Articulated Industrial Robot Market Research, 2032

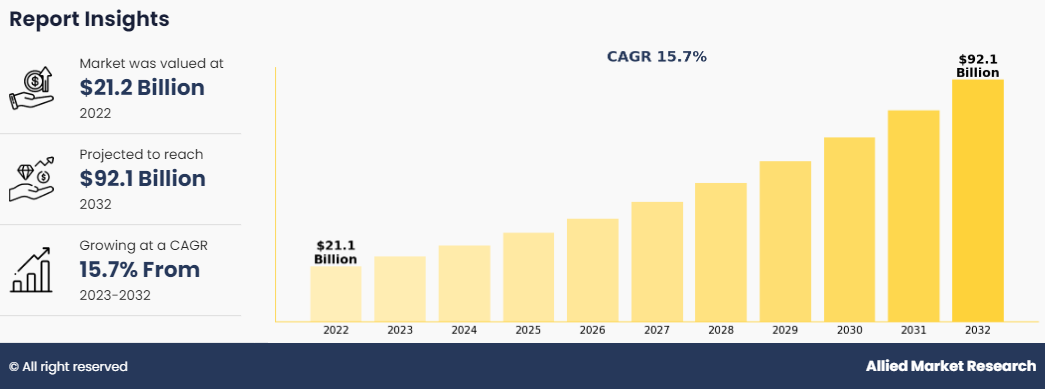

The Global Articulated Industrial Robot Market was valued at $21.151.1 million in 2022, and is projected to reach $92.081.2 million by 2032, growing at a CAGR of 15.7% from 2023 to 2032.

Report Key Highlighters

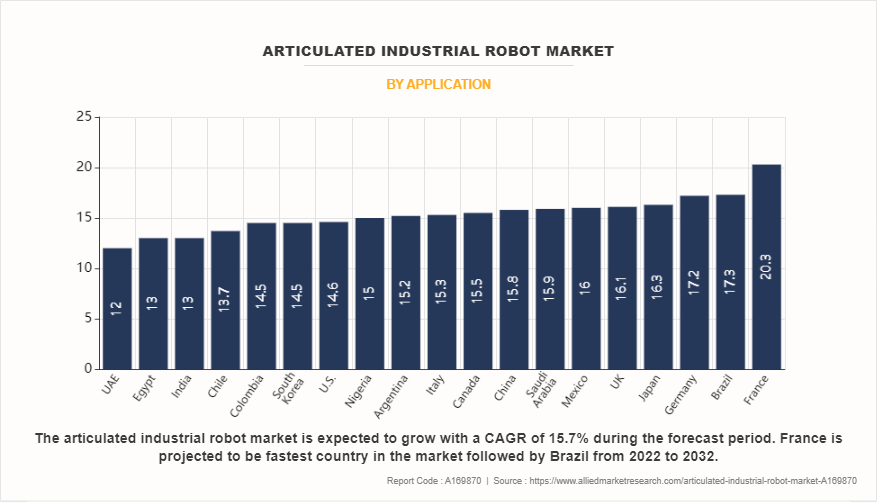

The articulated industrial robot market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2023 to 2032.

The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

The articulated industrial robot market share is marginally fragmented, with players such as Mitsubishi Electric Automation, Inc, DENSO Robotics Incorporated, KUKA AG, Delta Electronics, Inc., Robotic Automation Systems, ABB Ltd., Omron Corporation, Kawasaki Heavy Industries, Ltd., Hirata Corporation, and Panasonic Industry Co., Ltd.

Growing need for low-cost articulated robots that collaborate with humans.

Articulated industrial robot market growth is increase with the need for cost-effective articulated robots capable of interacting with humans is driven by a variety of causes that change the industrial environment. One significant driver is the demand for more adaptable automation systems that easily integrate into dynamic surroundings, especially in industries where traditional, task-specific robots are prohibitively expensive. Small and medium-sized businesses (SMEs) are increasingly looking for cost-effective automation solutions to boost production without paying costly upfront spending.

This need is in line with recent technological improvements, such as enhanced sensors, actuators, and manufacturing techniques such as 3D printing, which are helping to build more cost-effective articulated robots. Collaborative work settings that promote the safe collaboration of people and robots increase the demand for low-cost robots with greater safety features.

As industry transforms production procedures into smarter, connected systems, low-cost articulated robots play an important part in realizing the goal of smart factories. Furthermore, these economical robotic systems meet the demands of educational institutions and research facilities, encouraging robot innovation and exploration. Articulated industrial robot market sector are changing with diverse economic factors. In addition, to the pursuit of different applications in areas such as logistics, agriculture, healthcare, and services, highlight the rising importance of easily available and flexible robotic systems. In summary, the surge in demand for low-cost articulated robots represents an evolution toward automation that is technologically effective, and economically viable and adaptable to a wide range of jobs & sectors.

