Amylase Market Research, 2033

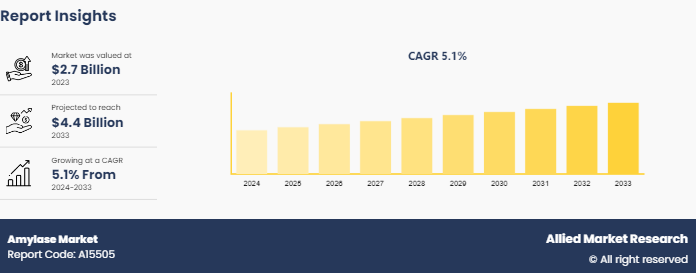

The global amylase market was valued at $2.7 billion in 2023, and is projected to reach $4.4 Billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

Market Introduction and Definition

Amylases are a group of enzymes that catalyze the hydrolysis of starch into sugars. They are crucial in various biological processes and industrial applications. Amylases have potential use in a wide range of industrial activities, including food, fermentation, and pharmaceuticals. Amylases can be obtained from plants, animals, or microorganisms. Nonetheless, fungal and bacterial amylases have dominated industrial uses. Amylase is required for the conversion of starches to oligosaccharides. Starch is an essential component of the human diet and a storage product in many commercially significant crops, including wheat, rice, maize, tapioca, and potato.

Moreover, amylases are among the most often used enzymes in business. These enzymes hydrolyze starch molecules, converting them into glucose-based polymers. Amylases have the potential to be used in a variety of commercial activities, including food production, fermentation, and pharmaceuticals. The enzyme ɑ-amylase is widely used in brewing starch-based beverages such as liquor and beer. It is done by fermentation, in which yeast consumes sugar and produces alcohol. In breadmaking, yeasts, which already produce amylase, degrade the starch in the flour into carbon dioxide and ethanol, giving rise to the bread while also contributing taste. In molecular biology, amylase can be used to select antibiotic-resistant genes.

Key Takeaways

- Over 1,500 product literatures, industry releases, annual reports, and various documents from major amylase industry participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The amylase market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) and volume (kilotons) for the projected period 2024-2033.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Market Dynamics

Amylase is widely used as an enzyme in food and beverage, textile, paper and pulp, and pharmaceutical industries due to its ability to speed the breakdown of starch into sugars, hence increasing manufacturing processes and product quality. Furthermore, rise in disposable income and changes in customer preferences for specialized and functional food are propelling demand for amylase. In addition, the growing demand for convenient and processed food, especially in developing countries, is driving the need for efficient and cost-effective enzymes such as amylase to fulfill manufacturing needs. Amylase is widely used in the food industry to enhance the processing and quality of various food products, primarily by breaking down complex carbohydrates into simpler, more easily processed sugars.

In 2021, China was responsible for more than half of global food and beverage sales. Food production increased by 6.3% in 2021 compared to last year, despite ongoing COVID-19 lockdowns and epidemics. The majority of China's higher-value products are imported, whereas the majority of food processing components are produced domestically. Also, China's food processing business has experienced steady expansion in recent years. The Chinese Ministry of Industry and Information Technology (MIIT) reported that sales, output, and revenue in the industry increased in 2020 compared to last year. China's major food processing companies reported total earnings of 620.66 billion yuan (about US$97 billion) in 2020, a 6.8% increase over the same period in 2019. Also, according to the study China's Rising Bakery Sector, China is the second largest market for baked products behind the U.S., with a projected value of $53 billion by 2025 from the United States Department of Agriculture data.

In recent years, China has implemented stronger food safety regulations to help improve the quality and safety of locally manufactured food items. However, this improved the quality of local food items and raised consumer awareness about the need for food safety. This increase in consumer emphasis on quality and safety has helped to raise awareness of safe and high-quality imported food ingredients. The U.S. is a prominent source for quality ingredients. According to the FAS office in Beijing, China's food processing sector is maturing and growing at a moderate rate. Also, U.S. food & beverages value added output expanded by approximately 1% in 2022, after growing 3.1% in 2021 and 1.8% in 2020.

Thus, growing use of amylase for enhancing the quality, efficiency, and appeal of food products coupled with growth of food and beverage industry is expected to drive the growth of the amylase market during the forecast period. As the food and beverage industry expands, there is a corresponding increase in the demand for additives and enzymes that can help manufacturers produce high-quality, efficient, and appealing products. This growth is fueled by factors such as rising consumer demand for processed and convenience food, advancements in food processing technology, and increase in health consciousness among consumers. However, the cost of raw materials utilized in enzyme manufacturing, such as substrates and nutrients, is a major restraint for the amylase market. Nevertheless. ongoing research and development efforts in biotechnology are yielding new applications and improved enzyme variations have become a significant catalyst for creating opportunities within the amylase market.

