Aroma Ingredients Market Outlook - 2026

The global aroma ingredients market size was valued at $11,391.0 million in 2018, and is expected to grow at a CAGR of 4.6% to reach $16,252.4 million by 2026. Aroma ingredients are complex compounds that are added to cosmetics and personal care & home care products to impart desired fragrance. Natural aroma ingredients include flower, fruit, wood, and spice, while synthetic aroma ingredients are produced from chemical compounds such as esters, aldehydes, alcohols, musk chemicals, and terpenes.

Increase in applications of aroma ingredients in cosmetic & personal care industry is the key factor that has driven the growth of global aroma ingredients market. For instance, they are widely used in creams, body lotions, shampoos, hair oils, deodorants, and perfumes. Apart from soaps & detergents and cosmetics, aroma ingredients are majorly used in fine fragrances and household products. Thus, upsurge in demand for personal care & cosmetics products among consumers is driving the growth of market.

Increase in applications of aroma ingredients in cosmetic & personal care industry is the key factor that has driven the growth of global aroma ingredients market. For instance, they are widely used in creams, body lotions, shampoos, hair oils, deodorants, and perfumes. Apart from soaps & detergents and cosmetics, aroma ingredients are majorly used in fine fragrances and household products. Thus, upsurge in demand for personal care & cosmetics products among consumers is driving the growth of market.

In addition, rise in disposable income, increase in awareness for personal care & hygiene, and introduction of innovative products to cater to changing consumer demands & preferences are the other factors that are responsible for aroma ingredients market growth.

Moreover, consumers have shifted their preference toward natural & bio-based products, due to rise in awareness about the harmful effects of synthetic chemicals. This growing preference for natural ingredients is one of the key trends positively impacting the growth of the market. However, high cost of production for natural & bio-based products hampers the growth of the market.

In addition, stringent regulations related to the use of synthetic chemicals restrict the growth of the market. On the contrary, continuous technological advancements in cosmetics and personal care industry and strong innovations and investments in R&D are expected to provide lucrative opportunities for aroma ingredients market expansion.

