Anti Aging Products Market Outlook, 2033

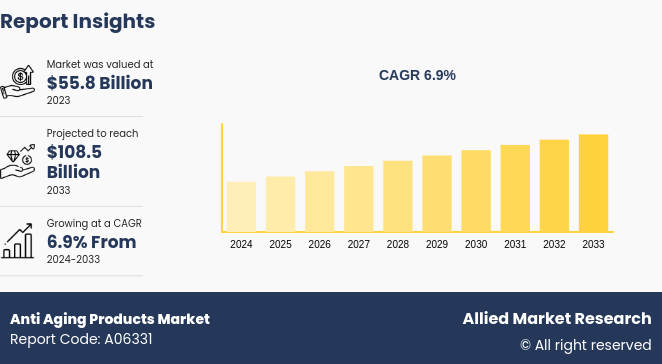

The global anti aging products market size was valued at $55.8 billion in 2023, and is projected to reach $108.5 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033. Anti aging products are cosmetic and skincare items designed to reduce or delay visible signs of aging on the skin. These products typically aim to address concerns such as fine lines and wrinkles, uneven skin tone, age spots, sun damage, loss of skin elasticity and firmness, and overall dryness and dullness. To fight these issues, anti-aging products often incorporate common ingredients like retinoids, antioxidants, peptides, hyaluronic acid, alpha-hydroxy acids (AHAs) , and sunscreen agents. These formulations come in various forms, including serums, moisturizers, eye creams, face masks, and night creams, each tailored to target specific aging concerns and skin areas.

Key Takeaways

The anti aging products market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major anti aging products industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

As the global population ages, particularly in regions such as Asia-Pacific and Europe, the anti aging products market demand has increased. According to U.S. Census Bureau, the increase in life expectancy and the growing proportion of individuals aged 65 and older drive the market for products designed to combat the visible signs of aging. In 2020, there were over 414 million people aged 65 and older in Asia alone, a number projected to more than triple by 2060??.

This demographic shift leads to increased consumer awareness and demand for skincare products that address wrinkles, fine lines, and age spots. As a result, companies are innovating and expanding their anti aging product lines to cater to this burgeoning market segment, thus propelling the overall market growth.

However, the intense competition among numerous players, both established and emerging faces significant restraint. This competitive environment leads to market saturation, making it challenging for individual brands to differentiate themselves and capture anti aging products market.

Companies often engage in aggressive pricing strategies, frequent promotional activities, and continuous product innovations to stay ahead of competitors. While these practices benefit consumers through lower prices and a variety of choices, they squeeze profit margins for manufacturers and create barriers for new entrants. In addition, intense competition may lead to skepticism among consumers regarding the efficacy of various products, further complicating market dynamics and potentially hampering growth of anti aging products market share.

Moreover, the increasing awareness and acceptance of skincare routines among men are creating significant opportunities for anti aging products market growth. Traditionally dominated by female consumers, the market is witnessing a growing demand from male consumers seeking solutions for aging-related skin concerns such as wrinkles, fine lines, and dark spots. This shift is driven by changing societal norms and greater emphasis on personal grooming and appearance among men.

Companies are responding by developing and marketing targeted anti-aging products specifically formulated for men's skin, which tends to be thicker and more prone to oiliness. This expanding consumer base offers new revenue streams and growth prospects for the industry, encouraging innovation and diversification in product offerings.

General Skincare Statistics

Unsurprisingly, moisturizers (used by 93% of respondents in a survey) , cleansers (85%) , and sunscreens (83%) are the top three most used skincare products. These essentials form the foundation of a good skincare routine.

While cleansers and moisturizers reign supreme, many people incorporate additional products. Eye creams (65%) , serums (57%) , and exfoliators (55%) are popular choices. These target specific concerns like wrinkles, dark circles, and uneven skin tone.

- Skincare is becoming a priority for everyone, regardless of gender. While women traditionally make up a larger portion of skincare users, the men’s skincare market is experiencing a surge, growing by a whopping 400% in the last five years.

