Ash Handling System Market Research: 2031

The Global Ash Handling System Market Size was valued at $3,367.9 million in 2021 and is projected to reach $4,780.9 million by 2031, registering a CAGR of 3.4% from 2022 to 2031. An ash handling system is an industrial machinery used for collecting ash of the burnt fuel from the furnace and transferring it to a site from where it can further be transported via other media to a disposing site or to the industrial facility where it can further be reused. These systems typically use air or water as a medium to move ash within the industrial facility. In addition, machines that move the ash mechanically via conveyor belts are also widely used.

Market Dynamics

The ash handling system market has been witnessing rapid growth for the past few decades, largely due to the increasing number of industries that burn fuel such as coal and produce ash. Industrial ash, especially coal ash, is highly hazardous to human and animal health. Ash constitutes of very fine sized and relatively bigger-sized particles known as fly ash, and bottom ash respectively. Ash contains various chemicals such as arsenic, mercury, lead, and other chemicals which are detrimental to the physical and mental health of humans.

For instance, in April 2020, in the district of Singrauli, Madhya Pradesh fly ash slurry entered nearby farms and villages when a breach occurred in the fly ash dyke of Sasan plant of Reliance Power in the Singrauli, resulting in the death of six people. Moreover, when ash comes in direct contact of water bodies, it leads to environmental contamination, damaging local ecosystems and harming the health of local communities. Thus, to prevent such occurrences, ash is generally reused in various construction sites, as well as a raw material in cement production.

Furthermore, owing to the very fine size of ash, it is challenging to handle the ash; therefore, special ash handling systems are utilized to properly handle the ash. Such equipment includes hydraulic pneumatic, and mechanical ash handling system. The largest producer of ash are coal-fired power plants. Many countries such as U.S., Canada, and many countries in Europe have pledged to reduce the number of coal-fired power plants; however, currently coal contributes significantly to the total energy mix of these countries.

Contrarily, developing countries such as China, India, Indonesia, Nigeria, and others are building new coal-fired power plants to produce electricity for their huge power-hungry population. Thus, the increasing number of coal-fired power plants are driving demand for ash handling systems. Furthermore, the steel industry is a major producer of ash as it utilizes coal for producing heat as well as to produce coke to treat iron ore. Across the globe, the demand for steel is increasing with the growth in construction, automotive industry, increasing infrastructure development activities, and others.

Thus, growth in the steel industry is driving demand for ash handling systems. Furthermore, other industries that use ash handling systems are incineration plants, aluminum producing facility, chemical industry, paper industry, and many others. In addition, various guidelines set forth by government agencies that regulate the disposal of hazardous waste including ash are one of the major factors driving the growth of the ash handling system market. For instance, the Environment Protection Agency of the U.S. revised its coal combustion residuals (CCR) rules in 2018.

Moreover, increasing demand for cement, driven by the rapid growth in the construction sector is expected to provide lucrative growth opportunities for the ash handling system market growth. For instance, the Indian Government in the Union Budget 2022-23, allocated significant resources for infrastructure, affordable housing schemes, and road projects to fuel the economy; thus, a surge in the cement industry is expected in the country. However, the high maintenance cost of ash handling systems is anticipated to restrain the market growth. In addition, a gradual shift towards more environment-friendly processes is also expected to negatively influence market growth.

The market growth for ash handling systems witnessed a standstill in 2020, owing to low demand for ash handling systems from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic had reduced the production of various goods such as steel, cement, and others; thus, hampering the growth of the ash handling system market significantly during the pandemic. The major demand for ash handling systems was previously noticed from giant industrial hubs such as the U.S., Vietnam, India, and China, which were severely affected by the spread of coronavirus, thereby halting demand for ash handling systems.

However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. This has led to the full-fledged reopening of ash handling system manufacturing companies, and their end-user sectors as well as their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, as of the beginning of 2023, the number of COVID-19 infection cases is surging again, especially in China, this has brought negative sentiments in the market, which may have a negative impact on the ash handling system market for a short duration.

Segmental Overview

The ash handling system market is segmented on the basis of ash type, system type, end-user industry, and region. By ash type, it is bifurcated into fly ash and bottom ash. By system type the market is classified into hydraulic, pneumatic, and mechanical. By end-user industry, it is classified into power plants, cement manufacturing, steel plants, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

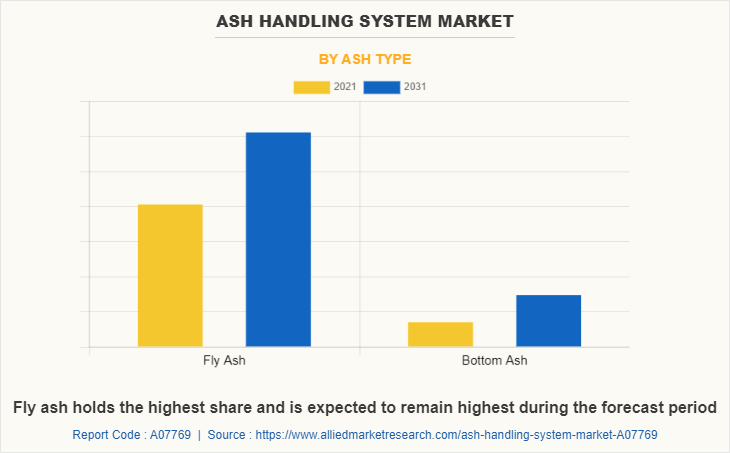

By Ash Type:

