Application Container Market Insights: 2025

The global application container market size was valued at USD 698 million in 2016, and is projected to reach at USD 8,202 million by 2025, growing at a CAGR of 31.8% from 2018 to 2025

The application container technology helps enterprises to enhance their core competencies, such as security, network connectivity, customer relationships, and end-to-end services level monitoring. It enables the end-user organizations to optimize their application infrastructure resource utilization and save operating cost. The adoption of application container is growing, as a number of organizations are deploying containers to help build, manage, and easily move applications across different environments. Moreover, it provides increased flexibility and efficiency, and allows customers to migrate to cloud native environments.

Global Application Container Market

Factors such as gaining momentum in microservices architecture and ongoing modernization of existing business-critical applications have driven the growth of the application container market. In addition, increase in financial investment in container technology and presence of large number of start-ups & established vendors in the market are expected to present major opportunities for application container market expansion in the near future.

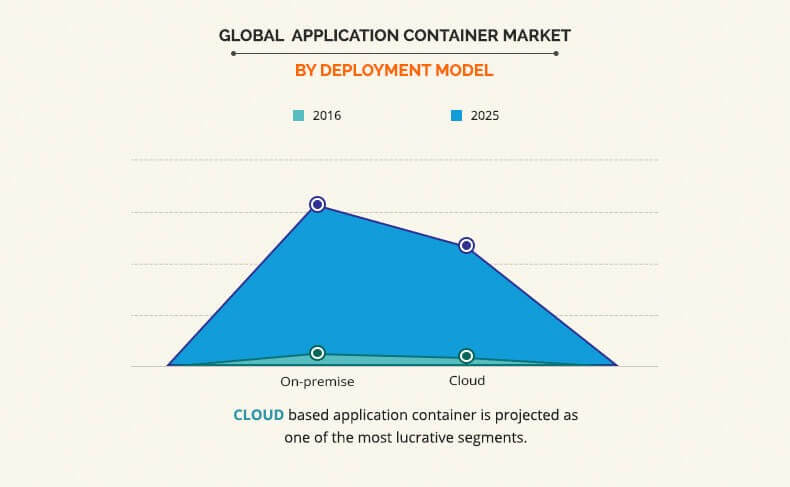

Global Application Container Market, by Deployment Model

The on-premise segment dominated the overall market in 2016, and is expected to continue this trend in the near future, owing to continuous change in on-premises deployment, which has many of the characteristics of the cloud such as high degree of virtualization and relative independence from hardware constraints through abstraction.

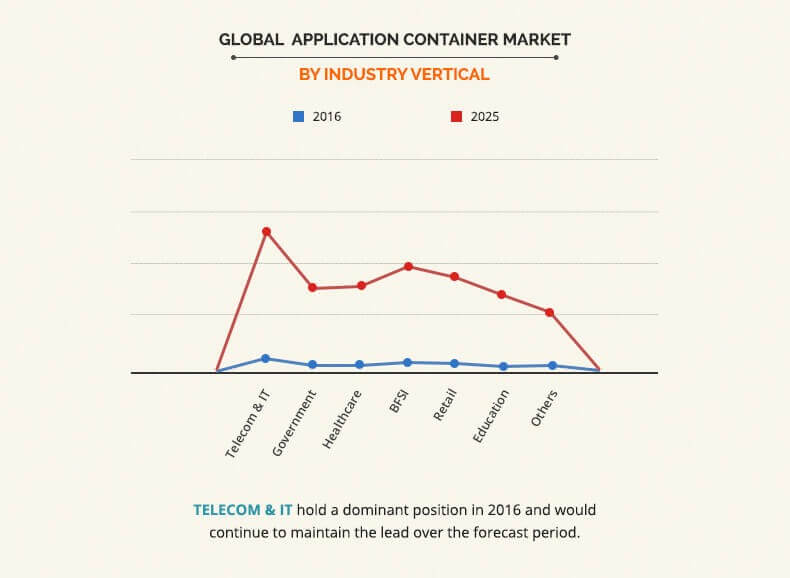

Global Application Container Market, by Industry Vertical

The IT & telecom segment dominated the overall application container market share in 2016, and is expected to continue this trend in the near future, owing to ongoing application modernization in IT industry primarily to empower digital customer experience and growing need for agile business applications.

Application Container Market, by Region

North America dominated the overall market in 2016, due to the factors such as availability of advanced ICT infrastructure in the region, consistent research & development activities performed by the technology providers, and an extensive cloud network established by major cloud service providers. However, Asia-Pacific is expected to witness the highest growth rate during the forecasted period.

The report focuses on the growth prospects and restraints of the market based on the analysis of regional application container market trends. The study provides Porter’s Five Forces analysis of the industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the growth of the market. These factors collectively impact the growth of the global application container market size during the forecast period.

Segment Review

The global application container market is segmented into deployment model, organization size, industry vertical, and region. Based on deployment model, the market is bifurcated into on-premise and cloud-based. On the basis of organization size, it is categorized into small & medium sized enterprises (SMEs) and large enterprises. By industry vertical, it is divided into IT & telecom, government, healthcare, BFSI, retail, education, others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global application container market include Amazon Web Services, Inc., CA Technologies, Docker Inc., Google, Inc., IBM Corporation, Joyent, Inc., Mesosphere, Inc., Microsoft Corporation, Rancher Labs, Inc., and Red Hat, Inc.

