Aqua Ammonia Market Research, 2033

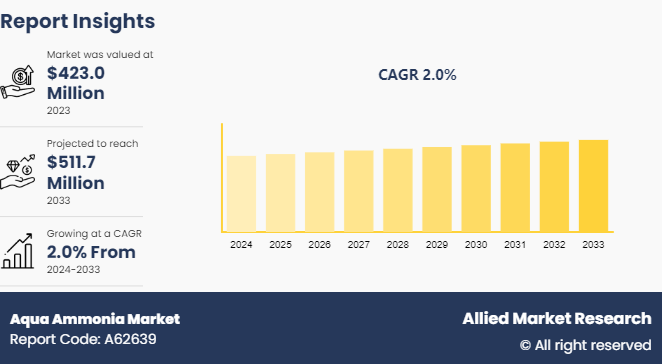

The global aqua ammonia market was valued at $423.0 million in 2023, and is projected to reach $511.7 million by 2033, growing at a CAGR of 2% from 2024 to 2033.

Market Introduction and Definition

Aqua ammonia, also known as ammonium hydroxide, is a solution of ammonia gas (NH3) dissolved in water (H2O) . It is a colorless liquid with a pungent odor, commonly used in various industrial and household applications. The concentration of ammonia in these solutions can vary, typically ranging from 5% to 30% by weight. Aqua ammonia is an alkaline substance with a high pH, making it corrosive and potentially harmful upon contact with skin or inhalation. Its chemical formula is NH4OH, although in solution it primarily exists as a mixture of ammonia (NH3) and water molecules, with only a small fraction dissociating into ammonium (NH4+) and hydroxide (OH-) ions.

The properties of aqua ammonia include its ability to act as a weak base, reacting with acids to form ammonium salts. It is highly soluble in water, producing a slightly exothermic reaction upon dissolution. In industry, aqua ammonia is used in the production of fertilizers, cleaning agents, and as a refrigerant. Its cleaning efficacy stems from its ability to emulsify fats and oils, making it a common ingredient in household cleaning products. Safety precautions are essential when handling aqua ammonia due to its corrosive nature and potential to release toxic fumes, particularly in poorly ventilated areas.

Key Takeaways

- The aqua ammonia market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The water treatment industry is emerging as a significant driver of the aqua ammonia market, fueled by the increasing need for clean and safe water. Aqua ammonia, or ammonium hydroxide, plays a critical role in water treatment processes, primarily due to its effectiveness in pH adjustment and its use as a disinfectant. In water treatment plants, maintaining optimal pH levels is crucial for the efficacy of coagulation and flocculation processes, which are essential for removing impurities and contaminants. Aqua ammonia’s ability to neutralize acidic compounds makes it an indispensable agent in this regard. In addition, the global push towards stringent water quality standards and environmental regulations is amplifying the demand for efficient water treatment solutions. Regulatory bodies across the world are imposing stricter guidelines to control water pollution and ensure safe drinking water, thereby driving the adoption of advanced treatment methods that often utilize aqua ammonia. Industrial sectors, in particular, are under pressure to treat wastewater effectively before discharge, further boosting the demand for aqua ammonia.

The Council on Energy, Environment, and Water (CEEW) intends to enhance wastewater management in India through the 2030 Water Resources Group. Additionally, the CEEW seeks to augment private investments in enterprises that manufacture chemicals for water treatment, enabling them to construct raw materials and wastewater treatment facilities. In addition, the $170 million Stormwater Treatment Area 1 West Expansion project calls for the building of water treatment facilities on 2, 509 hectares of land in Florida, the U.S. Municipal wastewater treatment is the main use of wastewater technology by Indian city municipal authorities. As per the World Bank, the countries that would spearhead the global urban population growth by 2050 are India, China, Indonesia, Nigeria, and the U.S.

Moreover, the growth in awareness of waterborne diseases and the need for effective sanitation have increased investments in water treatment infrastructure, particularly in developing regions. As urbanization and industrialization expand, so does the necessity for robust water treatment facilities to support sustainable development. The versatility of aqua ammonia in addressing diverse water treatment challenges, from municipal water supplies to industrial effluents, underpins its rising demand. Health and safety concerns pose significant challenges to the demand for aqua ammonia in the market. Aqua ammonia, or ammonium hydroxide, is a hazardous chemical with potential health risks associated with its handling, storage, and use. Exposure to aqua ammonia can result in respiratory issues, skin burns, and eye irritation, making it imperative for businesses to implement stringent safety measures to protect workers and the surrounding environment.

