Asia Pacific IVD Market Insight 2023

The Asia Pacific IVD Market accounted for $13,680 million in 2016, and is estimated to reach at $19,888 million by 2023, growing at a CAGR of 5.4% from 2017 to 2023. IVD are the medical diagnostic devices comprised of any reagent, calibrator, control material, kit, specimen receptacle, software, instrument, apparatus, equipment or system; used alone or in combination with other diagnostic devices, specifically designed for in-vitro examination of specimens of human body.

Increase in prevalence of communicable and non-communicable diseases and large pool of geriatric population in Asia-Pacific primarily drives the Asia Pacific IVD market. In addition, growth in trend toward personalized medicine and use of companion diagnostics devices have increased the IVD market growth. Furthermore, growth in investment in healthcare sector by government is anticipated to boost the Asia Pacific IVD Market growth. However, stringent government regulations associated with production and sale of IVD are expected to hamper the market growth. Ongoing R&D activities related to IVD are anticipated to present new opportunities for the market. Moreover, the Asia-Pacific region offers lucrative growth opportunities to the Asia Pacific IVD market players owing to the increase in economies of the countries such as India, South Korea, China, and others.

Segment Review

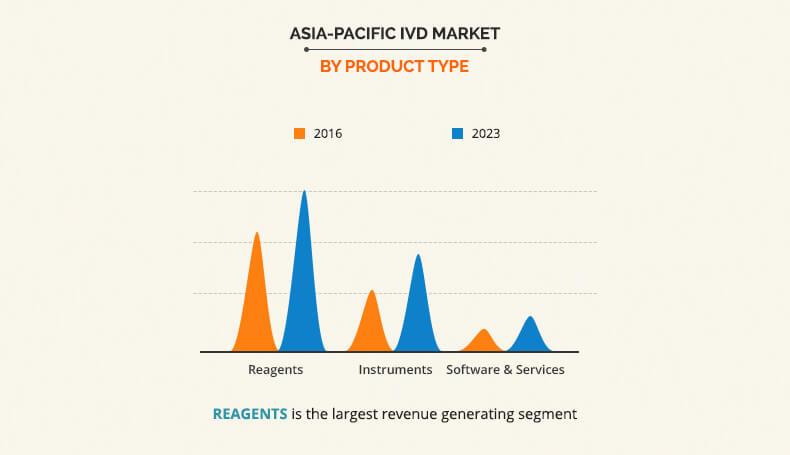

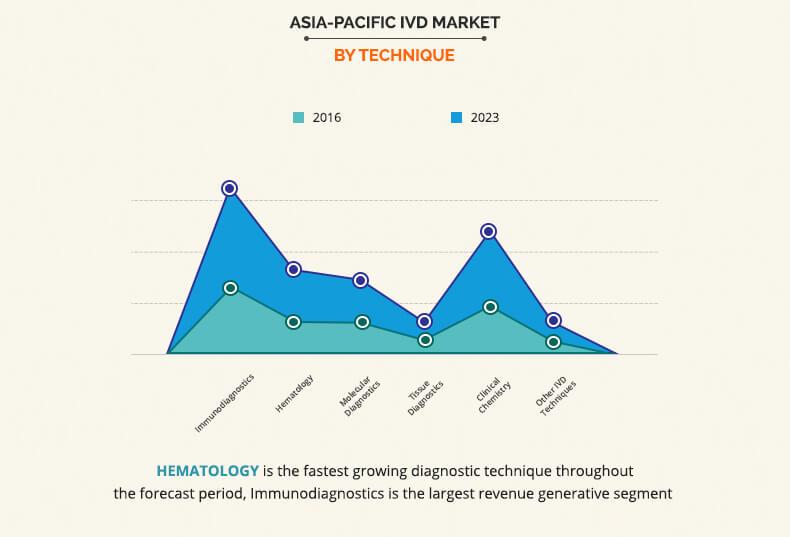

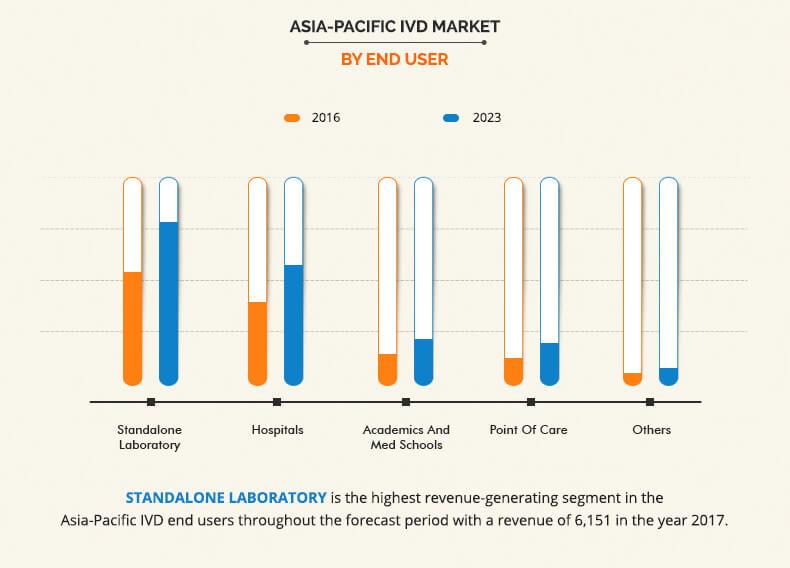

Based on product type, the Asia Pacific IVD Market is categorized into reagents, instruments, and software & services. The reagent segment accounted for the highest market share in 2016, and the software and services is expected to grow at the highest growth rate during the forecast period. The growth of the reagent market is attributed to the recent introduction of new novel reagents and wide availability of effective and cost-efficient reagents. On the basis of techniques, the immunodiagnostics segment captured the highest market share in 2016, due to the increase in demand for personalized medicines. On the basis of application, infectious diseases segment captured the highest market