API Intermediate Market Research, 2032

The global API intermediate market was valued at $139.4 billion in 2022, and is projected to reach $285 billion by 2032, growing at a CAGR of 7.4% from 2023 to 2032. API intermediates, also known as active pharmaceutical ingredient intermediates, are chemical compounds that are produced and used during the synthesis of active pharmaceutical ingredients (APIs), which are the key components in pharmaceutical drugs. These intermediates play a crucial role in the pharmaceutical manufacturing process and have several applications. API intermediates are used in the research and development phase of new pharmaceutical compounds. API intermediates serve as building blocks or precursor molecules for the synthesis of APIs. API intermediates are employed as reference standards in quality control procedures.

It is used to establish the identity, purity, and potency of APIs during various stages of the manufacturing process. Intermediates with known properties serve as benchmark materials for analytical testing, ensuring that the final API meets the required quality standards.

Historical Overview

The API intermediates market share was analyzed qualitatively and quantitatively from 2022 to 2032. The API intermediates market experienced growth at a CAGR of around 7.4% from 2022 to 2032. Most of the growth during this period was derived from North America, owing to the presence of key players that manufacture API intermediates and increase in the prevalence of chronic diseases such as cardiovascular disease, cancer, orthopedic diseases, and others.

Market Dynamics

Growth of the global API intermediates market size is majorly driven by rise in the number of populations suffering from chronic diseases, increase in number of geriatric populations, and high presence of market players. Increase in prevalence of chronic diseases is anticipated to fuel the demand for API intermediates and is expected to drive the growth of the market. For instance, API intermediates are used in production of cardiovascular drugs, anti-cancer drugs, antihistamine drugs, anti-psychotic drugs, anti-diabetic drugs, gastrointestinal disease drugs, pulmonary disease related drugs, and others. Thus, rise in prevalence of chronic diseases such as cardiac diseases, cancer, respiratory disorders, and orthopedic diseases is anticipated to drive the growth of the market.

For instance, according to Center for Disease Control and Prevention (CDC), in 2021, around 523 million people had some form of cardiovascular disease (CVD) globally, and approximately 19 million deaths were attributable to CVD, which represents approximately 32% of all global deaths and is an increase of 18.7% from 2010. Moreover, increase in prevalence of cancer also boosts the market growth. For instance, according to World Health Organization (WHO), in 2020, around 22,61,419 population were suffering from breast cancer, 2206771 were suffering from lung cancer, and 1931590 were suffering from colorectal cancer. Thus, rise in prevalence of chronic disease is expected to increase the demand for drugs and boost the growth of the API intermediates market size.

High presence of market players who manufacture API intermediates is expected to drive the market growth during the forecast period. For instance, Shubham Specialty Products, Akums Drugs & Pharmaceuticals Ltd., Vasoya industrial Pvt. Lmt., Corey Organics, Icon Pharma Chem and SLN Pharmachem, Anyang General Chemical Co., Ltd., Sandoo Pharmaceuticals, Evonik Industries AG, Shree Ganesh Remedies Limited, Pfizer, Cambrex Corporation, Zeal & Innovation in Medicine, Cation Pharma, Hikal Ltd., and Espee are major market players who manufacture veterinary intermediate and human medicine intermediates.

Moreover, rise in number of manufacturing units for development of API intermediates is expected to drive the growth of the market. For instance, in March 2022, Sumitomo Chemical Co., Ltd., a major Japanese chemical company, constructed a new manufacturing plant for active pharmaceutical ingredients (APIs) and intermediates for small molecule drugs at its Oita Works (Oita City, Oita Prefecture, Japan) to enhance the company’s capacity to supply a variety of high-quality APIs and intermediates in response to the rise in demand for small molecule drugs.

Rise in the geriatric populations is anticipated to increase the prevalence of chronic diseases such as cardiac diseases, orthopedic diseases, gastrointestinal diseases, and others. Thus, this factor is expected to fuel the growth of the API intermediates market. The geriatric population is highly susceptible to cardiac diseases due to a variety of factors such as lack of physical activity, frailty, obesity, and other diseases such as diabetes and arteriosclerosis.

In addition, alarming increase in prevalence of comorbidities such as high blood pressure, high cholesterol, and diabetes, can further increase their risk of developing cardiac diseases. Therefore, rise in aging population coupled with sedentary lifestyle increases the risk of developing heart diseases. Thus, increase in number of geriatric populations suffering from heart disease is anticipated to drive the demand for cardiovascular drugs and API intermediates for formulation of those drugs. Hence, this factor fuels the market growth.

