Anti-fog Lidding Film Market Research, 2031

The global anti-fog lidding film market size was valued at $675.8 million in 2021, and is projected to reach $1.3 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

Anti-fog film is a high barrier film that prevents fogging when food is stored in containers and trays. These films provide longer shelf life and reduce food wastage. In addition, these films are heat resistant. They control the buildup of moisture and prevent food contamination & spoilage. Anti-fog film is generally made up of various Polyethylene (PE), Polyethylene Terephthalate (PET), polyamide & polypropylene (PP), polymers, and others. In addition, these films are widely used in the packaging of a variety of products such as dairy products, frozen foods, meat poultry, seafood, ready-to-eat products, confectionery, and bakeries.

Packaging is an important factor for any industry. Without proper packaging, the safety of the product inside the packaging cannot be ensured. The products must be protected from moisture so that the quality of the product could be maintained. The packaged food, which contains moisture in it generally tends to form water droplets on the packaging. This results in fogging on the package, which makes the customer unable to see the food product inside the packaging. Therefore, anti-fog lidding films are widely used to prevent the formation of fog. In addition, various packaged food products are transported to longer distances. To maintain the freshness of the packaged food product till it gets consumed, it must be packed appropriately. Appearance of the food product could be affected due to long distance transportation. Moreover, anti-fog lidding film prevents any damage to the food product by providing good tensile strength, excellent heat resistance, and UV & temperature stability. Therefore, such factors are expected to boost the anti-fog lidding film market growth.

Major players have adopted various strategies such as product launch and acquisition to sustain the competition and improve the product portfolio. For instance, in April 2021, Constantia Flexibles acquired Propak packaging in order to expand its packaging business throughout Turkey. This acquisition provides significant synergy opportunities and expands Constantia Flexibles' film packaging presence in a growing market.

