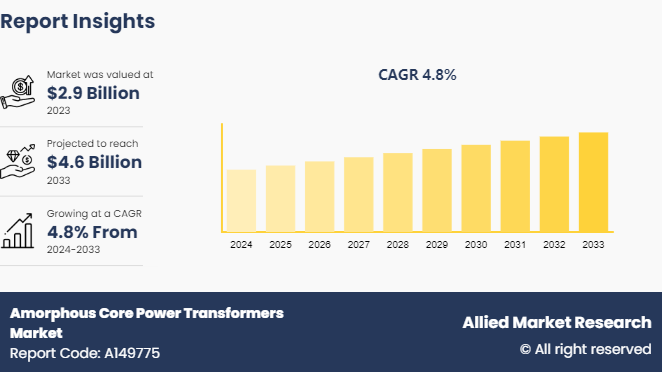

The global amorphous core power transformers market size was valued at $2.9 billion in 2023, and is projected to reach $4.6 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Amorphous core transformers are electrical transformers where the core is made from a non-crystalline, or amorphous, metal alloy. This alloy typically consists of iron and boron, sometimes with additional elements like silicon or phosphorus. The non-crystalline structure of the alloy allows for reduced core losses, primarily eddy current losses, compared to traditional transformers with crystalline (or grain-oriented) silicon steel cores. The properties of amorphous core transformers include high efficiency and energy savings due to lower core losses. These transformers are particularly advantageous in electrical distribution networks, power generation plants, and industrial facilities, where energy efficiency is critical. The reduced losses also contribute to lower operating temperatures and longer operational lifespans, enhancing reliability and reducing maintenance costs over time.

Moreover, amorphous core power transformers exhibit excellent magnetic properties, including high magnetic permeability and low coercivity, which ensure efficient energy transfer and minimal hysteresis losses. The demand for amorphous core transformers continues to grow, driven by their superior performance and contribution to reducing carbon footprints in electrical infrastructure as environmental concerns and energy efficiency regulations become stringent globally.

Key Takeaways

- The amorphous core power transformers market report covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Amorphous core power transformers industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Increase in investments in power infrastructure worldwide is expected to significantly drive the growth of the amorphous core power transformers market. There is a surge in recognition of the benefits offered by amorphous core power transformers as countries strive to modernize their electrical grids and enhance energy efficiency. These transformers are known for their superior energy efficiency compared to traditional silicon steel core transformers, as they reduce core losses by up to 75%. The surge in investments is primarily driven by the need to upgrade aging power infrastructure, accommodate renewable energy integration, and meet increasing electricity demand. Amorphous core power transformers play a crucial role in these efforts by minimizing energy losses during transmission and distribution, thereby improving overall grid efficiency and reliability. Moreover, governments and utilities are increasingly focusing on reducing carbon emissions and enhancing energy sustainability. Amorphous core power transformers align with these goals by lowering greenhouse gas emissions associated with energy losses. This environmental benefit further encourages their adoption in both developed and emerging markets.

One of the significant challenges hindering the widespread adoption of amorphous core power transformers is their higher initial cost compared to conventional transformers. While amorphous core power transformers offer substantial energy efficiency benefits, including lower core losses and reduced operational costs over their lifespan, their upfront purchase price tends to be higher. This higher initial cost can pose a barrier, especially for utilities and industries operating under stringent budget constraints or in regions with limited financial resources for infrastructure upgrades. In addition, the perception of higher initial investment can deter potential buyers from opting for amorphous core power transformers, despite the long-term economic and environmental advantages they offer. The decision-making process often prioritizes short-term financial considerations over long-term benefits, thereby impacting the market penetration of these transformers. Initiatives such as government subsidies, incentives for energy-efficient equipment, and advancements in manufacturing processes are projected to help reduce production costs over time. Cost competitiveness of amorphous core powertransformers is projected to gradually improve, facilitating broader adoption in the global transformer market with improvement in technology.

Smart grid initiatives are poised to significantly boost the growth prospects of the amorphous core power transformers market. There is an increase in the demand for advanced technologies that enhance efficiency and reliability as countries worldwide strive to modernize their electrical grids. Amorphous core power transformers play a pivotal role in smart grid deployments due to superior energy efficiency compared to traditional transformers. Smart grids incorporate digital communication technologies to monitor, control, and optimize electrical distribution in real-time, facilitating better management of energy resources and improving grid stability. Amorphous core power transformers are preferred in smart grid applications because they minimize energy losses during electricity transmission and distribution, thereby reducing overall operational costs and environmental impact. Furthermore, the integration of renewable energy sources, such as wind and solar power, into smart grids necessitates transformers that can accommodate fluctuating loads and ensure efficient energy conversion. This trend aligns with global initiatives to achieve sustainability goals and reduce carbon emissions.

