Application Delivery Controllers (ADC) Market Insights:

The global application delivery controllers (ADC) market size was valued at USD 2.3 billion in 2020, and is projected to reach USD 12.8 billion by 2030, growing at a CAGR of 19.1% from 2021 to 2030.

Inclination toward cloud is expected to increase over the next few years. Increase in the usage rate of cloud gives rise to several network errors. Implementation of ADC in cloud networking helps to control such errors. Thus, increase in complications, due to rapid adaptation rate of cloud networking is expected to fuel the demand for app delivery controller. In addition, growth of SMEs and increase in adoption of ADC by IT and telecom sectors are the major factors that propel the growth of application delivery controllers market.

However, implementation of government regulations limits the market application delivery controllers market growth. On the contrary, surge in shift from hardware ADC to software virtual delivery application controllers, increase in trend of bring your own device at workplace, and rise in penetration of mobile-based applications at the workplace drive the growth of ADC market. Low setup and maintenance costs are other factors that encourage enterprises to opt for VDAC. Therefore, adoption of ADC is expected to grow tremendously in the future.

Application delivery controllers (ADC) is a computer networking device used as a part of application delivery network (ADN) in a data center. The emerging need to maintain uninterrupted communication channels among diversified business operations, increase in complications of the companies to communicate and coordinate with business units supported by increased internet traffics, and rise in the number of applications drive the implementation of ADCs.

The report focuses on growth prospects, restraints, and trends of the ADC market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the application delivery controllers market.

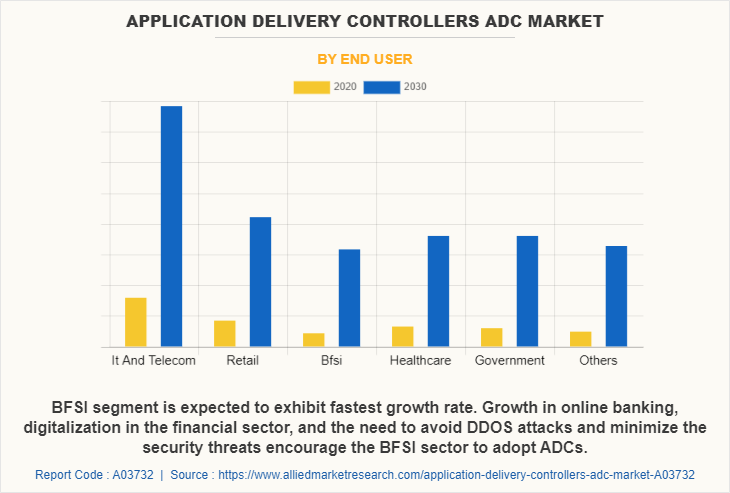

The global application delivery controllers market analysis is segmented on the basis of deployment type, enterprise size, end user, and region. Depending on deployment type, the market is divided into software/virtual and hardware. According to enterprise size, it is bifurcated into SMEs and large enterprises. As per end user, it is categorized into retail, IT & telecom, BFSI, healthcare, government, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The end-user industries shift toward cloud networking. The IT & telecom sector segment is expected to grow at a notable rate during the application delivery controllers market forecast. The demand for the ADCs from developing countries, due to high internet penetration. This, in turn, is expected to offer lucrative growth opportunities for the app delivery controller. The government segment is expected to grow during the forecast period.

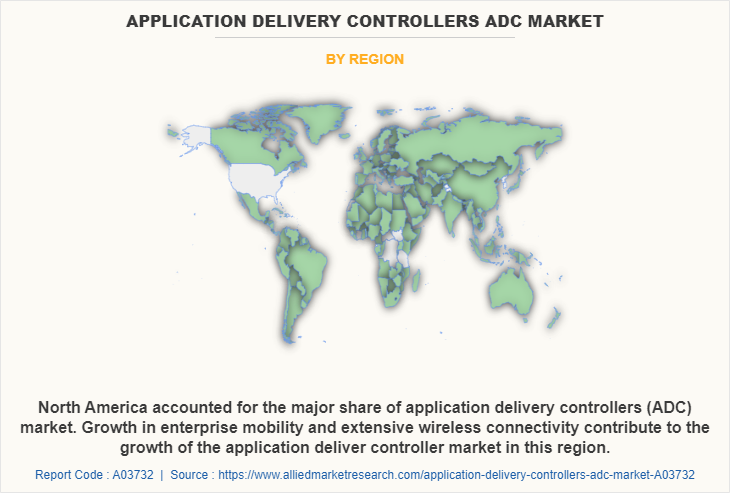

Emerging regions of Asia-Pacific are expected to witness maximum growth of ADCs. Factors such as rapid development of various industries, including IT and emergence of online transactions drive the growth of the ADC. North America accounted for the highest ADC market share of 50% in 2020, and is expected to maintain its dominance throughout the forecast period, owing to existence of well-developed IT and various end-user industries.

