Anionic Surfactants Market Research, 2033

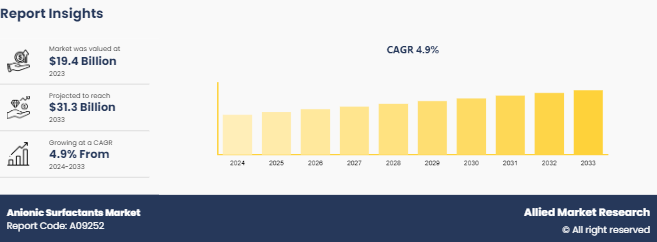

The global anionic surfactants market size was valued at $19.4 billion in 2023, and is projected to reach $31.3 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

Market Introduction and Definition

Anionic surfactants have a negative charge at the hydrophilic end. The surfactant molecules use their negative charge to lift and suspend soils in micelles. Anionic surfactants are frequently used in soaps and detergents as they are capable of attacking a wide range of soils. When anionic surfactants are combined together, they produce a large amount of foam. Anionic surfactants are excellent for lifting and suspending particle soils, however, they are less effective in emulsifying oily soils. Anionic surfactants are found in a variety of goods, including personal care items, cleaning supplies, laundry detergents, and dishwashing detergents.

Key Takeaways

- Over 1, 500 product literatures, industry releases, annual reports, and various documents from major anionic surfactants industry participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The anionic surfactants market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Market Dynamics

Anionic surfactants are widely used in personal care products such as shampoos, body washes, and toothpaste due to their excellent foaming and cleansing properties. The increase in focus on personal hygiene and grooming habits, especially in emerging economies, drives the demand for these products. Moreover, there is an increased demand for household cleaning products containing anionic surfactants, with the growing awareness of hygiene and cleanliness, especially in light of recent global health concerns. Consumers are inclined towards products that offer effective cleaning and disinfection properties. Anionic surfactants are widely used in personal care products such as shampoos, body washes, and toothpaste due to their excellent foaming and cleansing properties. The increase in focus on personal hygiene and grooming habits, especially in emerging economies, drives the demand for these products. Therefore, the abovementioned factors are expected to foster the demand for anionic surfactants in the coming years.

However, ?anionic surfactants, particularly those derived from petrochemicals, can have adverse environmental effects, such as aquatic toxicity and bioaccumulation. This has led to increased scrutiny and regulation. Stricter environmental regulations and standards imposed by governments and environmental agencies can also limit the production and use of certain anionic surfactants. Compliance with these regulations can increase production costs and limit market expansion. Nevertheless. environmental concerns, combined with increased consumer awareness, have driven significant growth in environment-friendly surfactant molecules known as green surfactants, oleochemical-based surfactants, renewable surfactants, biosurfactants, and natural surfactants. These new generations of eco-friendly surfactant molecules, which are usually directly or indirectly derived/developed from renewable building blocks, can be widely referred to as sustainable surfactants?and are gaining popularity in a different applications in household & personal care, oil & gas, and construction industries.

Further, consumer attitudes have shifted rapidly toward products that are organically derived, environment-friendly, and sustainable. The household and personal care sector dominates the usage of anionic surfactants and is driving the industry's growth. A limited number of major consumer firms and brands, such as P&G, Unilever, and Henkel, are driving additional growth. Consumers in the U.S., Canada, Western Europe, Japan, and, increasingly, China demand naturally derived products and are willing to pay the more for them. This encouraged manufacturers to shift to oleochemical-based personal care and cosmetic goods, creating a market for organically marketed detergent and home care products. Furthermore, domestic laundry detergent sales are the largest market for surfactants, accounting for approximately half of the total market. It also has the highest surfactant content per unit weight of product.

Market Segmentation

The anionic surfactants market is segmented into type, application, and region. On the basis of type, the market is categorized into linear alkylbenzene sulfonate, lignosulfonate, fatty alcohol sulfates, alkyl sulfates, sodium lauroyl sarcosinate, alpha olefin sulfonates, phosphate esters, and others. On the basis of application, the market is classified into household and personal care, oil and gas, construction, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The demand for anionic surfactants in North America is experiencing a notable increase, driven by their extensive use in various industries including home care, personal care, oil and gas, and construction. Anionic surfactants, which include compounds such as alkyl sulfates, alkyl ether sulfates, and linear alkylbenzene sulfonates, are preferred for their superior cleaning, foaming, and emulsifying properties.

In the U.S., the largest market in North America, the demand for anionic surfactants is primarily propelled by the home and personal care sectors. The heightened focus on hygiene and cleanliness has led to a surge in the use of products like detergents, shampoos, and soaps. For instance, in 2021, the US personal care industry's growth increased, and revenues reached $42 billion. This was followed by yearly growth?of roughly 3% in 2022 and 2023, with sales reaching $43.3 billion and $44.7 billion, respectively. Also, the oil and gas industry also significantly contribute to the demand, utilizing anionic surfactants in enhanced oil recovery (EOR) and drilling operations?.

Competitive Landscape

Key players in the anionic surfactants market include The Dow Chemical Company, Croda International Plc, Evonik Industries AG, Solvay S.A., Stepan Company, Clariant AG, Kao Corporation, Huntsman Corporation, Nouryon, and BASF SE.