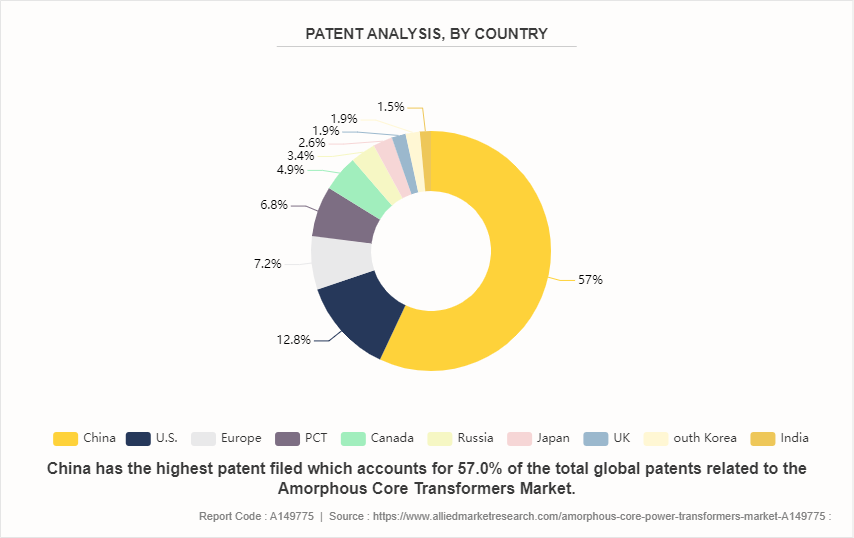

Patent Analysis of the Global Amorphous Core Power Transformers Market

Based on the provided patent analysis data, China dominates the global market for amorphous core power transformers with a substantial 57.0% share of patents. The U.S. follows with 12.8%, while Europe holds 7.2%. The PCT18 region contributes 6.8%, indicating a significant international presence. Canada, Russia, Japan, UK, South Korea, and India collectively hold smaller shares ranging from 4.9% to 1.5%. This distribution highlights China's strong position in innovation within the amorphous core power transformers market, likely driven by advancements in technology and manufacturing capabilities in the region.

Market Segmentation

The amorphous core power transformers market is segmented into type, application, and region. By type, the market is classified into oil-immersed and dry-type transformers. By application, the market is divided into consumer electronics, aerospace, medical, electricity, automotive, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The key players holding a dominating amorphous core power transformers market share include Hitachi Industrial Equipment Systems Inc., ABB Ltd., Toshiba Energy Systems & Solutions Corporation, Zhixin Electric Ltd., Jiangshan Scotech Electrical Co., Ltd., San Jiang Electric Mfg. Co., Ltd., Siemens Energy ag, Mitsubishi Electric Corporation, Eaton Inc., and HYUNDAI ELECTRIC CO., LTD.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. Surge in demand for amorphous core power transformers, and rapid urbanization and industrialization in countries like China, India, and Southeast Asian nations have led to a surge in electricity consumption. There is a growing shift towards deploying transformers that minimize energy losses as governments prioritize energy efficiency and environmental sustainability. In addition, infrastructure investments in power transmission and distribution networks further drive the adoption of amorphous core power transformers, which offer higher efficiency and lower lifecycle costs compared to traditional transformers. These factors collectively propel the market growth in Asia-Pacific.

- As part of the Sagarmala Program, over 610 projects, totaling $10.5 million, will be executed from 2015 to 2035. These projects aim to modernize and build new ports, enhance port connectivity, promote port-linked industrialization, and develop coastal communities.

- The Bharatmala Pariyojana is a new comprehensive highway program focused on enhancing freight and passenger movement efficiency across India by addressing critical infrastructure gaps. It involves developing Economic Corridors, Inter Corridors and Feeder Routes, National Corridor Efficiency Improvements, Border and International Connectivity Roads, Coastal and Port Connectivity Roads, and Green-field expressways. The PM Gati Shakti Master Plan for Expressways, set to be implemented in 2022-2023, will enable faster transit. The National Highway network will expand by 25, 000 kilometers in 2022-203, costing $2.42 million (INR 20, 000 crore) .

- In 2022, India's road sector saw significant growth, with new national highways constructed and several projects and fundraises approved and completed. This year was better than the previous one, featuring an integrated multi-modal national network of transportation and logistics, improved connectivity with isolated and difficult terrains, and the decongestion of key road network sites.

- In January 2022, the government approved the development of 21 greenfield airports in India, including the country's largest airport in Uttar Pradesh's Gautam Buddha Nagar area. The Ministry of Civil Aviation plans to build 21 more airports in the coming years. Over the next four to five years, the Airports Authority of India (AAI) aims to create new airports and expand and upgrade existing ones for $338 million. This includes expanding and modifying terminals, constructing new terminals, strengthening existing runways, and enhancing technical blocks, aprons, and Airport Navigation Services control towers. By 2025, three PPP (Public-Private Partnership) airports in Delhi, Bengaluru, and Hyderabad will invest $3.66 billion (INR 30, 000 crore) in expansion plans.

- Therefore, Asia-Pacific is projected to emerge as a dominant force in the amorphous core power transformers market forecast period.

