Artificial Intelligence Chip Market Summary, 2034

The global Artificial Intelligence Chip Market Size was valued at $44.9 billion in 2024, and is projected to reach $460.9 billion by 2034, growing at a CAGR of 27.6% from 2025 to 2034. An artificial intelligence chip refers to a specialized integrated circuit tailored for efficient and fast execution of AI tasks. These chips are purposefully crafted to expedite intricate algorithmic calculations, crucial for various AI applications. They harness parallel processing abilities, unique neural network architectures, and optimized memory structures to achieve remarkable performance improvements compared to general-purpose processors. Artificial intelligence chip plays a pivotal role that propels AI technology, enabling real-time inference and training for diverse applications.

Key Takeaways

The artificial intelligence chip market Share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

AI chips find practical utility across a broad spectrum of industries and applications. In autonomous vehicles, these chips drive tasks such as identifying objects, merging sensor data, and making decisions, thus fostering safety and enabling self-driving capabilities. In healthcare, AI chips are majorly used for analyzing medical images, facilitating diagnoses from X-rays, MRIs, and CT scans.

Language-related AI functions, such as voice recognition and language translation, owe their functionality to AI chips, leading to advances in virtual assistants and instantaneous language translation tools. Moreover, AI chips enhance the efficiency of financial services by enabling algorithmic trading, fraud detection, and risk assessment.

AI provides impetus to initiate smart city programs in the developing countries such as India. Tools and technologies that are artificially intelligent possess a huge potential for transforming interconnected digital homes and smart cities. The utilization of AI chips holds the potential to significantly escalate the Artificial Intelligence Chip Market Demand for smart homes and smart cities by facilitating advanced automation, intelligence, and effectiveness.

In the context of smart homes, AI chips drive instantaneous processing of data, leading to improved energy management, tailored user interactions, and seamless integration of IoT devices, thus streamlining everyday tasks. In the domain of smart cities, AI chips can evaluate extensive data streams from sensors and cameras to optimize traffic patterns, resource allocation, and bolster public safety via anticipatory analysis and real-time surveillance. The increased AI processing capabilities of these chips revolutionize both residential spaces and urban landscapes, offering compelling advantages that surge the adoption of intelligent technologies.

AI chips cater to a diverse array of end users spanning various sectors. Within the tech industry, companies creating AI-centric products and services, such as smartphones featuring AI-powered cameras or smart speakers with voice-activated helpers, incorporate AI chips to ensure smooth user experiences. Enterprises utilize AI chips within data centers to tackle tasks such as training expansive machine learning models and refining business operations through predictive analysis.

Research institutions and academia leverage AI chips to push the frontiers of AI research, delving into novel algorithms and architectures. Ultimately, consumers benefit as end users of AI chips, gaining rewards from improved products and services reliant on accelerated AI processing, such as tailored streaming recommendations or intelligent home automation.

Furthermore, the emergence of quantum computing and surge in implementation of AI chips in robotics drive the growth of the global AI chip market. In addition, the emergence of autonomous robotics‐”robots that develop and control themselves autonomously‐”is anticipated to provide potential growth opportunities for the Artificial Intelligence Chip industry.

However, dearth of skilled workforce is one of the major restraints of the market. Most of the tasks such as testing, bug fixing, cloud implementation, and others are taken over by AI chips; however, the delivery of such tasks lack essential skill sets.

However, AI consists of complex algorithms for its development. In addition, management of AI and automated systems is difficult at times. This requires exceptional software engineering skills and notable experience in dealing with distributed and concurrent programming or debugging with communication protocols. However, many regions, particularly the emerging economies, lack people with such skills. Hence, dearth of skilled workforce is a prominent restraining factor for the market.

Furthermore, a pressing constraint in the AI chip market is the acute skilledâ€‐˜labor shortage. The Semiconductor Industry Association reports that U.S. chipmakers will need 115,000 new workers by 2030, yet may fall 67,000 positions short‐”primarily in engineering and technician roles. Globally, Deloitte forecasts over one million additional skilled hires are required by 2030, equating to >100,000 annually, despite fewer than 100,000 EE/CS graduate students enrolling in the U.S. each year. The U.S. also faces a shortfall of 70,000‐“90,000 semiconductors workers, prompting 10â€‐˜day boot camps to bridge gaps.

