Artificial Joints Market Research, 2032

The global artificial joints market size was valued at $20.2 billion in 2022, and is projected to reach $31.8 billion by 2032, growing at a CAGR of 4.6% from 2023 to 2032. Artificial joints, commonly referred to as prosthetic joints or joint implants, are medical devices created to replace a human body joint that has been injured or undergoes degenerative changes. These tools are designed to act similarly to a natural joint, improving joint mobility, relieving pain, and regaining physical function. Artificial joints are typically used in orthopedic surgeries, such as joint replacement surgeries, to replace joints that have been severely damaged due to conditions such as osteoarthritis, rheumatoid arthritis, joint degeneration, or joint trauma.

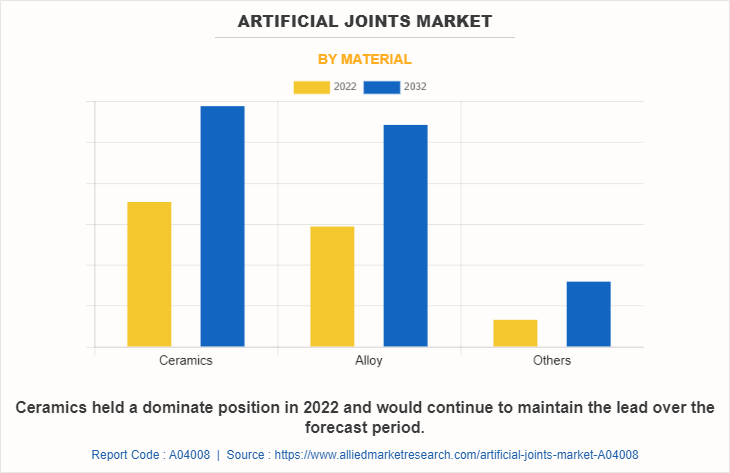

Artificial joints are constructed using biocompatible materials, such as metal alloys, high-density plastics, ceramics, or a combination of these materials. These materials are chosen for their durability, strength, biocompatibility, and ability to withstand the mechanical stress and movements of the joint.

Historical Overview

The artificial joints market share is analyzed qualitatively and quantitatively from 2022 to 2032. The artificial joints market experienced growth at a CAGR of around 4.6% from 2022 to 2032. Most of the growth during this period is derived from North America owing to rise in the number of market players for artificial joints and increase in the number of populations suffering from orthopedic diseases such as osteoarthritis.

Market Dynamics

Growth of the global artificial joints market forecast is majorly driven by high presence of market players artificial joints, increase in prevalence of osteoarthritis, and technological advancements for development of artificial joints. Moreover, rise in prevalence of osteoarthritis is anticipated to increase the number of surgical procedures such as knee replacement and hip replacement. Thus, this factor is anticipated to drive the demand for artificial joints and boost the growth of the market. Osteoarthritis is a degenerative joint disease that can cause significant pain, stiffness, and functional limitations in the affected joint. Thus, this factor is anticipated to boost the demand for artificial joints and drive the growth of the market.

For instance, according to the Centers for Disease Control and Prevention (CDC), in 2021, osteoarthritis was the most common form of arthritis and about 58.5 million people suffered from arthritis in the U.S. Thus, rise in prevalence of osteoarthritis cases is expected to drive the growth of artificial joints market. In addition, surge in incidences of knee osteoarthritis further increases the demand for artificial knee joints. For instance, according to the data published by National Center for Biomedical Information (NCBI), in November 2020, around 86.7 million individuals were suffering from knee osteoarthritis, globally. Therefore, increase in incidence rate of knee osteoarthritis is expected to increase the number of knee replacement surgeries and boost the artificial joints market growth.

Moreover, rise in the number of orthopedic surgeries such as knee replacement, knee arthroplasty, and hip replacement is anticipated to drive the demand for artificial knee and hip joints. Thus, this factor is expected to drive the growth of the market. For instance, according to annual report of The Swedish Arthroplasty Register, 222,249 individuals had at least one hip replacement and 155,041 individuals had at least one knee replacement in Sweden at the end of 2021.

Moreover, according to, National Library of Medicine, in 2022, the demand for total knee arthroplasty (TKA) in the U.S. was anticipated to increase 673% from 2005 to 2030, with 5.28 million TKAs to be done annually. In addition, American Joint Replacement Registry Annual Report, in 2022 reported that, over 2.8 million hip and knee procedures were performed in 1,250 institutions of Columbia. Thus, rise in the number of knee replacement, knee arthroplasty, and hip replacement is anticipated to fuel the demand for artificial joints and drive the growth of the market.