Regulatory compliance adds another layer of complexity, as governments enforce strict guidelines to ensure the safe handling and disposal of ammonia-based products. Failure to adhere to these regulations can lead to legal repercussions and reputational damage for companies operating in the aqua ammonia market. Additionally, the perception of aqua ammonia as a hazardous substance may deter some potential users from adopting it in their processes, further limiting market demand. Despite its efficacy in various industrial applications such as water treatment and agriculture, the health and safety concerns associated with aqua ammonia act as a barrier to its widespread use and may prompt businesses to seek alternative chemicals with fewer associated risks.

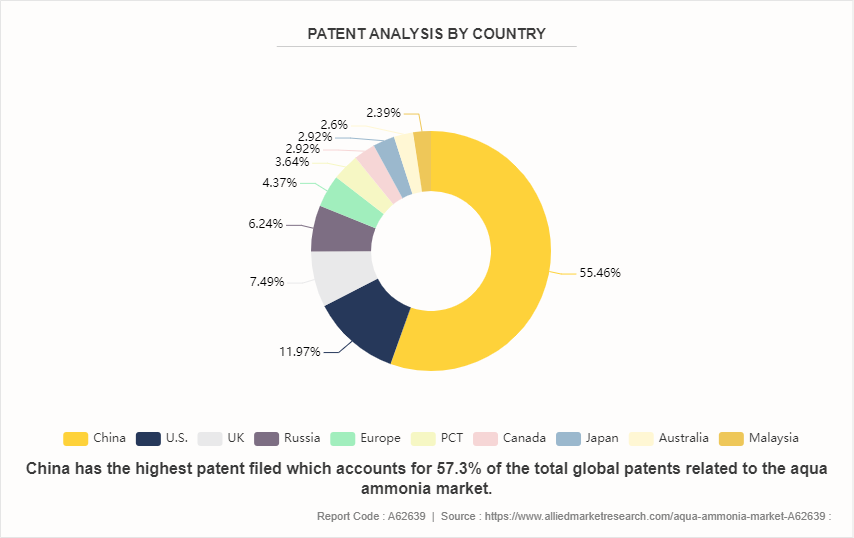

Patent Analysis of Global Aqua Ammonia Market

In the aqua ammonia market, China dominates with a substantial 57.3% share, signaling its significant role in production and consumption. The U.S. follows with an 11.5% share, indicating its considerable presence in the market. Notably, the European Patent Office and PCT together hold a 7.7% share, implying a focus on innovation and patenting within the industry. The presence of countries such as the UK, Russia, Canada, and Japan highlights a global interest and investment in aqua ammonia technologies. This distribution suggests a competitive landscape with potential for collaboration and innovation, particularly in areas such as production efficiency, environmental sustainability, and application diversification.

Market Segmentation

The aqua ammonia market is segmented into grade, end-use industry, and region. By grade, the market is classified into industrial grade, electronic grade, pharma grade, and others. By end-use industry, the market is divided into agriculture, pharmaceuticals, leather, pulp and paper, rubber and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific region is witnessing a surge in demand for aqua ammonia. The rapid industrialization and urbanization in countries such as China and India are driving its use in water treatment and waste management. In addition, the growing agricultural sector relies on aqua ammonia as a nitrogen fertilizer. The expanding chemical manufacturing industry also contributes to its increased demand, given its role in producing various chemicals and pharmaceuticals. Environmental regulations promoting cleaner production methods further boost aqua ammonia usage. Collectively, these factors highlight the compound's growing significance across multiple sectors in the region.

- India is the second-largest producer of cereals, including wheat and rice, in the world. A favorable environment is being created for the export of Indian grain goods by the enormous demand for cereals on the international market. Ministry of Agriculture of India released its first estimate for 2020–21, which put the country's production of important grains such as rice, maize, and bajra at 102.36 million tons, 19.88 million tons, and 9.23 million tons, respectively. According to the most recent data available, wheat output in 2019–20 is expected to reach 107.49 million tons (4th advance estimates) .

- The Agricultural & Processed Food Products Export Development Authority (APEDA) reports that the value of India's grain exports in 2021–2022 was $12, 872.64 million. 75% (in terms of value) of India's total cereal exports consisted primarily of rice, including basmati and non-basmati. Conversely, just 25% of the cereals exported from India during this time were other grains, such as wheat.

- As of May 2022, India's foodgrain production is expected to reach a record 314.51 metric tons, up 3.77 metric tons from 2020–21, according to the Union Ministry of Agriculture and Farmers' Welfare. In addition, the projected production exceeds the average production of the preceding five years (2016–17 to 2020–21) by 23.80 metric tons.