The market is categorized into bifurcated into fly ash and bottom ash. In 2021, the fly ash segment dominated the ash handling system market, in terms of revenue, and the bottom ash segment is expected to grow with a higher CAGR during the forecast period. Out of the total ash produced, a major portion is fly ash. Particles of fly ash are very fine in size; thus, they fly away with flue gas, and are caught using various equipment before it reaches the chimney stack. Fly ash has wide-scale applications in construction, as filler material and also as an additive in concrete, along with other applications. Moreover, bottom ash is heavier than fly ash, thus drops below the furnace. As compared to fly ash, bottom ash is slightly more difficult to reuse.

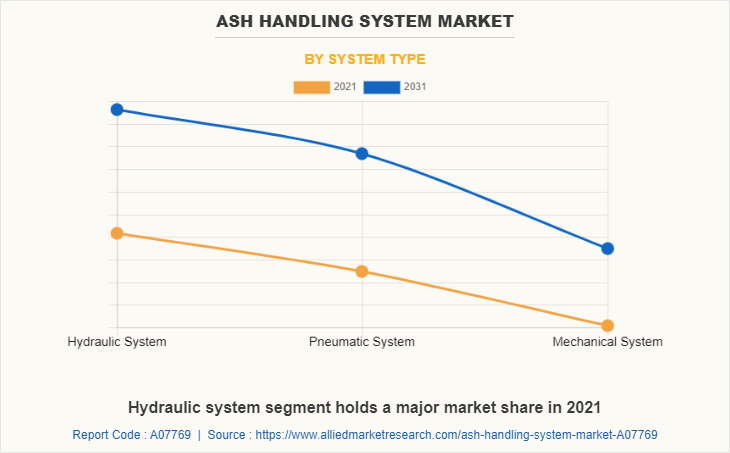

By System Type:

The market is classified into hydraulic, pneumatic, and mechanical. The hydraulic segment accounted for the highest revenue in 2021, and the pneumatic segment is expected to grow with the highest CAGR during the forecast period. The hydraulic ash handling system utilizes water as a medium to transfer ash from the furnace to a desired location on the site. It includes low as well as high pressure systems. Hydraulic ash handling systems can handle large volumes of ash; therefore, are applicable for large plants. Moreover, the pneumatic segment utilizes an air stream to transfer ash through a pipe. This system is fast, and the probability of corrosion is less as water is not used in this system.

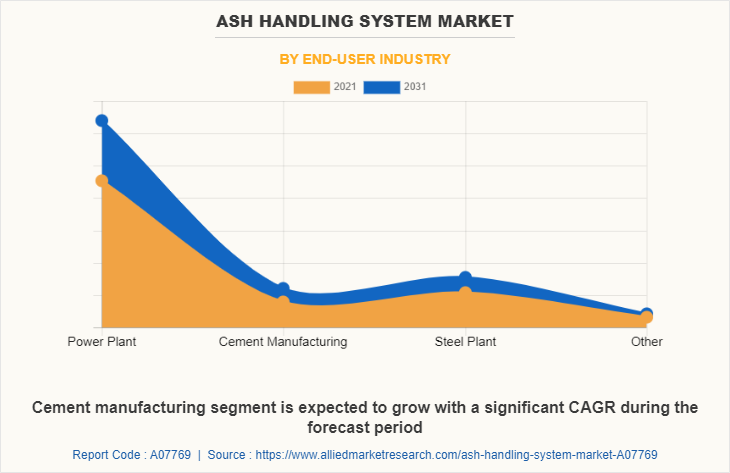

By End-User Industry:

On the basis of the end-user industry, the ash handling system market is classified into power plants, cement manufacturing, steel plants, and others. The power plants segment was the highest revenue contributor to the market in 2021. And the cement manufacturing segment is expected to register a higher CAGR during the forecast period. The power plants segment includes the electricity generation plants that use coal as an energy source. The rise in industries and population, especially in developing countries, is expected to drive the need for electricity, thus increasing the number of coal-fired power plants. Furthermore, demand for residential, commercial, and industrial buildings is growing with the increasing population, urbanization, and rise in disposable income, which is eventually driving cement manufacturing segment.