Rise in the number of geriatric populations is anticipated to increase the number of populations suffering from osteoarthritis, which is expected to increase the number of surgical procedures and increase the demand for artificial joint. Therefore, fueling the growth of the market. For instance, according to National Poll of Healthy Aging, in 2022, three in five adults of age group 50 years to 80 years (60%) reported that they have arthritis, with 30% reporting a diagnosis of osteoarthritis, that is, “wear and tear,” “bone-on-bone,” or degenerative arthritis. Less commonly reported types of arthritis were rheumatoid arthritis (8%), gout or pseudogout (7%), or another kind of arthritis (5%).

Moreover, the Swedish Arthroplasty Register, in 2021, reported that around 46,777 population of age group 65 years to 74 years, and around 58,020 population of 75 year to 84 years have undergone knee replacement surgery in Sweden. Thus, rise in prevalence of osteoarthritis in geriatric population is anticipated to increase the number of arthroplasty surgeries. Thus, this factor is anticipated to fuel the needs for artificial joints in aging population and boost the artificial joints market share.

Increase in prevalence of sports injuries is anticipated to increase the prevalence of osteoarthritis, thus, expected to rise the demand for surgical intervention and fuel the demand for artificial joints. Therefore, boosting the growth of the market. Injuries to the joints, such as sports-related injuries, repetitive stress injuries, or accidents, are predicted to increase the risk of developing osteoarthritis. Joint trauma can damage the protective cartilage within the joint, leading to accelerated joint degeneration and the onset of osteoarthritis. For instance, according to report published by National Safety Council of U.S, in 2021, 20% rise in sports and recreational injuries was observed as compared to 2020. Thus, increase in the number of sports injuries boosts the growth of the market.

On the other hand, side effects associated to surgical intervention, in which artificial joints are used, is expected to hamper the growth of the market. For instance, side effects of surgical intervention include risk of infection at the surgical site or in the joint following arthroplasty surgery and risk of blood clots forming in the legs (deep vein thrombosis) or traveling to the lungs (pulmonary embolism). Moreover, it also includes issues with the artificial joint itself can occur, such as joint dislocation, loosening, or wear and tear over time, alleviate pain, allergic reaction, and others. Thus, this factor anticipated to decrease in number of surgical procedures and expected to hamper the growth of artificial joints market.

COVID-19 had a significant impact on the artificial joints market. Several clinical trials have been disrupted due to the pandemic and social distancing regulations. The shortage of healthcare workers, financial constraints, and lockdowns have led to increase in the number of patients who are unable to access timely treatments. Thus, these factors are anticipated to restrain the growth of the market. In addition, decrease in the number of orthopedic surgeries such as total joint arthroplasty (TJA) and total knee arthroplasty (TKA) is anticipated decrease the demand for artificial joints and restrain the growth of the market.

For instance, according to National Library of Medicine, in 2021, there was 30.1% decrease in revision TKA surgery and a 6.80% decrease in revision total hip replacement surgery in the U.S. Moreover, Springer Journal of Experimental Orthopedics reported that, there was drop of 54% and 42%, in the rate of joint replacements and arthroscopies, respectively, in April 2020. Thus, cancelation of elective surgeries, decrease in the number of consultations in orthopedic diseases, and financial constraints were anticipated to hinder the growth of the market during the COVID-19 pandemic.

