Asia-Pacific Endotherapy Devices Market Overview:

Endoscopy is a minimally invasive medical procedure, which is used for the diagnosis, prevention, and treatment of complications in the visceral organs. The device is either placed in the body through natural openings or cavities (such as anus and mouth) or through incisions, especially in case of arthroscopy. Increase in the incidence rate of targeted diseases such as colon cancer and gastrointestinal disorders propel the demand for endotherapy devices, as these devices help to use minimally invasive techniques to treat the patient. The Asia-Pacific endotherapy devices market is projected reach $1,315 million by 2024 from $826 million in 2017, growing at a CAGR of 6.9% from 2018 to 2024.

Increase in prevalence of diseases that require endotherapy devices as well as technological advancements in endotherapy devices drive the market growth. Furthermore, shorter recovery time, minimal postoperative complications, and rise in patient preference for minimally invasive surgeries are projected to supplement the market growth. However, infections caused by few endotherapy, dearth of trained physicians & endoscopists, and high costs associated with endotherapy devices hamper the growth of the market. On the contrary, unmet medical demands and lucrative opportunities in the developing countries such as China and India offer profitable opportunities for market expansion.

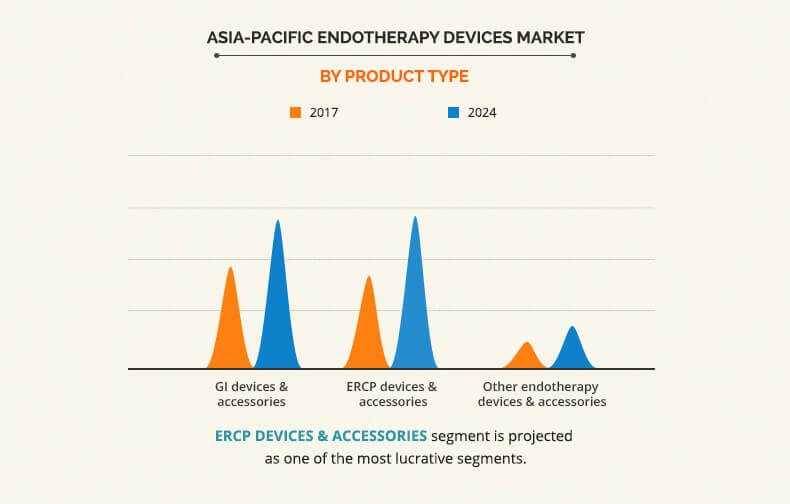

Product Segment Review

Based on product, the market is categorized into GI devices & accessories, ERCP devices & accessories, and others. GI devices & accessories segment was the dominant segment in 2017, contributing towards the growth of Asia-Pacific endotherapy devices market, owing to increase in geriatric population which is at a high risk of suffering from gastrointestinal disorders, thereby fueling the need for GI endotherapy.