- Gen Z (aged 18-24) is leading the charge. A survey found that 41% of Gen Z shoppers prioritize spending on skincare products over other beauty categories.

- Most people, almost 74%, have a dedicated skincare routine, with separate regimens for morning and night.

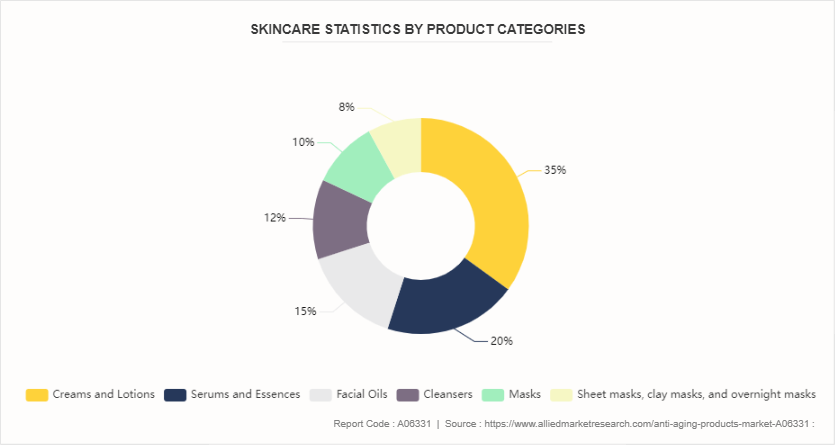

Skincare Statistics by Product Categories in 2024

According to coolest gadgets, the skincare statistics for 2024 reveal a detailed breakdown of market shares and popular products within various categories. Creams and lotions dominate the market with a 35% share, highlighting their critical role in daily skincare routines. Popular items in this category include moisturizers, anti-aging creams, and sunblock creams, which cater to hydration, protection, and aging concerns.

Serums and essences hold a 20% market share, with a focus on highly concentrated treatments like Vitamin C serums, hyaluronic acid serums, and retinol serums. These products are favored for their targeted benefits, such as brightening, hydration, and anti-aging.

Facial oils, comprising 15% of the market, include popular choices like argan oil, jojoba oil, and rosehip oil. These oils are celebrated for their nourishing and rejuvenating properties, making them a staple in many skincare regimens.

Cleansers account for 12% of the market share, with foam cleansers, gel cleansers, and micellar water being the top picks. These products are essential for removing impurities and maintaining skin health.

Masks represent 10% of the market, featuring sheet masks, clay masks, and overnight masks. These products provide intensive treatments for hydration, detoxification, and overnight repair.

The final category, with an 8% market share, includes toners, exfoliating scrubs, and eye creams. These products are crucial for refining skin texture, exfoliation, and addressing delicate eye area concerns.

The Average Revenue Per Capita For 2023

As per Skincare Statistics, in 2023, the average revenue per Capita of Bay and Child skincare products was USD 0.60, followed by body (USD 4.07) , face (USD 14.18) , natural skin care (USD 3.33) , and sun protection (USD 1.41) .

The Average Revenue Per Capita For 2023

Year | Baby and Child | Body | Face | Natural Skin Care | Sun Protection |

2023 (Billion) | 0.6 | 4.07 | 14.18 | 3.33 | 1.41 |

Skincare Statistics by Gender Usage Share, 2024

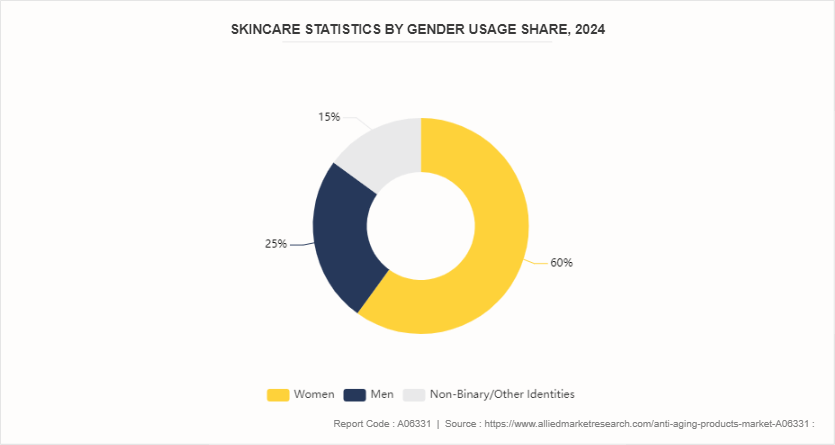

The skincare market statistics by gender usage share for 2024 reveal distinct patterns in market share, annual growth rates, key product purchase categories, and average annual spending per person.

