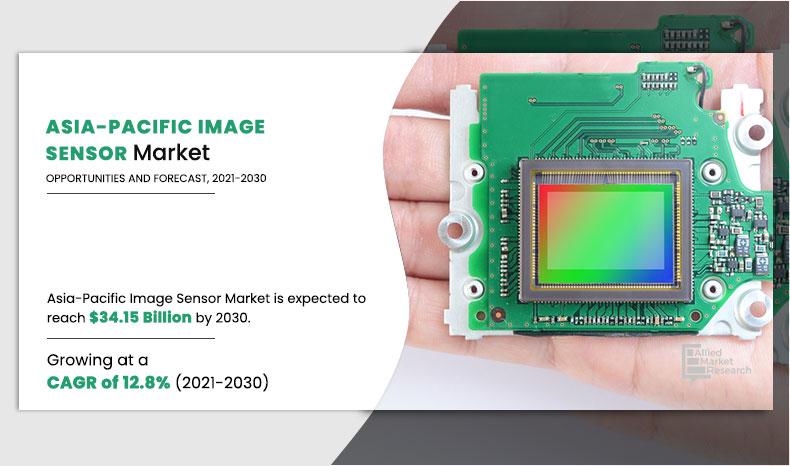

Asia-pacific Image Sensor Market Outlook -2030

The Asia-Pacific Image Sensor Market was valued at $10.60 billion in 2020, and is projected to reach $34.15 billion by 2030, registering a CAGR of 12.8% from 2021 to 2030.

Image sensor is an electronic device used to detect & transmit optical image presented by a lens for making an image. Image sensor devices are used in analog and digital electronic imaging devices such as digital cameras, radar, thermal imaging devices, sonar, and varied camera modules. Furthermore, two types of sensor image technologies are available in the market, which include charge-coupled sensor (charged-coupled device) and the active-pixel sensor (complementary metal-oxide semiconductor sensor). Charge-coupled sensor and the active-pixel sensor both are intended to use metal oxide-semiconductor technology, with CCDs using MOS capacitors and CMOS using MOS field-effect transistor (MOSFET) amplifiers.

In addition, the next-generation complementary metal-oxide-semiconductor (CMOS) image sensor world contains a photodiode and a CMOS transistor switch, allowing pixel signals to be amplified separately. Moreover, the CMOS camera technology has led to a paradigm shift in the industry for designing advanced image sensors due to its enhanced efficiency, thereby driving the market growth.

The Asia-Pacific Image Sensor Market is expected to witness notable growth during the forecast period, owing to surge in adoption of image cameras for automotive applications. Furthermore, rise in use of image sensors in improved medical imaging solutions has driven the growth of the market. Moreover, surge in demand for image sensor solution for security & surveillance is expected to propel the growth of the Asia-Pacific Image Sensor Market growth during the forecast period.

However, decline in adoption of CCD image sensors and high manufacturing cost of image sensors are some of the prime factors restraining the market growth. On the contrary, increased adoption of image sensor cameras in autonomous vehicles is expected to provide lucrative opportunities for the growth of the market during the forecast period.

By Technology

CMOS Image Sensor segment influence the market in 2020, and expected to follow the same in future.

The outbreak of COVID-19 has significantly impacted the growth of the image sensor solution in 2020, owing to significant impact on prime players operating in the image sensor value chain. However, rise in penetration of consumer electronics such as laptops, smartphones, and PCs is some of the prime factor propelling the market growth during pandemic. On the contrary, the market was principally hit by several obstacles created amid the COVID-19 pandemic such as lack of skilled workforce availability and delay or cancelation of projects due to partial or complete lockdown, globally. Furthermore, surge in adoption of smart infrastructure solutions across automotive, retail, and healthcare sectors is expected to strengthen the market growth in Asia-Pacific post pandemic.

Segmentation Analysis

The Asia-Pacific Image Sensor Market is segmented into technology, application, and country. Depending on technology, the market is segregated into charge-coupled device (CCD) and complementary metal–oxide–semiconductor (front-side illuminated (FSI) and back-side illuminated (BSI)). The CMOS segment dominated the market, in terms of revenue, in 2020, and is expected to follow the same trend during the forecast period. On the basis of application, it is categorized into consumer electronics, defense & aerospace, medical, industrial, automotive, and security & surveillance. The consumer electronics segment acquired the largest Asia-Pacific image sensor market share in 2020, however, the BFSI segment is expected to grow at a high CAGR from 2021 to 2030.