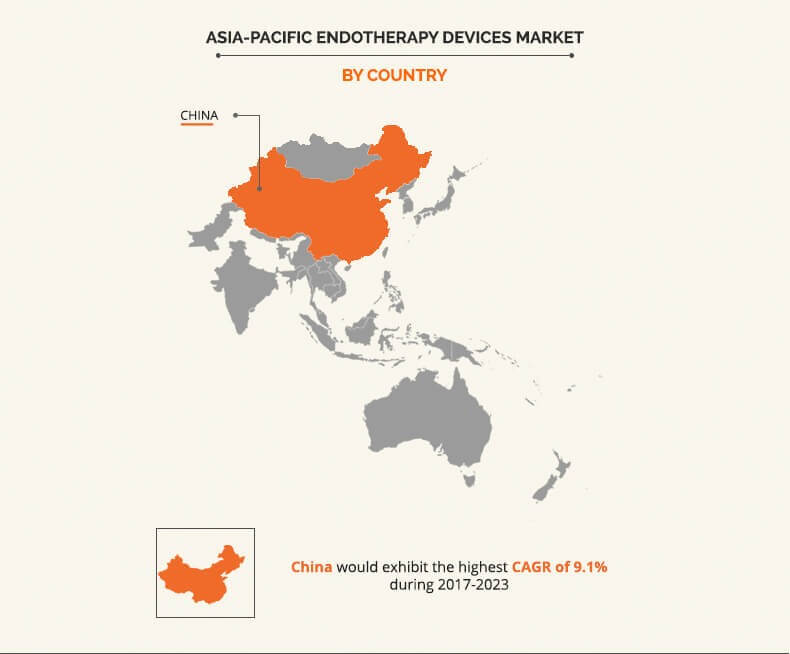

Asia-Pacific Endotherapy Devices Market: Key Countries

Country wise, the market is analyzed across China, Japan, India, Singapore, Malaysia, Thailand, and rest of Asia-Pacific. Japan accounted for the largest market share in the Asia-Pacific endotherapy devices market in 2017, and is expected to retain its dominance throughout the forecast period. However, China is expected to grow at the highest rate during the forecast period

The key players operating in the Asia-Pacific endotherapy devices market include Hoya Corporation, Olympus Corporation, Stryker Corporation, Boston Scientific Corporation, Fujifilm Holdings Corporation, Conmed Corporation Medtronic Plc., Karl Storz GmbH & Co. KG, Smith & Nephew, Plc., and Johnson & Johnson.

Other prominent players in the value chain include B. Braun Melsungen AG, Cook Medical, Siemens Healthcare, STERIS Corporation, Frontier Healthcare, and Advanced Sterilization Products Services Inc.

Key Benefits

- This report entails a detailed quantitative analysis of the current market trends from 2017 to 2024 to identify the prevailing opportunities.

- Market estimations are based on comprehensive analysis of the key developments in the industry.

- The Asia-Pacific market is comprehensively analyzed with respect to product and country.

- In-depth analysis based on country assists in understanding the regional market to assist in strategic business planning.

- The development strategies adopted by key manufacturers are enlisted to understand the competitive scenario of the market.

Asia-Pacific Endotherapy Devices Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By COUNTRY |

|

| Key Market Players | Medtronic Plc, Stryker Corporation, Smith & Nephew Plc, CONMED Corporation, Olympus Corporation, FUJIFILM Holdings Corporation, HOYA Corporation, Johnson & Johnson (Ethicon, Inc.), Boston Scientific Corporation, KARL STORZ GmbH & Co KG |

Analyst Review

Endoscopes and endotherapy procedure are used to examine and treat the interior of a hollow organ or cavity of the body. The endotherapy devices market is expected to witness healthy growth with increase in the demand for minimally invasive surgical procedures. The endotherapy devices have drawn the interest of the healthcare industry, owing to rise in number of endotherapy procedures and increase in usage of these devices to treat abnormalities of internal organs and cavities.

The endotherapy devices market piqued the interest of healthcare industry, owing to their minimal invasive nature; fewer postoperative complications coupled; and wide range of applications across various disease indications such as cancers, gastrointestinal problems, gastroesophageal reflux disorder, orthopedic diseases, ophthalmic diseases, and others. Laparoscopy, gastrointestinal endoscopy, arthroscopy, and ENT endoscopy are widely performed, which contribute towards the growth of endotherapy devices market. There have been remarkable advancements and some major developments in this market such as introduction of devices with more throughput and accurate results, which further supplement the market growth.

Enhanced treatment options with high success rate, patient preference for minimal invasive surgeries, and technological advancements in endotherapy devices are the major factors that drive the growth of the Asia-Pacific endotherapy devices market. In addition, increase in awareness about the availability of technologically advanced devices and rise in awareness towards the benefits of minimally invasive procedures are anticipated to boost the demand for endotherapy devices in the near future, thereby propelling the market growth. However, stringent regulations towards endotherapy devices, high cost of the treatment, and low reimbursement policy are projected to hamper the market growth.

Loading Table Of Content...