As per the anti aging products market overview, women represent the largest segment, holding a 60% market share with an annual growth rate of 7%. Their primary skincare purchases include moisturizers (35%) , serums (25%) , and anti-aging creams (20%) . The average annual spending per woman on skincare products is USD 250, reflecting a strong investment in maintaining and enhancing skin health. Men make up 25% of the market, experiencing an 8% annual growth rate.

Their key product categories are beard care products (30%) , acne treatments (20%) , and moisturizers (15%) . Men spend an average of USD 150 annually on skincare, indicating a growing awareness and commitment to skincare routines. Non-binary and other identities account for 15% of the market with the highest annual growth rate of 10%. Their focus is on gender-neutral skincare products (40%) , specialized treatments (25%) , and natural and organic products (20%) . The average annual spending per person in this group is USD 200, showcasing a preference for inclusive and diverse skincare options.

Skincare Statistics Average Annual Spending per Person (USD) by Gender, 2024

Gender | Average Annual Spending per Person (USD) |

Women | 250 |

Men | 150 |

Non-Binary/Other Identities | 200 |

These statistics highlight the varying preferences and spending habits across different gender groups, highlighting the anti aging products market in the skincare industry.

Market Segmentation

The anti aging products market is segmented into product type, end user, and region. On the basis of product type, the market is divided into facial creams and lotions, serums and concentrates, under eye creams, others. As per end user, the market is segregated male and female. On the basis of distribution channel, the market is divided into supermarkets/hypermarkets, specialty stores, pharmacies/drug stores, online retail stores, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Asia-Pacific region holds the largest share in the anti aging products market primarily due to its rapidly aging population. The region is experiencing an unprecedented demographic shift with a significant increase in the elderly population. As of 2020, according to U.S. Census Bureau, the Asia-Pacific had over 414 million people aged 65 and older, a number projected to more than triple to over 1.2 billion by 2060. This shift is driven by rapid declines in fertility and mortality rates, leading to higher life expectancy and a growing need for anti-aging products to cater to this demographic??. Consequently, the demand for products that address age-related skin concerns has surged, positioning the Asia-Pacific region as a dominant player in the global anti aging market.

Skincare Revenue Comparison by Country

Country | Revenue ($Bn) |

U.S | 24.35 |

Japan | 22.31 |

China | 21.67 |

India | 9.88 |

South Korea | 9.06 |

Indonesia | 2.76 |

U.K | 4.46 |

France | 5.11 |

Germany | 5.72 |

Italy | 3.19 |

Russia | 5.75 |

Spain | 2.79 |

Industry Trends:

Emerging Anti Aging Ingredients: The use of active ingredients to minimize ageing symptoms like wrinkles, fine lines, etc., is the latest anti aging skincare trend in the market. Among them, ingredients such as Bakuchiol, Squalane, etc., are being used on a large scale. Alpha-hydroxy acids are also being used on a large scale to minimize ageing lines, wrinkles, dark circles, and more. Other active ingredients, including niacinamide, ceramides, etc., are also popular among the leading anti ageing skincare brands. These powerful ingredients make the anti ageing products beneficial for consumers.

Natural & Organic Anti Ageing Products: While the use of active ingredients in anti-ageing products is on the rise, the trends in the anti-ageing skincare market are also influenced by consumer preferences. Nowadays, consumers are increasingly aware of the benefits of using natural and organic products. So, they check the ingredients list carefully and appreciate the transparent disclosure of ingredients by anti ageing brands. At the same time, consumers want brands to adopt sustainable and eco-friendly means of manufacturing their anti aging skincare products. So, they prefer brands that follow sustainable manufacturing and sourcing practices. This not only increases their trust but also helps the brands to improve their brand reputation.