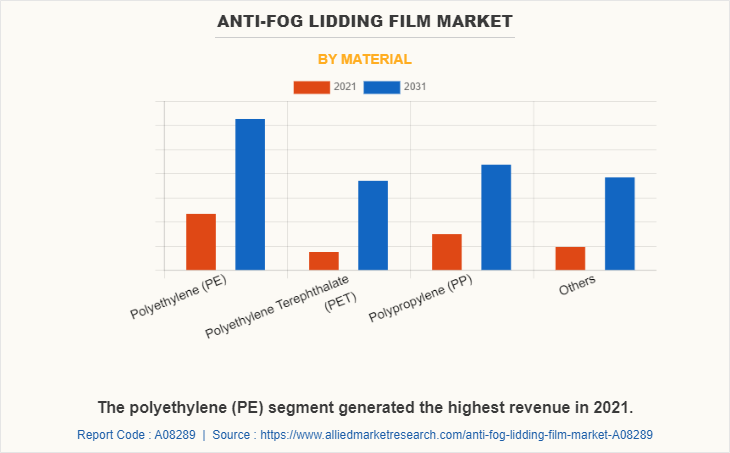

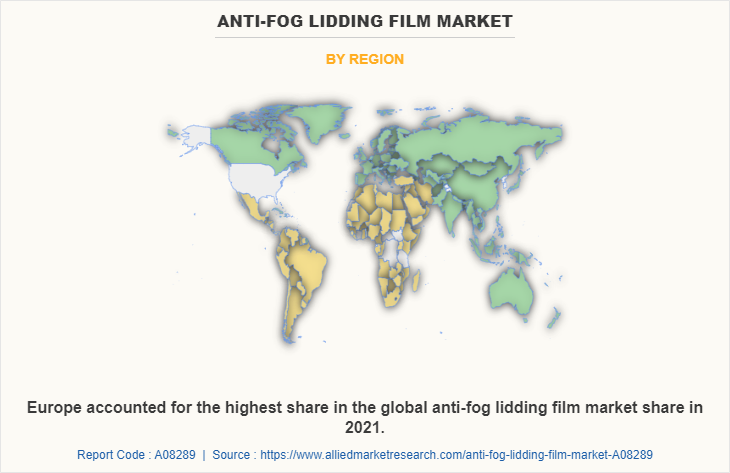

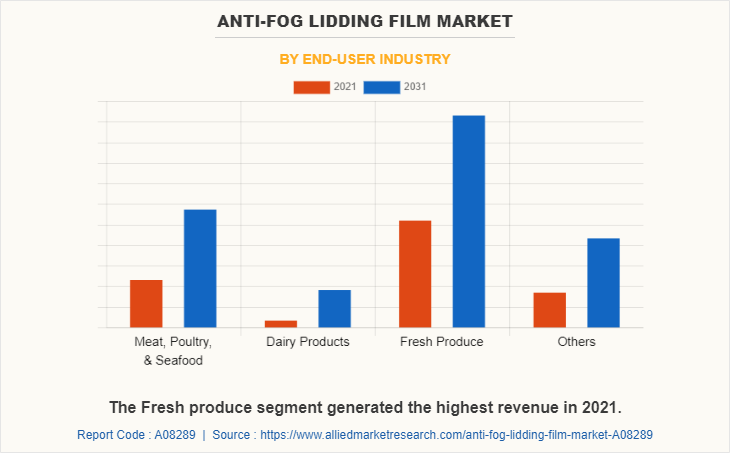

The anti-fog lidding film market is segmented into Material, End-user industry and Sealing type and region. On the basis of material, the market is divided into polyethylene (PE) polyethylene terephthalate (PET), polypropylene (PP), and others. On the basis of sealing type, the market is bifurcated into peelable films and resealable films. On the basis of end-user industry, the market is divided into meat, poultry, & seafood, dairy products, fresh produce, and others. Region-wise, the market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, Spain and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of material, the polyethylene (PE) segment generated the highest revenue in 2021, due to rise in demand for packaged food in various countries, which is expected to boost the anti-fog lidding film market opportunities.

On the basis of region, Europe registered the highest share in the global anti-fog lidding film market share in 2021, owing to surge in demand for food & beverage, which is expected to boost the demand for anti-fog lidding films during the forecast period.

On the basis of end user industry, the fresh produce segment accounted for the highest revenue in the global market in 2021 owing to increase in demand for home delivery of high-moisture foods, which provides the lucrative growth for the anti-fog lidding film market.

COMPETITION ANALYSIS

The key players that operate in the anti-fog lidding film market are American Packaging Corporation, Bemis Company Inc., Constantia Flexibles Group GmbH, Cosmo Films Ltd., Coveris Holdings SA, Effegidi International Spa, Flair Flexible Packaging Corporation, Flexopack SA., Mondi Group Plc, Plastopil Hazorea Company Ltd, ProAmpac Intermediate Inc., Rockwell Solutions Limited, RPC bpi group, Sealed Air Corporation, Toray Plastics (America), Inc., Uflex Ltd., and Winpak Ltd.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging global anti-fog lidding film market trends and dynamics.

- In-depth global anti-fog lidding film market analysis is conducted by constructing market estimations for key market segments between 2022 and 2031.

- Extensive analysis of anti-fog lidding film market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- Anti-fog lidding film market forecast analysis from 2022 to 2031 is included in the report.

- The key players with in anti-fog lidding film market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of anti-fog lidding film industry.

Anti-fog Lidding Film Market Report Highlights

| Aspects | Details |

| By Material |

|

| By End-user industry |

|

| By Sealing type |

|

| By Region |

|

| Key Market Players | Cosmo Films Ltd., Winpak Ltd., Flair Flexible Packaging Corporation, Sealed Air Corporation, Mondi Group Plc, Bemis Company Inc., Constantia Flexibles Group GmbH, american packaging corporation, Rockwell Solutions Limited, RPC bpi group, Flexopack SA., Toray Plastics (America) Inc, Plastopil Hazorea Company Ltd, Effegidi International Spa, Uflex Ltd.,, ProAmpac Intermediate Inc, Coveris Holdings SA |

Analyst Review

The anti-fog lidding film market has observed huge demand in North America, Asia-Pacific, and Europe. Europe is projected to register significant growth in near future owing to surge in demand for food & beverage, which is expected to boost the demand in the anti-fog lidding films market during the forecast period. Moreover, surge in demand for home delivery of high-moisture foods fosters the growth of the anti-fog lidding film market. The polyethylene (PE) segment generated the highest revenue in 2021, due to rise in demand for packaged foods in various countries, which is anticipated to boost the demand for anti-fog lidding film.

Various market players have adopted strategies, such as product launch, business expansion, acquisition, and agreement to expand their business and strengthen their market position. For instance, in November 2021, Winpak acquired the assets of Control Group, a leading provider of specialized printed packaging solutions to the pharmaceutical, healthcare, nutraceuticals, cosmetic, and personal care markets. This latest addition is expected to strengthen Winpak’s Value in the market. As a result, such strategic moves are anticipated to provide lucrative growth opportunities in the global anti-fog lidding film market.

Rise in demand for packaged food in various countries are the upcoming trends of Anti-fog Lidding Film Market in the world.

The fresh produce is the leading end-user industry of Anti-fog Lidding Film Market.

Europe is the largest regional market for Anti-fog Lidding Film.

The global anti-fog lidding film market size was valued at $675.8 million in 2021.

The key players that operate in the anti-fog lidding film market are American Packaging Corporation, Bemis Company Inc., Constantia Flexibles Group GmbH, Cosmo Films Ltd., Coveris Holdings SA, Effegidi International Spa, Flair Flexible Packaging Corporation, Flexopack SA., Mondi Group Plc, Plastopil Hazorea Company Ltd, ProAmpac Intermediate Inc., Rockwell Solutions Limited, RPC bpi group, Sealed Air Corporation, Toray Plastics (America) Inc., Uflex Ltd., and Winpak Ltd.

The top 17 market players are selected based on two key attributes - competitive strength and market positioning.

The base year considered in the global Anti-fog Lidding Film market is 2021.

The report contains an exclusive company profile section, where leading 17 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...