Rise in adoption of automation and optimized industrial robots.

The industrial industry has continued to integrate automation and robots into its processes. Although there are several reasons for this transformation, some important motivators include enhanced production, greater efficiency, and overall improved quality. Furthermore, the manufacturing business, including many others, struggles to recruit qualified candidates to fill open positions. As industrial robots grow more adaptable and collaborative, they work peacefully and securely alongside operators. Robots are capable of performing complicated jobs and are easily adaptable to changes in manufacturing needs. Articulated industrial robot market forecast that the robots are integrated with other technologies, boosting their capabilities and allowing real-time data analysis and optimization.

Automation is part of the industrial field's shift to a greater focus on technology. Intelligent systems automate supply chain management, inventory control, logistics, and quality control procedures. The usage of autonomous vehicles for material handling and delivery is expected to become increasingly common. Moreover, automation and robots enable a more streamlined and efficient manufacturing process, resulting in improved output and productivity. Robots labor indefinitely without weariness, execute repeated jobs with great precision, and finish procedures faster than human workers. Robots are precisely programmed for performing several activities. Automation tends to reduce mistakes caused by human factors including fatigue, stress, or a lack of focus. This is critical in areas requiring precision and accuracy, such as manufacturing, healthcare, and electronics.

Robots work at predictable rates and complete jobs with minimum fluctuation, resulting in increased efficiency and consistent and dependable performance. Automation and robots are more widely used in manufacturing that has led to a major change in a variety of areas. This progress is reflected in higher productivity, efficiency, safety measures, cost savings, better customization & flexibility, and a noticeable shift toward data-driven decision-making. As technology advances, the integration of automation and robots into production processes is expected to result in significant benefits across several major sectors, altering the industrial landscape and encouraging a more streamlined and efficient approach to production. This factors drive demand for articulated industrial robot sector and promote automation in industries.

Increasing demand in small and medium-sized businesses.

Automation is radically transforming industries and workplaces according to the International Federation of Robots, more than half of all manufacturing workers are expected to be using robots over the next decade (2032). The growing demand for industrial robots among small and medium-sized firms (SMEs) represents a significant change in the automation environment, driven by a number of fundamental factors. Advances in robot technology and manufacturing processes have permitted the creation of low-cost industrial robots, making automation solutions more accessible to SMEs with limited budgets.

The attraction of these robots stems from their flexibility and adaptability, which allow them to meet the different production demands of SMEs without incurring major reconfiguration expenses. Industrial robots help SMEs increase productivity by automating repetitive and time-consuming processes, freeing up human workers to focus on more complex and value-added activities.

Furthermore, robots assist SMEs in producing high-quality goods and competing on a worldwide scale with larger companies. Robots are able to assist SMEs alter their competitiveness and achieve much higher levels of production, efficiency, and profitability. Many small and medium-sized enterprises (SMEs) are now investing in robots to improve their global competitiveness.

Robot manufacturers, including Universal Robots (Denmark) and Denso Robotics (Japan), are producing low-cost systems that SMEs fully utilize. Articulated industrial robot market size is expected to increase in SMEs with rising automation environment during the forcasted period.