The recent progress in emerging economies such as China, South Korea, Japan, and India, alongside the extensive integration of AI technology across a range of industry domains such as media, advertising, finance, retail, healthcare, and automotive, has opened up promising pathways for the expansion of the AI chip market. The surge in adoption of AI within these sectors indicates a notable demand for effective processing solutions, which in turn drives the growth of specialized AI chips.

With ongoing economic development and the increase in indispensability of AI in these economies, the AI chip market is poised to gain substantial benefits from the advantageous prospects offered by these dynamic and technologically inclined Artificial Intelligence Chip industry. The time and cost benefits provided by AI are the major growth factors leading to its increased adoption in the developing regions. All these factors together fuel the growth of the market.

The artificial intelligence chip market is segmented on the basis of chip type, processing type, technology, application, industry vertical, and region. By chip type, the market is categorized into GPU, ASIC, FPGA, CPU, and others.

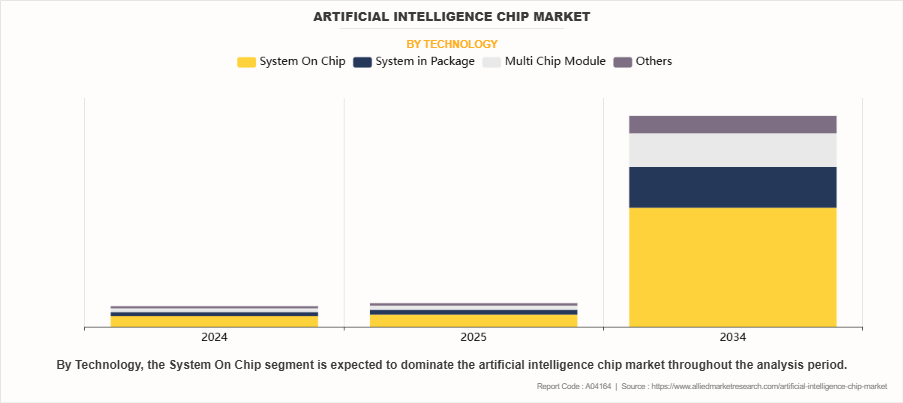

By processing type, it is categorized into edge and cloud. By technology, the market is categorized into system-on-chip, system-in- package, multi-chip module, and others. By application, the market is classified into natural language processing (NLP), robotics, computer vision, network security, and others.

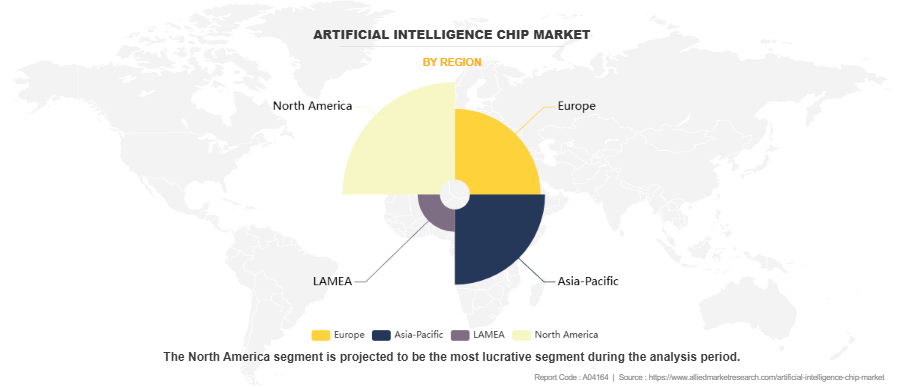

By industry vertical, the market is fragmented into media & advertising, BFSI, IT & telecom, retail, healthcare, automotive & transportation, and others. By region, the artificial intelligence chip market is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By chip type, the artificial intelligence chip market share is categorized into GPU, ASIC, FPGA, CPU, and others. In 2024, the CPU segment dominated the market, in terms of revenue, and ASIC segment will acquire highest CAGR during the forecast period.