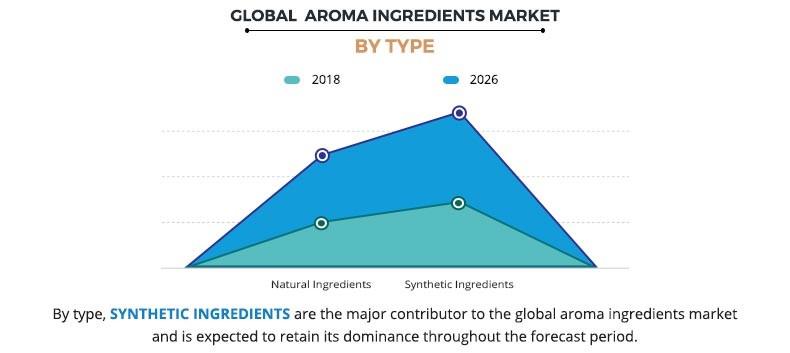

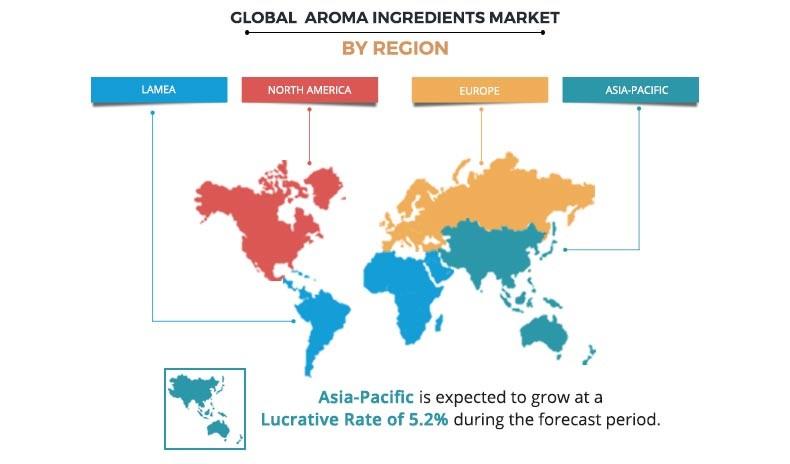

The global aroma ingredients market is segmented based on type, application, and region. Depending on type, the aroma ingredients market is categorized into synthetic ingredients and natural ingredients. The applications covered in the study include homecare, personal care, fine fragrances and perfumes, others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In 2018, the natural aroma ingredients segment accounted for $4,683.4 million, and is estimated to reach $6,993.1 million by 2026, at a CAGR of 5.2% during the forecast period. This is attributed to increase in customer tendency for natural & bio-based personal care & cosmetic products. The concerns related to harsh nature of chemicals such as allergies and others have enforced consumer to switch to natural products. However, upsurge in demand for homecare & personal care products such as detergents, deodorizers, aerosol sprays, room fresheners, vehicle deodorizers, floor cleaners, and others is expected to drive the growth for synthetic aroma ingredients. The homecare and personal care segments collectively accounted for about 73.7% aroma ingredients market share of the market in 2018, with the former constituting around 48.9% share.

By application, the home care segment accounted for $5,575.7 million, and is estimated to reach $7,851.1 million by 2026, at a CAGR of 4.4% during the forecast period. Rise in healthcare awareness and increase in disposable income have boosted the demand for essential consumer products such as soaps, detergents, hand wash, sanitizers, and toiletries. Thus, the development of the personal care and home care industry majorly contributes toward the growth of the aroma ingredients market.

Region wise, Europe is estimated to grow at steady CAGR of 4.0% during forecast period. However, Asia-Pacific and LAMEA are anticipated to witness relatively faster growth in terms of both value and volume. This is attributed to the presence of huge consumer base, low cost & availability of raw materials, and rapid development of end-user industries such as personal care & home care industry.

The leading players operating in the aroma ingredients market are BASF SE, Firmenich SA, Givaudan, International Flavors & Fragrances Inc. (IFF), Robertet SA, S H Kelkar and Company Limited., Sensient Technologies Corporation, Symrise, T. Hasegawa Co., Ltd., and Takasago International Corporation.

Key Benefits for Aroma Ingredients Market:

- The report provides a quantitative analysis of the aroma ingredients market trends, estimations, and dynamics of the market size from 2018 to 2026 to identify the prevailing market opportunities.

- The key countries in all the major regions are mapped based on their market share.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their network.

- In-depth analysis and the market size and segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global aroma ingredients industry.

- Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of market players.

- The report includes revenue generated from the sales of aroma ingredients and aroma ingredients market forecast across North America, Europe, Asia-Pacific, and LAMEA.

- The report includes the aroma ingredients market analysis at regional as well as the global level, key players, market segments, application areas, and growth strategies.

Aroma Ingredients Market Report Highlights

| Aspects | Details |

| By Type |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Symrise AG, Givaudan International SA, T. HASEGAWA CO., LTD, S H Kelkar and Company Limited, International Flavors & Fragrances Inc, Sensient Technologies Corporation, Robertet SA, BASF SE (BASF), Takasago International Corporation, Firmenich SA |

Analyst Review

Upsurge in demand for natural and unique fragrances from cosmetic and personal care & home care industries, owing to the changing consumer demand drives the growth of the global aroma ingredients industry. This is attributed to the fact that aroma ingredients are widely used in soaps, creams, lotions, shampoos, and other cosmetic & personal care essential products. Presently, consumer are more concerned about personal appearance and hygiene, and thus seek for new & improved options, which has boosted the demand for aroma ingredients. Moreover, products imparting gentle, exotic fragrance uplifts the mood of consumers, attracting a large customer base. In addition, aroma ingredients used in cosmetic or personal care products provide exotic fragrance; hence, the demand for aroma ingredients is increasing at a significant rate. Moreover, the demand for natural & bio-based products among consumer is increasing as compared to conventional products, thus driving the market growth.

In addition, surge in demand for homecare product accelerates the growth of the global aroma ingredients market. Furthermore, rise in disposable income and better access to quality brands of consumers, due to an effective supply chain, supplement the market growth. However, high cost involved in the preparation of natural & bio-based products impedes the growth of the overall market, as the prices for natural aroma ingredients are comparatively high. Furthermore, key companies in the aroma ingredients market are adopting different strategies such as innovation and acquisition to strengthen their foothold in the market and increase profitability. Demand from developing nations and significant technological advancements in production and extraction process of aroma ingredients to meet the consumer expectations are anticipated to provide lucrative opportunities for market expansion.

Loading Table Of Content...