Recent Developments

- In 2021, ?BASF's Care Creations?developed Plantapon?Soy, a bio-based anionic surfactant produced from soy protein that has several sustainability benefits. While created from non-GMO soybeans obtained from Europe and coconut oil, it is ideal?for both vegan formulations and natural cosmetic standards such as COSMOS. Plantapon Soy is 100% natural, hence it precisely meets the ISO 16128 standard. Plantapon Soy is also suited for formulations labelled "cruelty-free."

- In 2020, Clariant announced its plans to?boost?manufacturing capacity for its isethionate derivatives, Hostapon SCI - mild surfactants, to accommodate the growing trend among personal care formulators and brands to use mild surfactants to distinguish applications. It also demonstrates the increased consumer demand for sanitary products. Clariant's Hostapon SCI grades are natural, anionic, mild surfactants. Plant-based, they are non-irritant, ultra-mild, and comply with a variety of industry-recognized ecolabels, resulting in compositions with creamy, stable foams. They are part of Clariant's extensive range of mild surfactants?for skin cleaning, hair care, and infant care applications.

Key Industry Trends

- In 2024, In US Patent No. 11, 904, 034 B2 (Huan Wang, Mingxia Chan, Matthew Clair Ehrman, Singapore Anurag Makrandi) , P&G patented a transparent soap bar with a percent transmittance value more than 40%. The bar soap comprises a soap surfactant selected from the group incorporating?alkali or alkaline earth metals and ammonium salts of C6-C18 carboxylic acids; a?synthetic surfactant selected from the group comprising of an anionic surfactant, a nonionic surfactant, and blends.

- In 2022, German scientists developed a technique that improves the solubility of long-chain anionic surfactants at ambient temperatures.?In the future, it could potentially?employ the method to create cleaning solutions from rapeseed, olive, or sunflower oils, reducing the quantity of surfactant needed in washing detergents.?The method is known as Complet, or the concept of reducing melting points by ethoxylation. It relies on prior research by Werner Kunz of the University of Regensburg and colleagues, who discovered that anions with carboxylate headgroups and ethylene oxide units can be utilized as counterions to reduce the melting point and water solubility temperature of any cationic surfactant.

Cosmetics Industry Overview

Public Policies

- Under Toxic Substances Control Act (TSCA) , anionic surfactants must be registered, and their environmental and health impacts evaluated. This includes reporting and testing requirements to ensure they do not pose unreasonable risks to human health or the environment.

- As per Clean Water Act (CWA) , the discharge of anionic surfactants into water bodies is regulated to prevent water pollution. Effluent guidelines and standards are established for industries to control the discharge of surfactants and other chemicals.

- Canadian Environmental Protection Act (CEPA) regulates the import, manufacture, and use of anionic surfactants. It includes provisions for assessing and managing risks associated with chemicals to protect human health and the environment.

- Under Pollutant Release and Transfer Register (PRTR) , industries must report the release of pollutants, including anionic surfactants, to ensure transparency and inform regulatory actions to reduce pollution.

Key Sources Referred

- RSC Publishing

- OnePetro

- ACS Publications

- INFLIBNET Centre

- Vidyasagar University

- National Institutes of Health (NIH)

- U.S. Environmental Protection Agency

- USGS Publications Warehouse

- Environmental Working Group (EWG)

- ASME Digital Collection

- Laboratory of Formulation, Interfaces, Rheology and Processes

- American Oil Chemists' Society

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the anionic surfactants market analysis from 2024 to 2033 to identify the prevailing anionic surfactants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the anionic surfactants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global anionic surfactants market trends, key players, market segments, application areas, and market growth strategies.

Anionic Surfactants Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 31.3 Billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 295 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nouryon, The Dow Chemical Company, Stepan Company, Evonik Industries AG, Clariant AG, BASF SE, Solvay S.A., Huntsman Corporation, Croda International Plc, Kao Corporation |

Key players in the anionic surfactants market include The Dow Chemical Company, Croda International Plc, Evonik Industries AG, Solvay S.A., Stepan Company, Clariant AG, Kao Corporation, Huntsman Corporation, Nouryon, and BASF SE.

Household and personal care is the leading application of Anionic Surfactants Market.

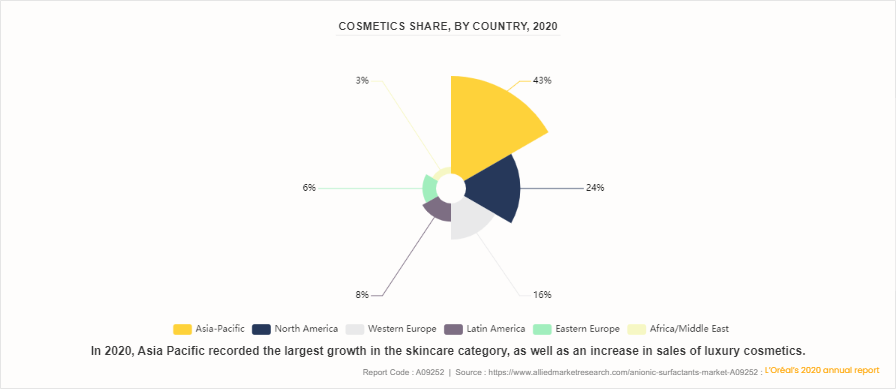

Asia-Pacific is the largest regional market for Anionic Surfactants.

The anionic surfactants market was valued at $19.4 billion in 2023, and is estimated to reach $31.3 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

Growing demand for household and industrial cleaning products propels the market growth, as anionic surfactants are essential ingredients in detergents, soaps, and dishwashing liquids due to their excellent cleaning and foaming properties.

Loading Table Of Content...