By processing type, the artificial intelligence chip market growth categorized into edge and cloud. In 2022, the edge segment dominated the market, in terms of revenue, and will acquire major market share till 2034.

By technology, the market is categorized into system-on-chip, system-in-package, multi-chip module, and others. In 2024, the system-on-chip segment dominated the market, in terms of revenue, and will acquire major market share till 2034.

The applications analyzed in the study are natural language processing (NLP), robotics, computer vision, network security and others. In 2022, the natural language processing (NLP) segment dominated the market, in terms of revenue, and will acquire major market share till 2034.

The industry verticals considered in the study include media & advertising, BFSI, IT & telecom, retail, healthcare, automotive & transportation, and others. In 2024, the healthcare segment dominated the market, in terms of revenue, and will acquire major market share till 2034.

Key players profiled in the report include SoftBank Corp., Qualcomm Technologies Inc., Alphabet Inc., Mythic, Baidu, NXP Semiconductors, Intel Corporation, MediaTek, Advanced Micro Devices, Inc., NVIDIA Corporation (Mellanox Technologies), and Samsung.

Key Developments/ Strategies

Qualcomm Technologies Inc., Baidu, MediaTek Inc, NVIDIA Corporation (Mellanox Technologies), Alphabet Inc., Mythic, NXP Semiconductors, Intel Corporation, Samsung Electronics Co Ltd, Advanced Micro Devices Inc.(Xilinx Inc.), and SoftBank Corp are the top companies holding a prime share in the artificial intelligence chip market. Top market players have adopted various strategies, such as product launch, acquisition, innovation, partnership, and others to expand their foothold in the Artificial Intelligence Chip Market Opportunity.

In January 2023, NXP Semiconductors announced the launch of i.MX 95 family, the newest addition to its i.MX 9 series of applications processors. The new i.MX 95 family combines high-performance computers, immersive Arm MaliTM-powered 3D graphics, an innovative new NXP accelerator for machine learning, and high-speed data processing. This technology enables advanced applications in automotive, industrial, networking, connectivity, advanced human machine interface (HMI), and others.

In September 2022, Kinara announced its collaboration with NXP Semiconductors. Through this collaboration, customers of NXP Semiconductors' AI-enabled product portfolio have the option to further scale their AI acceleration needs by utilizing the Kinara Ara-1 Edge AI processor for high performance inferencing with deep learning models fr AI chip technology.

In November 2021, NXP Semiconductors announced the i.MX 93 family of applications processors designed for automotive, smart home, smart building, and smart factory applications, which leverages edge machine learning to anticipate and automate based on user needs.

In September 2022, Intel launched the 4th, Gen IntelR. XeonR Artificial intelligence chipset. Scalable processors (Sapphire Rapids) and IntelR. Data Center GPUs. The introduced 13th Gen IntelR. CoreTM. processors based on AI offer the best gaming experience and stellar content creator performance.

In August 2022, Intel's collaborated with Aible a cloud-based solution provider to leverage artificial intelligence and delivered rapid and measurable business impact. This deep collaboration includes engineering optimizations and an innovative benchmarking program, enhanced Aible's ability to deliver rapid results to its enterprise customers.

In February 2022, Intel launched XeonR., which is a new dual-track roadmap of Performance-core and Efficient-core based products, moving from two optimized platforms into one common, industry-defining platform. This path maximizes performance-per-watt, segment features and Intel's overall competitiveness within the industry.

In August 2021, Baidu announced the launch of its artificial intelligence technology with the launch of Baidu Brain. The start of mass production of its 2nd generation Kunlun AI chip, Kunlun II, and the demonstration of industrial applications using Baidu AI Cloud.

In October 2022, Razer unveiled the highly anticipated Razer Edge 5G, designed in collaboration with Qualcomm Technologies, Inc. and Verizon. This groundbreaking collaboration introduced the dedicated 5G handheld gaming device, equipped with the latest processing power from the Snapdragon G3x and Razer's industry-leading gaming hardware.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the artificial intelligence chip market analysis from 2024 to 2034 to identify the prevailing artificial intelligence chip market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the artificial intelligence chip market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global artificial intelligence chip market trends, key players, market segments, application areas, and market growth strategies.