share in 2016, owing to the increase in prevalence of infectious diseases and rise in increase in preventive healthcare awareness among the population. Based on end users, the standalone laboratory segment captured the highest market share in 2016, primarily due to non-availability of complex tests in hospitals and commercial clinics.

Asia Pacific IVD Market Segmentation

Country Wise Review

Country wise, it is analyzed across India, China, Japan, South Korea, Australia, and Rest of Asia-Pacific. Japan accounted for the highest share of the market in 2016, followed by China. India is anticipated to witness the highest growth rate during the forecast period. In addition, this region is expected to emerge as the area with maximum growth potential due to the focus of key players in the emerging economies and improvement in the healthcare infrastructure.

Increase in Prevalence of Non-communicable and Communicable Diseases

According to WHO, number of deaths due to non-communicable diseases (NCDs) is estimated to increase from 36 million deaths in 2010 to 44 million deaths in 2020; out of which the highest prevalence of NCDs is accounted in Western Pacific (12.3 million deaths) and South-East-Asia (10.4 million deaths) regions. According to OECD, Tuberculosis is the leading cause of death from infectious disease in the Asia-Pacific region. In 2014, OECD reported that four out of five countries in world; with the highest number of incident cases of tuberculosis, were in the Asia-Pacific region.

Increase in Geriatric Population

Geriatric population in Asia-Pacific has increased significantly and is vulnerable to various communicable and non-communicable diseases. According to the U.S. Census Bureau report “An Aging World: 2015” currently 7.9% of Asia population comprises of population aged 65 and over and this percentage is predicted to increase nearly 12.1% by 2030 and is anticipated to further increase to nearly 18.8% by 2050. Currently, Asia leads the world in speed of aging and size of older population and continue to lead during the forecast period. Therefore, the escalation in rate of the geriatric population is expected to raise the demand for diagnosis, thereby driving the IVD market.