Key players operating in the global application delivery controllers industry include A10 Networks Inc., Citrix Systems Inc., F5 Networks Inc., Array Networks, Inc., Webscale, Dell Inc., Barracuda Networks Inc., Fortinet Inc., Cisco Systems Inc., and KEMP Technologies Inc.

Top Impacting Factors:

Rapid Growth of Data Centers

Growth in dependence on web-based application of companies across the globe drives the data market. Most of the data center providers are offering data center as infrastructure as a service The data center market is rapidly growing, mainly, in the Asian region. For instance, International Business Machine and Nippon Telegraph and Telephone communication have set up their data centers in India. These factors, as a result promotes the application delivery controllers industry.

Growth of SMEs

Increase in adoption of cloud computing within the organization for various processes is anticipated to be a secondary factor that fuels the growth of the app delivery controller. The low infrastructure cost, low maintenance cost, flexibility, and scalability are few factors that attract SMEs to choose software/VADC.

Major Shift from Hardware ADC to Software /VDAC

Organizations across the globe migrate from the hardware ADC toward virtual ADC (VDAC). Trend of the BYOD at the workplace and increase in penetration of mobile-based applications at the workplace drive the VDAC market. Low setup and maintenance costs are other factors that encourage enterprises to choose VDAC.

Key Benefits for Stakeholders:

- The study provides in-depth analysis of the global application delivery controllers market share along with current & future trends to illustrate the imminent investment pockets.

- Information about key drivers, restrains, & opportunities and their impact analysis on the global ADC market size are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the application delivery controllers market forecast.

- An extensive analysis of the key segments of the industry helps to understand the global application delivery controllers market trends.

- The quantitative analysis of the global ADC market size from 2021 to 2030 is provided to determine the market potential.

Application Delivery Controllers (ADC) Market Report Highlights

| Aspects | Details |

| By Deployment Model |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | Fortinet Inc., A10 Networks Inc., Dell Technologies Inc., Cisco Systems Inc., F5 Networks Inc., Array Networks, Inc., Webscale, Citrix Systems Inc., KEMP Technologies Inc., Barracuda Networks Inc. |

Analyst Review

Increase in the installation of application delivery controllers (ADCs) is observed, owing to growth in data generation and complexities associated with network management. The market is estimated to depict a significant growth during the forecast period, due to increase in usage of wireless systems in various sectors, urbanization, and rise in adaptation of various networking devices significantly in developing counties such as India and China. Technical advancement across organizations, increase in trend of cloud computing services, Internet of Things(IoT), mobility services, and efficient management of big data encourage organizations for adoption of ADCs. End user implementing ADCs include IT, consumer goods & retail, BFSI, telecom, defense, and healthcare. IT & telecom industries segment are the major consumers of ADCs, owing to the increase in networking among companies, generation of huge amount of data, and cloud services.

Regional government initiatives, mainly in Asia-Pacific, encourage the small and medium enterprises and other users for digitization, which, in turn, supports the growth of the ADC market. Some of the key players profiled in the report include A10 Networks Inc., Citrix Systems Inc., F5 Networks Inc., Array Networks, Inc., Webscale, Dell Inc., Barracuda Networks Inc., Fortinet Inc., Cisco Systems Inc., and KEMP Technologies Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The demand for ADCs is driven by the emerging need for uninterrupted online communication system among the diversified business operations and increase in cyber-threats in business units, which leads to increase in internet traffic

The end-user industries shift toward cloud networking. The IT & telecom sector segment is expected to grow at a notable rate during the application delivery controllers market forecast. The demand for the ADCs from developing countries, due to high internet penetration.

North America accounted for the highest ADC market share in 2020, and is expected to maintain its dominance throughout the forecast period, owing to existence of well-developed IT and various end-user industries.

The global ADC market size was valued at $2,300.00 million in 2020, and is projected to reach $12,845.02 million by 2030, growing at a CAGR of 19.1% from 2021 to 2030.

Citrix Systems Inc., F5 Networks Inc., Fortinet Inc., and Cisco Systems Inc., hold the major share in the market and these players have adopted various strategies to increase their market penetration and strengthen their position in the application delivery controllers industry.

Loading Table Of Content...