Animal/Veterinary Ultrasound Market Research, 2031

The global animal/veterinary ultrasound market size was valued at $0.2 billion in 2021 and is projected to reach $0.5 billion by 2031, growing at a CAGR of 5.9% from 2022 to 2031. The sonography, also referred to as an ultrasound scan, produces images using sound waves or echoes rather than radiation, making it a safe treatment. A non-invasive diagnostic method for imaging inside the body is diagnostic ultrasonography. The ultrasound waves are produced by a transducer, which can also be used to detect ultrasonic echoes that are reflected back.

Market Dynamics

An animals are imaged using veterinary ultrasonography equipment for general imaging, disease monitoring, and pregnancy detection. These instruments are used by veterinarians in the clinics, hospitals, and in the research institutes to diagnose ailments in a range of animal species. Increased owner concern over their pets' health is what is driving the market. The Animal Ultrasound Market is growing as a result of the technological developments in the Veterinary Ultrasound Industry. Additionally, diagnosing and treating animal illnesses costs a lot of money. The market is growing because more people are using these services and are prepared to pay more money. However, the unavailability of veterinary imaging systems significantly slows the Veterinary Ultrasound Industry's expansion. In contrast, a growing number of skilled veterinary practitioners in emerging nations and increased knowledge of the value of using ultrasound devices present a potential prospect for the Veterinary Ultrasound Market Growth.

Growth in the Animal Ultrasound Market is also fueled by technical developments in veterinary imaging systems. Additionally, the identification and treatment of animal illnesses demand a substantial sum of money. The market is expanding due to the rise in the number of customers seeking these services and their willingness to pay more money. The lack of veterinary imaging technologies, however, seriously slows market expansion.

In addition, the development of new solutions by key players propels the market growth. Presence of economically and technologically developed as well as developing countries have made it a crucial market for hyperbaric oxygen veterinary ultrasound systems. The rise in demand for veterinary ultrasound systems has flourished among many leading healthcare companies in this region; major key market players have developed and launched advanced Veterinary ultrasound devices to generate revenue and meet consumer demands for sophisticated devices. Moreover, the strong presence of key players such as Siemens AG, IMV Imaging, Hallmarq Veterinary Imaging, and Esaote Spa impacts the growth of the market in this region. Moreover, the increase in the number of domestic & companion animals, the presence of veterinary practitioners, and the rise in expenditure on animal health are the prime factors contributing to the growth of the veterinary imaging market.

Furthermore, an increase in the prevalence of veterinary diseases, the rapid expansion of the veterinary industry, and a rise in awareness about animal care drive the growth of the market. The veterinary ultrasound market is segmented on the basis of type, product, end user, and region. On the basis of product, the market is categorized into 2D ultrasound, doppler ultrasound, and 3D/4D ultrasound. By type, it is divided into cart-based ultrasound scanners and portable ultrasound scanners. By end user, it is segmented into veterinary clinics, veterinary hospitals, and other end users Region-wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa (LAMEA).

Segments Overview

The animal/veterinary ultrasound market is segmented into the Type, Product, and End User.

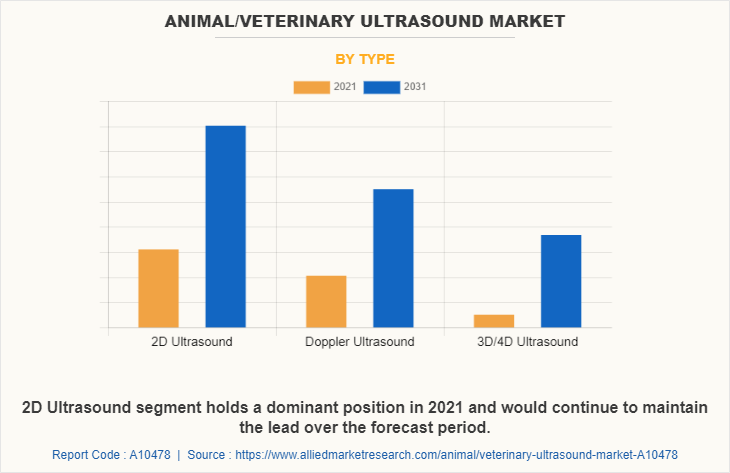

By Type

By type, the market is segmented into 2D ultrasound, doppler ultrasound, and 3D/4D ultrasound. The 2D ultrasound segment generated the maximum Veterinary Ultrasound Market Share in 2021, owing to ease in availability and advancements in the 2D ultrasound. The 3D/4D ultrasound segment is expected to witness the highest CAGR during the forecast period, owing to an increase in demand in developed nations and a rise in R&D activities in 3D/4D ultrasound.