By Cmos Image Sensor

BSI on the Move segment hold domination position in 2020.

Country wise, the Asia-Pacific Image Sensor Market trends are analyzed across China, Japan, India, Taiwan, South Korea, and rest of Asia-Pacific. Japan remains a significant participant in the Asia-Pacific image sensor industry.

This is attributed to the fact that major organizations and government institutions in the country are intensely putting resources into the technology, which is anticipated to open new avenues for the expansion of the Asia-Pacific Image Sensor Market.

By Application

Consumer Electronics segment generated the highest revenue in 2020.

Top Impacting Factors

Significant factors that impact the growth of the Asia-Pacific image sensor industry include rise in demand for image sensor solution for security and surveillance, rise in use of image sensors in improved medical imaging solutions, and surge in adoption of image cameras for automotive applications. Moreover, decline in adoption of CCD image sensors and high manufacturing cost of image sensors affect the market growth. In addition, rise in adoption of image sensor cameras in autonomous vehicles influences the market growth. However, each of these factors is expected to have a definite impact on the growth of the Asia-Pacific Image Sensor Market during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major Image Sensor Market players, such as Canon Inc., Panasonic Corporation, SK Hynix Inc., Sony Corporation, Samsung Electronics, STMicroelectronics, Hamamatsu Photonics K.K., Omnivision Technologies Inc., Galaxycore Shanghai Limited Corporation, and Smartsens are provided in this report.

By Country

Japan segment garner significant market share in 2020.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the Asia-Pacific Image Sensor Market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall Asia-Pacific image sensor market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The Asia-Pacific image sensor market forecast is quantitatively analyzed from 2021 to 2030 to benchmark the financial competency.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the smart display.

- The Asia-Pacific image sensor market report includes the share of key vendors and market trends.

Asia-Pacific Image Sensor Market Report Highlights

| Aspects | Details |

| By Technology |

|

| By Application |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Image sensor device is primarily used across standalone and embedded imaging and digital cameras devices. Furthermore, next-generation image sensors are designed to convert lights into an electronic signal and subsequently transmit it to an electronics application processor to transform the electronics signal into a digital image. In addition, surge in demand for artificial intelligence, the Internet of Things, and smart infrastructure solutions across the automotive, consumer electronics, and healthcare sectors is expected to drive the growth of the market across Asia-Pacific in the coming years.

The Asia-Pacific image sensors market is highly competitive, owing to the strong presence of existing vendors. Asia-Pacific image sensors vendors who have access to extensive technical and financial resources are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Surge in adoption of image sensor cameras in autonomous vehicles is driving the need to enhance image sensors solutions. Moreover, prime economies, such as China, South Korea, and Japan, plan to develop and deploy next-generation image sensors solutions across various sectors. For instance, on October 13, 2021, SK Hynix, a leading memory semiconductor manufacturer, announced its business expansion in the non-memory semiconductor market to develop image sensors, which is anticipated to provide lucrative opportunities for market growth.

Among the analyzed regions, Japan exhibits the highest adoption rate of image sensors. On the other hand, Asia-Pacific is expected to grow at a faster pace, due to emerging countries, such as China, Japan, and Australia, investing in these technologies.

Globally, various key players and government agencies operating in Asia-Pacific are investing in image sensors to make them compatible with various industrial platforms. For instance, in July 2021, Taiwan Semiconductor Manufacturing Company announced to build its first semiconductor hub to develop advanced chips for image sensors, which is showcasing lucrative growth opportunities for the market growth.

The key players profiled in the report include Canon Inc., Panasonic Corporation, SK Hynix Inc., Sony Corporation, Samsung Electronics, STMicroelectronics, Hamamatsu Photonics K.K., Omnivision Technologies Inc., Galaxycore Shanghai Limited Corporation, and Smartsens.

The Asia-Pacific Image Sensor Market is estimated to grow at a CAGR of 12.5% from 2021 to 2030.

The Asia-Pacific Image Sensor Market is projected to reach $34.15 billion by 2030.

To get the latest version of sample report

Significant factors that impact the growth of the Asia-Pacific image sensor industry include rise in demand for image sensor solution for security and surveillance, rise in use of image sensors

The key players profiled in the report include Canon Inc., Hamamatsu Photonics K.K., Panasonic Corporation and many more.

On the basis of top growing big corporations, we select top 10 players.

The Asia-Pacific Image Sensor Market is segmented into technology, application, and country.

Rise in adoption of image sensor cameras in autonomous vehicles influences the market growth

Loading Table Of Content...