Aortic Endografts Market Research, 2034

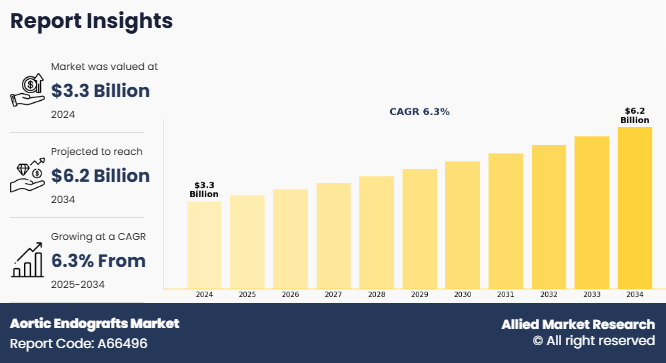

The global aortic endografts market was valued at $3.3 billion in 2024, and is projected to reach $6.2 billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034. Aortic endografts are specialized medical devices used in endovascular procedures to treat aortic aneurysms, particularly abdominal and thoracic aortic aneurysms. For instance, according to the World Health Organization in 2023, an estimated 1.28 billion adults aged 30–79 years worldwide had hypertension, thereby increasing the chances of aneurysms.

With more patients being diagnosed through improved screening and imaging technologies, the need for effective and timely treatment has risen, thus boosting demand for endovascular solutions. Aortic grafts are inserted through the blood vessels and placed inside the aorta to reinforce the weakened section, thus reducing the risk of rupture. They offer a minimally invasive alternative open surgical repair, leading to faster recovery and fewer complications.

Key Takeaways

- By type, the abdominal aortic endografts segment was the largest contributor to the aortic endografts market size in 2024 and thoracic aortic endografts are expected to register the highest CAGR during the forecast period.

- By procedure, the endovascular aortic aneurysm repair was the largest contributor to the aortic endografts market size in 2024 and the frozen elephant trunk segment is expected to register the highest CAGR during the forecast period.

- By end user, the hospitals segment dominated the aortic endografts market share in 2024 and is expected to grow at the highest CAGR during the forecast period.

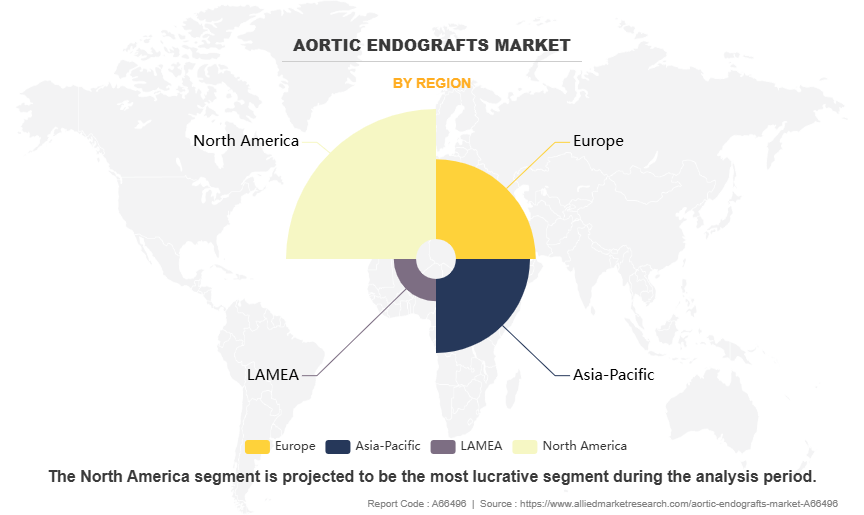

- Region wise, North America generated the largest aortic endografts market share in 2024. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The aortic endografts market growth is primarily driven by the increasing incidence of aortic aneurysms, particularly abdominal aortic aneurysms (AAA) and thoracic aortic aneurysms (TAA), among aging populations worldwide. Patients and clinicians are increasingly favoring endovascular aneurysm repair (EVAR) and thoracic endovascular aortic repair (TEVAR) over traditional open surgery due to their minimally invasive nature. These procedures significantly reduce hospital stays, lower complication rates, and offer quicker recovery factors that accelerate the shift toward endograft based treatments.

