Asia-Pacific Cold Insulation Market Overview:

Asia-Pacific Cold Insulation Market size was valued at $1,912,720 thousand in 2016, and is estimated to reach $3,251,903 thousand by 2023, growing at a CAGR of 7.7% from 2017 to 2023. Cold insulation involves blending of two or more materials used to avoid heat loss or heat gain to conserve the valuable energy. These materials can protect the environment from greenhouse gasses. Cold insulation is used on cold surface for cold conservation or to avoid surface condensation, and maintain low temperatures for process control. This process is widely applicable in sectors such as chemicals, oil & gas, and refrigeration.

Growth in oil & gas industry, increase in environmental awareness, and rapid development in building & construction drive the Asia-Pacific cold insulation market. However, the market is restricted by the volatile nature of raw material prices. Nevertheless, the development of bio-based insulation materials presents numerous growth opportunities.

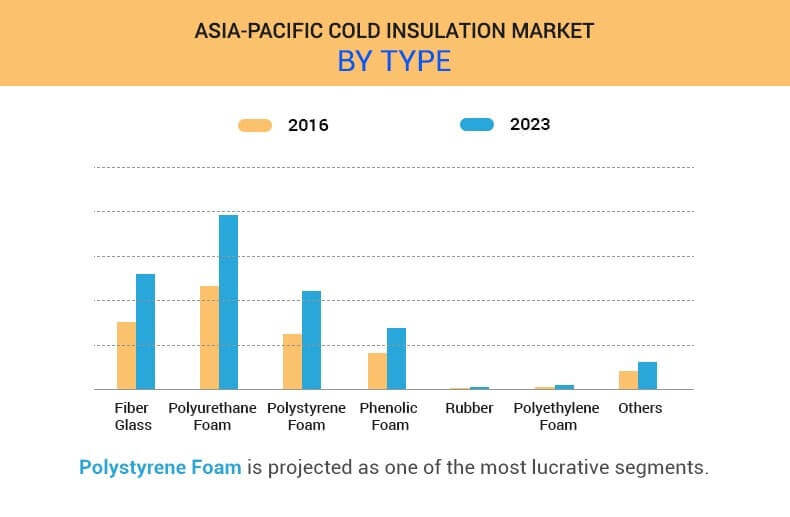

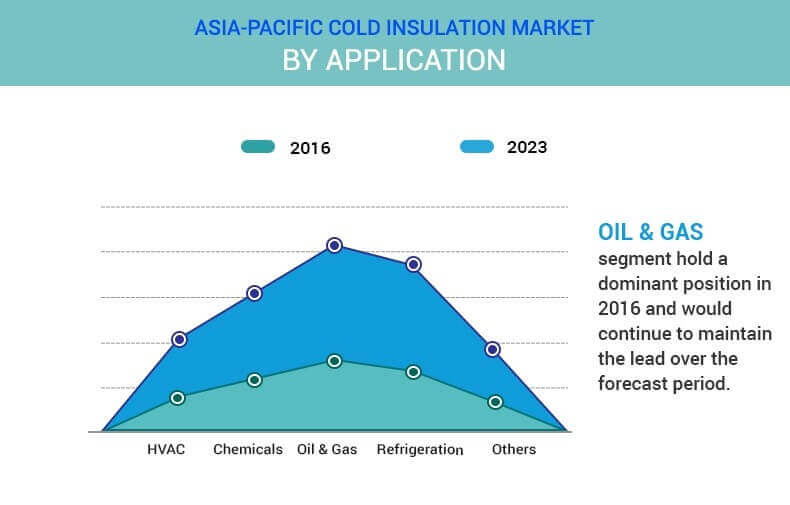

The Asia-Pacific cold insulation market is segmented based on type, application, and country. Based on type, it is divided into fiber glass, polyurethane foam, polystyrene foam, phenolic foam, rubber, polyethylene foam, and others. Based on application, it is categorized into HVAC, chemicals, oil & gas, refrigeration, and others. Based on country, it is analyzed across China, Japan, India, Australia, South Korea, Indonesia, Malaysia, Singapore, Vietnam, Thailand, Philippines, Myanmar, and rest of Asia-Pacific.

