Anti-Viral Coatings Market Research - 2027

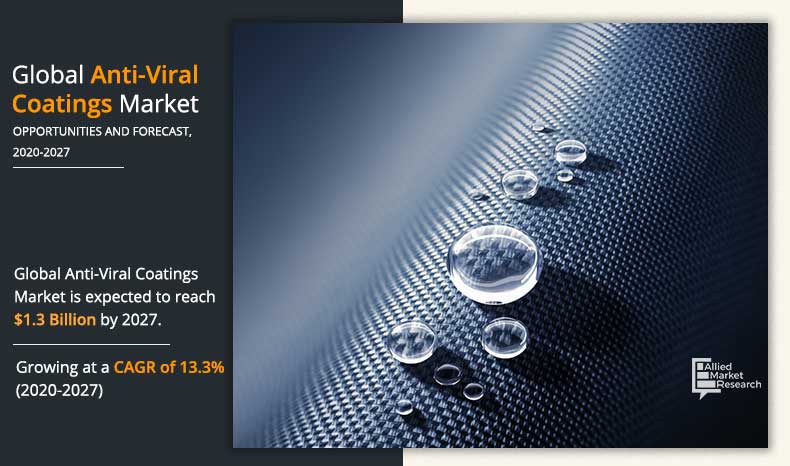

The global anti-viral coatings market size was valued at $0.5 billion in 2019 and is anticipated to generate $1.3 billion by 2027. The market is projected to experience growth at a CAGR of 13.3% from 2020 to 2027.

Viruses are a group of heterogeneous organisms that feed on the host’s body. They have no metabolic activity of their own and thus, completely depend on the host for living. The protection from virus can be done only when there contact with the living host is cut off. The molecular structure of virus contains a protein coat that protects them. However, when they are controlled on the surface level, they can be contained and further spread can be prevented. Anti-viral coatings are used for the purpose of containing the virus on the surface. The nano particles attack the virus’s surface and do not allow the protein formation, which cuts the further spread.

Anti-viral coatings market is driven by increased demand during the pandemic situation. The need for preventing the spread has driven the demand for anti-viral coatings further fostering the market growth. Moreover, high demand from indoor air/HVAC applications have also positively impacted the market growth. However, lower R&D activities and lack of demonstration proving the effectiveness of such coatings have always restrained the market growth. Meanwhile, challenges faced during the pandemic have certainly made industries aware about the importance of such coatings and has opened opportunities for the industry growth. Research and development activities are being carried out at deeper level and faster pace, which can soon result into enhanced and more reliable solutions, offering wide opportunities for the industry growth.

The key players operating in the anti-viral coatings industry are Arkema, Dais Corporation, Hydromer, Kobe Steel, Ltd., nano Care Deutschland AG, Nippon Paints, EnvisionSQ, Bio-Fence, Bio-Gate AG, and GrapheneCA. The players are continuously researching and working toward finding the impact of several coatings on coronavirus.

By Type

Nano Coatings is projected as the most lucrative segment.

Anti-viral coatings Market, by Type of Coatings

Based on type of coatings, the high-performance coatings segment dominated the market owing to its wide use. However, nano coatings segment is expected to grow at faster pace owing to their demonstrated effectiveness against viruses. Moreover, the ease of incorporating nano particles into the coatings material also acts as driving factor for anti-viral coatings market growth.

By Material

Silver is projected as the most lucrative segment.

Anti-viral coatings Market, by Type of Material

Depending on type of material, silver dominated the market share followed by copper. Silver and copper have been used for long time as anti-bacterial and anti-viral as they are toxic to micro-organisms. The use of silver and copper have not shown any harmful effects on human beings and hence, they are widely used for several medical purposes. Moreover, as they both have abundant natural occurrence, thus, ease in availability in large amounts also acts as driving factor for the anti-viral coatings market growth.

By Application

Medical is projected as the most lucrative segment.

Anti-viral coatings Market, by Application

On the basis of application, the medical segment dominated the market share and is expected to do so during the forecast period. This is due to their wide use in medical products, surfaces, door handles, devices, and others that require regular cleaning and disinfection owing to the nature of the industry. Moreover, during the current pandemic outbreak, the disinfection and regular sanitization of surfaces has changed the way the world is living. Thus, anti-viral coatings offer long and reliable solution with hopes in cutting down the numbers of disinfection and sanitization activities even on per day basis.

By Form

Liquid is projected as the most lucrative segment.

Anti-viral coatings Market, by Form

Based on form, liquid coatings dominated the market share, however, spray coatings are expected to drive the market growth owing to ease of use andexpected demand from commercial and residential sectors.

By Region

North America is projected as the most lucrative market.

Anti-viral coatings Market, by Region

North America dominated the market share in 2019. However, the rise in demand from across the world is expected owing to the COVID-19 outbreak. The most affected areas in the world are anticipated to boost the demand for anti-viral coatings as they are effective in preventing the spread of virus.

Key Benefits For Stakeholders

- The report provides an in-depth analysis and anti-viral coatings market forecast along with the current and future market trends.

- This report highlights the key drivers, opportunities, and restraints of the anti-viral coatings market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the anti-viral coatings industry for strategy building.

- A comprehensive analysis of the factors that drive and restrain the market growth is provided.

- The qualitative data in this report aims on anti-viral coatings market trends, dynamics, and developments.

- The report provides extensive qualitative insights on the significant segments and regions exhibiting favorable anti-viral coatings market share.

Anti-Viral Coatings Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Material |

|

| By Application |

|

| By Form |

|

| By Region |

|

| Key Market Players | Hydromer, Inc., Dais Corporation, EnvisionSQ, Kobe Steel, Ltd., GrapheneCA, Bio-Fence, Arkema, Nippon Paint Holdings Co., Ltd., Nano-Care Deutschland AG, Bio-Gate AG |

Analyst Review

Anti-viral coatings are used in preventing spread of viruses on surfaces. The anti-viral coatings market had a significant share in the anti-microbial coatings market. The COVID-19 outbreak has increased the demand for disinfection of surfaces and led to regular cleaning activities. The regular cleaning activities and deep level sanitization can be costly and a rigorous & tiring activity. Anti-viral coatings offer protection for longer time period as it prevents surface spread. The rising demand for anti-viral coatings from medical industry as well as commercial & residential sectors owing to COVID-19 outbreak acts as a driving factor for the anti-viral coatings market growth. Moreover, demand from indoor air/HVAC applications also drives the anti-viral coatings market growth. However, lacking R&D activities in the sector acts as restraint for the market growth. Meanwhile, COVID-19 outbreak has opened new opportunities for the market growth as market players are investing huge amounts in R&D activities.

The total market size of global Anti-Viral Coatings Market is $0.5 billion in 2019.

Arkema, Dais Corporation, Hydromer, Inc., Kobe Steel, Ltd., nano Care Deutschland AG, Nippon Paints, EnvisionSQ, Bio-Fence, Bio-Gate AG, and GrapheneCA are the emerging players in the industry.

Medical and protective clothing industry is the major are of development in the industry followed by mining and aviation.

Medical, packaging, air & water treatment, and building & construction industry is projected to increase demand for anti-viral coatings market.

Anti-viral coatings market is driven by increased demand during the pandemic situation. The need for preventing the spread has driven the demand for anti-viral coatings further fostering the market growth.

The most influencing segment is liquid coatings and nano coatings in terms of form and type of coatings respectively.

North America holds the maximum market share of the Anti-Viral Coatings market.

Medical device coatings, protective clothing coatings, package coatings, and air & water treatment are expected to drive the adoption of Anti-Viral Coatings.

Loading Table Of Content...