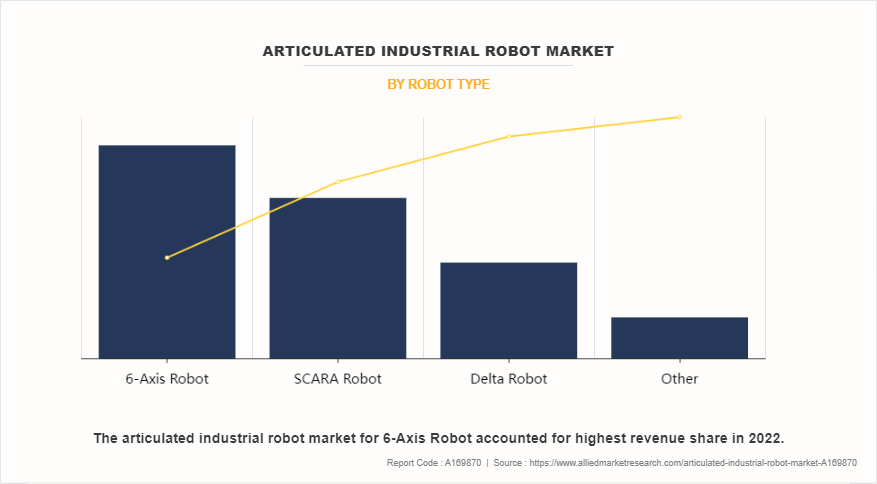

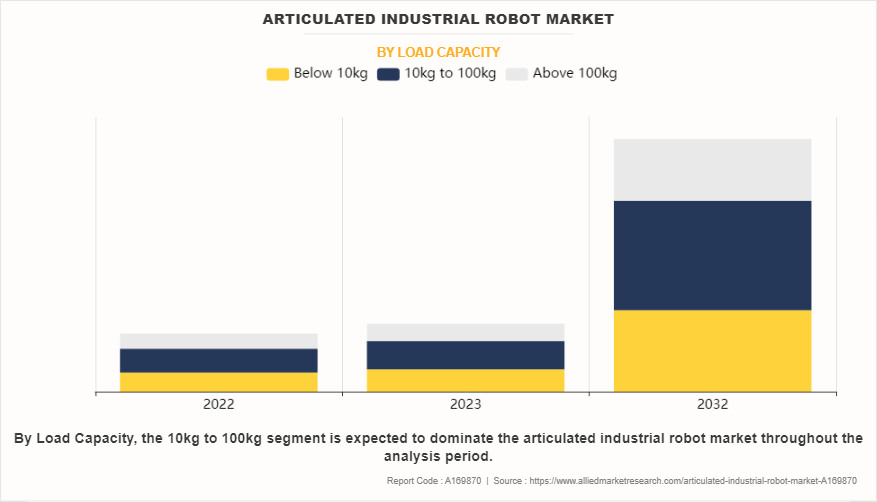

The articulated industrial robot market is segmented on the basis of robot type, application, load capacity, and region. By robot type, the market is categorized in SCARA, delta robot, 6-axis, and other. Depending on application, the market is classified into assembly, handling, welding, and others. On the basis of load capacity, it is categorized into below 10kg, 10kg to 100kg, and above 100kg.

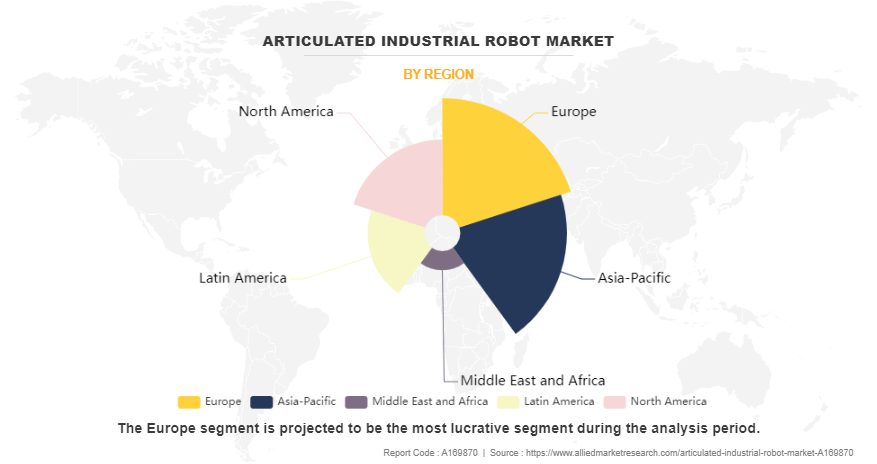

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA. On the basis of region, Asia-Pacific is expected to be the largest market shareholder owing to the region constantly increasing companies expenditure into integrated advanced industrial machines such as industrial robot and equipment across articulated industrial robot business.

Competitive Analysis

Competitive analysis and profiles of the major global articulated industrial robot market players that have been provided in the report include Mitsubishi Electric Automation, Inc, DENSO Robotics Incorporated, KUKA AG, Delta Electronics, Inc., Robotic Automation Systems, ABB Ltd., Omron Corporation, Kawasaki Heavy Industries, Ltd., Hirata Corporation, and Panasonic Industry Co., Ltd. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Top Impacting Factors

The global articulated industrial robot market is expected to witness surge in need for low-cost articulated robots that collaborate with humans, rise in adoption of automation & optimized industrial robots, increasing demand in small and medium-sized businesses, and significant growth of industrial robot industry in Asia-Pacific.

Key Developments/ Strategies in Articulated industrial robot market

For instance, in October 2022, ABB unveiled its smallest industrial robot with class-leading payload and accuracy. The new IRB 1010 is designed to fulfill the rise in customer demand for wearable smart gadgets. It is the most accurate robot in class for 1.5 kg payloads for maximum production quality, with a 50% payload increase over comparable robots on the market. The OmniCore E10 controller consumes 20% less energy, allowing manufacturers to increase energy efficiency and save expenses.

For instance, in January 2022, ABB and HASCO formed a joint venture to develop smart manufacturing in China's car industry. Partnership strengthens current connection to provide more automation and sustainability for auto parts production.

