Animal Model Market Research, 2032

The global animal model market size was valued at $1.9 billion in 2022 and is projected to reach $3.6 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032. Animal models refer to non-human organism, typically animal, that is used in scientific research to study biological processes, investigate disease mechanisms, develop new treatments, and gain insights into human health and physiology. Animal models play a crucial role in various fields such as medicine, pharmacology, genetics, and toxicology. They provide researchers with a way to understand complex biological systems, test hypotheses, and make predictions before moving on to human studies.

Market Dynamics

The animal model market size is expected to grow significantly, owing to a surge in the usage of animal models in virology and infectious diseases, the physiological similarity of humans and animals for drug testing, an increase in the adoption of CRISPR (clustered regularly interspaced short palindromic repeats) technology.

Animal models, such as mice, rats, guinea pigs, and non-human primates, play a crucial role in studying the pathogenesis, transmission, and potential treatments for various viral infections and infectious diseases. These models provide researchers with a valuable platform to understand the complex mechanisms of viral replication, host immune responses, and disease progression.

Animal models have proven to be indispensable tools in virology research, allowing scientists to mimic human infections and assess the efficacy of antiviral drugs and vaccines. For instance, in the case of the COVID-19 pandemic, animal models played a pivotal role in understanding the SARS-CoV-2 virus and evaluating potential therapeutic interventions. Researchers used animal models to study viral entry, replication, and transmission, as well as to assess vaccine candidates and antiviral drugs. These sudies provided critical insights into the virus's behavior and facilitated the development of effective preventive and therapeutic strategies.

Moreover, animal models have been instrumental in investigating other infectious diseases, including influenza, HIV/AIDS, Zika virus, Ebola virus, and hepatitis. For instance, according to a 2022 report by the National Library of Medicines, several small animal models, including mice, Syrian hamsters, guinea pigs, and ferrets are used to study the pathogenicity, transmissibility, and antigenicity of seasonal and pandemic influenza viruses. Mice and ferrets are frequently used for influenza virus research, but Syrian hamsters and guinea pigs are also well-established as small animal models. By escaping the existing immunity in humans, seasonal influenza viruses cause annual epidemics with increases in morbidity and mortality. Suitable animal models are essential to characterize the pathogenicity, transmission, and antigenicity of these viruses and to test novel vaccine preparations and vaccination approaches. Thus, the rise in the prevalence of infectious viral diseases results in a surge in demand for animal models for drug and vaccine development which drive the animal model market growth.

The physiological similarities between humans and animals have long been recognized as a major driving force behind the use of animal models in drug testing. Animals, particularly mammals, share many fundamental biological systems and processes with humans, making them valuable tools for studying the efficacy and safety of potential pharmaceutical interventions. One of the key physiological similarities between humans and animals is the overall organization and functioning of the major organ systems.

Animals possess cardiovascular, respiratory, digestive, nervous, and endocrine systems that are structurally and functionally similar to those found in humans. This similarity allows researchers to assess the effects of drugs on these systems in animals, providing insights into potential human responses. For instance, according to the Institute of Cancer Research UK, in 2022, 22,991 mice and 98 rats were used in cancer research. Animals are used in cancer research to help understand the mechanisms that underpin cancer, such as the growth and spread of tumors, and to develop new ways of diagnosing, treating, and preventing the disease. Institute of Cancer Research UK majorly uses mice, which can grow tumors that mimic those of human cancer patients. Thus, physiological similarities between humans and animals are a vital factor driving the use of animal models in drug testing and boosting animal model market size.

In addition, the adoption of CRISPR (clustered regularly interspaced short palindromic repeats) technology has emerged as a significant driver of the animal model market. CRISPR enables researchers to edit specific genes in animals with unprecedented precision, leading to the development of more accurate disease models. By introducing specific mutations associated with human diseases into animal genomes, scientists can mimic the genetic conditions seen in patients, thus enabling a better understanding of disease mechanisms and the evaluation of potential therapeutic interventions.

For instance, according to a 2022 report by the National Library of Medicine, CRISPR has been applied to study cancer because the method allows for many new ways to model the disease. This includes the development of pre-clinical models of cancer, where CRISPR is used to generate mutations that are found in human cancer. Therefore, unique mutations can be studied in a physiologically relevant setting, and CRISPR technology has accelerated the engineering of these models. The developer of CRISPR technology, Emmanuelle Charpentier and Jennifer Doudna was awarded the Nobel Prize in 2020.

However, the availability of alternative testing methods is expected to act as a significant restraint during the animal model market forecast. Moreover, high growth potential in emerging markets is anticipated to present significant opportunities for market growth during the forecast period.

The 2023 recession had negative impacts on the animal model industry. Pharmaceutical companies and research institutions are looking for ways to optimize their costs during a recession, which could include consolidating animal model suppliers or reducing the number of animals used in experiments. This led to increased competition among animal model suppliers and potential pricing pressures.