Additionally, modern aortic endografts, typically composed of biocompatible materials like ePTFE and polyester, are designed to withstand complex anatomical challenges while providing long-term durability. Advancements in device design such as fenestrated and branched endografts allow treatment of aneurysms near vital arterial branches, which were previously deemed inoperable. These innovations provide surgeons with more precise, customizable, and safe treatment options, especially in high-risk or elderly patients who are unsuitable for open repair, thus driving aortic endografts market outlook.

The increasing awareness of aortic aneurysms through routine imaging and early screening programs is further expanding the candidate pool for endograft procedures, thereby driving aortic endografts market growth. As diagnostic technologies improve and become more accessible, more aneurysms are being detected at earlier, more treatable stages, thus supporting aortic endografts market opportunity. This trend is especially pronounced in developed nations with advanced healthcare systems and reimbursement frameworks supporting EVAR/TEVAR.

Moreover, social and economic factors such as aging demographics, rising lifestyle-related comorbidities like hypertension and smoking, and growing healthcare expenditure are playing a crucial role in driving demand for endografts. Technological progress in imaging-guided navigation systems, 3D printing for patient-specific grafts, and minimally invasive techniques are improving surgical precision and outcomes, thereby enhancing adoption among both surgeons and patients.

However, one of the major restraint aortic endografts industry is the high cost associated with aortic endograft devices and the procedure itself, which can limit accessibility, particularly in low- and middle-income countries. Additionally, concerns over device migration, endoleaks, and long-term durability, especially in younger or more active patients, pose clinical and regulatory challenges. Device recalls and strict post-market surveillance also impact manufacturer profitability and patient confidence.

Despite these challenges, emerging economies present significant growth opportunities for the aortic endografts market. Countries across Asia-Pacific, Latin America, and the Middle East are experiencing increasing healthcare investments, improved diagnostic infrastructure, and growing awareness of endovascular treatment options. As these regions continue to modernize their healthcare systems, the demand for safer, less invasive cardiovascular procedures is expected to surge, making them key markets for aortic endografts market forecast.

Segmental Overview

The aortic endograft market is segmented into type, procedure, end user, and region. By type, the market is categorized into abdominal aortic endografts and thoracic aortic endografts. On the basis of procedure, it is segregated into open surgery, endovascular aortic aneurysm repair, and frozen elephant trunk. On the basis of end user, the market is categorized into hospitals, ambulatory surgical centers, and others.

Region-wise, the aortic endografts market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Type

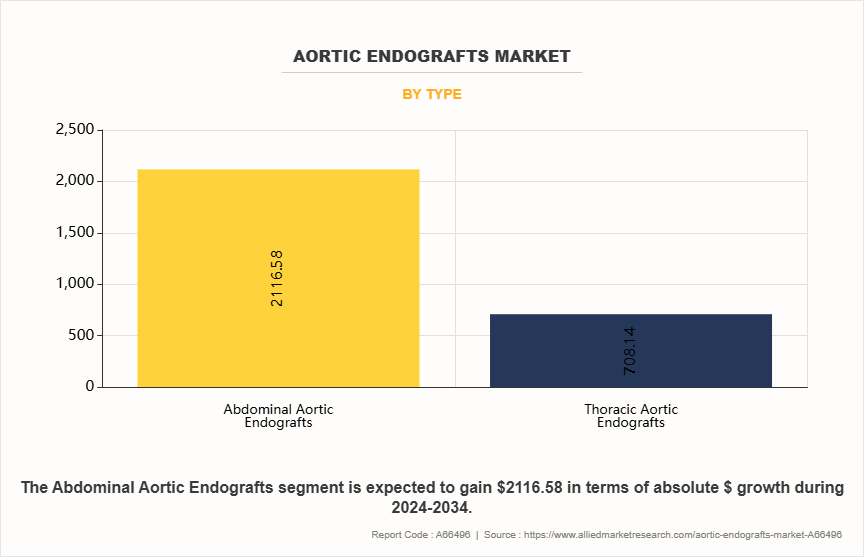

The abdominal aortic endografts segment accounted for the largest aortic endografts market share in 2024 owing to the higher incidence of abdominal aortic aneurysms (AAAs) compared to thoracic aneurysms. Their minimally invasive approach, combined with improved device designs, has increased adoption, especially in aging populations with comorbidities.