Increasing Government Expenditures on Healthcare

There is a widespread awareness about spread of disease in Asia-Pacific countries and its impacts on the health. Hence, the government of all the regions have increased their healthcare expenditures for reducing the disease rate in the countries. According to the IMF World Economic Outlook database projections, the GDP of Asia is anticipated to increase from 5.3% in 2016 to 5.4% in 2018. Whereas, it also estimated that GDP of Pacific Island countries and other small states increased from 3.4% in 2016 to 3.8% in 2018. According to the WHO, the Japans’ government healthcare expenditure has increased from 20.12% in 2013 to 20.28% in 2014. The increase in Asia-Pacific economic conditions are expected to increase government funding in healthcare sector, which in turn contributes to the increase in the IVD market growth.

Major companies operating in this market adopted product launch as their key development strategy. Companies profiled in this market include, Thermo Fisher Scientific Inc., Alere Inc., Biomerieux, Danaher Corporation, F. Hoffmann-La Roche AG, Becton Dickinson and Company, Bio-Rad Laboratories, Bayer AG, Sysmex Corporation, and Johnson & Johnson among others.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the Asia Pacific IVD Market along with the current trends and future estimations to explain the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the Asia Pacific IVD Market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2016 to 2023 is provided to enable the stakeholders to capitalize on the prevailing Asia Pacific IVD Market opportunities.

- Extensive analysis of the key segments of the industry helps to understand the application and products of IVD Market used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the Asia Pacific IVD Market.

Asia Pacific IVD Market Report Highlights

| Aspects | Details |

| By PRODUCT TYPE |

|

| By TECHNIQUE |

|

| By APPLICATION |

|

| By END USERS |

|

| By ASIA-PACIFIC IVD MARKET |

|

| By Region |

|

| Key Market Players | DANAHER CORPORATION, BECTON DICKINSON AND COMPANY, F. HOFFMANN-LA ROCHE AG, SYSMEX CORPORATION, BAYER AG, JOHNSON & JOHNSON, THERMO FISHER SCIENTIFIC INC., ALERE INC., BIO-RAD LABORATORIES, BIOMERIEUX |

Analyst Review

In vitro diagnostics (IVD) are diagnostic tools used alone or in combination to examine blood, urine, stool, tissues, and other body fluids of human body for detection of diseases, conditions, and infections in in vitro conditions. Different IVD products are used for this procedure such as reagents, instruments, and software & services. The reagents accounted for the highest market share in 2016 and is expected to dominate the market during the forecast period owing to accessibility of wide range of reagents that are cost efficient, reliable, and effective for fast diagnosis of diseases and disorders.

Japan accounted for the highest share owing to improving healthcare infrastructure due to increase in government expenditure in healthcare sector. According to the WHO, the Japanese government healthcare expenditure has increased from 20.12% in 2013 to 20.28% in 2014. India accounted for the highest market potential owing to rise in prevalence of communicable and non-communicable diseases such as tuberculosis, diabetes, cancer, and others. In addition, government initiatives for the improvement of healthcare sector, and rise in focus of leading manufacturers to expand their geographical presence in the emerging Indian economy are expected to gain high growth opportunities in the market.

Major companies involved in the Asia-Pacific IVD market are Thermo Fisher Scientific Inc., Alere Inc., Biomerieux, Danaher Corporation, F. Hoffmann-La Roche AG, Becton Dickinson and Company, Bio-Rad Laboratories, Bayer AG, Sysmex Corporation, and Johnson & Johnson among others.

The total market value of Asia Pacific IVD Market is US $$19,888 million by 2023.

The forcast period for Asia Pacific IVD Market is 2017 to 2023

The market value of Asia Pacific IVD Market in 2016 is $ $13,680 million.

The base year is 2017 in Asia Pacific IVD Market

Thermo Fisher Scientific Inc., Alere Inc., Biomerieux, Danaher Corporation, F. Hoffmann-La Roche AG, Becton Dickinson

Loading Table Of Content...