- $15.9 billion (INR 1.24 lakh crore) has been set out for the Department of Agriculture, Cooperation, and Farmers' Welfare in the Union Budget 2022–2023. To make sure that farmers have access to updated technology including better crop variety seeds, new strains of livestock and fish, and enhanced production and protection technologies, a nationwide network of 729 Krishi Vigyan Kendras has been developed at the district level. Therefore, it is anticipated that the adoption of more sustainable farming methods, government initiatives, and the desire to increase agricultural productivity through extension services would all contribute to the aqua ammonia market's growth during the forecast period.

Competitive Landscape

The major players operating in the aqua ammonia market include Yara International ASA, CF Industries, Uralchem, PotashCorp, EuroChem Group, Shandong Everlast AC Chemical Co., Ltd., Malanadu Ammonia Pvt. Ltd., KMG Chemicals, First Chemical Industries, and Thatcher Company. Other players in the aqua ammonia market include Tanner Industries, Inc., Thermo Fisher Scientific Inc., Sigma-Aldrich Co. LLC., and GFS Chemicals, Inc.

Recent Key Strategies and Developments

- In March 2024, BASF and International Process Plants (IPP) have reached an agreement to sell ammonia, methanol, and melamine plants at BASF's Ludwigshafen facility in Germany. While BASF modifies its Ludwigshafen operations to stay competitive in the evolving European market, these plants are available. At the Ludwigshafen location, BASF will keep producing methanol and ammonia in separate facilities.

- In April 2023, Sinopec and QatarEnergy struck a deal, making Sinopec the first Asian client to participate in the eastern extension of North Field, a liquefied natural gas project in Qatar. Sinopec would hold a 5% stake in an LNG train with an annual capacity of 8 million tons.

Growing Pharmaceutical Industry is Likely to Boost Aqua Ammonia Demand:

The increasing demand within the pharmaceutical industry presents a significant opportunity for the aqua ammonia market. Aqua ammonia, being a versatile chemical reagent, finds various applications in pharmaceutical manufacturing processes. It is utilized in the synthesis of certain pharmaceutical intermediates and active pharmaceutical ingredients (APIs) . Additionally, aqua ammonia is used in the production of specialty chemicals and reagents required for pharmaceutical research and development.

As the pharmaceutical industry continues to expand globally, driven by factors such as population growth, increase in healthcare expenditure, and advancements in medical technology, the demand for aqua ammonia is expected to rise correspondingly. Companies operating in the aqua ammonia market can capitalize on this opportunity by establishing strategic partnerships with pharmaceutical manufacturers, developing tailored products to meet specific industry needs, and ensuring consistent quality and regulatory compliance. Moreover, investing in research and development to explore new applications and formulations of aqua ammonia within the pharmaceutical sector can further enhance market competitiveness and drive growth.

Industry Trends:

- Aqua ammonia can be used to produce other nitrogen fertilizers, such as urea and ammonium nitrate, further broadening its application in agricultural practices aimed at improving soil fertility and crop productivity.

- Of the three main elements in fertilizer, the U.S. is one of the biggest importers. Leading manufacturers of the primary fertilizer ingredients are Morocco, China, Russia, and Canada. The U.S. Department of Agriculture (USDA) announced in March 2023 the opening of the first two grant rounds of a new initiative to increase domestic fertilizer production capacity through innovative production in 47 states and two territories. The USDA also revealed that it received $3 billion in applications from over 350 separate businesses, indicating a noteworthy rebound in the nation's fertilizer market.

- According to the USDA, China accounts for 25% of the world's total fertilizer production and is the leading producer and exporter of fertilizers in both the area and the globe. India will utilize 70 million metric tons of fertilizers in 2021, making it the second-largest fertilizer consumer in the world. Even though India is the world's third-largest producer of fertilizers, it still depends on imports.

Key Sources Referred

- The Agricultural & Processed Food Products Export Development Authority (APEDA)

- Ministry Of Agriculture of India

- Union Ministry of Agriculture and Farmers' Welfare

- Union Budget 2022-23

- U.S. Department of Agriculture (USDA)

- The Council on Energy, Environment, and Water (CEEW)

- World Bank

- Invest India

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aqua ammonia market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aqua ammonia market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aqua ammonia market trends, key players, market segments, application areas, and market growth strategies.

Aqua Ammonia Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 511.7 Million |

| Growth Rate | CAGR of 2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Grade |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | PotashCorp, Malanadu Ammonia Pvt. Ltd., Yara International ASA, EuroChem Group, KMG Chemicals, Inc., First Chemical Industries., Thatcher Company, CF Industries, Shandong Everlast AC Chemical Co.,Ltd, Uralchem |

Loading Table Of Content...