However, the thoracic aortic endografts is projected to register the highest CAGR during the aortic endografts market forecast period owing to rising incidence of thoracic aortic aneurysms and dissections, along with growing adoption of minimally invasive thoracic repair procedures. Additionally, technological advancements like branched and fenestrated thoracic stent grafts are expanding treatment options for complex anatomies, thus driving higher adoption.

By Procedure Type

By procedure type, the aortic endografts market is classified into open surgery, endovascular aortic aneurysm repair and frozen elephant trunk (FET). The endovascular aortic aneurysm repair segment occupied highest aortic endografts market share in 2024 and is expected to remain dominant during the forecast period, owing to its minimally invasive nature, offering significant clinical and economic advantages over traditional open surgical repair. Moreover, shorter hospital stays and faster recovery allow patients, particularly elderly and high-risk individuals, to resume normal activities sooner.

However, the frozen elephant trunk (FET) is projected to register the highest CAGR during the aortic endografts market forecast period owing to advantages over traditional open surgical repair in terms of reduced invasiveness and postoperative complications. Furthermore, advancements in surgical techniques and the development of specialized devices have improved the effectiveness and safety of the FET procedure.

By End User

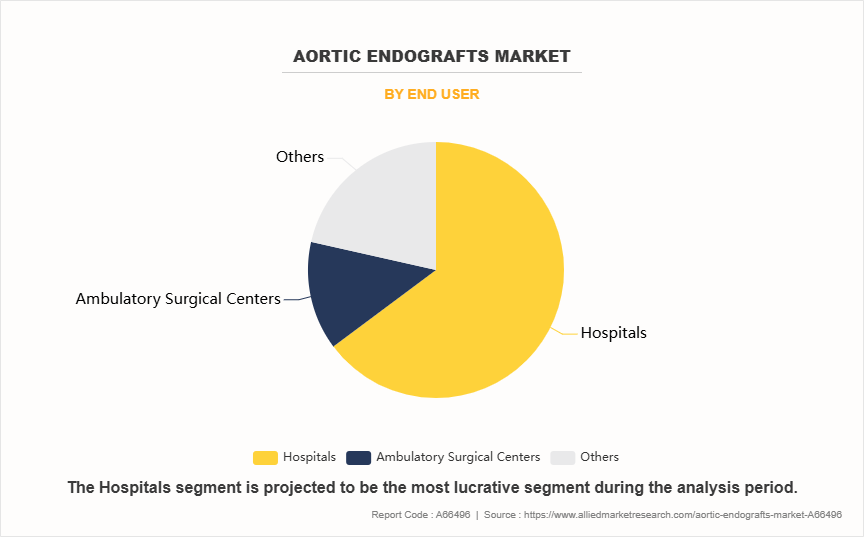

By end user, the market is categorized into hospitals, ambulatory surgical centers, and others. The hospitals segment accounted for the largest aortic endografts market share in 2024 and is expected to grow at the fastest CAGR during the forecast period due to the availability of advanced imaging, surgical infrastructure, and skilled vascular teams necessary for performing procedures and managing postoperative care efficiently.

By Region

The aortic endografts market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in terms of revenue in 2024. The growth in the region is attributed to strong healthcare & cardiovascular infrastructure, high procedural volumes, and increasing adoption of minimally invasive technologies. The region benefits from robust healthcare funding, well-established reimbursement systems, and early access to next-generation aortic repair devices.

The U.S. aortic endografts market is anticipated to contribute the largest share of the regional market, driven by a high prevalence of aortic aneurysms, a large aging population, and the presence of leading manufacturers, advanced skilled healthcare vascular surgeons and interventional radiologists. Moreover, product launches, widespread use of hybrid operating rooms, and collaboration between medical device manufacturers and academic hospitals further accelerate growth in this region.

However, the Asia-Pacific aortic endografts market is projected to grow at the highest CAGR due to increasing prevalence of hypertension, awareness, improving diagnostic capabilities, and rising investments in cardiovascular healthcare. Growing healthcare expenditure, a high population base, and the shift toward minimally invasive procedures are driving rapid growth in this region.

Furthermore, growth in geriatric population, and rise in number of individuals with hypertension, which is associated as a risk factor for aortic aneurysm are further fueling the market growth. The expansion of tertiary care hospitals and specialized cardiac centers also supports demand for endografts in this region.