The Singapore cold insulation market is expected to exhibit a CAGR of 8.5% during the forecasted period. This is attributed to its emergence as a hub for central laboratories in the Asia-Pacific region. Several global biomedical science players, such as Abbott, Amgen Inc., and GlaxoSmithKline are using the nation as their base. The emergence of the hub is attributed to its well-developed infrastructure, transparent regulations, and excellent connectivity.

Polystyrene foam is projected to be the most lucrative segment in the market, as polystyrene is a waterproof thermoplastic foam, which acts as an excellent temperature insulation material. In addition, its superior compressive and tensile strength make it the most suitable material in packaging and consumer goods industry.

The oil & gas segment is estimated to dominate the Asia-Pacific cold insulation market during the forecast period. This is attributed to the growth in demand for oil & gas. Increase in consumption of oil from the transportation sector in the developing countries and explosive population growth are expected to generate high demand for oil, which will also boost the demand for insulation materials.

The key players profiled in the report are Kingspan Groups PLC., BASF SE, Huntsman Corporation, ITW Insulation Systems, Rockwool International A/S, Covestro Ag (Bayer Material Science), DowDuPont, Inc., Dongsung FineTec Co., Ltd., Armacell International Holding Inc. and Nichias Corporation.

The other major players (not profiled in report) in the market include KAEFER Isoliertechnik GmbH & Co. KG, Owens Corning, Maghard Insulators Pvt. Ltd., Fletcher Insulation Pty Ltd. and Arabian Fiberglass Insulation Company Ltd.

Key Benefits

This report provides an extensive analysis of the current & emerging market trends and dynamics of the Asia-Pacific cold insulation market.

In-depth analysis of all regions is conducted by constructing market estimations for key segments between 2016 and 2023, which assist to identify the prevailing opportunities.

- The report assists to understand the strategies adopted by the companies for Asia-Pacific cold insulationmarket expansion.

- This study evaluates the competitive landscape to understand the competitive environment across various regions.

- Extensive analysis is conducted by following product benchmarking, positioning, and monitoring the top competitors within the Asia-Pacific market.

Asia-Pacific Cold Insulation Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Country |

|

| Key Market Players | DOWDUPONT, INC., KINGSPAN GROUP PLC, ROCKWOOL INTERNATIONAL A/S, COVESTRO AG, NICHIAS CORPORATION, DONGSUNG FINETEC, HUNTSMAN CORPORATION, BASF SE, ILLINOIS TOOL WORKS (ITW INSULATIONS SYSTEMS), ARMACELL INTERNATIONAL S.A. |

Analyst Review

Cold insulation is a process that provides a material or a blend of two or more materials that could be used to avoid heat loss or heat gain to conserve the valuable energy. Insulation materials have the ability to protect the environment from greenhouse gasses. Cold insulation technique is used for cold conservation or prevention of condensation. These are adopted in a wide range of applications to maintain low temperature for process control, avoid surface condensation, and maintain refrigeration. These are used in various applications such as chemicals, oil & gas, refrigeration, and others.

In 2016, the polyurethane foam segment held the highest share, accounting for more than one-third share of the Asia-Pacific cold insulation market. Polyurethane exhibits unique properties, such as lightweight, low thermal conductivity, low water absorption, good strength, and high chemical resistance. It is ideal for handling low thermal conductivity and substances stored at below freezing temperature. Polyurethane foam emits low smoke and provides low water vapor permeability. The oil & gas application segment accounted for the highest market share in 2016, accounting for two-sevenths share of the Asia-Pacific market. The refrigeration segment is projected to grow at the highest CAGR of 8.2% from 2017 to 2023.

China, Japan, Korea, and India are the major contributors for Asia-Pacific cold insulation market growth. Manufacturers find Asia-Pacific as an attractive market, owing to the low labor cost, low cost of setting up manufacturing units, and low cost of insulation materials.

Loading Table Of Content...