Furthermore, recessionary periods often result in reduced funding for R&D across various sectors. Government agencies, academic institutions, and private companies may face budget cuts, impacting their ability to invest in animal models for research purposes. This reduction in funding could lead to a decline in demand for animal models. However, it is important to note that the animal model market has historically demonstrated resilience, as biomedical research remains a crucial component of scientific advancements. While a recession may temporarily impact the market, the long-term demand for animal models is likely to continue as researchers strive to understand diseases, develop new therapies, and improve human health.

Segmental Overview

The global animal model industry is segmented into animal type, application, end-user, and region. On the basis of animal type, the market is categorized into rats, mice, guinea pigs, rabbits, and others. The other segment includes zebrafish, amphibians & reptiles, hamsters, chinchillas, gerbils, and armadillos. By application, the market is divided into drug discovery & development, basic research, and others. The others segment includes medical device development, and production & quality control. Depending on the end-user, the market is segregated into pharma & biotech companies, academic research institutes, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

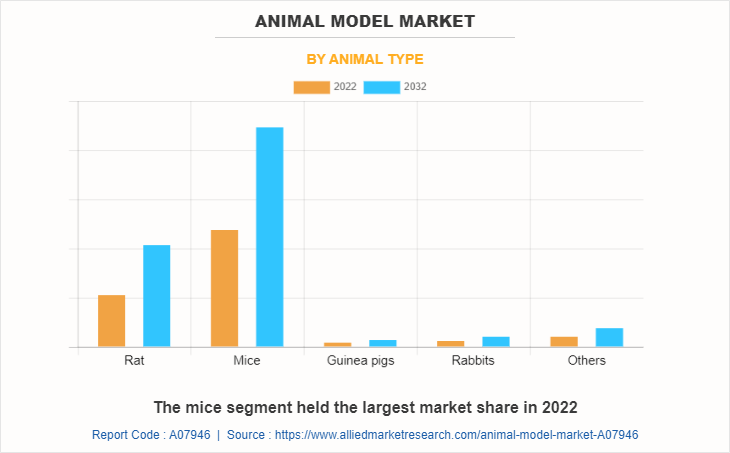

By Animal Type

The animal model market is categorized into rat, mice, guinea pigs, rabbits, and others. The mice segment was the largest revenue contributor to the market in 2022, owing to their amenability to genetic manipulation. However, the rat segment is expected to register the fastest growth, owing to significant genetic similarities between rats and humans, making them suitable for studying various physiological, anatomical, and behavioral aspects.

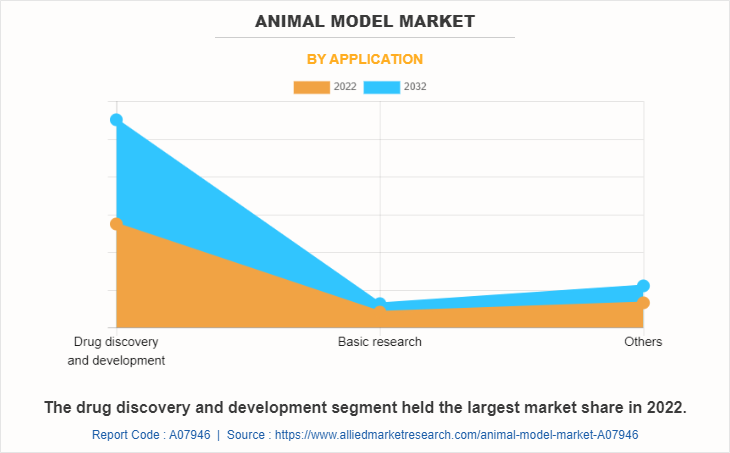

By Application

By application, the market is divided into drug discovery & development, basic research, and others. The drug discovery & development segment dominated the global animal model market share in 2022 and is anticipated to continue this trend during the forecast period owing to the high use of animal models during the drug discovery & development process.

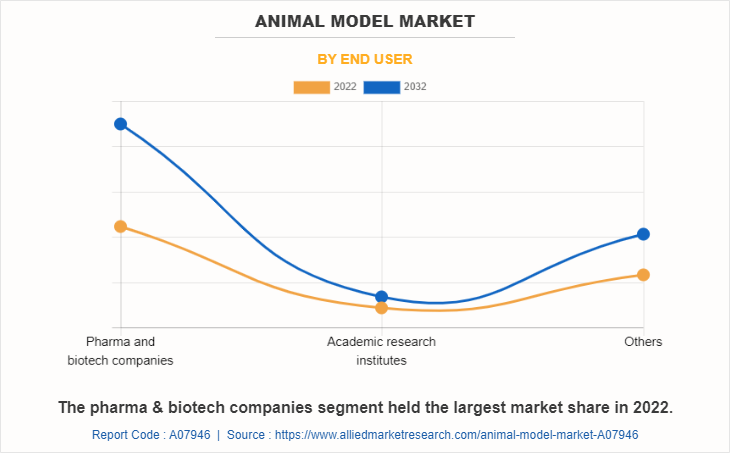

By End User

On the basis of end-user, the market is classified into pharma & biotech companies, academic research institutes, and others. The pharma & biotech companies segment dominated the market in 2022 and is expected to remain dominant throughout the forecast period. This is attributed to an increase in the production of novel products, which boosts the need for animal models for clinical trial procedures by pharmaceuticals & biotechnology companies.

