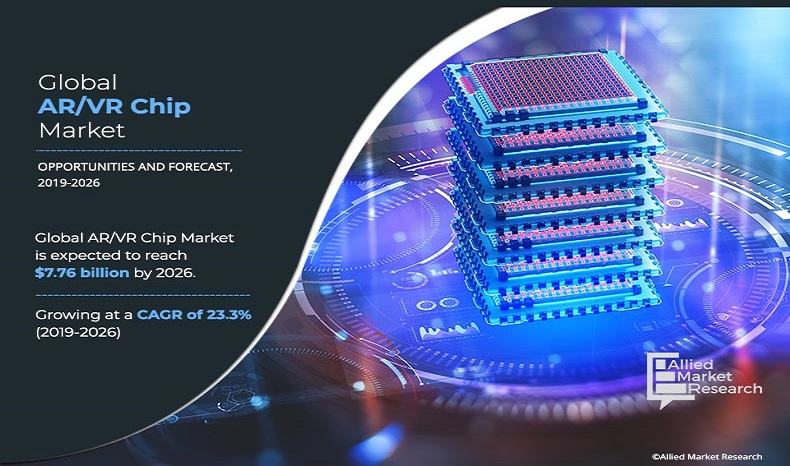

AR/VR Chip Market Outlook - 2026

The global AR/VR chip market size was valued at $1.38 billion in 2018, and is projected to reach $7.76 billion by 2026, registering a CAGR of 23.3% from 2019 to 2026. Augmented reality is a technology that uses the existing user’s environment and overlays the digital or virtual content or information over it. Augmented reality applications are developed on special 3D programs that enable developers to integrate contextual or digital content with the real world. While virtual reality is also a three-dimensional (3D)—computer generated environment—which completely immerses end users in an artificial world without seeing the real world. This report includes, the revenue generation from the sale of augmented and virtual reality enabled hardware and content.

The growth of the AR/VR chip market is driven by rise in demand for AR/VR chip in gaming vertical, cost-efficient benefits of augmented and virtual reality based solutions, and surge in need for the adoption of AR/VR in various applications. However, resistance to adopt the augmented and virtual reality technology and lack of investments in R&D restrain the growth of the market. Furthermore, technological advancements and introduction of industry-specific solution offer lucrative opportunities for the AR/VR chip market growth.

Augmented reality (AR) technology allows the computer-generated data or imagery to overlap physical objects accurately in real time. AR enhances the perception of users, and provided information helps them perform tasks in the real world. The major components of an AR system are displays, sensors, and embedded electronics. It is widely used in areas such as employee training and video conferencing.

Virtual reality (VR) technology enables the users and provides the virtual environment by using computer hardware and software. It provides a fully immersive environment in which the user can interact with objects similar to those in the real world. VR technology works on components such as gesture recognition systems, sensors, and embedded electronics.

Augmented and virtual reality offers a cost-effective and efficient solution in training and skill development as it replicates the real scenarios by using augmented and virtual reality enabled solutions. For instance, in civil aviation or military application, it is costlier to utilize an actual aircraft to train a pilot. Further, it could harm the human as well. Whereas, augmented and virtual reality solutions create a virtual environment similar to the real world, where a trainee can understand and tackle challenges with strategic mapping. Moreover, in healthcare, training students or nurses or other medical professionals on live humans is unethical and could be harmful. Thus, augmented and virtual reality-based solutions provide valid tools to train medical professionals without compromising and harming one’s life.

Segmentation

The AR/VR chip market is segmented on the basis of chip type, device type, end user, and application. On the basis of chip type, the market is divided into processor ICs, user interface ICs, and power management ICs. Device types covered in the study include head mounted display, head up display, handheld device, gesture tracking device, and projector & display wall. End user includes gaming, entertainment & media, aerospace & defense, healthcare, and others. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Chip Type

Processor ICs AR/VR Chip based chip type segment is projected as one of the most lucrative segments.