Multifunctioning Anti Aging Products: In today’s fast-paced world, consumers are looking for efficient and effective skin care solutions. Multifunctioning anti-aging products meet this demand by offering multiple benefits in a single product, like a sunscreen that protects skin against UV damage, while also having moisturizing and anti-aging properties. This trend reflects the latest anti-aging skin care advancements where convenience is the key feature. Products that can provide comprehensive care while saving time are becoming increasingly popular anti-aging skin care choices. While multifunctioning anti-aging products offer the convenience of combining multiple skin benefits into one, it’s important to consider all aspects to ensure they align with users skin care needs.

Competitive Landscape

The major players operating in the anti aging products market include Estee Lauder Inc., Procter & Gamble, Unilever, LOreal SA, Oriflame Cosmetics AG, Beiersdorf Global, Shiseido Company Limited, Groupe Clarins, Caudalie and Natura & Co.

Recent Key Strategies and Developments

In April 2024, Nivea expanded its anti-aging product portfolio by launching the Q10 Dual Action serum. The company claims that the serum targets sugar-induced skin aging and wrinkle formation. The formula was designed to prevent protein glycation in the dermis skin layer, protecting collagen and elastin from damage.

L'Oréal Canada launched SkinBetter Science, a medical aesthetic skincare brand, adding it to the L'Oréal Dermatological Beauty (LDB) division. The brand claimed that SkinBetter Science is currently distributed across Canada and on the www.skinbetter.ca.

In In January 2024, Estée Lauder unveil its newest product innovation, new Re-Nutriv Ultimate Diamond Transformative Brilliance Soft Crème, with SIRTIVITY-LP™ which reveals visible age reversal starting in just 14 days.

In August 2023, OLAY is introduced its latest technological breakthrough, OLAY Super Serum, a superpowered skin care innovation that includes activated niacinamide, as well as vitamin C, collagen peptide, vitamin E and alpha hydroxy acid (AHA) — all working together to deliver an unparalleled skin transformation.

Key Sources Referred

Beauty Packaging Magazine

Scottmax

Coolest Gadgets

DSM

China Beauty Expo

Beauty Matter

Medical News Today

Skin Inc.

China Briefing

Exploding Topics

World Crunch

Global Cosmetic Industry

Healthcare Radius

Annmarie

U.S. Sensus Bureau

Key Benefits for Stakeholders

This report provides a quantitative analysis of the anti aging products market segment, current trends, estimations, and dynamics of the anti aging products market analysis from 2024 to 2034 to identify the prevailing anti aging products market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the anti aging products market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global anti aging products market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global anti aging products market trends, key players, market segments, application areas, and market growth strategies.

Anti Aging Products Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 108.5 Billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 195 |

| By Product Type |

|

| By End User |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Procter & Gamble, Groupe Clarins, LOreal SA, Natura & Co., Beiersdorf Global, Caudalie, Oriflame Cosmetics AG, Shiseido Company Limited, Estee Lauder Inc., Hindustan Unilever Ltd |

Emerging trends in the global anti aging products market include a shift towards natural and organic ingredients, personalized skincare solutions utilizing AI and biotechnology, and multi-functional products that combine anti-aging benefits with sun protection and pollution defense.

The leading application of the anti aging products market is facial skincare. This primarily focuses on reducing visible signs of aging such as wrinkles, fine lines, and age spots, while also improving skin firmness, elasticity, and overall texture. These products aim to help consumers maintain a more youthful appearance as they age.

Asia-Pacific is the largest regional market for Anti aging products?

The anti aging products market was valued at $55.8 billion in 2023, and is estimated to reach $108.5 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033

The Estee Lauder Inc., Procter & Gamble, Unilever, LOreal SA and Oriflame Cosmetics AG are the top companies to hold the market share in Anti aging products.

Loading Table Of Content...