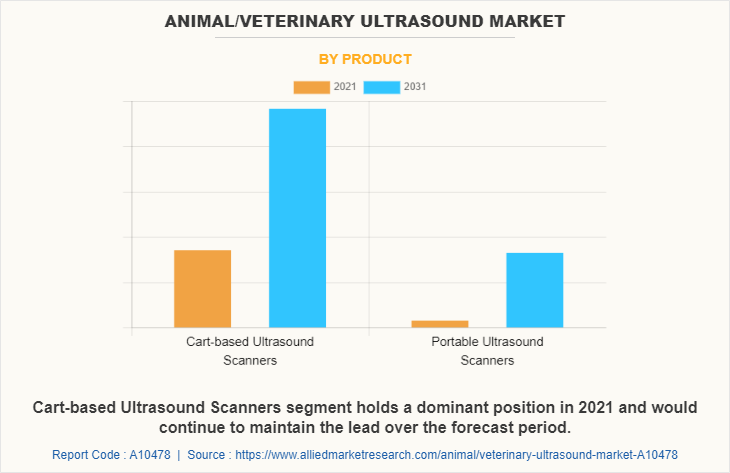

By Product

Depending on the product, the market is divided into cart-based ultrasound scanners and portable ultrasound scanners. The cart-based segment dominated the Veterinary Ultrasound Market size in 2021 and also is expected to witness the highest CAGR during the forecast period owing to high demand in emergency rooms and intensive care units.

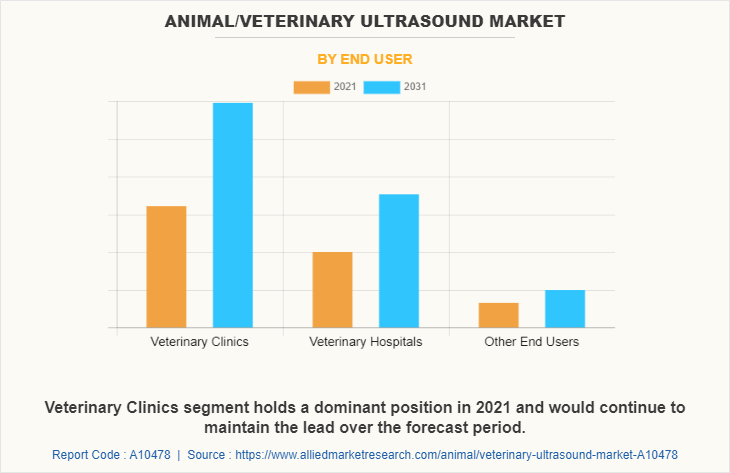

By End User

Depending on the end user, the market is divided into veterinary clinics, veterinary hospitals, and other end-users. The veterinary clinic segment dominated the Veterinary Ultrasound Market Size in 2021 and is also expected to witness the highest CAGR during the forecast period owing to an increase in the number of veterinary clinics and a rise in demand of advanced veterinary facilities.

By Region

North America accounted for a majority of the global veterinary ultrasound market share in 2021 and is anticipated to remain dominant during the Veterinary Ultrasound Market Forecast period. This is attributed to technological advancements in Veterinary ultrasound techniques, the integration of advanced devices and software processes in veterinary ultrasound devices, presence of key and robust hospital infrastructure in the region. However, Asia-Pacific is anticipated to witness notable growth, owing rise in pet adoption, the development of healthcare infrastructure, and an increase in investment projects in the region.

The major players profiled in the report are Carestream Health, Inc., Esaote S.P.A., Fujifilm Holdings Corp, General Electric, Heska corporation, Idexx laboratories Inc, Shenzhen Mindray Bio-Medical Electronics Co Ltd., Siemens Limited and Sound Technologies.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the animal/veterinary ultrasound market analysis from 2021 to 2031 to identify the prevailing Veterinary Ultrasound Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the animal/veterinary ultrasound market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global animal/veterinary ultrasound market trends, key players, market segments, application areas, and market growth strategies.

Animal/Veterinary Ultrasound Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 523.9 million |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Type |

|

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Siemens Medical Solutions, Heska Corp., IDEXX, Esaote SpA, Shenzhen Mindray Bio-Medical Electronics Co., Ltd, Fujifilm Sonosite, Inc., SOUND, Hallmarq Veterinary Imaging, BCF (IMV Imaging), CARESTREAM HEALTH |

Analyst Review

This section provides opinions of top-level CXOs in the global veterinary ultrasound market. According to the insights of CXOs, leading companies in the market, the development of advanced and reliable veterinary ultrasound systems has led to an extensive number of products of this technique. A rise in animal health awareness with growth in animal health spending and an increase in the prevalence of animal disease with the surge in pet adoption is expected to propel the growth of the veterinary ultrasound market.

The veterinary ultrasound industry holds high potential, owing to innovative concepts and multidisciplinary expertise demand for new technological advancements in the creation of veterinary ultrasound systems. The rise in demand for pet ultrasound systems with technological advancements in ultrasound devices, the rise in the number of veterinary hospitals & trained veterinary professionals, and the launch of portable battery charge portable chambers are majorly driving the market growth.

The total market value of the veterinary ultrasound market is $292.91 million in 2021.

The forecast period in the report is from 2022 to 2031.

North America is the largest regional market for Animal/Veterinary Ultrasound

The market value of the veterinary ultrasound market in 2022 was $311.95 million.

The top companies that hold the market share in veterinary ultrasound market are Carestream health, Inc., Esaote S.P.A., Fujifilm Holdings Corp, General Electric , Heska corporation, Idexx laboratories Inc, Shenzhen Mindray Bio-Medical Electronics Co Ltd , Siemens Limited and Sound Technologies.

The base year for the report is 2021.

Asia-Pacific is expected to register the highest CAGR of 7.2% from 2022 to 2031, owing to an increase in the prevalence of veterinary disorders, the presence of key players, and the high animal population.

The key trends in the veterinary ultrasound market are an increase in the number of veterinary hospitals, advancements in veterinary ultrasound, and R&D in veterinary ultrasound treatment.

Loading Table Of Content...