For instance, according to the British Heart Foundation, in 2023, around 25,971 population from age group 65 years to 74 years, 48,619 population from age group 75 year to 84 year, and 71,455 population of age group above 85 are suffering from heart and circulatory diseases in the UK. Moreover, geriatric population is susceptible to orthopedic diseases such as osteoporosis. Thus, increase in prevalence of osteoporosis is anticipated to boost the growth of the market. For instance, according to National Library of Medicine, osteoporosis prevalence is to be 29.7% and 22% in people aged 60 years and above in the U.S. Thus, rise in number of geriatric populations increase the demand for drugs and API intermediates, thereby driving the growth of the market.

On the other hand, stringent government rules and dependency of API intermediates on the other nations such as China are anticipated to restrain the growth of the market. In addition, frequent and unannounced changes in medication pricing regulations in emerging regions, where majority of manufacturing businesses are located, are also projected to hinder the growth of the API intermediates market during the forecast period.

COVID-19 had a significant impact on the API intermediates market. Globally, a number of government agencies reported shortage of many medications, due to supply chain gap. The market for API intermediates is expected to witness variety of short- and long-term consequences as a result of the pandemic. Scarcity of raw materials is mostly caused by constraints in the global supply chain. Pharmaceutical industry faces some major issues such as project delays, lack of material, and lack of labor. Thus, this factor is anticipated to hamper the growth of the market.

Segmental Overview

The global API intermediates market share is segmented into type, application, end user, and region. By type, the market is divided into bulk drug intermediates and chemicals intermediate. On the basis of application, the market is divided into analgesics, anti-infective drugs, antidiabetic drugs, cardiovascular drugs, anticancer drugs and others. By end user, the market is segmented into biotech & pharmaceutical companies, CMO and research laboratories. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

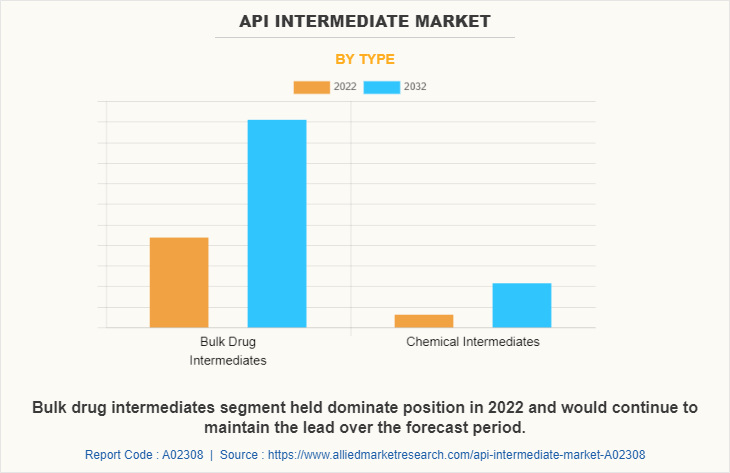

Based on Type

The market is fragmented into bulk drug intermediates and chemical intermediate. The bulk drug intermediates segment is expected to dominate the market, owing to rise in the prevalence of chronic diseases and increase in the number of market players who manufacture bulk drug intermediates.

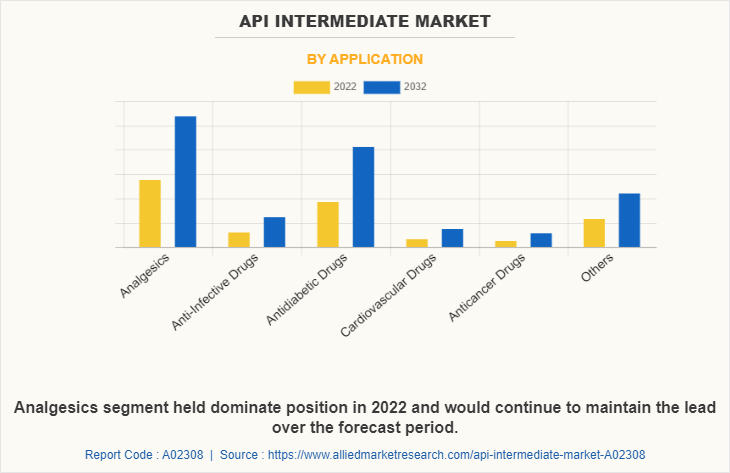

By Application

The market is classified into analgesics, anti-infective drugs, antidiabetic drugs, cardiovascular drugs, anticancer drugs and others. The analgesics segment is projected to exhibit the highest growth during the forecast period due to rise in prevalence of chronic pain and increase in awareness among the people regarding pain killer drugs.