For instance, in April 2022, Comau LLC introduced the N-220 industrial robot, which features a streamlined design for ease of use. This next-generation robot, which expands company product offering, and delivers clear consumer benefits through its unique design and cutting-edge advanced robots technology.

For instance, in September 2020, KUKA AG, a German manufacturer of industrial robots and factory automation systems, introduced new SCARA robots from the KR SCARA line-up, which excel in applications such as tiny component assembly, materials handling, and inspection jobs with a payload of 6 kg. The robot is supplied in cost-sensitive areas.

For instance, in October 2020, ABB acquired Codian Robotics (Netherlands), a leading provider of delta robots used primarily for high-precision pick and place applications. Codian Robotics offers a hygienic design line, ideal for hygiene-sensitive industries including food & beverage and pharmaceuticals. With this acquisition, ABB increased its delta robot offerings in the markets.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the articulated industrial robot market analysis from 2023 to 2032 to identify the prevailing articulated industrial robot market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the articulated industrial robot market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global articulated industrial robot market trends, key players, market segments, application areas, and market growth strategies.

Articulated Industrial Robot Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 92.1 billion |

| Growth Rate | CAGR of 15.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 289 |

| By Application |

|

| By Robot Type |

|

| By Load Capacity |

|

| By Region |

|

| Key Market Players | HIRATA Corporation, Kawasaki Heavy Industries, Ltd., Omron Corporation, ABB Ltd., Robotic Automation Systems, Panasonic Industry Co., Ltd., DENSO Robotics Incorporated, KUKA AG, Mitsubishi Electric Automation, Inc, Delta Electronics, Inc. |

Analyst Review

The articulated industrial robot market has experienced constant growth and expansion, owing to a rise in demand for automation in a variety of sectors. These robots, which have multi-jointed arms similar to human limbs, find use in welding, assembling, and material handling. The market is dominated by key global companies such as ABB Ltd., Fanuc Corporation, and KUKA AG, with rising players adding to the competition. Articulated robots are frequently utilized in the automotive, electronics, pharmaceutical, and other industries. The integration of sensors and collaborative robots is an ongoing technical trend. By region, the market is dominated by Asia-Pacific, particularly China, Japan, and South Korea, with significant contributions from Europe and North America. Initial expenditures, the requirement for experienced workers, and attention to safety norms & laws are all significant challenges. The market is projected to expand further, owing to increased automation usage for improved productivity.

Furthermore, articulated industrial robots, defined by their multi-jointed limbs, are remarkably versatile across industries, performing a wide range of tasks that improve efficiency and precision. In automobile production, these robots excel at welding, assist to in painting vehicles with uniform coatings, and facilitate assembly operations with accuracy component handling. The electronics sector benefits from their application in pick-and-place operations and quality control inspections. In pharmaceutical production, articulated robots assist in packaging and lab automation tasks. The food and beverage industry uses these robots for picking and packaging processes, as well as palletizing completed items. In metal and equipment manufacture, articulated robots transport materials and perform exact cutting and machining.

Moreover, they are used in injection molding operations and to ensure the quality of molded components in the plastics and rubber industries. Articulated robots are used in the aerospace sector for assembly and inspection operations in hazardous settings. Textile production makes utilizes them in material handling, stitching, and sewing operations. These robots serve to assemble complex medical gadgets and perform testing & inspections. The logistics and warehousing sectors use articulated robots to automate palletizing, depalletizing, and order fulfillment. This adaptability highlights their critical role in modern manufacturing, which improves automation and overall production processes across a wide range of applications and sectors.

The global Articulated Industrial Robot Market was valued at $21,151.1 million in 2022 and is projected to reach $92,081.2 million by 2032, registering a CAGR of 15.7% from 2023 to 2032.

The base year calculated in the Articulated Industrial Robot Market report is 2022.

The forecast period in the Articulated Industrial Robot Market report is 2023 to 2032.

The top companies analyzed for global Articulated Industrial Robot Market report are Industrial Mitsubishi Electric Automation, Inc, DENSO Robotics Incorporated, KUKA AG, Delta Electronics, Inc., Robotic Automation Systems, ABB Ltd., Omron Corporation, Kawasaki Heavy Industries, Ltd., Hirata Corporation, and Panasonic Industry Co., Ltd.

Europe holds the maximum market share of the Articulated Industrial Robot Market

The company profile has been selected on the basis of revenue, product offerings, and market penetration.?

The market value of the Articulated Industrial Robot Market in 2022 was $21,151.1 million

The 6-Axis Robot segment is the most influential segment in the Articulated Industrial Robot Market.

Loading Table Of Content...

Loading Research Methodology...