The key players profiled in the report include Qualcomm Technologies Inc., NVIDIA Corporation, Imagination Technologies Limited, MEDIATEK Inc., Intel Corporation, Spectra 7, Advanced Microdevices Inc, International Business Machine Corporation, Samsung Electronics Co. Ltd, and Huawei Technologies Co. ltd. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their AR/VR chip market share.

Top Impacting Factors

The significant factors impacting the global AR/VR chip market include rise in demand for AR/VR chip in gaming vertical, cost-efficient benefits of augmented and virtual reality-based solutions, surge in need for the adoption of AR/VR in various applications, resistance to adopt the augmented and virtual reality technology, lack of investment in R&D, advancement in technology, and introduction of industry specific solutions.

By End User

Gaming segment is expected to secure leading position during forecast period.

Rise in demand for AR/VR chip in gaming vertical

Video game is one of the major applications of augmented and virtual reality technology. Over the past few years, number of gamers worldwide has increased at a rapid pace. This is attributed to increased demand for augmented and virtual reality-based games, which in turn drives the market growth. The smartphone manufacturing companies are increasing the number of gaming features in their devices for enhancing the overall user interface experience and to keep ahead of their competitors in the market.

Lack of investment in R&D

Prominent players in the UK, Germany, and others are focused on delivering the product rather than investing in R&D activities. This is expected to restrict the growth of the market as novel solutions would not be produced to tackle existing challenges, which are yet to be solved.

Introduction of industry-specific solution

Augmented and virtual reality solutions find high usage in various industries such as civil aviation, defense & security, healthcare, digital manufacturing, education, and entertainment. However, prominent players operating in the augmented and virtual reality market are projected to concentrate on the introduction of industry-specific solutions to expand their presence across various industries such as mining, oil & gas, and transportation.

By Geography

Asia Pacific region would exhibit the highest CAGR of 24.7% during 2019-2026

Key Benefits for Stakeholders:

- This study includes the analytical depiction of the global AR/VR chip market outlook along with the current trends and future estimations to determine the imminent investment pockets.

- The market size is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact on the AR/VR chip market analysis.

- The current AR/VR chip market forecast is quantitatively analyzed from 2018 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the AR/VR chip industry.

- The report includes the AR/VR chip market trends and market share of key vendors.

AR/VR Chip Market Report Highlights

| Aspects | Details |

| By Chip Type |

|

| By Device Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Huawei Technologies Co., Ltd., Advanced Micro Devices, Inc., MEDIATEK INC, Imagination Technologies Limited, Intel Corporation, Spectra7, International Business Machines Corporation (IBM), NVIDIA Corporation, SAMSUNG ELECTRONICS CO. LTD, Qualcomm Technologies, Inc. |

Analyst Review

Augmented and virtual reality offers a cost-effective and efficient solution for training and skill development as it replicates the real scenarios by using augmented and virtual reality enabled solutions. Augmented reality is a technology that uses the existing user’s environment and overlays the digital or virtual content or information over it. Augmented reality applications are developed on special 3D programs that enable developers to integrate contextual or digital content with the real world.

The growth of the AR/VR chip market is driven by rise in demand for AR/VR chip in gaming vertical, cost-efficient benefits of augmented and virtual reality-based solutions, and surge in need for the adoption of AR/VR in various applications. However, resistance to adopt the augmented and virtual reality technology and lack of investments in R&D restrain the growth of the market. Furthermore, technological advancement and introduction of industry-specific solution offer lucrative opportunities for the market growth.

The key players profiled in the report include Qualcomm Technologies Inc., NVIDIA Corporation, Imagination Technologies Limited, MEDIATEK Inc., Intel Corporation, Spectra 7, Advanced Microdevices Inc, International Business Machine Corporation, Samsung Electronics Co. Ltd, and Huawei Technologies Co. Ltd.

Loading Table Of Content...