Artificial Intelligence Chip Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 460.9 billion |

| Growth Rate | CAGR of 27.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 300 |

| By Chip Type |

|

| By Processing Type |

|

| By Technology |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Advanced Micro Devices, Inc., NXP Semiconductors, Mythic, Samsung, Intel Corporation, Baidu, Qualcomm Technologies Inc., Alphabet Inc., MediaTek, NVIDIA Corporation (Mellanox Technologies), SoftBank Corp. |

| Other Key Market Players | GRAPHCORE LTD., GROQ, GYRFALCON TECHNOLOGY INC., HORIZON ROBOTICS, INC., HUAWEI TECHNOLOGIES CO. LTD., INTEL CORPORATION, INTERNATIONAL BUSINESS MANAGEMENT CORPORATION, KNUEDGE, INC., KRTKL INC., MEDIATEK, INC., MICRON TECHNOLOGY, INC., MICROSEMI CORPORATION, MYTHIC, INC., NEC CORPORATION, KOREA ELECTRONIC CERTIFICATION AUTHORITY, INC. (AI BRAIN, INC.), NVIDIA CORPORATION, NXP SEMICONDUCTORS N.V., QUALCOMM INCORPORATED, SAMSUNG ELECTRONICS CO. LTD., SHANGHAI THINK-FORCE ELECTRONIC TECHNOLOGY CO. LTD., SK HYNIX, INC., SOFTBANK GROUP CORP. (ARM HOLDINGS PLC), TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED, TENSTORRENT INC., TEXAS INSTRUMENTS INCORPORATED, TOSHIBA CORPORATION, UNIVERSITY OF CALIFORNIA SYSTEM (UNIVERSITY OF CALIFORNIA, DAVIS), WAVE COMPUTING, INC., XILINX, INC. |

Analyst Review

According to the insights of the CXOs of leading companies, the artificial intelligence chip market holds high potential for the semiconductor industry. The current business scenario has witnessed an increase in the demand for artificial intelligence chip, particularly in the developing regions such as China and India. Companies in this industry have adopted various novel techniques to provide customers with advanced and innovative product offerings. According to the insights of the CXOs of leading companies, the AI chip market signifies a promising future for the technological industry..

The current business scenario has witnessed an increase in the adoption of this technology, particularly in the developing regions. Companies have adopted innovative techniques to provide customers with advanced and innovative product offerings. The market is shifting toward smart homes, smart cities, and smart gadgets as a result of technical breakthroughs, which has caused the artificial intelligence (AI) chip market to experience remarkable growth. In addition, growing investments in AI start-ups and development of quantum computers are anticipated to boost market expansion during the forecast period. Other factors, such as widespread use of AI technology and development of robotics, fuel the market expansion.

However, high research costs and shortage of competent labor limits the growth of the artificial intelligence (AI) chip market during the forecast period. In addition, significant increase in R&D, greater use of autonomous robotics across different industrial verticals, and introduction of high-tech products are expected to open up new market opportunities, accelerating the growth of the artificial intelligence (AI) chip market.

The artificial intelligence chip market was valued at $44,942.1 million in 2024 and is estimated to reach $460,886.6 million by 2034.

The global artificial intelligence chip market to grow at a CAGR of 27.6% from 2025 to 2034

Qualcomm Technologies Inc., Baidu, MediaTek Inc, NVIDIA Corporation (Mellanox Technologies), Alphabet Inc., Mythic, NXP Semiconductors, Intel Corporation are the top companies hold the market share in artificial intelligence chip market.

Aisa- Pacific region accounted for the artificial intelligence chip market share.

The global artificial intelligence chip market witnessed remarkable growth in 2024, driven by rapid advancements in AI applications across industries such as automotive, healthcare, finance, and manufacturing.

Loading Table Of Content...

Loading Research Methodology...