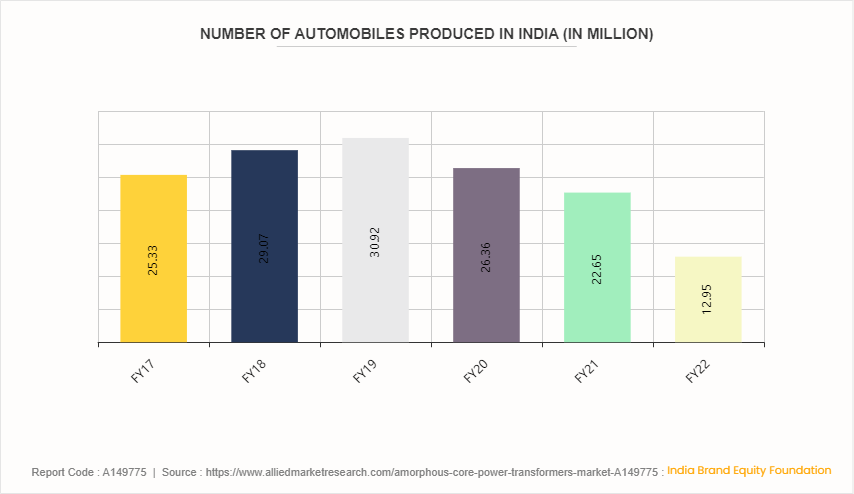

Rising Automobile Production in India is Boosting the Amorphous Core Power Transformers Market in Asia-Pacific.

The growth of the amorphous core power transformers market in the Asia-Pacific region is significantly driven by the increasing number of automobiles produced in India. As the automotive industry expands, the demand for efficient and reliable power distribution systems also rises. Amorphous core power transformers are known for their energy efficiency and reduced energy losses, making them an ideal choice for the burgeoning automotive sector. Additionally, government initiatives promoting energy-efficient technologies and infrastructure development in India further boost the market. This trend highlights the symbiotic relationship between automotive production growth and advancements in power distribution technologies within the region.

Industry Trends

- The amorphous core power transformers market is witnessing several key trends that are shaping its trajectory and adoption across various industries. One prominent trend is the increase in focus on energy efficiency and sustainability. Amorphous core power transformers offer significantly lower core losses compared to traditional transformers, making them an attractive choice for utilities and industries aiming to reduce energy consumption and operating costs.

- Another notable trend is the growing integration of renewable energy sources such as wind and solar power into the grid. These sources require transformers capable of handling variable and fluctuating loads efficiently, which aligns with the characteristics of amorphous core power transformers in minimizing losses and improving overall grid stability.

- Technological advancements play a crucial role in the market's evolution, with ongoing research and development efforts focused on enhancing transformer efficiency, performance, and reliability. Innovations in materials and manufacturing processes are enabling the production of amorphous core power transformers that offer better operational efficiencies and longer service life.

- Additionally, there is an increase in emphasis on grid modernization initiatives globally. Aging power infrastructure in many regions necessitates the replacement of older transformers with more efficient and reliable alternatives like amorphous core power transformers, driving market growth.

- Overall, these trends indicate a shift towards more sustainable and efficient electrical distribution systems, positioning amorphous core power transformers as a pivotal component in the modernization of power grids globally.

Key Sources Referred

- Ericsson Mobility Report

- IEA

- Our World In Data

- India Ministry of Coal statistics

- The Ministry of Power

- The National Institution for Transforming India (NITI Aayog)

- Airports Authority of India (AAI)

- The Ministry of Civil Aviation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the amorphous core power transformers market analysis from 2024 to 2033 to identify the prevailing amorphous core power transformers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the amorphous core power transformers market share among the segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global amorphous core power transformers market overview, trends, key players, market segments, application areas, and market growth strategies.

Amorphous Core Power Transformers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.6 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Zhixin Electric Ltd, Siemens Energy AG, Toshiba Energy Systems & Solutions Corporation, Hitachi Industrial Equipment Systems Inc, HYUNDAI ELECTRIC CO., LTD., ABB Ltd, San Jiang Electric Mfg. Co., Ltd., Eaton Inc, Mitsubishi Electric Corporation, Jiangshan Scotech Electrical Co., Ltd. |

Asia-Pacific is the largest regional market for Amorphous Core Power Transformers.

The amorphous core transformers market was valued at $2.9 billion in 2023 and is estimated to reach $4.6 billion by 2033, exhibiting a CAGR of 4.8% from 2024 to 2033.

Consumer electronics is the leading application of Amorphous Core Power Transformers Market.

include Hitachi Industrial Equipment Systems Inc., ABB Ltd., Toshiba Energy Systems & Solutions Corporation, Zhixin Electric Ltd., Jiangshan Scotech Electrical Co., Ltd., San Jiang Electric Mfg. Co., Ltd., Siemens Energy ag, Mitsubishi Electric Corporation, Eaton Inc., and HYUNDAI ELECTR.IC CO., LTD. are the top companies to hold the market share in Amorphous Core Power Transformers

Energy efficiency and reduction in core losses and increase in demand for renewable energy integration are the drivers of Amorphous Core Power Transformers Market in the globe.

Loading Table Of Content...