Segmental Overview

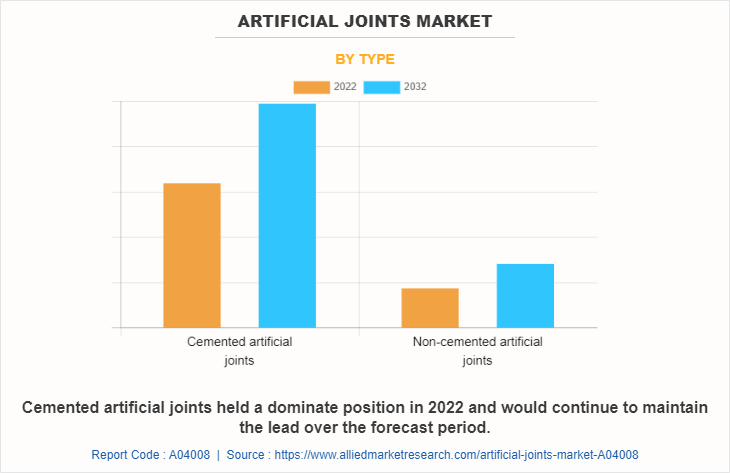

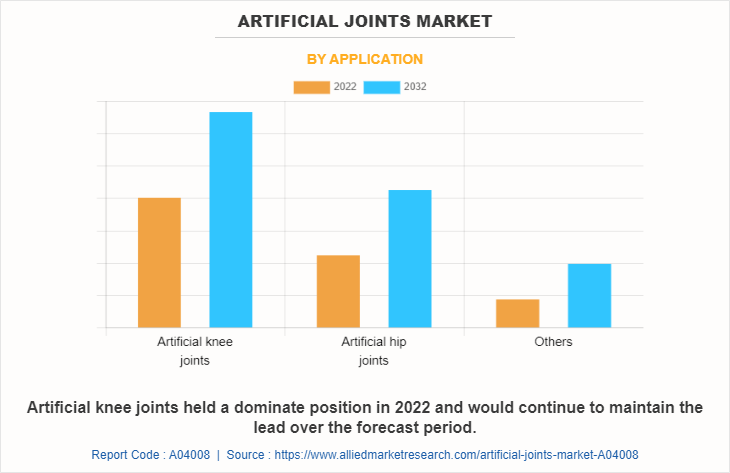

The artificial joints market size is segmented on the basis of type, application, material, end user, and region. On the basis of type, the market is bifurcated into cemented artificial joints and non-cemented artificial joints. On the basis of application, the market is divided into artificial knee joints, artificial hip joints, and others. Others includes shoulder artificial joint and ankle artificial joint. On the basis of material, the market is segmented into ceramics, alloy, and others. Others includes high-density plastics and oxinium. On the basis of end user, the market is bifurcated into hospitals and ambulatory surgical center. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

The artificial joints industry is classified into cemented artificial joints and non-cemented artificial joints. The cemented artificial joints segment is expected to be the fastest growing segment during the forecast period, as cemented fixation has been widely used in joint replacement surgeries for several decades and has shown good long-term clinical outcomes. The technique has a well-established track record of success, particularly in older patients with compromised bone quality.

By Application

The artificial joints industry is classified into artificial knee joints, artificial hip joints and others. Others include shoulder artificial joint and ankle artificial joint. The artificial knee joints segment is projected to be the fastest growing segment during the forecast period owing to rise in prevalence of knee osteoarthritis and increase in number of knee replacement surgeries.

By Material

The market is classified into ceramics, alloy, and others. Others includes high-density plastics and oxinium. The ceramic segment is projected to be the fastest growing segment during the forecast period, owing to high provision of ceramic artificial joints and ceramic materials are biocompatible and can reduce friction and wear on the joint.

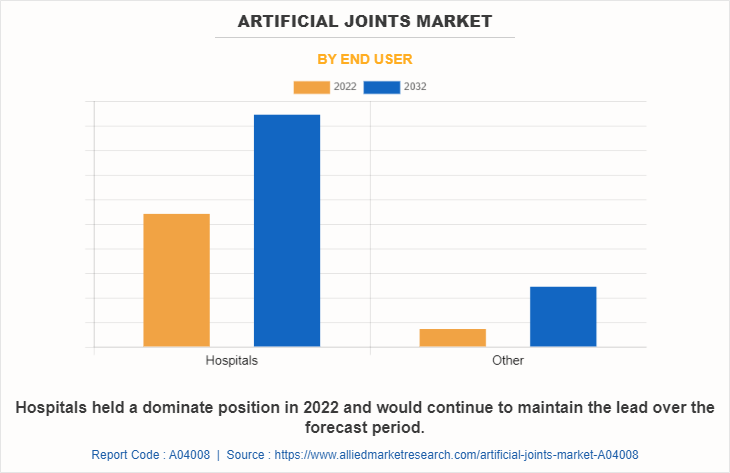

By End User

The market is classified into hospitals and ambulatory surgical center. The hospitals segment is projected to be the fastest growing segment during the forecast period, owing to rise in adoption of orthopedic surgical in hospital and increase in development in healthcare infrastructure.

By Region

The North America artificial joints market opportunity is expected to grow during the forecast period, owing to rise in the number of adoptions of key strategies such as agreement and others and increase in the number of product approval and product launch for artificial joints. For instance, in September 2022, Conformis, Inc, a leading medical technology company featuring personalized knee and hip replacement products, announced that it has received 510(k) clearance from the U.S. Food and Drug Administration for its Actera Hip System. The artificial joint used in hip arthroplasty surgery.