Competition Analysis

Major key players that operate in the global aortic endografts industry are Medtronic plc, Artivion, Inc, Terumo Corporation, W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, Cook Group Inc, ENDOLOGIX LLC, Cordis Corporation., Bentley InnoMed GmbH, and Braile Biomédica S.

Recent Developments in Aortic Endograft Industry

- In August 2024, Terumo India announced the launch of the TREO Stent-Graft System, an advanced solution for Endovascular Aneurysm Repair (EVAR).

- In May 2023, Terumo Aortic received the U.S. Food and Drug Administration (FDA) approval of the Relay Pro Thoracic Stent-Graft device for the treatment of dissection and transection in the U.S.

- In April 2022, Terumo Aortic received the U.S. Food and Drug Administration (FDA) approval of the Thoraflex Hybrid Frozen Elephant Trunk (FET) device for commercial sale in the U.S. for the treatment of patients with complex aortic arch disease.

- In March 2022, Terumo Aortic received the U.S. Food and Drug Administration (FDA) grant of Breakthrough Device Designation for the RelayBranch Thoracic Stent-Graft System. The RelayBranch Thoracic Stent-Graft System is implanted in patients with thoracic aortic arch pathologies requiring treatment that includes coverage of the innominate and left common carotid arteries.

- In April 2025, MicroPort Endovascular MedTech, a subsidiary of MicroPort Scientific Corporation announced that its Talos Thoracic Stent Graft System (Talos) received marketing approval in Brazil and Argentina, thus improving patient access to advanced aortic therapies.

- In May 2023, MicroPort Endovascular MedTech, a subsidiary of MicroPort Scientific Corporation, received registration approval from the Health Sciences Authority of Singapore for its Minos Abdominal Aortic Stent-Graft and Delivery System.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aortic endografts market analysis from 2024 to 2034 to identify the prevailing aortic endografts market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aortic endografts market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aortic endografts market trends, key players, market segments, application areas, and market growth strategies.

Aortic Endografts Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 6.2 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2034 |

| Report Pages | 314 |

| By Type |

|

| By Procedure |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bentley InnoMed GmbH, Terumo Corporation, Cordis Corporation, Braile Biomédica S.A., Cook Group, Medtronic plc, W. L. Gore & Associates, Inc., MicroPort Scientific Corporation, Artivion, Inc., Endologix Inc. |

Analyst Review

This section provides insights from top-level CXOs in the global aortic endograft market. According to CXOs, the market is poised for strong growth, primarily driven by rise in incidence of aortic aneurysms, increase in preference for minimally invasive vascular procedures and advancements in endograft technologies. As patient awareness grows and early diagnosis improves, endovascular procedures like EVAR are becoming the standard of care, especially for high-risk or elderly patients.

CXOs also emphasized that the shift toward minimally invasive interventions is accelerating, owing to reduced recovery time, lower procedural risks, and shorter hospital stays compared to open surgery. The integration of advanced imaging systems and the development of next-generation stent-grafts tailored for complex anatomies have significantly broadened the eligible patient population. Additionally, collaborations between device manufacturers, hospitals, and vascular specialists are enhancing clinical outcomes and expanding treatment access globally.

North America dominated the aortic endograft market in 2024, supported by a well-established healthcare infrastructure, early adoption of advanced surgical techniques, and the presence of major medical device players. However, CXOs believe that the Asia-Pacific region is expected to exhibit the fastest growth during the forecast period. This growth is attributed to rising healthcare investments, an aging population, increasing prevalence of cardiovascular diseases, and improved access to vascular care in emerging economies like China and India. Moreover, government initiatives to expand healthcare coverage and upgrade medical technologies are expected to further accelerate adoption in the region.

2024 is the base year of aortic endografts market.

Abdominal aortic endografts is the leading type of aortic endografts

The aortic endografts market was valued at $3.3 billion in 2024.

North America is the largest regional market for aortic endografts.

2025-2034 is the forecast year of aortic endografts market.

The top companies that operate in the global aortic endograft market are Medtronic plc, Artivion, Inc, Terumo Corporation, W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, Cook Group Inc, ENDOLOGIX LLC , Cordis Corporation., Bentley InnoMed GmbH, and Braile Biomédica S.A.

Loading Table Of Content...

Loading Research Methodology...