Asia and MEA Construction Chemicals Market Outlook - 2025

The Asia and MEA construction chemicals market was valued at $15,907.9 million in 2017 and is expected to reach $27,740.7 million by 2025, growing at a CAGR of 7.2% from 2018 to 2025.Construction chemicals are known for enhancing the concrete properties such as strength, quality, and rigidity and render the overall construction durables. They are used in concrete to reduce the overall quantity of water and cement thereby reducing the overall cost of construction. If used with proper composition and formulation construction chemicals have long term benefits and offers more than ten years of service life.

The Asia & MEA construction chemicals market is operating in growing phase of industry life cycle and is expected to witness significant growth during the forecast period. Extensive growth in the global construction industry is the key factor driving the demand for Asia & MEA construction chemicals Market. In 2018, the global construction industry was $11.4 trillion contributing more than 13% in the global GDP. Furthermore, the global construction industry is expected to grow at 4.2% during the next five years which is slightly above anticipated global GDP growth of next five years (i.e. 3.1%).

Therefore, expanding global construction industry also expanding the Asia & MEA construction chemicals Market size. Factors such as growth in the population, increase in investment in new construction projects, and technological advancements are key factors that fuel the growth of construction industry. Hence, development of the construction industry is the prime factor driving consumption rate of the Asia & MEA construction chemicals Market.

Increase in urban population in both Asia and Middle East & Africa region is setting a growth momentum for Asia & MEA construction chemicals Market. Asia registered highest rate of urbanization, 1.5% as of 2018 which is resulting into increasing demand for housing projects. Incorporation of new construction practices such as energy conservation building codes toward achieving sustainable infrastructure and use of smart compacting concrete is resulting into greater adoption of construction chemicals. However, lack of awareness regarding construction chemical products is expected to hamper the growth of the Asia & MEA construction chemicals market. Rise in trend for energy-efficient buildings and sustainable infrastructure, and construction repair activities in next five years is expected to create new growth opportunities during the assessment period.

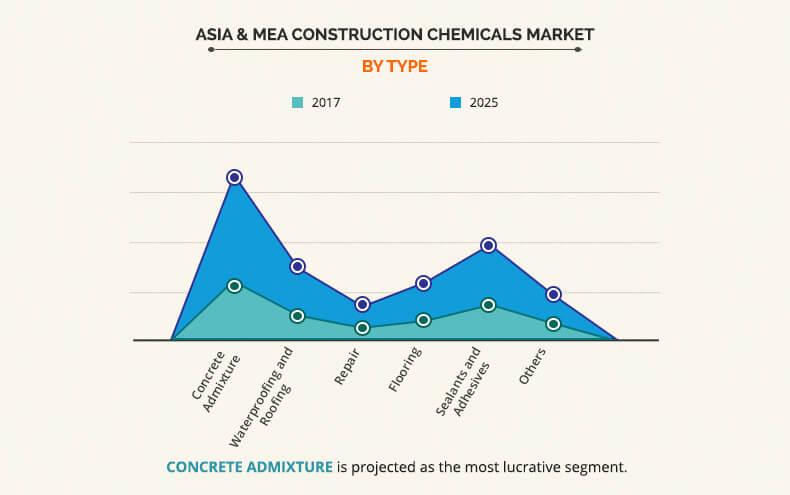

The Asia & MEA construction chemicals market is segmented based on type, application, and region. Based on type, the market is divided into concrete admixture, waterproofing and roofing, repair, flooring, adhesives & sealants, and others. Concrete admixture segment acquired largest Asia & MEA construction chemicals market share due to associated benefits with it. Market segmentation based on application includes residential, industrial, infrastructural, repair, structure, and others. Asia & MEA construction chemical market growth for residential segment is mainly driven by increasing population and resulting demand for housing project. Due to which residential segment accounted for largest market share in this market.