Moreover, in August 2022, Conformis, Inc., a leading medical device company that features personalized knee and hip replacement products, announced it has entered into a multi-year agreement with Vizient, Inc., the nation's largest member-driven healthcare performance improvement company. It offers personalized orthopedic implants to Vizient’s large membership of healthcare facilities through this contract.

In addition, in May 2022, Johnson & Johnson MedTech, announced that the INHANCE shoulder system from DePuy Synthes, the orthopedics company of Johnson & Johnson, has received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for use in reverse total shoulder arthroplasty procedures. Thus, rise in the number of product approvals for artificial joints and increase in the number of adoptions of key strategies by market players are anticipated to boost the growth of the market in North America.

However, the Asia-Pacific artificial joints market is expected to grow during the forecast period, owing to rise in prevalence of osteoarthritis and increase in the number of geriatric populations. Population suffering from osteoarthritis is anticipated to boost the number of arthroplasty surgeries and increase the demand for artificial joints. Thus, this factor is anticipated to drive the growth of the artificial joints market in Asia-Pacific. According to Eva Hospital, in 2021, osteoarthritis affects more than 15 million adults annually in India. Thus, rise in prevalence of osteoarthritis, increase in the number of knee replacement surgeries, and rise in the number of geriatric populations are anticipated boost the growth of the artificial joints market.

Competition Analysis

Some of the major companies that operate in the global artificial joints market include Zimmer Biomet, Smith & Nephew, Stryker Corporation, DePuy Synthes, B. Braun, Aesculap, Medtronic, Medacta International, Exactech, and MicroPort Orthopedics Inc.

Product Approval in the Artificial Joints Market

In June 2023, Smith & Nephew, one of the leading medical technology companies, announced that it has received 510(k) clearance from the U.S. food and drug administration (FDA) for its Aetos shoulder system. This system is used in surgical procedure of shoulder arthroplasty.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the artificial joints market analysis from 2022 to 2032 to identify the prevailing artificial joints market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the artificial joints market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global artificial joints market trends, key players, market segments, application areas, and market growth strategies.

Artificial Joints Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31.8 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 447 |

| By Type |

|

| By End user |

|

| By Application |

|

| By Material |

|

| By Region |

|

| Key Market Players | Medacta International SA, Exactech, MicroPort Orthopedics Inc, B. Braun Melsungen AG, Smith & Nephew plc, Johnson and Johnson (DePuy Synthes), Stryker Corporation., Zimmer Biomet Holding Inc., Conformis Inc., Medtronic plc |

Analyst Review

Artificial joints are orthopedic prostheses that are frequently made of metal, oxonium, ceramics, and other materials. An arthritic or damaged joint surface is replaced using prosthetic joints during an orthopedic surgery procedure. Increase in the number of market players who manufacture artificial joints and rise in the number of adoptions of key strategies such as acquisition, agreement, product launch, and product approvals are anticipated to boost the growth of the market. For instance, in June 2023, Smith+Nephew, one of the leading medical technologies companies, announced that it has received clearance from the U.S. food and drug administration (FDA) for its Aetos shoulder system. This system is used in surgical procedure of shoulder arthroplasty.

In addition, in November 2022, Smith+Nephew, one of the leading medical technologies companies, announced the introduction of its Journy II Rox total knee solution, a reverse hybrid construct for total knee arthroplasty. This product solution aims to provide surgeons with the clinical advantage of an advanced bearing material and anatomic design, combined with the efficiency and potential long-term tibia fixation of a cementless knee.

The top companies that hold the market share in artificial joints market are Zimmer Biomet, Smith & Nephew, Stryker Corporation, DePuy Synthes, B. Braun and Aesculap.

North America is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop the healthcare sector, increase in the prevalence of orthopedic diseases and increase in the number of geriatric populations.

The key trends in the artificial joints market are increase in number of knee replacement surgeries and rise in number of populations suffering from osteoarthritis.

The base year for the report is 2022.

10 artificial joints companies are profiled in the report.

The total market value of artificial joints market is $20,235.51 million in 2022.

The forecast period in the report is from 2023 to 2032.

High cost of joint replacement surgery is restraining factor for artificial joints market.

Loading Table Of Content...

Loading Research Methodology...