ASEAN Blood Pressure Monitoring Devices Market Overview:

The ASEAN blood pressure monitoring devices market was valued at $31.5 million in 2017 and is expected to reach $53.3 million by 2025, registering a CAGR of 6.8% from 2018 to 2025. In terms of volume, the ambulatory BP monitors segment is expected to register the highest CAGR of 7.9% from 2018 to 2025.

Measurement of blood pressure is an important parameter that helps diagnose numerous diseases. Blood pressure was measured using the auscultatory technique initially, with the pressure in the cuff measured using a mercury sphygmomanometer. This subsequently became, and to date is recognized as, the gold standard. However, environmental concerns regarding use of mercury in the sphygmomanometer have led to a ban on the device in several developed countries such as the UK, Sweden, the Netherlands, and others. Further, use of digital and ambulatory devices has replaced sphygmomanometer for measuring blood pressure. In addition, digital BP monitors enable patients to easily monitor their blood pressure even at home.

The major key factors that drive the ASEAN blood pressure monitoring devices market include significant increase in the prevalence of hypertension, surge in demand for these devices to self-monitor blood pressure, and rise in geriatric population. However, lack of awareness about hypertension among patients in ASEAN countries and significance of blood pressure monitoring in adequate time is anticipated to hamper the growth of the ASEAN blood pressure monitoring devices market. On the contrary, increase in healthcare expenditure in emerging economies is expected to create lucrative opportunities in future.

Product segment review

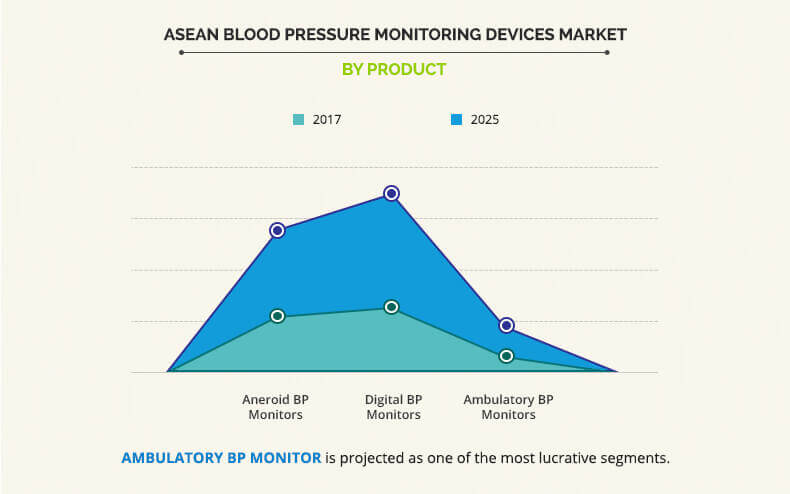

Based on product, the ASEAN blood pressure monitoring devices market is categorized into aneroid BP monitors, digital BP monitors, and ambulatory BP monitors. The digital BP monitors segment was the highest contributor to the market in 2017 and is anticipated to maintain its dominance throughout the forecast period. This was attributed to the fact that digital BP monitors are easy to use as compared to other blood pressure monitoring devices. In addition, they are small enough to fit in the hands of a patient to enable fast and accurate readings.

Country segment review

Based on country, the ASEAN blood pressure monitoring devices market is analyzed across Malaysia, Indonesia, Thailand, Vietnam, Philippines, and rest of ASEAN countries. Malaysia dominated the market in 2017, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period, owing to the significant increase in healthcare expenditure and high adoption of advanced medical technology. However, Indonesia is projected to register the highest growth rate from 2018 to 2025 owing to surge in prevalence of hypertension in this region

The report provides a comprehensive analysis of the leading companies operating in the ASEAN market such as A&D Company, Limited, Contec Medical Systems Co. Ltd., GE Healthcare, Hill Rom Holdings, Inc., Koninklijke Philips N.V., Masimo Corporation, Nihon Kohden Corporation, Omron Corporation, Smiths Group Plc., and Halma PLC.

The other players in the value chain include SunTech Medical, Rossmax International Ltd, Spacelabs Healthcare Inc., Panasonic Corporation, and Microlife AG.

Key Benefits for ASEAN Blood Pressure Monitoring Devices Market:

The study provides an in-depth analysis of the ASEAN blood pressure monitoring devices market with the current trends and future estimations to elucidate the imminent investment pockets.

A comprehensive analysis of the factors that drive and restrict the market growth is provided.

A comprehensive quantitative analysis of the industry is provided from 2018 to 2025 to assist stakeholders to capitalize on the prevailing market opportunities.

An extensive analysis of the key segments of the industry helps understand the trends in the ASEAN blood pressure monitoring devices market.

Key players and their strategies are provided to understand the competitive outlook of the industry.

ASEAN Blood Pressure Monitoring Devices Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Country |

|

| Key Market Players | GE HEALTHCARE, NIHON KOHDEN CORPORATION, OMRON CORPORATION, CONTEC MEDICAL SYSTEMS CO. LTD, HALMA PLC., MASIMO CORPORATION, HILL ROM HOLDINGS, INC., SMITHS GROUP PLC., KONINKLIJKE PHILIPS N.V., A&D COMPANY, LIMITED |

Analyst Review

Blood pressure is one of the main risk factors for chronic heart diseases and strokes, which are the leading cause of death around the world. Rise in demand for blood pressure monitoring devices in home care settings and emergence of advanced technologies drive the market growth in ASEAN countries. Moreover, increase in sedentary lifestyles and surge in prevalence of hypertension in this region boost the growth of the blood pressure monitoring devices market in this region.

The blood pressure monitoring devices market has fueled the interest of healthcare professionals, owing to the recognition of risk factors such as stroke and heart attack, associated with high blood pressure, which can help physicians determine the severity of any disease. Moreover, the market is driven by growth in geriatric population and rise in prevalence of hypertension. Further, use of blood pressure monitoring devices is the highest in Malaysia followed by Thailand, due to high government expenditure on healthcare.

Loading Table Of Content...