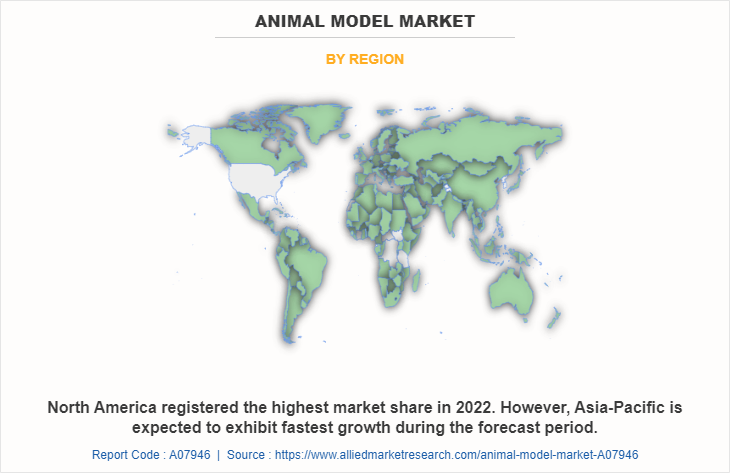

By Region

On the basis of region, the animal model market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America has the highest animal model market share in 2022. This is attributed to the high increase in research and development activities by pharma and biotech companies and the strong presence of key market players to provide animal models to meet the demand. However, Asia-Pacific is expected to register a noteworthy CAGR during the forecast period, owing to high research in the field of vaccines.

Competition Analysis

Competitive analysis and profiles of the major players in the animal model market such as The Jackson Laboratory, Janvier Labs, LLC, Genoway S.A., Hera Biolabs, Crown Bioscience Inc, Ozgene Pty Ltd., Taconic Biosciences, Trans Genic Inc., Inotiv, Inc., and Charles River Laboratories have been provided in the report. Major players have adopted agreements, partnerships, strategic alliances, and product launches as key developmental strategies to improve the product portfolio and gain a strong foothold in the animal model market.

Recent Agreements in the Animal Model Market

- In November 2022, Charles River Laboratories announced that it has signed an agreement to breed, distribute, market, and sell Hera BioLabs' SRG rat to the global preclinical research community.

- In June 2021, Genoway S.A. announced that it has entered a non-exclusive license agreement with ERS Genomics Limited. The agreement grants GenOway past and future access to ERS Genomics’ CRISPR/Cas9 patent portfolio

Recent Partnership in the Animal Model Market

- In December 2020, Genoway S.A. announced that it entered into a strategic partnership with Cyagen to commercialize high-standard preclinical humanized immune checkpoint and immunodeficient BRGSF mouse models to nonprofit and for-profit organizations in Asia-Pacific from 2020.

Recent Strategic Alliance in the Animal Model Market

- In September 2022, Genoway S.A. and Sigma-Aldrich Co LLC announced a new structure to their 2018 strategic alliance in the CRISPR/Cas9 field. GenOway will continue leading the commercialization of the Sigma-Aldrich CRISPR patent portfolio in the field of rodent animals.

Recent Product Launch in the Animal Model Market

- In January 2023, Charles River Laboratories announced that it has expanded its triple-immunodeficient mouse model portfolio by introducing two new NCG mouse strains best suited for studies in oncology, immunology, and infectious diseases.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the animal model market analysis from 2022 to 2032 to identify the prevailing animal model market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the animal model market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global animal model market trends, key players, market segments, application areas, and market growth strategies.

Animal Model Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.6 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 295 |

| By Animal Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Janvier Labs, LLC, Hera Biolabs, Taconic Biosciences, Charles River Laboratories, Crown Bioscience Inc., Inotiv, Inc., Genoway S.A., Trans Genic Inc., The Jackson Laboratory., Ozgene Pty Ltd. |

Top companies such as Charles River Laboratories International, Inc., The Jackson Laboratory, Inotiv, Inc, Taconic Biosciences, Inc., and Genoway S.A held high market share in 2022.

An animal model refers to the use of animals, typically non-human species, in scientific research to study various biological and physiological processes, diseases, and test potential treatments or interventions.

The mice segment is the most influencing segment owing to high adoption of mice towards the genetic mutaion.

Surge in use of animal models in virology and infectious diseases, increase in adoption of CRISPR technology, and rise in number of R&D activities are driving the growth of animal model market

North America is the largest regional market for animal model owing to rise in the research and development in the field of pharmaceuticals which requires animal model for drug discovery and development process and the strong presence of major key player in this region.

Animal models are primarily used by pharma and biotech companies for drug discovery and development procedures.

The forcast period for animal model market is 2023 to 2032

Asia-Pacific is expected to experience the growth rate of 8.0% during the forecast period, owing to high research in the field of vaccines in this region.

The estimated industry size of animal model in 2032 is $3617.92 million.

The base year is 2022 in animal model market.

Loading Table Of Content...

Loading Research Methodology...