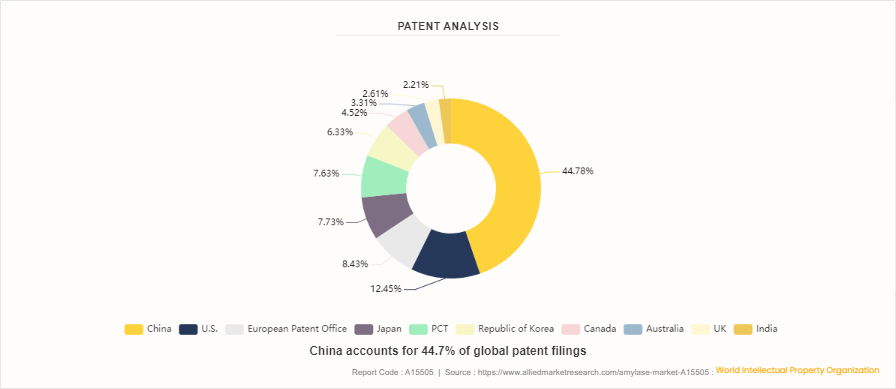

Patent Analysis of Global Amylase Market

Market Segmentation

The amylase market is segmented on the basis of source, type, end-use, and region. By source, the market is divided into microbes, plants, and animals. By type, the market is classified into alpha-amylase, beta-amylase and gamma-amylase. By end-use, the market is categorized into food and beverage, textile, paper and pulp, pharmaceutical, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

Key players in the amylase market include Novozymes A/S, DSM, AB Enzymes, Chemzyme Biotechnology Co., Ltd, Sisco Research Laboratories Pvt Ltd, Kerry Group, Biolaxi Corporation, International Flavors & Fragrances Inc., Infinita Biotech Private Limited, and Antozyme Biotech.

Recent Developments

- In May 2023, International Flavours & Fragrances, Inc. introduced the ENOVERATM 2000 line in Europe, the latest addition to its wide collection of top-tier baking solutions. The ENOVERATM 2000 series, marketed as a next-generation enzyme dough strengthener, is designed for bakery makers looking for a feasible alternative for critical gluten, particularly in demanding situations such as whole wheat bread preparation.

- In February 2023, AB Enzymes announced an extension of its distribution arrangement with Barentz for bake and food enzymes throughout a large area of Europe. The official signing ceremony took place in Paris in December 2022. This five-year deal reinforces AB Enzymes' objectives and position in the European markets.

- Kerry Group Plc signed a formal agreement in December 2023 to buy a part of the worldwide lactase enzyme business from Chr. Hansen Holding A/S ("Chr. Hansen") and Novozymes A/S ("Novozymes") , referred to collectively as the "Lactase Enzymes Business." This transaction is reliant on Kerry's acceptance as a bidder by the European Commission and is part of the larger merger approval process involving Novozymes and Chr. Hansen.

Regional/Country Industry Outlook

Asia-Pacific is predicted to experience significant growth in the global market. The region's population is experiencing growth, resulting in greater demand for baked goods. The growth of bakery chains and the popularity of specialty bakeries in Asia-Pacific contribute to increased demand for these enzymes. These enzymes are used to maintain consistency and quality in a wide range of baked items. The Asia-Pacific baking industry is experiencing innovation in the development of unique and regionally specialized baked food.

Moreover, urbanization and changes in dietary habits are boosting the demand for processed and convenience food, which in turn drives the demand for amylase in food processing. For instance, the food processing business in India plays a critical role in connecting Indian farmers with customers in both local and international markets. The Ministry of Food Processing Industries (MoFPI) is making every effort to attract investment throughout the value chain. The food processing business accounts for 12.22% (at the 3-digit NIC classification) of total employment in the Registered Factory sector, employing around 2.03 million people. According to the NSSO's 73rd Round report 2015-16, the unregistered food processing industry employs 5.1 million people and accounts for 14.18% of all unregistered manufacturing jobs. The major sectors of India's food processing industry include processed fruits and vegetables, RTE/RTC, mozzarella cheese, processed marine products, edible oils, drinks, and dairy products.

By 2023, Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) projects sanctioned under various schemes include 41 Mega Food Parks, 371 Cold Chain projects, 68 Agro-Processing Clusters, 474 proposals under Creation/Expansion of Food Processing & Preservation Capacities (CEFPPC) , 61 Creation of Backward and Forward Linkages Projects, 46 Operation Green projects, and 186 Food Testing Laboratories projects approved across the country. Thus, developments in the food processing industry is expected to foster the demand for amylase in the coming years.

Public Policies

- Amylase used as a food additive must comply with Food Safety and Standards Authority of India (FSSAI) standards regarding permissible limits, safety, and labeling requirements.

- Amylase must be approved by FSSAI before it can be used in food products, requiring detailed documentation on its safety and efficacy.

- Enzymes must be Generally Recognized as Safe (GRAS) for use in food products, influencing global standards.

- Enzymes used in pharmaceuticals must undergo rigorous testing and approval by Central Drugs Standard Control Organization (CDSCO) .

Key Sources Referred

- National Institutes of Health (NIH)

- Cleveland Clinic

- MedlinePlus

- RCSB PDB

- European Bioinformatics Institute

- Mount Sinai

- Center for Science in the Public Interest

- Endocrine Abstracts

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the amylase market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the amylase market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global amylase market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global amylase market trends, key players, market segments, application areas, and market growth strategies.

Amylase Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.4 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Source |

|

| By Type |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Novozymes A/S, Infinita Biotech Private Limited, Antozyme Biotech Private Limited, DSM, Biolaxi Corporation, Chemzyme Biotechnology Co., Ltd, International Flavors & Fragrances Inc., AB Enzymes, Kerry Group, Sisco Research Laboratories Pvt Ltd |

Loading Table Of Content...