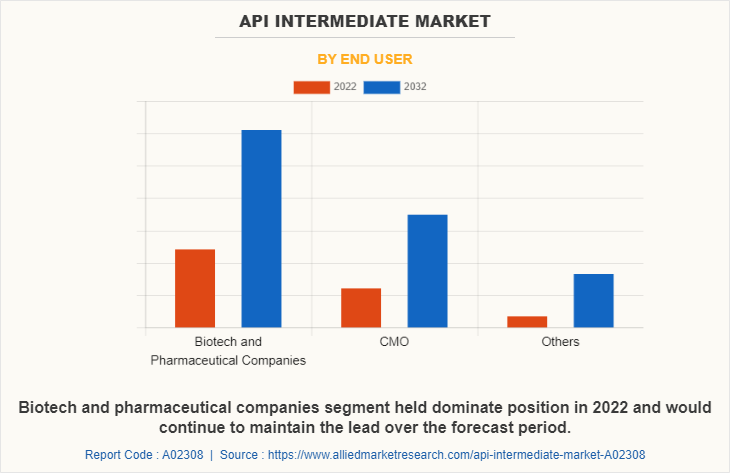

By End User

The API intermediates industry is classified into biotech & pharmaceutical companies, CMO and research laboratories. The biotech & pharmaceutical companies segment is projected to exhibit the highest growth during the forecast period due to rise in presence of biotech & pharmaceutical companies who import API intermediates.

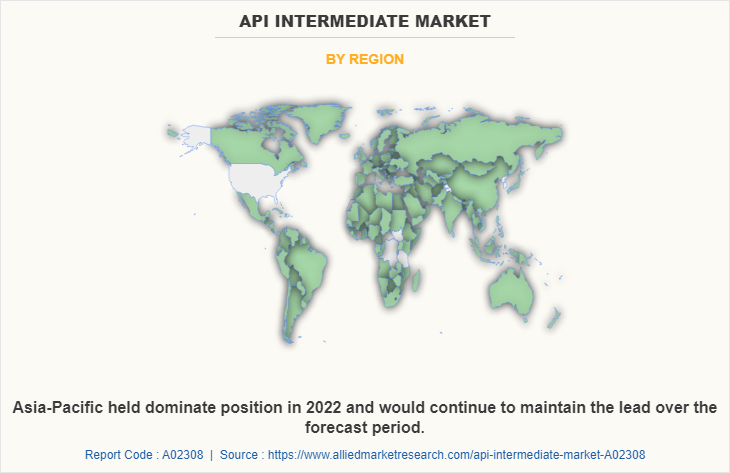

By Region

Asia-Pacific garnered the largest share in 2022 and is expected to continue this trend during the forecast period, owing to increase in prevalence of chronic diseases and rise in the number of geriatric populations. However, Asia-North America is expected to exhibit fastest growth during the forecast period, owing to rise in number of initiatives taken by government to develop healthcare infrastructure.

Region-wise, the North America API intermediates market is expected to grow at a notable pace during the forecast period, owing to rise in the number of geriatric populations. Geriatric population is more susceptible to chronic diseases such as cardiac diseases, orthopedic diseases, respiratory diseases, and others. Thus, increase in the number of geriatric populations increases the demand for drugs and API intermediates, thus boosting the market growth. According to Place for Mom, a service provider for geriatric population, in 2022, 54.1 million adults or 16.3% of the U.S. population were seniors aged 65 or older. The senior population is expected to rise to 22% by 2040 and 25% by 2060.

Moreover, alarming surge in prevalence of cardiovascular diseases such as coronary artery disease, arrhythmias, heart valve disease, and other structural heart defects is anticipated to fuel the demand for cardiovascular intermediates such as prazosin, temanogrel and terazosin, thereby boosting the growth of the market. For instance, according to the Center for Disease Control and Prevention (CDC), around 20.1 million adults ages 20 years and older have coronary artery disease (CAD).