Based on region, Asia & MEA Construction Chemicals Market is dominated by Asia region. China, India, and Japan have greatly contributed in the region. China is the leader in the Asia construction chemicals market that accounted for a 58% share in 2017. Japan is a developed economy and represents an organized construction industry. It complies with the majority of construction related codes launched by government, more specifically, regarding energy conservation buildings. It incorporates the new construction technologies in all its recent construction initiatives. On the other hand, India is anticipated to exhibit the highest CAGR of 8.33% during the forecast period. It is one for the most dynamic economies for the construction industry, actively catering to the needs of the increase in demand for infrastructure development and rise in housing projects.

On the other hand, growth in tourism industry is setting a growth trajectory of construction chemicals market in MEA. Incorporation of new construction technologies in MEA, has helped build one of the finest skyscrapers in the world Burj Khalifa, and Royal Clock Tower Hotel. This has set the growth trajectory for construction chemicals in the region. Africa is the key regional market and is expected to drive the demand for construction chemicals. Rise in urban population is the prominent factor expected to provide plenty of scope to the new residential projects. The upcoming global event such as FIFA World Cup 2022, to be held in Qatar, is projected to fuel infrastructure development and can be an additional growth driver to construction chemicals.

The major key players operating in the Asia & MEA construction chemicals market include Arkema SA, Ashland Inc., BASF SE, Fosroc International Inc., MAPEI S.P.A., Pidilite Industries Limited, RPM International Inc., SIKA AG, DowDuPont Inc., W.R. Grace and Co., and Others. Some of the other player includes 3M Chemical Company, Henkel AG, Adrex GmbH, and Evonik Industries. Top 10 construction chemicals manufacturers accounted for majority market share in 2018 strategic moves adopted by these companies such as aggressive marketing, product development & launch and merger & acquisition.

Asia & MEA Construction Chemicals Market, by Region

Based on region, the construction chemicals market is dominated by the Asia region. Some of the key factors driving the growth of the Asia region are increase in population, rise in urban population, and growth in investment in the infrastructure from public and private domain.

Asia & MEA Construction Chemicals Market Share, by Type

Based on type, the Asia & MEA construction chemicals market is dominated by concrete admixture. Some of the major advantages of using concrete admixtures include lower overall concrete cost in construction, modified concrete properties, and easier concrete handling during construction, which leads to shorter application time and higher concrete quality.

Asia & MEA Construction Chemicals Market Share, by Application

Based on application, the construction chemicals market is dominated by residential segment. Rise in the population, increase in single residence families & nuclear families, and economic development enforce people to invest in better living experience. Owing to these factors, there is a rise in the number of residential complexes, which in turn drives the demand for construction chemicals in the market. Increasing infrastructural development activities across India, Qatar, Saudi Arabia and African countries expected to extend overall Asia & MEA construction chemical market size.

Key Benefits for Asia and MEA Construction Chemicals Market:

- Porter’s five forces analysis helps to analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building

- The report outlines the current trends and future scenario of the construction chemicals market size from 2018 to 2025 to understand the prevailing opportunities and potential investment pockets.

- Major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analyses are elucidated in the study

- Asia & MEA construction chemicals market trends includes analysis of both macroeconomic and micro economic trend analysis in order to understand the development of the market

- Asia & MEA construction chemicals market analysis includes various parameters such as macro and micro economic analysis of various geographies

- The profiles of key players along with their key strategic developments are enlisted in the report

Asia & MEA Construction Chemicals Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ARKEMA GROUP, DOWDUPONT INC., SIKA AG, FOSROC, INC., ASHLAND INC., BASF SE, PIDILITE INDUSTRIES LIMITED, MAPEI S.P.A., W. R. GRACE & CO., RPM INTERNATIONAL INC. |

Analyst Review

The growth of Asia & MEA construction market is progressive, and this trend is expected to continue during the forecast period with surge in urbanization and increase in large-scale infrastructure projects across several economies. FIFA World Cup 2022, which is to be held in Qatar is one of them. In addition, rise in awareness regarding high-value products such as concrete admixture and waterproofing is expected to play a crucial role in the market expansion. Furthermore, increase in investment in the infrastructural development is expected to result in increased industrialization, which in turn propels the demand for construction chemicals. However, lack of awareness regarding long-term benefits of construction chemical projects is anticipated to limit the growth of the overall market.

Loading Table Of Content...