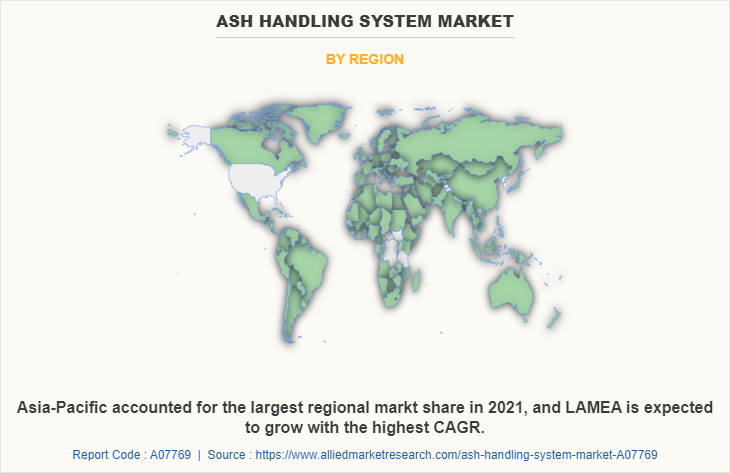

By Region:

The ash handling system market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for the highest ash handling system market share in 2021, and LAMEA is anticipated to secure the leading position during the forecast period, due to the high growth potential of the industrial sector including machinery manufacturing, building material manufacturing, automotive industry, and others in LAMEA. Rapidly developing countries such as India, China, and Vietnam are a few of the major manufacturing hubs in Asia-Pacific, attributed to the availability of cheap and skilled labor, and support from governments for domestic industrial growth.

For instance, India’s output of coal, steel, cement, and electricity registered an increased growth in November 2022 as compared to that of in November 2021. Therefore, major players are striving to develop manufacturing units in these markets to improve production quantities as well as serve the industries in Asia-Pacific. Moreover, about 172 gigawatts capacity of coal-fired power plants were being built across the world, out of which more than 50% are being built in China, and a significant portion of it is being built in India, and Indonesia. For instance, as of June 2021, 33 gigawatts of coal-fired power capacity were under construction in India. Moreover, China is considered to be the world’s factory owing to the large manufacturing sector in the country; therefore, growth in China, India, and other nations in Asia-Pacific is considered to play an important role in driving demand for ash handling system.

Competition Analysis

Competitive analysis and profiles of the major players in the ash handling system market, such as ANDRITZ, Babcock & Wilcox Enterprises, Inc., Bevcon Wayors, Macawber Beekay, McNally Bharat Engineering Co., Nederman National Conveyors, ProcessBarron, Qingdao Sizhou Electric Power Equipment Co. Ltd., Schenck Process, and United Conveyor Corporation are analyzed and incorporated in the report. The key players in the market have been involved in launching new and innovative products to remain competitive in the market.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging ash handling system market trends and dynamics.

In-depth ash handling system market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the ash handling system market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing ash handling system market opportunities.

The ash handling system market forecast analysis from 2022 to 2031 is included in the report.

The key players within the ash handling system market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the ash handling system industry.

Ash Handling System Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.8 billion |

| Growth Rate | CAGR of 3.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 188 |

| By System Type |

|

| By End-user Industry |

|

| By Ash Type |

|

| By Region |

|

| Key Market Players | Nederman National Conveyors, Andritz, ProcessBarron, Babcock and Wilcox, Mcnally Bharat Engineering Company Ltd, United Conveyor Corporation, Bevcon Wayors Private Limited, Qingdao Sizhou Electric Power Equipment Co. Ltd., Macawber Beekay Pvt Ltd., Schenck Process |

Analyst Review

The ash handling system market has been surging for the past few years owing to increased production of steel and cement. These industries utilize coal and produce ash.

In addition, the number of coal-fired power plants in countries such as India, China, Indonesia, Nigeria, and Brazil are increasing, which is also playing a significant role in driving demand for ash handling systems. Furthermore, the implementation of various regulations that regulate the disposal of ash is driving the ash handling system market growth. Fly ash, one of the ash types, comprising a major portion of the total ash produced is extensively used for building bricks, to spread over frozen roads, to fill under embankments, and others; therefore, it accounted for the largest market share in 2021. However, high maintenance cost, and reduction in utilization of coal for electricity production in developed countries is expected to negatively affect the market

In addition, increasing demand for cement, for construction of buildings and infrastructure is expected to provide lucrative growth opportunities for market growth.

Increasing demand for cement and steel is a major demand growth factor for the market expansion. In addition, the increasing number of coal-fired power plants in some countries is also expected to positively influence the market.

Ash handling systems are used for collecting ash from the furnace and disposing it at some other place in the facility premises.

Asia-Pacific accounted for a major market share in 2021.

The global ash handling system market size was valued at $3,367.9 million in 2021.

ANDRITZ, Babcock & Wilcox Enterprises, Inc., Bevcon Wayors, Macawber Beekay, McNally Bharat Engineering Co., Nederman National Conveyors, ProcessBarron, Qingdao Sizhou Electric Power Equipment Co. Ltd., Schenck Process, and United Conveyor Corporation are analyzed and incorporated in the report.

By ash type, the fly ash segment dominated the ash handling system market, in terms of revenue, in 2021.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The global ash handling system market is projected to reach $4,780.9 million by 2031, registering a CAGR of 3.4% from 2022 to 2031

Loading Table Of Content...