The Asia-Pacific API intermediates market trends is expected to witness notable growth during the forecast period, owing to high presence of API intermediates market players. For instance, Sumitomo Chemical, Anyang General Chemical. Co., Ltd., Anyang General Chemical. Co., Ltd., Shree Ganesh Remedies Limited, Hikal Ltd., Cation Pharma, and others are major manufacturers of API intermediates.

Moreover, rise in the number of manufacturing units of API intermediates industry and increase in adoption of key strategies such as acquisition, agreement, and business expansion by market players who manufacture API intermediates boost the growth of API intermediates market opportunity. For instance, in March 2022, Sumitomo Chemical Co., Ltd., a major Japanese chemical company, constructed a new manufacturing plant for active pharmaceutical ingredients (APIs) and intermediates for small molecule drugs at its Oita Works (Oita City, Oita Prefecture, Japan) to enhance the company’s capacity to supply a variety of high-quality APIs and intermediates in response to the increasing demand for small molecule drugs.

Moreover, rise in expenditure by government for development of the pharmaceutical sector is expected to drive the growth of API intermediates market forecast. For instance, in 2022, according to Ministry of Chemicals and Fertilizers of India, India was one of the major producers of active pharma ingredients (API) or bulk drugs in the world. India exported bulk drugs/drug intermediates worth $403.7 million in the financial year 2021-22. However, the country also imports various bulk drugs/APIs for producing medicines from various countries. Thus, high presence of market players and increase in number of government initiatives to develop the healthcare infrastructure are anticipated to boost the API intermediates market growth.

Competition Analysis

Some of the major companies that operate in the global API intermediates market analysis include Anyang General Chemical Co., Ltd., Sandoo Pharmaceuticals, Evonik Industries AG, Shree Ganesh Remedies Limited, Pfizer, Cambrex Corporation, Zeal & Innovation in Medicine, Cation Pharma, Hikal Ltd., and Espee.

Recent Business Development in the API Intermediates Market

In March 2022, Sumitomo Chemical Co., Ltd., a major Japanese chemical company, construct a new manufacturing plant for active pharmaceutical ingredients (APIs) and intermediates for small molecule drugs at its Oita Works (Oita City, Oita Prefecture, Japan) to enhance the company’s capacity to supply a variety of high-quality APIs and intermediates in response to the increasing demand for small molecule drugs.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the API intermediate market analysis from 2022 to 2032 to identify the prevailing api intermediate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the API intermediate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global api intermediate market trends, key players, market segments, application areas, and market growth strategies.

API Intermediate Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 285 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 390 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Hikal Ltd, Espee, Sandoo Pharmaceuticals, Cambrex Corporation, Anyang General Chemical Co., Ltd., Pfizer Inc., Zeal & Innovation in Medicine, Shree Ganesh Remedies Limited, Evonik Industries AG., Cation Pharma |

Analyst Review

This section provides various opinions of the top-level CXOs in the global API intermediates market. The API intermediates market is expected to witness notable growth with rise in the number of adoptions of key strategies such as acquisition and business expansion by market players of API intermediates.

For instance, Cambrex, a leading global contract development and manufacturing organization (CDMO), announced that it has entered into a definitive agreement to acquire Snapdragon Chemistry, a leading US-based provider of chemical process development services, which specializes in active pharmaceutical ingredient (API) batch and continuous flow process development. The new facility expanded the company’s capacity for supplying clinical intermediates and drug substances.

Moreover, in May 2022, Cambrex announced the completion of a $50 million expansion of its large-scale active pharmaceutical ingredient (API) manufacturing capabilities at its Charles City, Iowa facility. The facility is located on a 45-acre property and produces a wide range of APIs and pharmaceutical intermediates, including highly potent molecules and controlled substances.

The top companies that hold the market share in API intermediates market are Anyang General Chemical Co., Ltd., Sandoo Pharmaceuticals, Evonik Industries AG, Shree Ganesh Remedies Limited, Pfizer, Cambrex Corporation.

North America is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop the healthcare sector, increase in the prevalence of chronic diseases and increase in the number of geriatric populations.

The key trends in the API intermediates market are high presence of API intermediate manufacturers and rise in number of populations suffering from chronic diseases.

The base year for the report is 2022.

10 API intermediate companies are profiled in the report

The total market value of API intermediates market is $139,421.09 million in 2022.

The forecast period in the report is from 2023 to 2032.

Stringent government rules is restraining factor for API intermediates market.

Loading Table Of Content...

Loading Research Methodology...