Top Impacting Factors

Rise in popularity of application container technology over virtual machines, surge in adoption of cloud-based computing system in organizations, and rise in trend of Internet of Things (IoT) among end users act as the major drivers of the market. However, security risks associated with the application container technology is expected to hamper the market growth during the forecast period.

Rise in Popularity of Application Container Technology Over Virtual Machines

Rise in popularity of application container technology over the virtual machines due to its numerous benefits is expected to boost the growth of the market. For instance, an application container is of the size 10 megabytes, whereas a virtual machine with its own entire operating system have size of several gigabytes. Owing to this, a single server can host far more containers than virtual machines. Another major benefit is that virtual machines may take several minutes to boot up their operating systems and begin running the applications they host, while application container can be started almost instantly.

Surge in Adoption of Cloud-based Computing System in Organizations

Cloud computing vendors are offering multitenancy services, which provide a single set of software application to more than one customer at the same time. The adoption of multitenancy cloud environment helps enterprises to decrease the cost of running a technology by sharing information technology resources. SMEs are deploying multitenancy architecture to reduce the IT maintenance cost and achieve economies of scale. Thus, emergence of multitenancy services is expected to increase the adoption of cloud computing.

Rise in Trend of Internet of Things (IoT) Among End Users

Continuously increase in volume of data generated by the adoption of Internet of Thing (IoT) is boosting the market for application container. Moreover, application containers are used to support all the features, which are required to run an application on resource constrained IoT Devices. They are portable, efficient, and allow quick application deployment and rapid application scaling. IoT-frontend applications would benefit the most with the use of application container model, as it will make it easy to deploy, run, and upgrade the applications by using container orchestration tools such as Kubernetes.

Impact of COVID-19 on Application Container Market:

- The global lockdown has not impacted on the application container market as the operations in the IT industry are carried out normally by ‘working from home’ structure. And, as a result, the use of application container in IT industry has a constant demand across the world.

- Moreover, the application container has become helpful to provide greater efficiency and better application development during work from home. Therefore, all the software organizations have adopted the application container during Covid-19 pandemic.

Key Benefits for Stakeholders

- This study includes the analytical depiction of the global application container market along with current trends and future estimations to determine the imminent investment pockets.

- The report presents information related to key drivers, restraints, and opportunities in application container market.

- The application container market is quantitatively analyzed from 2016 to 2023 to highlight the financial competency of the industry.

- Porter’s Five Forces analysis illustrates the potency of buyers & suppliers in the global application container industry.

Application Container Market Report Highlights

| Aspects | Details |

| By Deployment Model |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Geography |

|

| Key Market Players | Joyent, Inc., Google LLC, Red Hat, Inc., SAP SE, Mesosphere, Inc., International Business Machines Corporation, Amazon Web Services, Inc., Microsoft Corporation, Docker, Inc., Rancher Labs, Inc., CA Technologies |

Analyst Review

Application containerization is an OS-level virtualization method, which is used to deploy and run distributed applications without launching an entire virtual machine (VM) for each app. Adoption of application container technology has increased over a period of time, as the use of multitenancy and cloud management platforms has increased. Furthermore, increase in volume of data generated by the adoption of Internet of Things (IoT) is expected to provide lucrative opportunities for the market. Emergence of ideas such as smart homes, connected cars, connected healthcare, and smart cities are gaining momentum over a period of time. This has enforced enterprises to adopt big data management systems with application containers to effectively analyze and manage large databases.

Increase in interest of enterprises in application container technology boosts the growth of the market. Moreover, presence of a large number of start-ups & established vendors in this market are adopting merger and acquisition as their key developmental strategies. Although there is intense innovation, competition and disruption in the application container market, it has already experienced some consolidation. For instance, in May 2016, Apprenda, a platform as a service (PaaS) cloud software company, acquired Kismatic, a start-up that provides commercial support for the open-source Docker and Kubernetes software for working with applications with code packaged up in containers. North America and Western Europe are continued to be the prime consumers of application container technology. However, Asia-Pacific is expected to experience robust growth, owing to major shift towards cloud computing and virtualization, which make investment in application container technology more attractive to SMEs and organizations in the emerging markets such as China, Japan.

Some of the key players profiled in the report include Amazon Web Services, Inc., CA Technologies, Docker Inc., Google, Inc., IBM Corporation, Joyent, Inc., Mesosphere, Inc., Microsoft Corporation, Rancher Labs, Inc., and Red Hat, Inc. These players have adopted various strategies to enhance their product offerings and to increase their market penetration. For instance, in May 2018, Alphabet Inc. launched gVisor, a sandboxed container runtime that aims to ensure a secure isolation between containers. Moreover, Docker, Inc. launched Docker Enterprise Edition (EE) 2.0 to manage and secure applications on Kubernetes in multi-Linux, multi-OS, and multi-cloud customer environments.

Rise in popularity of application container technology over virtual machines, surge in adoption of cloud-based computing system in organizations and rise in trend of Internet of Things (IoT) among end users act as the major drivers of the market.

Asia-Pacific is expected to witness the highest growth rate during the forecasted period.

The key players operating in the global application container market include Amazon Web Services, Inc., CA Technologies, Docker Inc., Google, Inc., IBM Corporation, Joyent, Inc., Mesosphere, Inc., Microsoft Corporation, Rancher Labs, Inc., and Red Hat, Inc.

The application container market is projected to grow at a compound annual growth rate of 31.8% from 2018-2025 reach at USD 8,202 million by 2025

The global application container market size was valued at USD 698 million in 2016, and is projected to reach at USD 8,202 million by 2025

Loading Table Of Content...